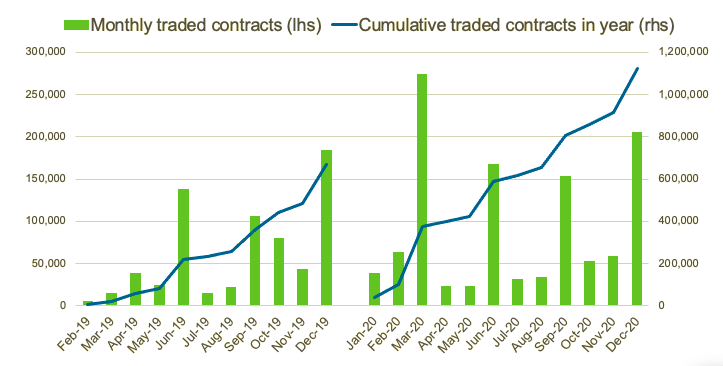

Trading in futures on the STOXX® Europe 600 ESG-X Index (FSEG) has topped the 1-million-contracts mark this year, the first such milestone for a sustainability-focused derivative listed on Eurex, as more investors turn to the products to manage responsible portfolios.

The number of FSEG contracts that exchanged hands in 2020 reached almost 1,010,000 on Dec. 15, according to data from Eurex. The futures were listed in February 2019, and 668,000 contracts traded last year.

Exhibit 1 – Monthly traded FSEG volume

More flexibility in the toolkit

Environmental, social and governance (ESG) derivatives give investors the ability to hedge, take positions and lower trading costs with instruments that are fully compliant with their sustainability principles. Market participants in Europe have been quick to embrace the products, in line with the rapid growth of ESG mandates in the region. Deep liquidity in these contracts, in turn, facilitates the transition to sustainable portfolios.

STOXX’s ESG-X family is composed of versions of established STOXX benchmarks that apply exclusionary screens based on the standard responsible policies of large asset owners. The indices exclude companies in breach of Sustainability’s Global Standards Screening, as well as those involved with controversial weapons, thermal coal and tobacco.

Listed derivatives on the ESG-X family also include futures on the STOXX® USA 500 ESG-X Index, which were at the time of listing the first derivatives in Europe tracking ESG exclusions on US stocks and the first worldwide to include a screening for thermal-coal mining and coal-fired power plants. Investors can also access options on the STOXX Europe 600 ESG-X Index.

ESG integration

Since November, two Qontigo second-generation ESG indices also underlie futures and options on Eurex. They are the EURO STOXX 50® ESG Index and DAX® 50 ESG Index EUR price return version.

The EURO STOXX 50 ESG Index and DAX 50 ESG Index remove companies involved in activities that are undesirable or controversial from a responsible-investing perspective, like do the STOXX ESG-X indices. Additionally, they integrate sustainability parameters into stock selection, meaning they prioritize companies with the highest ESG scores over the laggards.

Other available ESG derivatives include futures on the STOXX® Europe Climate Impact Ex Global Compact Controversial Weapons & Tobacco Index and EURO STOXX 50® Low Carbon Index, and futures and options on the STOXX® Europe ESG Leaders Select 30 Index.

Benefits of ESG futures

Money managers with responsible mandates can find that the use of ESG derivatives materially lowers costs when hedging or overseeing liquidity of sustainable portfolios, relative to buying a whole basket of ESG-selected stocks. For many of them, the use of conventional index futures is banned by their internal rules.