Earlier in the year, STOXX introduced the EURO STOXX 50® ESG Index, a second-generation environmental, social and governance (ESG) version of the iconic EURO STOXX 50® Index that follows standard investment exclusions and integrates companies’ ESG scores into stock selection.

The combination of ESG exclusions and integration in one systematic methodology is a step further from the existing exclusion-based responsible-investing benchmarks such as the EURO STOXX 50® ESG-X Index.

The EURO STOXX 50 ESG Index was created with the aim to become the leading sustainable-investing index for the Eurozone, at a time when investors are quickly adopting responsible policies and are looking for suitable benchmarks for their core portfolios.

The methodology excludes the 10% least sustainable constituents from the benchmark EURO STOXX 50 Index (integration scoring step), in addition to those in breach of UN Global Compact principles or involved in controversial products like tobacco and weapons (negative/norms-based screening step). The excluded securities are then replaced with companies from their same Industry Classification Benchmark (ICB) supersector that have a higher ESG score.

New study puts focus on index returns and risk

To analyze the effect of implementing such a strategy, a new STOXX research paper1 puts the EURO STOXX 50 ESG Index’s profile and characteristics under the microscope. The analysis also compares the index’s performance against a traditional market-capitalization benchmark and vis-à-vis a sole strategy of ESG exclusions.

The study, by Ladi Williams and Anand Venkataraman of STOXX’s Product Management team, uncovers some interesting findings. Among them:

- The EURO STOXX 50 ESG Index maintains a similar composition to its benchmark, upholding its diversification across countries and industries. At the same time, the ESG index has historically shown a higher ESG score than the benchmark.

- Both the replacement of excluded securities and subsequent weighting redistributions have added to the portfolio’s overall ESG score.

- Similarly, ESG integration has added to relative returns while negative exclusions have been a drag.

Improved ESG profile

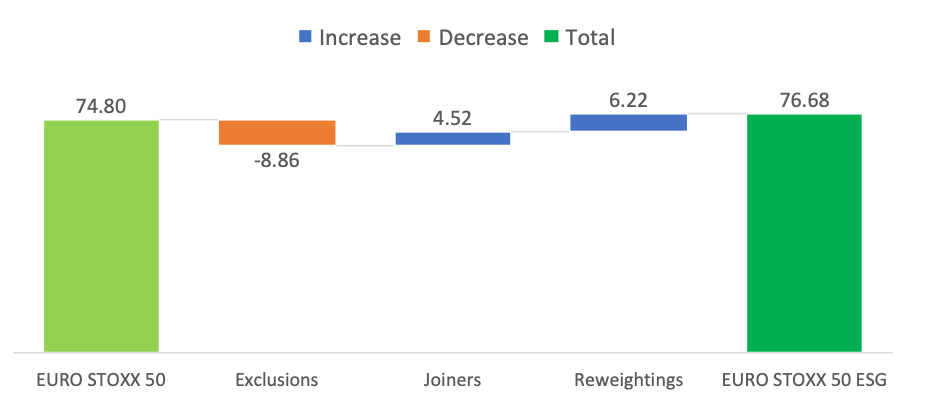

As would be expected, the EURO STOXX 50 ESG Index improves the portfolio’s sustainability profile, the authors found. Historically, the subsequent weight redistributions have had more of a positive impact on the ESG score than the stock replacements in isolation. The chart below shows the evolution of the portfolio’s overall ESG score as of September, as it transitions from benchmark-based to EURO STOXX 50 ESG Index.

Integration outperforms exclusions

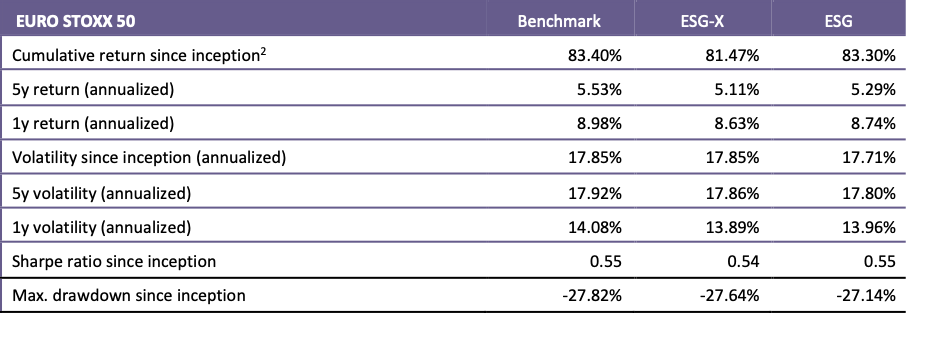

The EURO STOXX 50 ESG Index shows risk and return ratios that are not far off from those of the market-value benchmark. Both indices have slightly higher returns than the EURO STOXX 50 ESG-X Index, suggesting the better performance of higher ESG-scorers outweighs the drag of excluding certain outperforming companies, such as those involved in controversial weapons.

The table below is taken from the report and shows the performance and risk analysis for the EURO STOXX 50 Index (benchmark) and its two ESG variants.

Whereas the exclusions-based approach adopted by the EURO STOXX 50 ESG-X introduced a performance drag of 193 basis points since data starts in 2012, the EURO STOXX 50 ESG almost entirely offset this, adding back 183 basis points while also reducing volatility by 14 basis points.3

Liquidity largely unaffected

The authors also probed the liquidity in both the benchmark and ESG portfolios, as measured by the days it takes to sell down the portfolio’s holdings in the market. The study concluded that the ESG integration methodology, in general, did not have a material impact on liquidity.

A more comprehensive ESG approach

In summary, the paper underscores the potential of exploiting the ability of some companies to manage their ESG-related risks and opportunities better than industry peers. This is likely to be of interest to the increasing number of investment managers looking beyond negative screening strategies, where the focus is more on alignment with moral codes than on enhancing a benchmark’s risk-return profile.

The EURO STOXX 50 ESG Index offers a more comprehensive sustainable version of its flagship benchmark and that complements the existing ESG-X series, building upon its simplicity and transparent rules-based approach. This latest research note is likely to prove a helpful guide for potential investors in such a strategy.

Featured indices

1 Williams, L., Venkataraman, A.; ‘EURO STOXX 50® ESG Index – An ESG Version of the Iconic Blue-Chip Eurozone Index,’ STOXX Ltd., September 2019.

2 Inception refers to start of data in March 2012.

3 Gross returns in euros, Mar. 19, 2012-Sep. 20, 2019.