Doxing, hacking, bugging, phishing. The world of digital communications has opened up a long list of modern threats, and companies are reacting to fend them off.

With cases of illegal access to sensitive data and cyberattacks on the rise,1 and the growth of third-party access through cloud computing and the Internet of Things, executives are taking the threat seriously. At the same time, regulators have beefed up compliance rules around data privacy in a move to protect consumers following high-profile breach cases.

According to Gartner, worldwide enterprise security investments will increase 8% to $96 billion this year, relative to 2017.2 The outlay is a result of regulations, shifting buyer mindset, awareness of emerging threats and the evolution to a digital business strategy, the research firm has said.

Targeting the beneficiaries of the trend

To gain access to the beneficiaries of this spending trend, STOXX this year introduced the STOXX® Global Digital Security Index. The new index is derived from the STOXX® Global Total Market Index of developed and emerging markets, is equal-weighted, and comprised of companies that are positively exposed to the digital security sector. This encompasses businesses involved in the transmission, safeguarding or handling of sensitive data, and in the access control to secure locations (i.e. data centers).

As demand for digital security solutions grows, these companies or their business lines are positioned to benefit from long-term structural trends driving economic change, which, in the future, may have a substantial impact on their performance.

The index forms part of STOXX’s revenue-based thematic indices, which employ FactSet Revere data to obtain a detailed breakdown of the revenue sources of eligible companies. The granular business classification analysis allows the index to select companies with at least 50% exposure to 38 sectors related to digital security in an accurate way.

The index underlies an exchange-traded fund managed by BlackRock, the iShares Digital Security UCITS ETF.

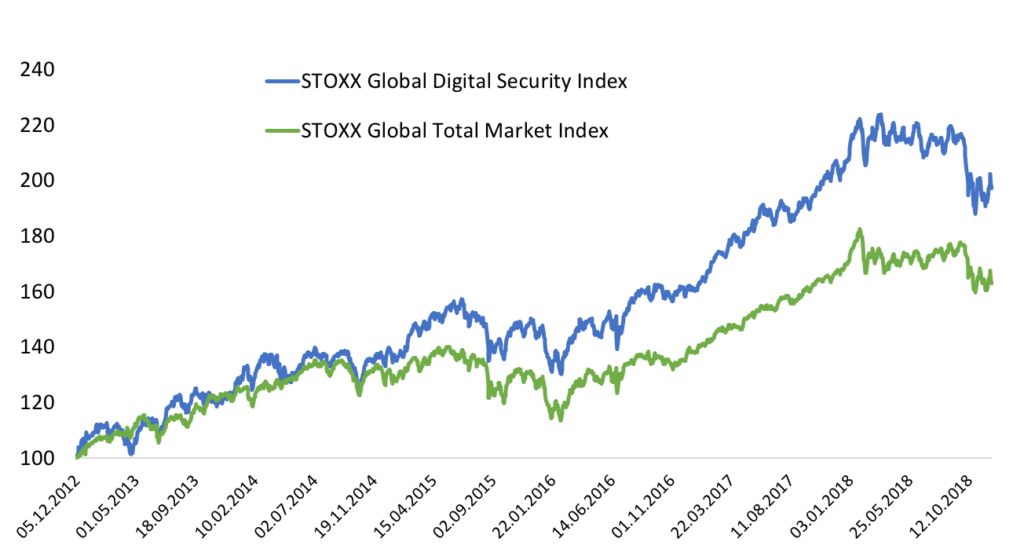

Chart 1 shows the performance of the STOXX Global Digital Security Index and of the STOXX Global Total Market Index in the past five years.

Chart 1

Strong concepts arising from megatrends

Thematic investing attempts to capitalize on broad, disruptive, compelling and often hard-to-predict trends that are changing our society. Their growth characteristics means these trends may significantly outpace the market’s average rates. Thematic investing also differs from the traditional stock-picking portfolio in that it shifts the focus away from sector and cyclical views, is forward-looking rather than rely on past earnings performance, and in that it may require a longer-term view from an investor.

STOXX currently maintains 11 thematic indices, each covering a strong concept that emanates from three broad ‘megatrends’: demographics, climate change and technology. They include strategies tracking ageing population, automation & robotics, breakthrough healthcare, digitalization, blockchain, fintech, three AI indices, and an index that combines blockchain, robotics, AI and nanotechnology.

Stay tuned as we expand this family with more interesting concepts in coming months.

Featured indices

STOXX® Global Digital Security Index

1Online Trust Alliance, ‘The Cyber Incident Tsunami – Time to Get Ready,’ Jan. 25, 2018.

2Gartner, ‘Gartner Forecasts Worldwide Security Spending Will Reach $96 Billion in 2018, Up 8 Percent from 2017,’ Dec. 7, 2017.