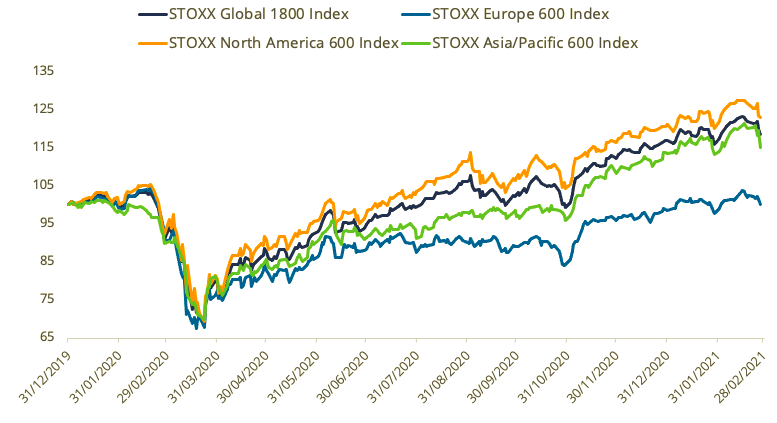

Stocks climbed in February on continued hopes for a post-lockdown economic recovery. Indices pared more than half of their advance at the end of the month following a spike in bond yields and inflation expectations.

The STOXX® Global 1800 Index advanced 2.4% in the month when measured in dollars and including dividends.1 The index climbed as much as 6.3% in the first two weeks, before paring gains as 10-Year US Treasury yields rose to 1.41% from 1.07% and some other measures pointed towards rising inflation expectations. The benchmark gained 2.5% in euros during the month.

The Eurozone’s EURO STOXX 50® Index added 4.6% when measured in euros, while the pan-European STOXX® Europe 600 Index rose 2.5%. The STOXX® North America 600 Index gained 2.5% in dollars and the STOXX® USA 500 Index rose 2.4%. The STOXX® Asia/Pacific 600 Index increased 1.7% in dollars.

The STOXX Global 1800 rose 16.9% last year, its second straight year of double-digit percentage gains, as investors raised expectations that policy support and vaccines will help economies overcome the COVID-19-induced slump.

Exhibit 1 – Returns since Jan. 1, 2020

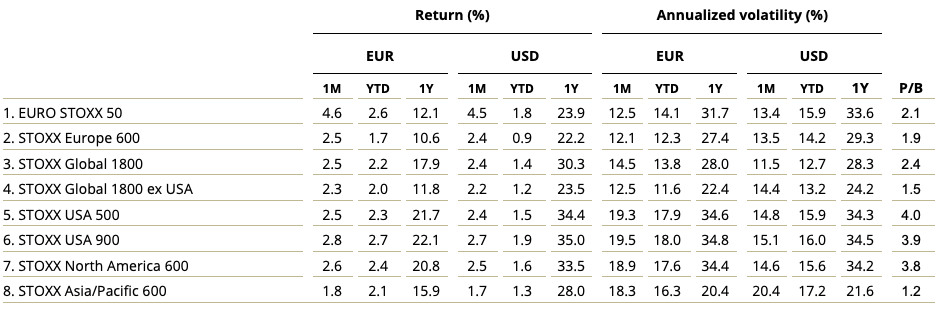

Exhibit 2 – Benchmark indices’ February risk and return characteristics

Volatility decreases

The EURO STOXX 50® Volatility (VSTOXX®) Index, which tracks EURO STOXX 50 options prices, fell to 26.9 from 29 in January. A higher reading suggests investors are paying up for puts that offer insurance against stock price drops.

Gains for most developed markets

Eighteen of 25 developed markets tracked by STOXX advanced during February when measured in dollars. The STOXX® Italy Total Market Index led gains, rising 5.7%. The STOXX® Developed Markets 2400 Index climbed 2.6% in dollars and 2.7% in euro terms.

Sixteen of the 21 national developing markets tracked by STOXX also posted a gain for the month. The STOXX® Vietnam Total Market Index was the best performer, jumping 11.1%. The STOXX® Emerging Markets 1500 Index rose 3% in dollars and 3.1% in euros.

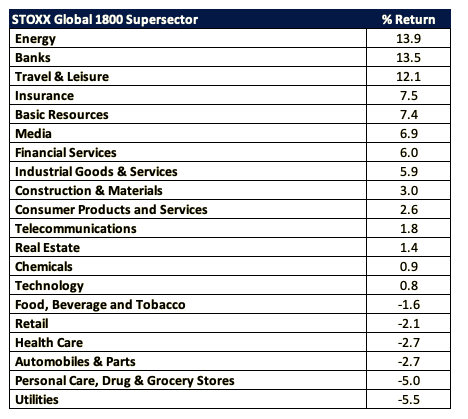

Supersectors reflect inflation concerns

Sector performance reflected investor reaction to higher bond yields (Exhibit 3). The STOXX® Global 1800 Banks Index, which tends to benefit from rising interest rates, was one of the best performers among 20 Supersector indices within the global benchmark.

At the other end, the STOXX® Global 1800 Utilities Index performed poorly as the bond-proxy industry’s high dividend yields became less appealing relative to bond payments. Consumer-related shares such as Retail; Food, Beverage and Tobacco; and Personal Care, Drug and Grocery Stores fell on concern an acceleration in inflation will eat into profits.

Exhibit 3 – STOXX Global 1800 Supersectors monthly returns

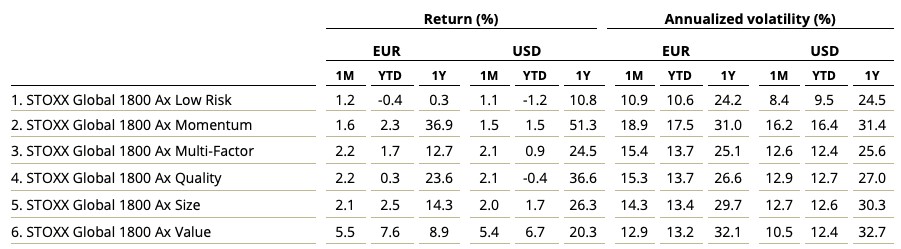

Factor-based strategies

Investors turned further to Value stocks in February. The STOXX® Global 1800 Ax Value Index added 5.4%. It was a notable performance given that none of the other five styles in the STOXX Factor Indices outperformed the benchmark. The STOXX® Global 1800 ESG-X Ax Value Index, which applies the same factor approach but also excludes companies involved in controversial activities from a sustainability point of view, jumped 5.8%.

Exhibit 4 – STOXX Factor (Global) indices’ February risk and return characteristics

On a regional basis, gains were led by the STOXX® Europe 600 Ax Value Index (+3.1%), STOXX® USA 900 Ax Value Index (+3.2%) and STOXX® Asia/Pacific 600 Ax Value Index (+6.2%).2

Factor Market Neutral Indices

Four of the seven iSTOXX® Europe Factor Market Neutral Indices had a positive return during February. The indices hold a short position in STOXX Europe 600 futures to help investors neutralize systematic risk. The iSTOXX® Europe Quality Factor Market Neutral Index had the highest return, at +1.2% on a net-return basis.

Minimum variance

Minimum variance strategies continued to underperform amid a background of risk-taking. The STOXX® Global 1800 Minimum Variance Index gained only 0.6% during the month and the STOXX® Global 1800 Minimum Variance Unconstrained Index slipped 1.7%. The STOXX® Europe 600 Minimum Variance Index added 0.8% in euros, while its unconstrained version decreased 1.6%.

The STOXX® Minimum Variance Indices come in two versions. A constrained version has a similar exposure to its market-capitalization-weighted benchmark but with lower risk. The unconstrained iteration, on the other hand, has more freedom to fulfill its minimum variance mandate within the same universe of stocks.

Sustainability indices

The STOXX® ESG-X indices performed broadly in line with benchmarks during February. The indices are versions of traditional, market-capitalization-weighted benchmarks that observe standard responsible exclusions of leading asset owners. The STOXX® Global 1800 ESG-X Index added 2.4% in dollars, as did the STOXX® Europe 600 ESG-X Index in euros.

Within indices that combine exclusions and ESG integration, the EURO STOXX 50® ESG Index underperformed its benchmark by 33 basis points during the month. The ESG index, which is derived from the iconic EURO STOXX 50 Index, beat its benchmark by more than 3 percentage points in 2020.

The DAX® 50 ESG Index, which excludes companies involved in controversial activities from a sustainability point of view and integrates ESG scoring into stock selection, rose 2.9%, compared with a 2.6% advance for the blue-chip DAX®.

Climate benchmarks

The STOXX Paris-Aligned Benchmark Indices (PABs) and the STOXX Climate Transition Benchmark Indices (CTBs) underperformed during February. The indices were introduced last year and follow the requirements outlined by the European Commission’s Technical Expert Group (TEG) on climate benchmarks.

The EURO STOXX 50® Low Carbon Index beat its benchmark by almost 1 percentage point during February, while the STOXX® Europe 600 Low Carbon Index came up in line with its benchmark.

Blockchain concept gains among thematic indices

The outperformance streak of the STOXX® Thematic Indices paused last month, at least for several of the indices. The indices seek exposure to the economic upside of disruptive global megatrends and follow two approaches: revenue-based and artificial-intelligence-driven. Thirteen of 22 revenue-based thematic indices underperformed the STOXX Global 1800 Index during the month that ended.

The STOXX® Global Sharing Economy Index was the group’s best performer last month, jumping 7.5%. The STOXX® Global Digital Security Index, at the other end, lost 3.5%. The average 2020 gain for all 22 indices was 35%, more than double that of the benchmark STOXX Global 1800 Index.

The three STOXX artificial-intelligence-driven thematic indices, on the other hand, showed strong returns relative to their benchmark in the month that ended. The STOXX® AI Global Artificial Intelligence Index rose 4.4% and the iSTOXX® Yewno Developed Markets Blockchain Index jumped 7.8%.

New ESG-X Select Dividend family

It was also a good month for the dividend strategies tracked by STOXX, which outperformed for a fourth month, in spite of the rise in bond yields. The STOXX® Global Maximum Dividend 40 Index,3 which selects the highest-dividend-yielding stocks, beat the STOXX Global 1800 Index by 1.3 percentage points during February.

The STOXX® Global Select Dividend 100 Index, which tracks companies with sizeable dividends but also applies a quality filter such as a history of stable payments, topped the benchmark by 4.2 percentage points. The STOXX® Global ESG-X Select Dividend 100 Index did even better, returning almost 5.5 points more than the benchmark. The index belongs to the STOXX ESG-X Select Dividend family, which was introduced last month and targets the highest-yielding stocks within universes screened for responsible investment criteria.

Finally, the STOXX® Global Select 100 EUR Index beat the benchmark by 14 basis points in euros.4 The index blends increasing dividend yields with low volatility, and was a strong underperformer in recent months.

Dividend strategies were overall very weak performers in 2020 and have since recently reversed their trend.

1 All results are total returns before taxes unless specified.

2 The European index is in euros, while the other two are in dollars.

3 STOXX Maximum Dividend 40 Index is calculated in net returns.

4 This index is measured in euros.