In May 2011, STOXX launched its Thematics suite with the introduction of the STOXX® Global Extended Infrastructure 100 and STOXX® Global Infrastructure Suppliers 50 indices. The index family has come a long way since then and now includes over 40 solutions that target themes across three broad categories: the environment, future technology and socio-demographics. Figure 1 shows a selection of indices in the suite.

Figure 1: STOXX Thematics universe, selected indices

Thematic investors find themselves at a singular point. Fast societal and business change in our world is constantly generating new themes. At the same time, evolving technologies and ever-smarter datasets are enabling new methodologies to best harness the impact of that change. Index levels recovered last year from the dip in 2022, when a sell-off in the most growth-oriented parts of the market served as a reminder that thematic investing carries with it a risk, and that long-term performance is not immune to cyclical headwinds.

Despite market and economic volatility, many investors have allocated money into thematic strategies either for the potential for outsized returns, portfolio diversification (more on this below) or even as an inflation hedge.

Long-term performance

A key characteristic of thematic investing is that it aims to capture the upside of multi-year structural change, as opposed to the shorter economic cycles and annual corporate calendars that often dictate returns in large pockets of the market. This coincides with the findings of a survey from BNP Asset Management last June. In it, 34% of polled investors said thematic investing has a positive impact on returns in periods up to three years. In contrast, 84% said thematic investing has a positive impact on performance over periods of up to five years.

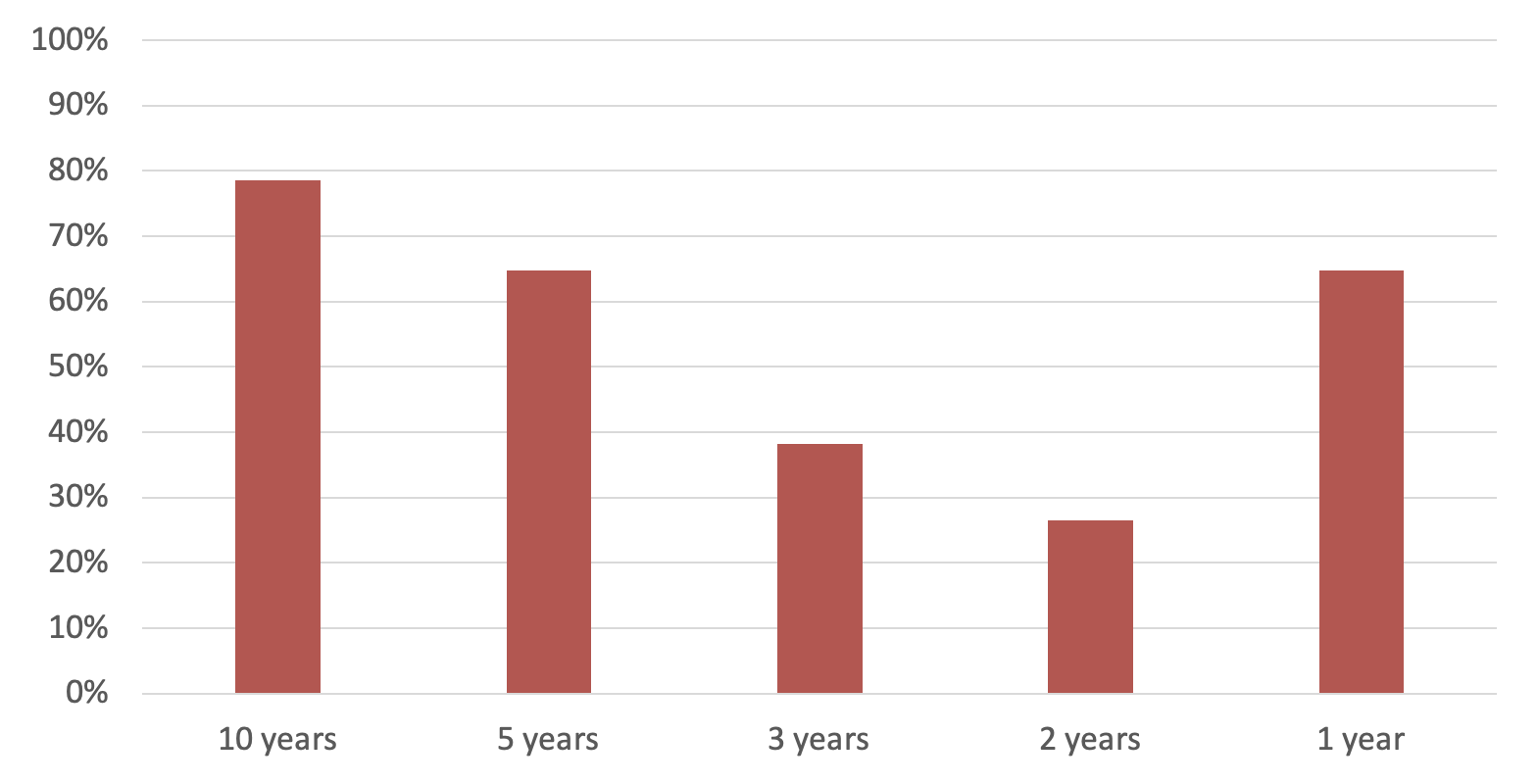

This is backed up by the performance of our indices in the past decade. Almost 80% of STOXX’s thematic indices beat the STOXX® World AC index over the past ten years, while about two-thirds did so over the past five years (Figure 2a).

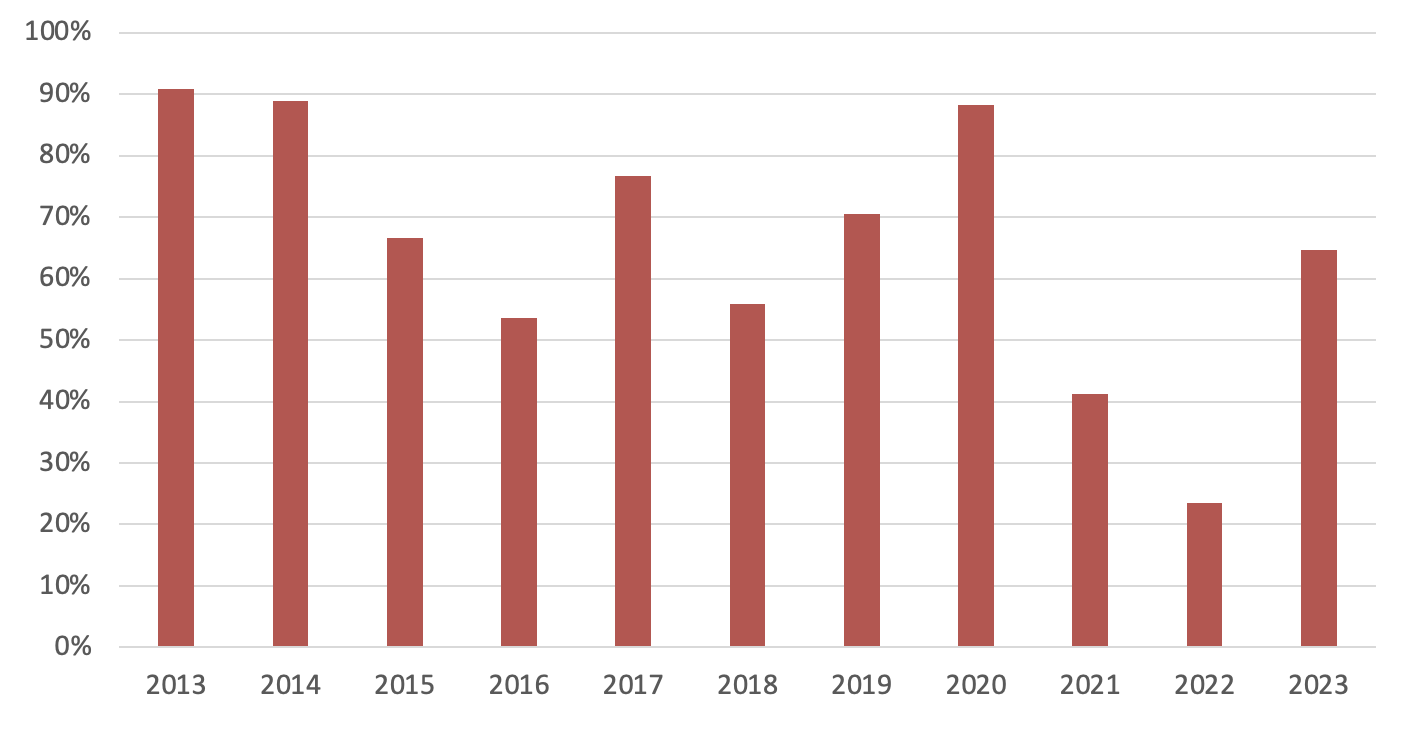

In more recent years, on the other hand, thematic funds faced a challenging environment as central banks aggressively raised interest rates to fight inflation. As such, the ratio of outperforming thematic indices over the past two years fell strongly, to under 30%. As thematic indices bounced back in 2023, the ratio of outperforming thematic indices in the past 12 months jumped back to 65%. Gains came around as investors predicted the world was headed for looser monetary policy.

Figure 2: Share of outperforming STOXX Thematic indices by period and year

a. By rolling period

b. By calendar year

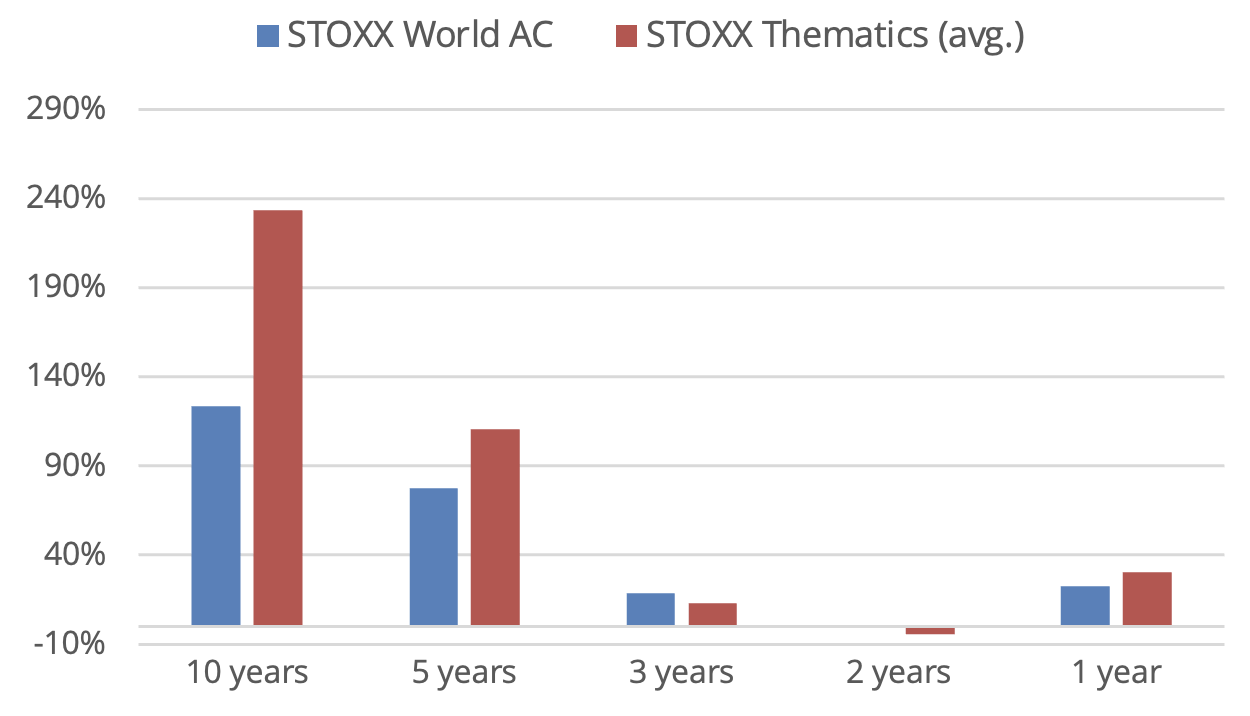

Figure 3 shows the average total return in a representative set of STOXX Thematic indices in red and those of the benchmark STOXX World AC in blue. Thematic indices amply outperformed when considering the last ten- and five-year periods, but that advantage disappears when taking the past two and three years.

Figure 3: Total returns

While offering higher potential returns, thematic investing usually carries higher volatility than benchmarks. This is to be expected from portfolios that are narrower and more targeted.

Diversification

One of the appeals of thematic indices is that they can help reduce a portfolio’s correlation to benchmarks and to the economic cycle[1], enabling investors to hedge their risk.

For example, the STOXX® Global Broad Infrastructure index has a beta of 0.76 to the STOXX World AC. Assets with a beta of 1 move in tandem. At the high end of the spectrum, the STOXX® Global Copper Miners index has a beta of 1.76, and the STOXX® Global Smart Cities scores a beta of 1.73.

The year of the ‘Magnificent Seven’

Looking at 2023’s performance within the three clusters in the STOXX Thematics suite, Future Technology delivered an average return of 43% in the year, followed by Socio-Demographics (+29%) and Environment (+6.8%).

The STOXX® World AC NexGen Software Development (+75%) and the STOXX® Global Artificial Intelligence (+71%) led gains, confirming the standing of artificial intelligence as last year’s ‘hot topic.’ Both indices are dominated by members of the ‘Magnificent Seven’ group of stocks that drove gains last year: Apple, Microsoft, Meta, Amazon, Alphabet, Nvidia and Tesla.

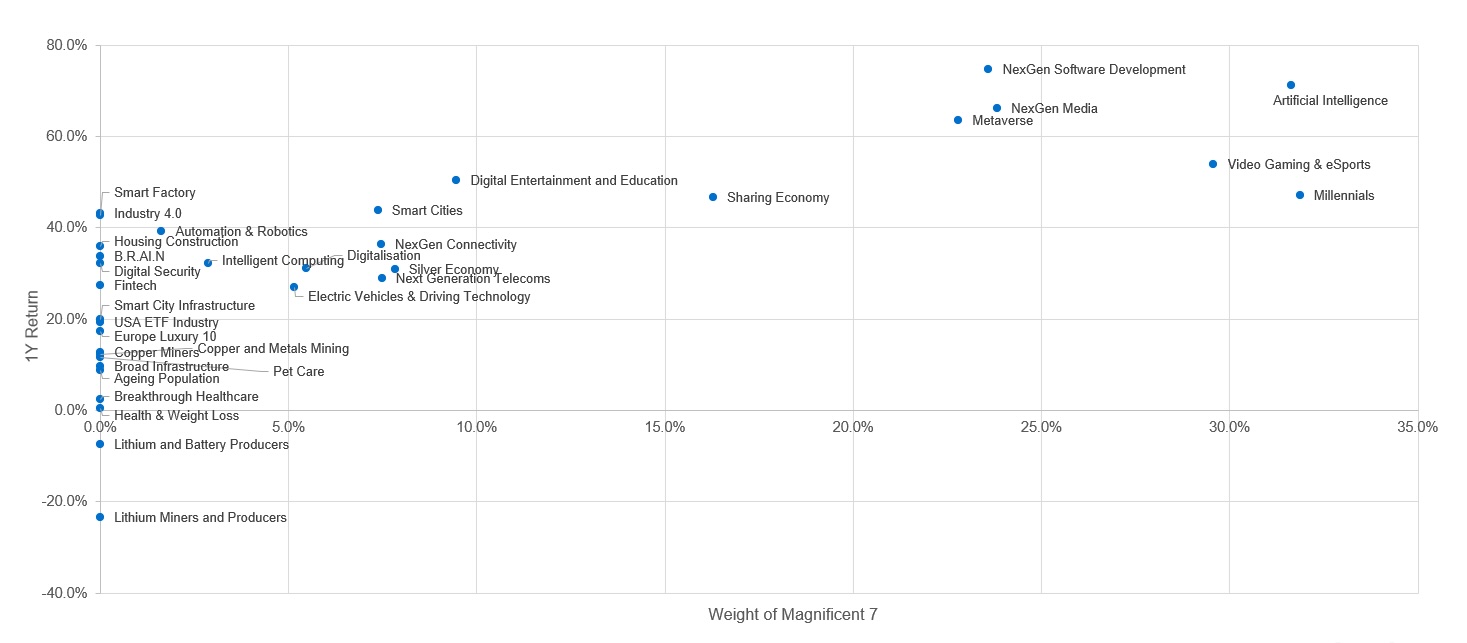

Figure 4 shows the one-year performance through December of the STOXX Thematic indices (vertical axis) vs. the weight of the Magnificent Seven in each index (horizontal axis) as of the end of the period.

A linear trend is generally observed, where the larger the presence of Magnificent Seven stocks, the better the index performance. Nevertheless, there are some notable outliers such as the STOXX® Global Industry 4.0 (43%), which did not feature any of the stocks.

Figure 4: Sway of ‘Magnificent Seven’ stocks

Expanded ecosystem

Thematic investing has established a foothold in professional investment portfolios, with new themes and ways to target them — such as listed futures — coming to the market. Our analysis shows that the strategies can outperform over multi-year periods that encompass different macroeconomic backgrounds. Additionally, because of particular characteristics that differ from those of benchmark indices, thematic strategies can play a diversification role in portfolios.

With technological and social change happening at ever-faster speed, and environmental considerations gaining precedence, thematic indices will continue to attract investors’ attention.

[1] See Wellington Management, “Thematic investing: Long-term thinking for a short-term world,” November 2022.