Qontigo has introduced the iSTOXX APG World Responsible Investment Indices (iSTOXX APG RI Index Family) in collaboration with Dutch pension fund provider APG, which track and measure the impact of various layers of ESG investing on a global equities portfolio.

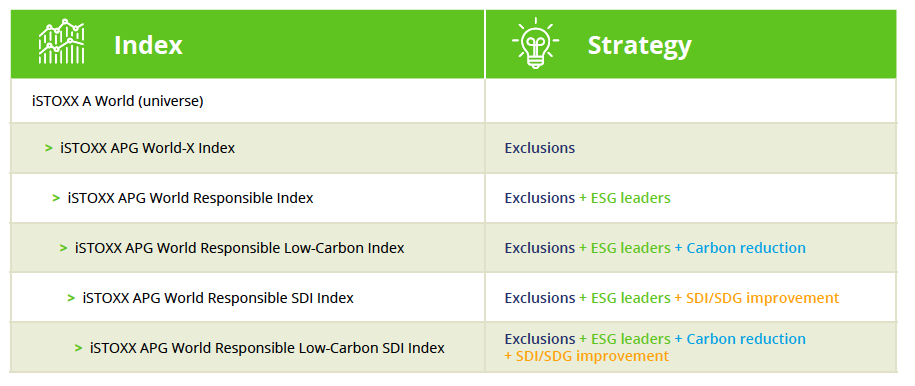

The new suite consists of five indices (Figure 1), each one incrementally implementing a different ESG, carbon and Sustainable Development Investments (SDI) strategy and quantifying the resulting effect on a portfolio’s return and risk budget. The indices use Qontigo’s line of Axioma portfolio construction tools, STOXX index design capabilities and, for the first time ever, data derived from the Sustainable Development Investment Asset Owner Platform (SDI AOP). The weight of each constituent security is determined by an optimization process with an objective of minimizing tracking error, while improving the ESG, carbon and SDI exposures.

Figure 1 – iSTOXX APG RI Index Family

One of the indices, the iSTOXX® APG World Responsible Low-Carbon SDI Index, will benchmark a mandate to be co-managed by BlackRock.

To find out more about the philosophy behind this innovative index family, we sat down for a conversation with Hamish Seegopaul, Managing Director, Head of R&D, ESG and Quantitative Indices at Qontigo; and Yurong Gu, Associate, R&D, ESG Indices. Below is our exchange.

Hamish, the iSTOXX APG RI Index Family is very different to anything Qontigo has done in the past. What are its most innovative aspects?

There are several core parts of the Qontigo DNA that brought the collaboration with APG to life: a commitment to open architecture, the belief that ESG is not a one-size-fits-all solution, and the idea that portfolio construction matters. When we think about innovation in indexing, we often think about applying novel approaches to solve problems. Here, we integrate APG’s sustainability datasets, Qontigo’s combined portfolio analytics and index design capabilities, and a layered approach to create a family of responsible, investable indices for a new era.

Yurong, these combined portfolio construction capabilities that Hamish mentions: can you tell us more about the index methodology and the optimization process? What does the latter achieve?

One can think of the problem we are trying to solve as follows: what is the set of constituents and weights that has the lowest tracking error to the benchmark, but also improves the overall sustainability profile of the portfolio across multiple dimensions, while ensuring tradability? The Axioma Portfolio Optimizer is a tool that allows us to select this portfolio. Within Qontigo, we have not only used this sophisticated optimization software, but also our leading risk models, to achieve this process.

Hamish, this process is applied throughout the iSTOXX APG RI Indices’ various incremental ESG objectives: exclusions, ESG leaders, low carbon and SDI criteria. Tell us more about that layered strategy structure.

When balancing multiple objectives simultaneously, particularly sustainable ones such as ESG, carbon and the UN’s Sustainable Development Goals (SDGs), what investors can gain in efficiency by selecting an ‘optimal’ portfolio, they can somewhat lose in terms of disentangling the impact of each element that is incorporated. By constructing and publishing indices that incrementally capture each methodology element using APG data, investors can gain a better understanding of these impacts — across risk, emissions, number of constituents, etc. This type of process is an example of what we mean when we say that intuition is a key pillar that distinguishes our indices.

Yurong, within that optimal portfolio, the control of tracking error remains a key variable. Why is this?

Another term for tracking error is active risk. In other words, we are asking ourselves the following question: how risky is the portion of my portfolio that is different to my benchmark? When incorporating sustainability criteria, this active risk is something we cannot avoid; and a key objective for the iSTOXX APG RI Index Family is to make the most efficient usage of this necessary deviation. By setting a target of minimizing (predicted) tracking error, and using Axioma risk models to forecast risk, we ensure that the index constituents represent the theoretically least risky portfolio that will meet the client’s sustainable — and other — needs.

BlackRock will manage a fund tracking the indices alongside APG. As the world of index-based investing has grown, so has the need for leading index developers to understand the key areas of index replication and investment. Working together with industry leaders in asset management such as BlackRock and APG, we are able to not only design indices that meet the needs for today, but also to scale for further investment capacity. Index design is becoming critical to meet targeted investment objectives and replicability in a transparent, systematic manner.

Finally, Hamish, the measurement of a portfolio’s societal impact is to some extent a new frontier in ESG investing. What does it mean for opportunities in passive investing?

Understanding, addressing and controlling ESG-related risk and the real-world impact of portfolios is becoming core to investment decisions today for many leading responsible investors. Data focused on the SDGs, like APG’s data that is derived from the SDI AOP, is a crucial step towards defining how to measure impact — and what can be measured can be integrated. The iSTOXX APG RI indices are now the first to use this valuable dataset into a transparent and passive investment solution and we couldn’t be more excited to be breaking ground there with and for our partners and clients. We expect this space to continue to grow.