Inflows and assets in exchange-traded funds (ETFs) tracking STOXX and DAX indices jumped in the first half of 2025, strongly outperforming the broader industry, as investors increased exposure to European stocks.

Investors poured a net EUR 23.4 billion into STOXX- and DAX-linked ETFs over the period, compared with EUR 2.8 billion in all of 2024, according to STOXX data[1]. Assets in the funds rose to EUR 162.7 billion, 30% more than at the end of 2024.

By contrast, assets in all global passive ETFs ended June 2025 at EUR 12.8 trillion, down from EUR 12.9 trillion at the start of the year, even after H1 net inflows of EUR 517 billion. A 12% increase in the common currency against the dollar this year has hindered growth in the industry’s assets when measured in euros.

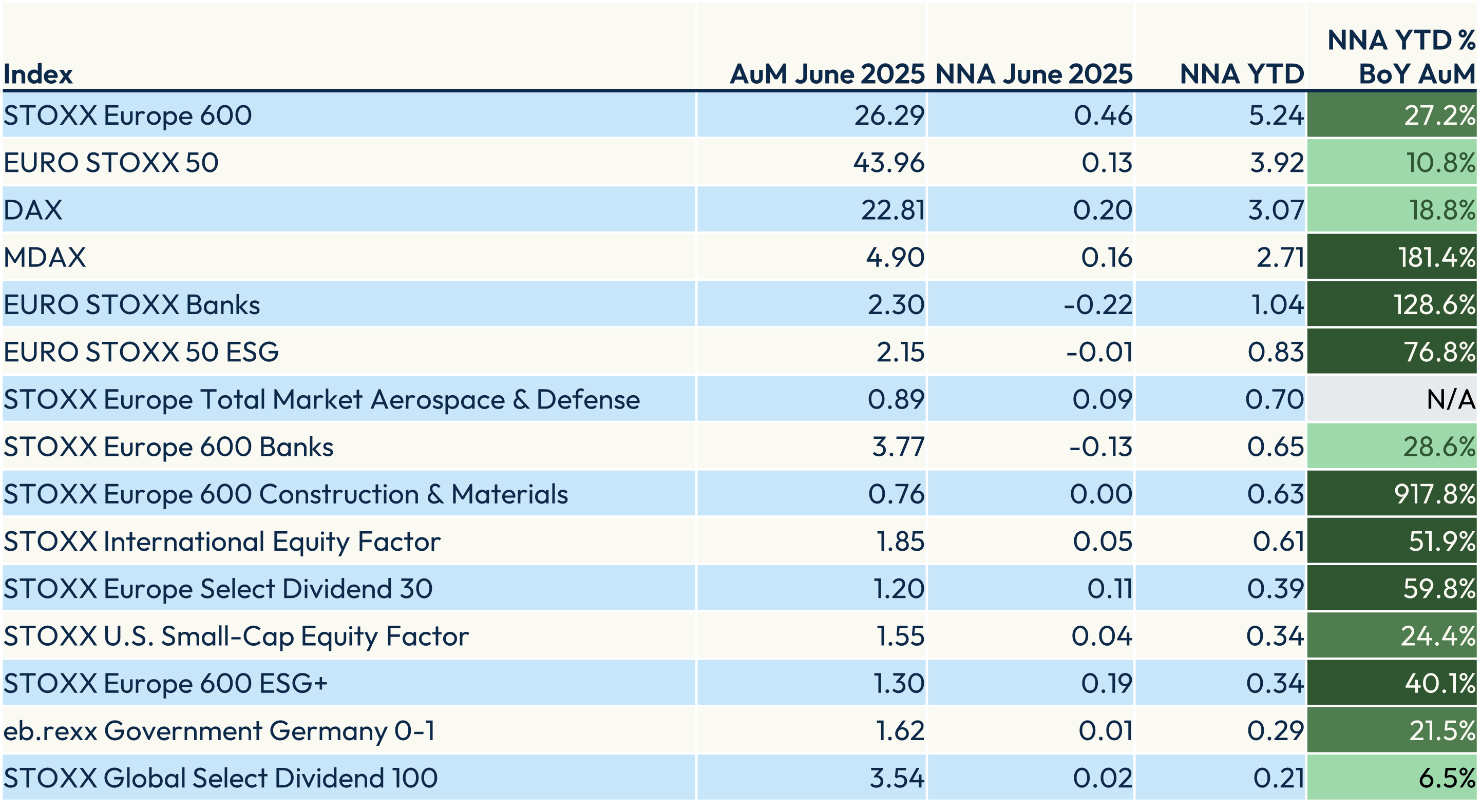

Inflows in the first six months of the year went into STOXX and DAX benchmarks including the STOXX® Europe 600, EURO STOXX 50® and DAX® (Figure 1). MDAX®, which gauges mid-cap German stocks, was the fourth-most sought index. The benchmark attracted a net EUR 2.7 billion in the six months through June, nearly double the assets invested in the index at the start of the period.

Figure 1: STOXX, DAX indices – Assets under management (AuM) and net new assets (NNA), EUR bn

The market for passive ETFs targeting EMEA equities grew 24.3% in the first half of 2025 to EUR 423.5 billion under management following share-price gains and net inflows of EUR 53.7 billion over the period. Nearly 44% of all net flows into the funds went to those tracking STOXX and DAX indices.

“Amid a year marked by macroeconomic and geopolitical uncertainty, investors are turning to Europe for a compelling mix of earnings growth and attractive valuations — offering both upside potential and relative protection,” said Serkan Batir, Global Head of Product Development and Benchmarks at STOXX. “We are pleased that the growing STOXX offering continues to provide the solutions that clients need.”

The STOXX Europe 600 has gained 9.4% this year and the DAX has surged 20%, driven by optimism that European governments are acting to spur economic growth after years of stagnation. The STOXX® USA 500, meanwhile, has added a slower 6.9% in dollars as investors look outside the US for shares with lower valuations.

Index categories

While benchmarks attracted the bulk of new money (EUR 18.9 billion) within all STOXX and DAX indices in the first half, factor-based indices lured EUR 1.9 billion and sustainability indices received EUR 1.4 billion. STOXX fixed income indices saw net inflows of EUR 0.6 billion in the six months.

Four ETFs following a STOXX index were introduced this year. The Amundi STOXX Europe Defense UCITS and the iShares Europe Defence UCITS, both launched in the second quarter, saw the most inflows within the group.

Worldwide trends

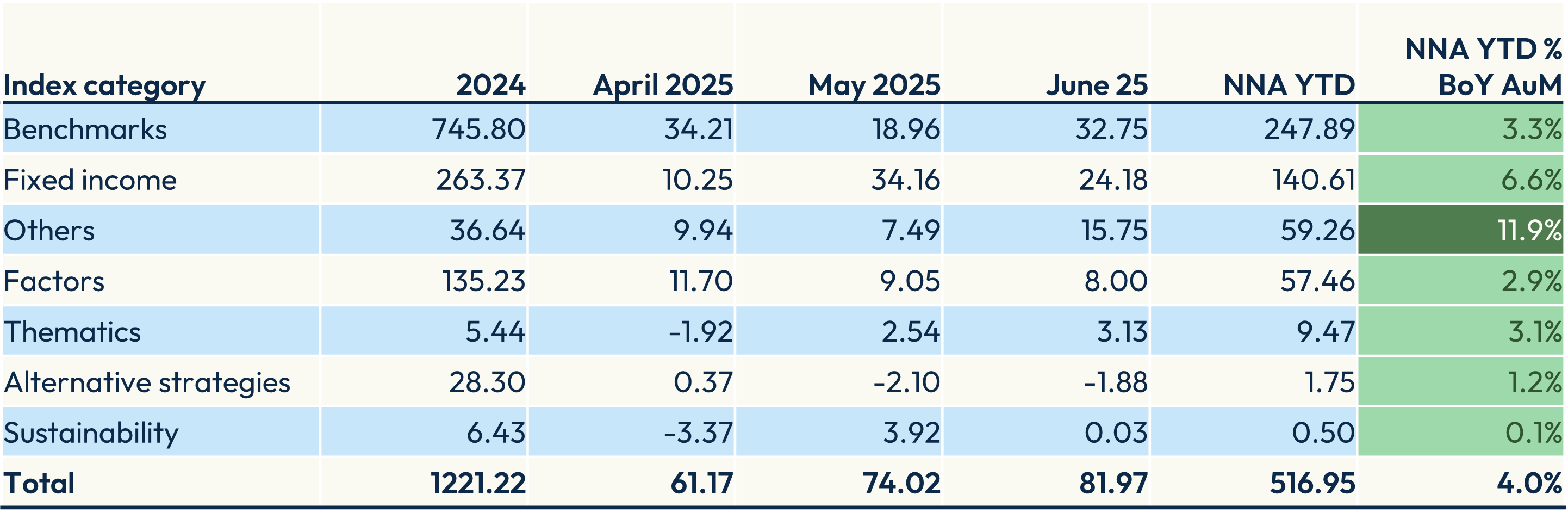

Globally, passive ETFs attracted a net EUR 517 billion in the first half of 2025, or 4% of existing assets in the funds at the start of the year (Figure 2), STOXX data show. The funds gathered EUR 1.2 trillion in all of 2024.

Funds tracking a benchmark got a net EUR 248 billion in the six months, or 3.3% of the funds’ managed assets at the start of the year. Fixed income ETFs attracted the second-highest amount among all categories, receiving EUR 141 billion, or 6.6% of assets.

The Others category, which includes commodities, cryptocurrencies and money-market funds, and Thematics saw the biggest increases in inflows relative to full-year sales in 2024.

Figure 2: Global passive ETFs’ NNA by segment, EUR bn

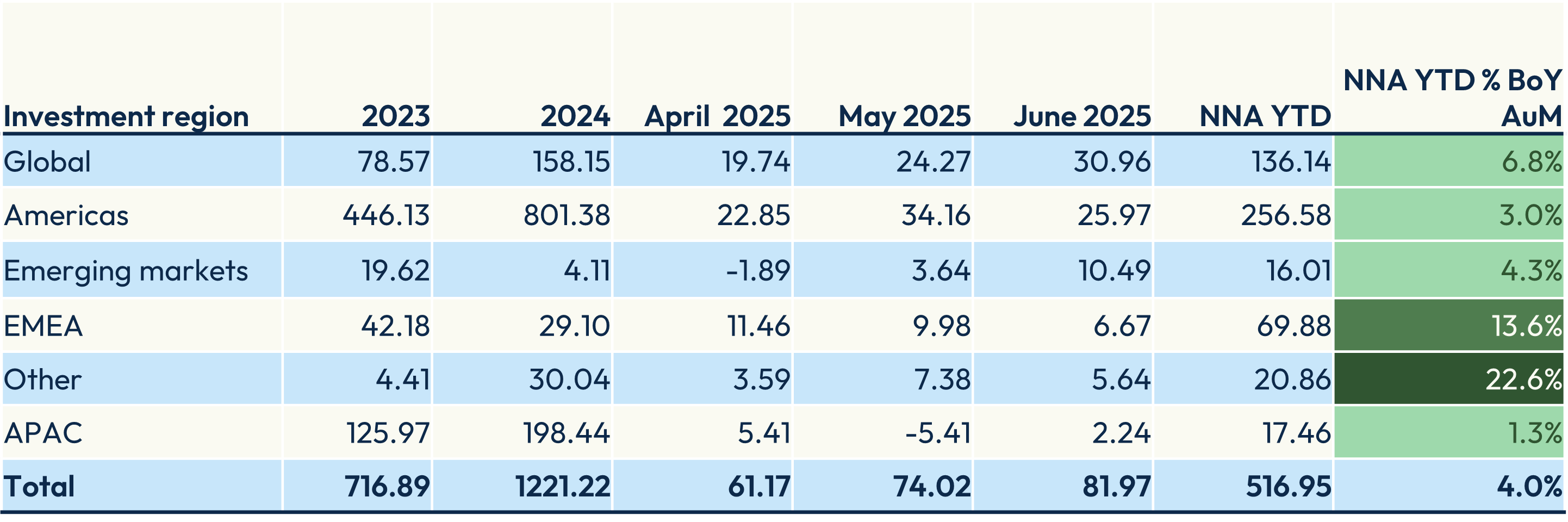

Flows into funds targeting the EMEA region across all asset classes amounted to EUR 69.9 billion, already more than twice the tally for all of 2024. Funds that invest in the Americas lured a net EUR 257 billion, compared with EUR 801 billion in all of last year.

Figure 3: Global passive ETFs’ NNA by targeted region, EUR bn

[1] Data throughout the article includes passive ETFs.