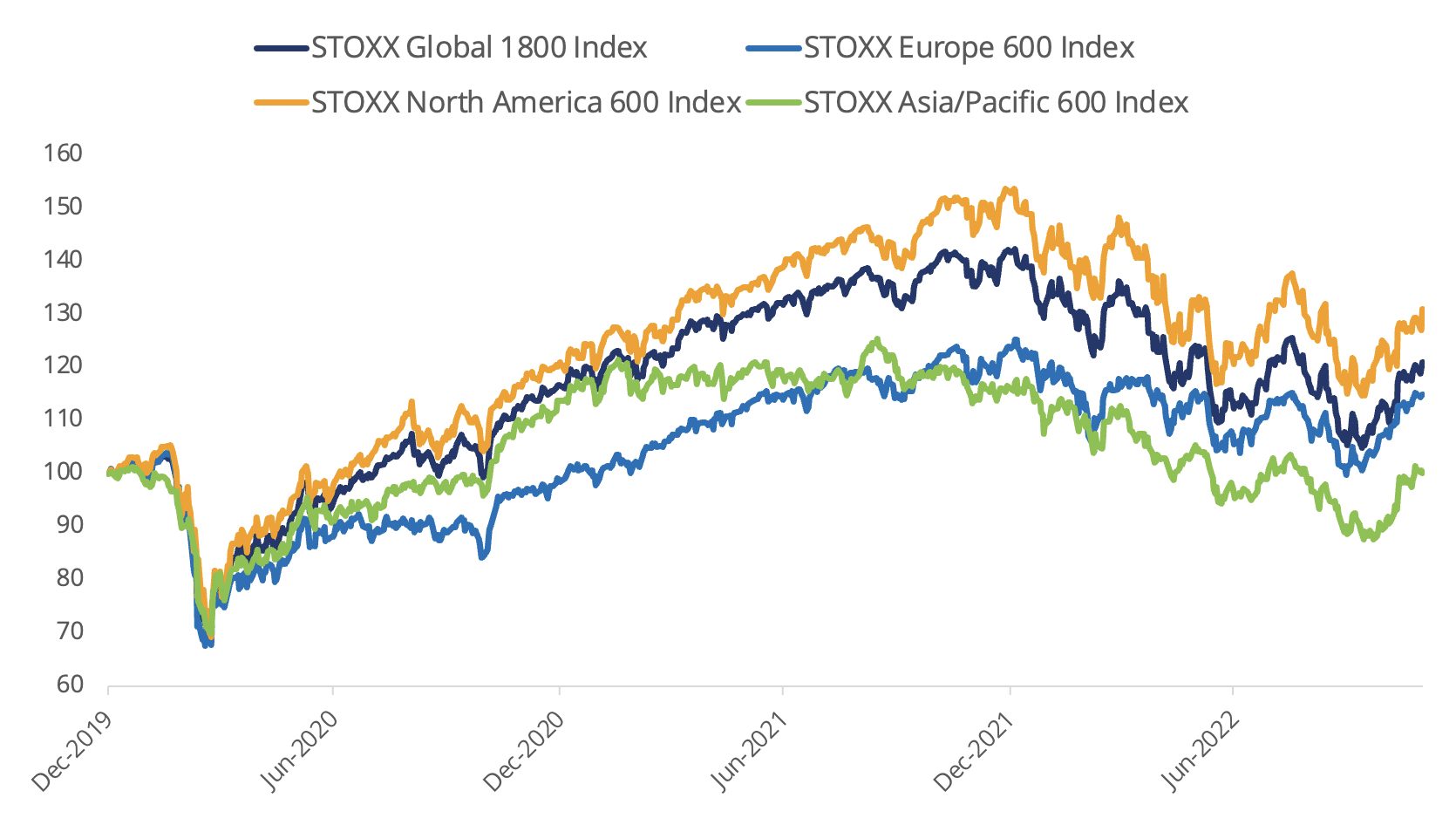

The STOXX® Global 1800 index rose for a second straight month in November as investors raised expectations that higher interest rates are helping temper inflation.

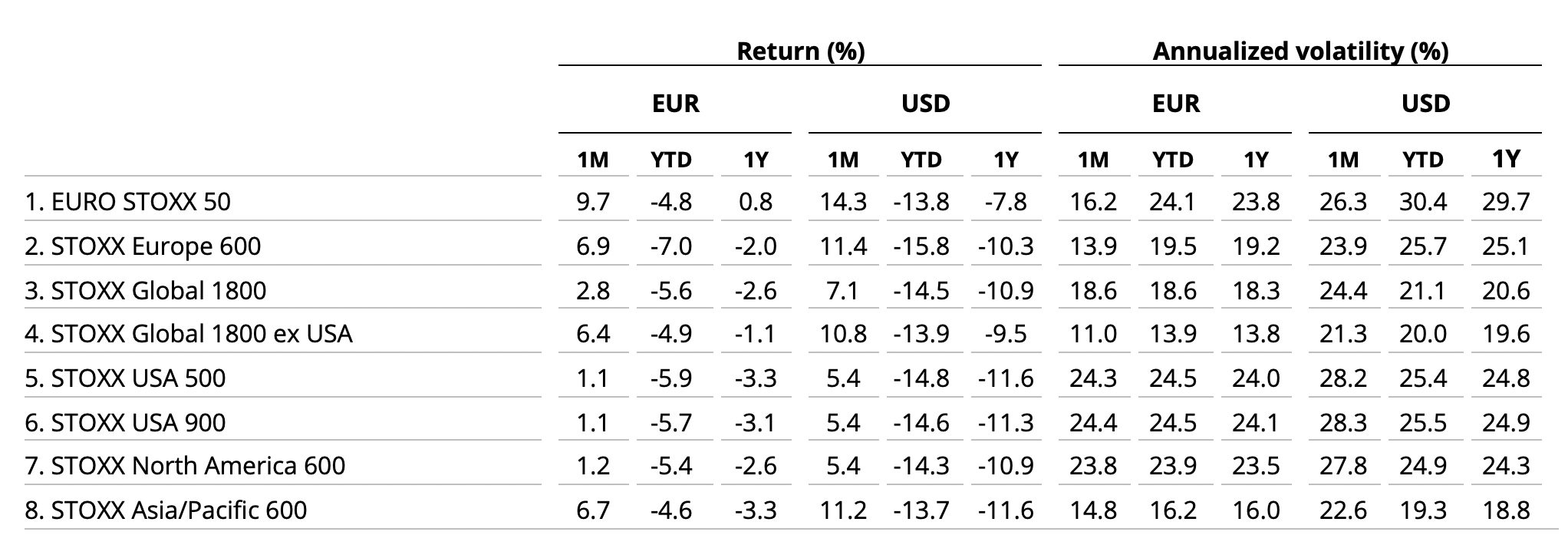

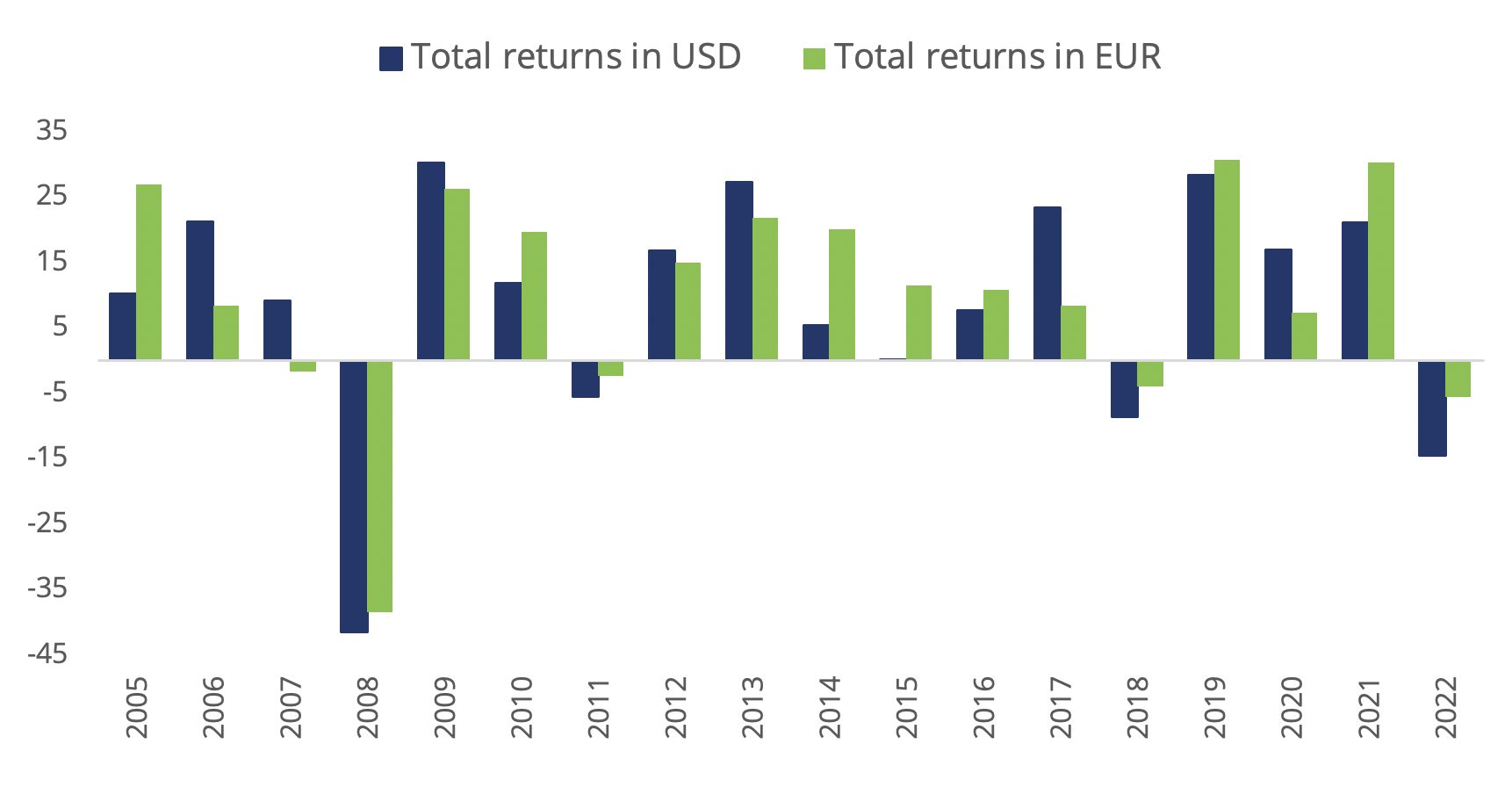

The global benchmark jumped 7.1% last month when measured in dollars and including dividends1, after a similar increase in October. Gains in euros last month were reduced to 2.8% after the common currency rose 4.2% against the greenback. The STOXX Global 1800 has still lost 14.5% in dollars in 2022, poised for its worst year since the Global Financial Crisis in 2008.

The pan-European STOXX® Europe 600 increased 6.9% in euros and the Eurozone’s EURO STOXX 50® jumped 9.7%, its best monthly showing since November 2020. The STOXX® North America 600 rose 5.4% in dollars in November, as did the STOXX® USA 5002. The STOXX® Asia/Pacific 600 gained 11.2% in dollars.

Figure 1: Benchmark indices’ November risk and return characteristics

Germany’s DAX® gained 8.6% in the month. MDAX®, which gauges the performance of German mid-caps, rose 8.1%.

Effect of higher interest rates

US inflation slowed in October to an annual rate of 7.7%, the lowest since January, the Labor Department reported on Nov. 10. Economists had expected an increase of 8%. Consumer prices rose by a four decade-high of 9.1% in June, and many investors are placing expectations that the Federal Reserve’s 375 basis points in interest rate hikes this year are helping cool inflation.

| For a complete review of all indices’ performance last month, visit our November index newsletter. |

Figure 2: Annual % returns for STOXX Global 1800 index

Figure 3: Returns since January 1, 2020

Volatility drops

The EURO STOXX 50® Volatility (VSTOXX®), which tracks EURO STOXX 50 options prices, slipped to 21.2 at the end of last month from 24.8 in October. A higher VSTOXX reading suggests investors are paying up for puts that offer insurance against stock price drops. The VDAX-New®, which measures volatility in German equities, fell to 21.7 from 25.2 in October.

Autos drop for second month

All but one of 20 Supersectors in the STOXX Global 1800 had a positive return in the month. For a second month in a row, the STOXX® Global 1800 Automobiles & Parts was the exception. The index dropped 2.4% last month.

All but one of 25 developed markets tracked by STOXX advanced in November when measured in dollars, with Israel bucking the trend. The STOXX® Developed Markets 2400 index added 6.9% in dollars and 2.6% in euros.

Eighteen of 20 national developing markets tracked by STOXX rose in the month on a dollar basis. The STOXX® Emerging Markets 1500 index gained 11.4% in the US currency.

Factor investing

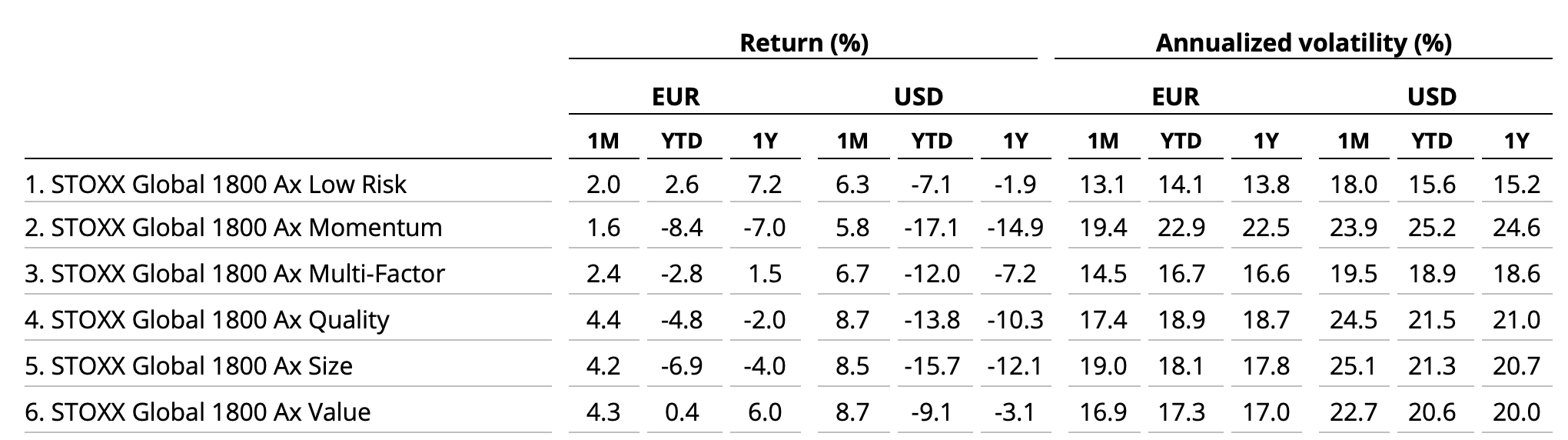

Quality and Value were the best-performing styles in the month that ended, while Momentum fared the worst, according to the STOXX Factor indices.

Figure 4: STOXX Factor (Global) indices’ November risk and return characteristics

Climate benchmarks

Among climate benchmarks, the STOXX® Global 1800 Paris-Aligned Benchmark (PAB) and the STOXX®Global 1800 Climate Transition Benchmark (CTB) added 7.2% and 7.3%, respectively. The PAB and CTB indices follow the requirements outlined by the European Commission’s climate benchmarks regulation.

The STOXX® Willis Towers Watson World Climate Transition Index advanced 7.4%. The STOXX Willis Towers Watson Climate Transition Indices (CTIs) employ a unique Climate Transition Value at Risk (CTVaR) methodology that quantifies the anticipated impact of an economic transition on equity valuations. The CTIs look beyond carbon emissions and make a forward-looking, bottom-up evaluation of asset repricing risks in a decarbonization pathway.

Among the STOXX Low Carbon indices, the EURO STOXX 50® Low Carbon (10%)3 outperformed the EURO STOXX 50 by 31 basis points in November. Elsewhere, the STOXX® Global Climate Change Leaders (9.1%), which selects corporate leaders that are publicly committed to reducing their carbon footprint, outperformed the STOXX Global 1800 index by more than 2 percentage points last month.

Sustainability indices

The STOXX® Global 1800 ESG-X index added 7.1% in the month. The STOXX® ESG-X indices are versions of traditional, market-capitalization-weighted benchmarks that observe standard responsible exclusions of leading asset owners.

Within indices that combine exclusions and ESG best-in-class integration, the EURO STOXX 50® ESG index rose 9.9%. Germany’s DAX® 50 ESG index (9.9%), which excludes companies involved in controversial activities and integrates ESG scoring into stock selection, outperformed the benchmark DAX.

Among other STOXX sustainability families, the STOXX® Global 1800 ESG Broad Market index rose 7.3% in the month. The STOXX ESG Broad Market indices apply a set of compliance, product involvement and ESG performance exclusionary screens on a starting benchmark universe until only the 80% top ESG-rated constituents remain.

The STOXX® Global 1800 ESG Target climbed 7.5%, the EURO STOXX® ESG Target rose 8.9% and the DAX® ESG Target gained 9.2%. The STOXX and DAX ESG Target indices seek to significantly improve the benchmark portfolio’s ESG profile while mirroring its returns as closely as possible. Through a series of constraints, the indices implement an optimization process to maximize the overall ESG score of the portfolio while limiting the tracking error to the benchmark.

The STOXX® Global 1800 SRI added 7.9%. The STOXX SRI indices apply a rigorous set of carbon emission intensity, compliance and involvement screens, and track the best ESG performers in each industry group within a selection of STOXX benchmarks.

Finally, the DAX® ESG Screened rose 9.2%. The index reflects the composition of the DAX benchmark minus companies that fail to pass norms-based and controversial weapons screenings, meet minimum ESG ratings or are involved in certain business activities considered undesirable from a responsible investing perspective.

Thematic indices

It was a mixed month for the revenue-based STOXX® Thematic indices, with 13 of 24 indices outperforming the benchmark STOXX Global 1800. The STOXX® Global Health & Weight Loss Index led gains with a 14.5% return.

Among the STOXX artificial-intelligence-driven thematic indices, the STOXX® AI Global Artificial Intelligence index (7.4%) and its ADTV5 version (7.6%) outperformed the STOXX Global 1800.

Dividend strategies

Dividend strategies had strong returns on a relative basis last month. The STOXX® Global Maximum Dividend 40 (9.9%) selects only the highest-dividend-yielding stocks. The STOXX® Global Select Dividend 100 (11.9%) tracks companies with sizeable dividends but also applies a quality filter such as a history of stable payments.

Minimum variance

There were strong relative performances from Minimum variance strategies covering global markets. The STOXX® Global 1800 Minimum Variance added 8.3%. The STOXX® Global 1800 Minimum Variance Unconstrained rose 9.3%, rebounding from its widest monthly underperformance to the benchmark in 11 years in October.

The STOXX Minimum Variance Indices come in two versions. A constrained version has similar exposure to its market-capitalization-weighted benchmark but with lower risk. The unconstrained version, on the other hand, has more freedom to fulfill its minimum variance mandate within the same universe of stocks.

1 All results are total returns before taxes unless specified.

2 Throughout the article, all European indices are quoted in euros, while global, North America, US, Japan and Asia/Pacific indices are in dollars.

3 Figures in parentheses show last month’s gross returns.