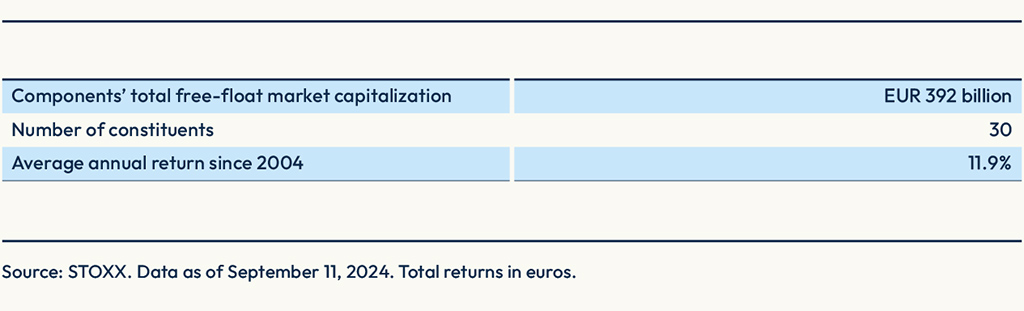

TecDAX®, the benchmark for German technology stocks, was launched on March 24, 2003. With an average annual return of 12% since inception,[1] the index’s broad yet focused approach offers exposure to technology companies across several industries.

This approach allows investors to track technology pioneers in industries such as Healthcare, Telecommunications, Energy or Utilities. The addition of biotechnology, wireless communications, medtech, renewable energies and others as part of a Technology sector helps capture Germany’s global leadership in those areas and avoids concentrated technology allocations in sectors such as semiconductors and software.

Composition criteria

The index comprises the 30 largest[2] companies listed on the Frankfurt Stock Exchange (FSE)’s Regulated Market segment that meet minimum quality and liquidity requirements, and that belong to the Technology industry according to the DAX Equity Industry Classification.

Figure 1: TecDAX in numbers

Two ETFs listed in Frankfurt, respectively managed by Amundi and iShares, track the TecDAX. The index also underlies futures and options on Eurex and is mirrored by over 2,000 investment certificates.

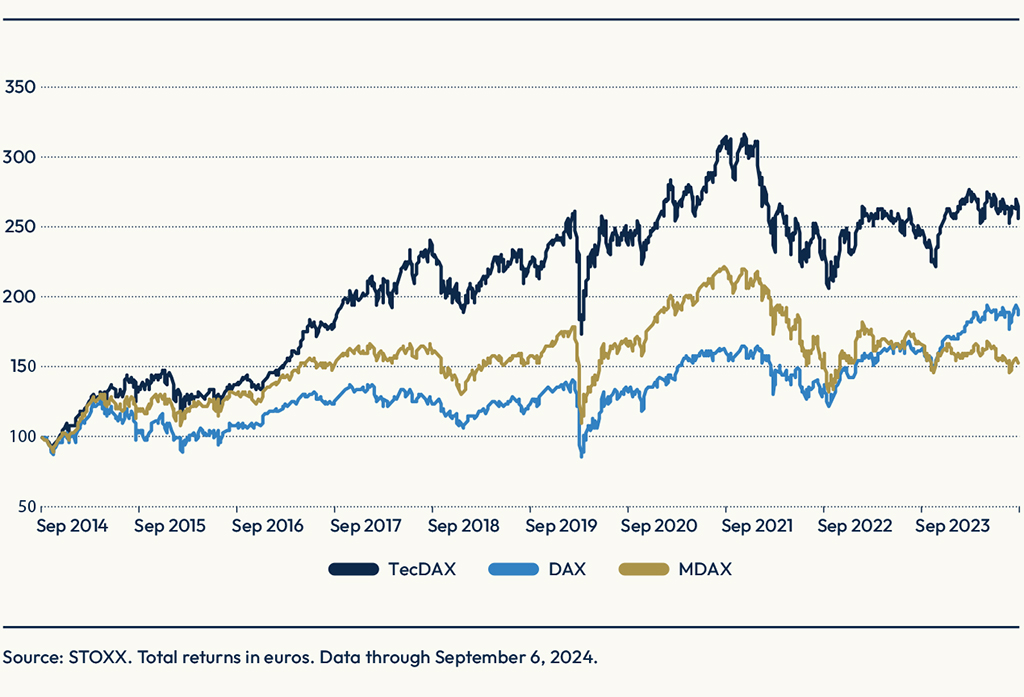

Strong relative returns in first part of past decade

In the past ten years, the TecDAX index has beaten the blue-chip DAX® by a total of 68 percentage points, and the MDAX® index for German mid-caps stocks by 103 points. Despite the recent gains, the technology measure is 19% below its record high reached in November 2021.[3] DAX, on the other hand, is trading at an all-time high.

Figure 2: Index 10-year returns

TecDAX has posted an average annual advance of 11.9% since 2004, compared with 9.2% for the blue-chip DAX, 11.2% for MDAX and 10.9% for SDAX®, the small-caps index.

“Technology has been a star performer globally in recent years, and Germany is no exception,” said Veronika Kylburg, Head of Product Benchmarks DAX at STOXX. “TecDAX represents a rules-based investment vehicle into the country’s corporate excellence and diversified technology sector.”

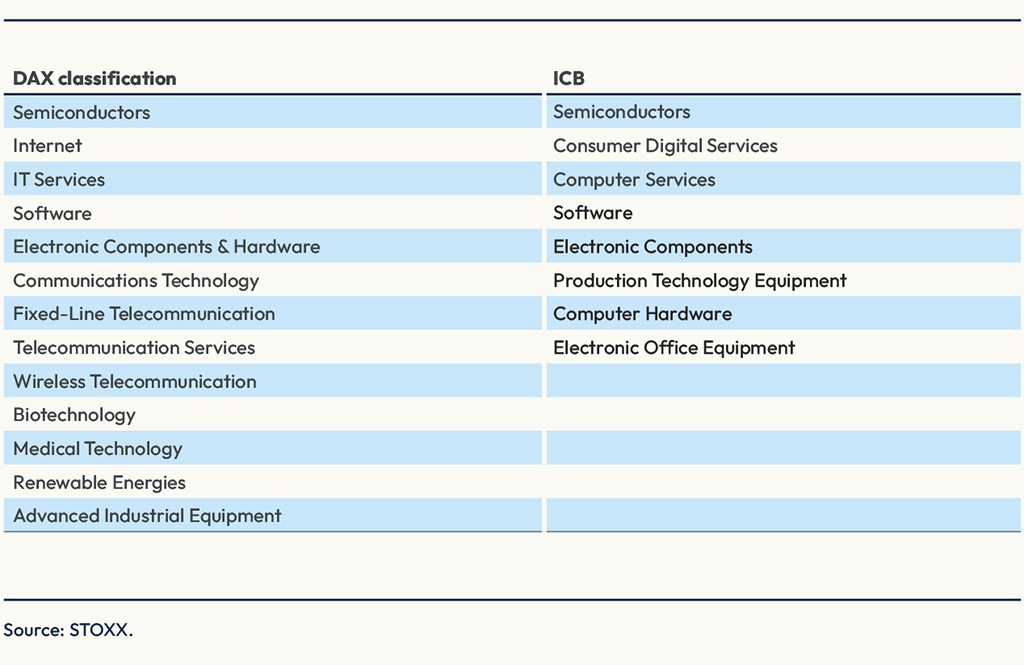

DAX Equity Industry Classification

Created in the early 2000s, the DAX Equity Industry Classification has a business taxonomy that differs from the more widely used Industry Classification Benchmark (ICB). Among those differences is a more comprehensive inclusion of technology activities that fall under non-Technology industries in the ICB Classification (Figure 3).

Figure 3: DAX Equity Industry Classification’s Technology Subsectors vs. ICB

More than half (54%) of the weight in TecDAX is made up of companies that are outside of ICB’s Technology Industry. That includes biotechnology companies Qiagen, Sartorius and Evotec (which are classified as Healthcare under ICB); Medtech companies Siemens Healthineers, Carl Zeiss Meditec (ICB Healthcare), and Eckert & Ziegler (ICB Basic Materials); renewable energy companies Nordex, PNE, Energiekontor and SMA Solar Technology (which are either Energy or Utilities under ICB); and telecoms providers Deutsche Telekom and Freenet (ICB Telecommunications).

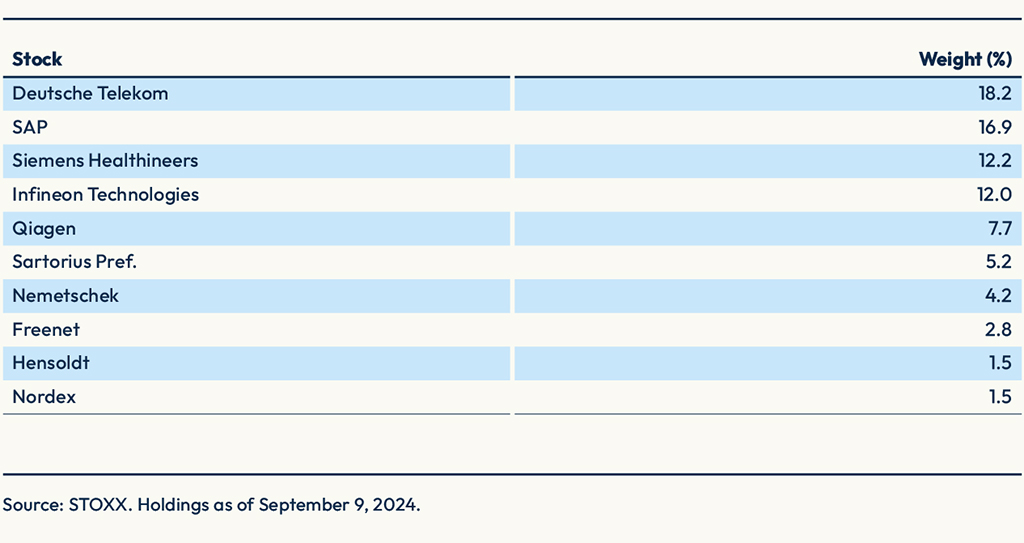

Deutsche Telekom, which besides traditional telecommunications services offers software-based, cloud services and digitalization strategies for companies, has the biggest index weight in that group and in the index, at 18.2%. It is followed by Siemens Healthineers (12.2%), which leverages data and artificial intelligence (AI) systems to provide health care. Then comes Qiagen (7.7%), which delivers solutions for molecular testing, and Sartorius (5.2%), which manufactures electronic equipment and components for laboratory, electrochemistry and other medical uses.

Figure 4 shows TecDAX’s largest components.

Figure 4: Top 10 index components

Performance attribution

That diversification has paid off in the last decade, as the three top active contributors over the period were taken from different sectors. Since the peak in November 2021, losses have been led by three tech-healthcare stocks: Sartorius, Evotec and Carl Zeiss Meditec.

When looking at factor attribution in the past decade, the Industry factor, or the share of returns that can be explained by a stock’s sector, generated the highest active returns, according to Axioma data.

Methodology updates

As with other DAX Selection Indices, TecDAX has seen important updates to its methodology in recent years. Until September 2018, technology blue-chips that were constituents of the flagship DAX were not allowed into the TecDAX index. That restriction was dropped to better reflect the size and sector representation of the technology markets and bring rules in line with international standards.

As part of a big overhaul announced in 2020, all components in TecDAX and other DAX Selection Indices are required to timely publish their audited annual financial reports and quarterly statements, and have an internal independent audit committee in place. The selection criterion of trading turnover was replaced by a minimum liquidity requirement, with market capitalization remaining the key metric as is customary internationally.

The TecDAX index is reviewed twice a year but goes through a quarterly so-called Fast Exit/Fast Entry review to account for significant changes in companies’ market capitalization. For more information, visit the DAX Equity Index Methodology Guide.

The weighting of index constituents is capped at 15%. A version of TecDAX that limits the weight of stocks to 10% was introduced in March of this year.

A world leader in technical innovation

With the clear and objective methodology that has characterized DAX indices since 1988, TecDAX represents a pure, targeted and comprehensive coverage of German technology stocks. The index offers access to research and development champions in a country leading in industries including software, advanced industrial equipment and medtech.

[1] Total return in euros, the most followed version of the index.

[2] Measured in terms of market capitalization.

[3] Data as of September 6, 2024.