In June, Qontigo introduced the STOXX® Paris-Aligned Benchmark Indices (PABs) and STOXX® Climate Transition Benchmark Indices (CTBs), which comply with, and exceed, the requirements laid out in the new European Union Climate Benchmarks regulation.

A new research paper1 from Qontigo looks in depth into the regulatory background, methodology, and carbon emission and returns analysis of the STOXX Paris-Aligned Benchmark Indices with specific focus on the STOXX® Europe 600 Paris-Aligned Benchmark Index. The paper acts as guide and supporting material for investors seeking to form portfolios that are in line with the overall long-term global warming target of the Paris Agreement, and illustrates the additional steps taken to reinforce the objectives of the EU PABs.

The new indices

A total of 12 indices make up the new suite, including CTB and PAB indices based on the STOXX® Europe 600 Index, EURO STOXX® Index, EURO STOXX® Total Market Index, STOXX® USA 500 Index, STOXX® USA 900 Index and STOXX® Global 1800 Index. The indices use ISS ESG carbon, climate and tobacco producers´ data, as well as Sustainalytics’ Global Standards Screening and controversial weapons research. They all follow the EU provisions in terms of decarbonization trajectory, activity exclusions and sector exposure constraints.

Under the new parameters, low-carbon indices will qualify as either CTB or PAB if they demonstrate a significant reduction in overall greenhouse gas (GHG) emission intensity2 relative to their underlying investment universe and to their own history, are sufficiently exposed to sectors with high impact on climate change and exclude companies involved in certain activities deemed controversial.3 A complete list of PAB and CTB requirements and their details is shown in the study and are also available here.

A look into methodology

The 31-page report starts with a review of how the STOXX Paris-Aligned Benchmark Indices compare against each minimum requirement in the EU regulation. It also describes the additional considerations that exceed the new rules, including the use of Scope 3 carbon emissions data from inception, more stringent activity exclusions, the implementation of a minimum ‘green-to-brown ratio’ at index level, and a weighting system based on ISS ESG’s Carbon Risk Rating data and Carbon Budget data.4

The STOXX Paris-Aligned Benchmark Indices: results and insights

The study then presents an evaluation of the STOXX Europe 600 Paris-Aligned Benchmark Index from a climate performance perspective and provides a detailed overview of carbon metrics and emission attribution exposure at portfolio, sector and company level. Such comprehensive information on the PAB and CTB indices will be provided by ISS ESG and published quarterly on STOXX’s website.

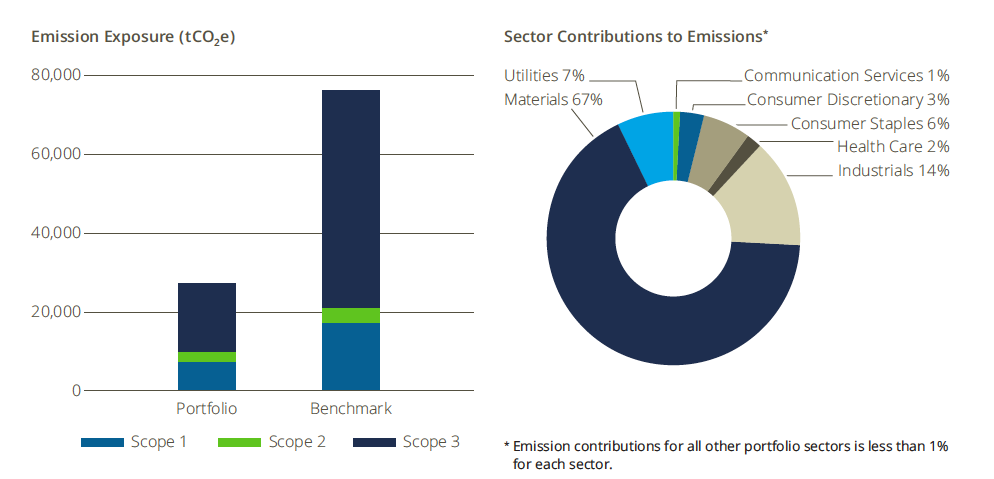

Figure 1, taken from the report, represents the emission exposures of the STOXX Europe 600 Paris-Aligned Benchmark Index portfolio against those of its benchmark, the STOXX® Europe 600 Index. The largest reduction in emissions comes from Scope 3 emissions.

Source: ISS ESG, March 31, 2020

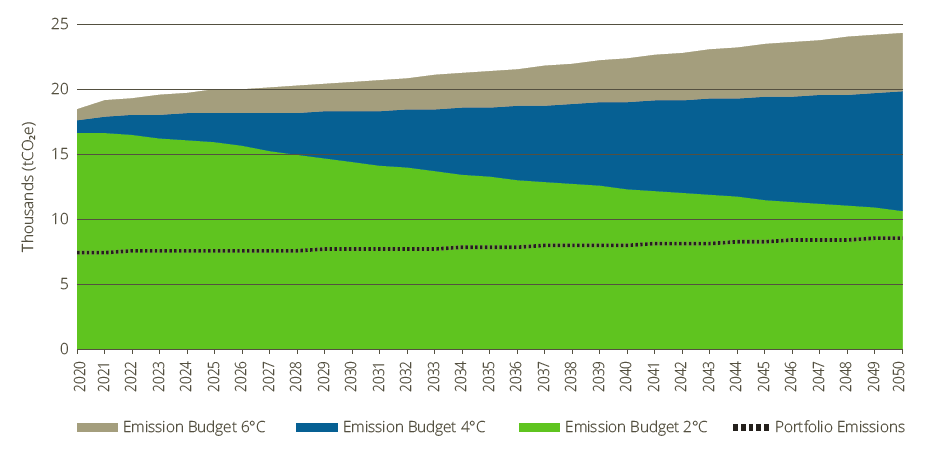

A climate scenario analysis additionally displays companies’ current and future direct emissions relative to their carbon budgets, so investors can understand the climate scenario with which the companies are aligned.

The scenario analysis chart plots the aggregated emissions per year at portfolio level and compares the pathway with the various climate scenarios until 2050. The STOXX Europe 600 Paris-Aligned Benchmark Index is aligned with a 20C scenario until 2050 (Figure 2).

Source: ISS ESG, Mar. 31, 2020.

The study’s authors also provide an analysis of physical climate and transition climate risks, both valuable insights that help investors incorporate natural, geophysical, economic and regulatory scenarios into their portfolios. They also provide a Carbon Risk Rating analysis by sector.

The report is completed with a look into the financial performance of the index.

Capturing climate risk and opportunities

The new STOXX Climate Benchmarks are transparent, liquid and diversified indices that help investors reduce exposure to climate-related financial risks, and allow for increased allocations to companies well positioned to capture opportunities in the transition to a low-carbon economy. We invite you to download the study and find out more about the new indices.

Featured indices

STOXX® Paris-Aligned Benchmark Indices

STOXX® Climate Transition Benchmark Indices

STOXX® Europe 600 Paris-Aligned Benchmark Index

1 Keogh, W., Cheung, A., Taddei, N., Tesfaldet, H., Kaloudis, I., ‘An Introduction to the STOXX Paris-Aligned Benchmark Indices,’ Qontigo, June 2020.

2 Data used to determine the decarbonization trajectory includes Scope 1 (direct emissions) and Scope 2 (indirect emissions), while Scope 3 (other indirect emissions) data is required to be phased in during a period of four years.

3 The STOXX PAB and CTB indices exclude companies involved in controversial weapons and tobacco production, as well as those that are non-compliant based on Sustainalytics’ Global Standards Screening assessment. PABs additionally exclude companies that derive pre-determined revenue thresholds from activities in coal, oil and natural gas.

4 ISS ESG’s Carbon Risk Rating (CRR) data assesses the climate-related performance of companies, taking industry-specific challenges, risk profiles, and companies’ positive impact. It establishes how an issuer is exposed to climate risks and opportunities. It provides investors with critical insights into how issuers are prepared for a transition to a low carbon economy and is a central instrument for the forward-looking analysis of carbon-related risks at portfolio and issuer level. This data is used to overweight companies contributing to the solving of climate change challenges and penalize companies from sectors not compatible with climate change mitigation. Separately, ISS ESG’s Carbon Budget data helps assess which climate scenario companies are aligned with. This Carbon Budget data is used in the weighing process of the STOXX Climate Transition Benchmark and STOXX Paris-Aligned Benchmark Indices to ensure the indices are aligned with the IEA’s 20C scenario until 2050.