A suite of new STOXX indices from Qontigo underlie single-stock short and leveraged exchange-traded products (ETPs) issued by Leverage Shares, which provide an efficient and low-cost way to pursue leveraged strategies.

The indices track inverse (-1x to -2x) and leveraged (2x to 3x) investments in 14 stocks and American Depositary Receipts (ADRs) of widely traded companies, including Tesla, PayPal, Square and HSBC. Leverage Shares has listed respective ETPs tracking the indices on the London Stock Exchange.

Investors and traders have long used short and leveraged strategies with a directional view in mind, but such positions are also common for other tactical purposes such as hedging, managing portfolios or relative value trading. Traditionally, they have been implemented with futures, certificates and over-the-counter (OTC) instruments such as CFDs. Pursuing the strategies through an ETP, however, brings cost, risk and operational benefits.

Among those benefits, an ETP does not require a margin account nor any margin levels. There are no extra costs for holding a position overnight. Unlike CFDs or futures contracts, the risk in ETPs is limited to the amount invested. Additionally, ETPs can bring tax efficiencies.1 Finally, there is no credit or counterparty risk as all investments are replicated physically, meaning they are backed by the underlying assets, and are cleared through a clearing house.

Clear, robust methodology

Each STOXX single-stock leveraged index is calculated real-time and aims to replicate a leveraged return from the net return of the underlying stock, adjusted for margin fees, borrowing costs, and interest earned or paid on the index notional. The indices bring in a clear, rules-based and systematic methodology that enhances the transparency, robustness and neutrality in the final product.

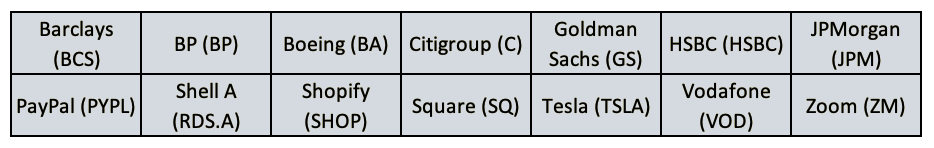

The new batch of indices cover the following companies:

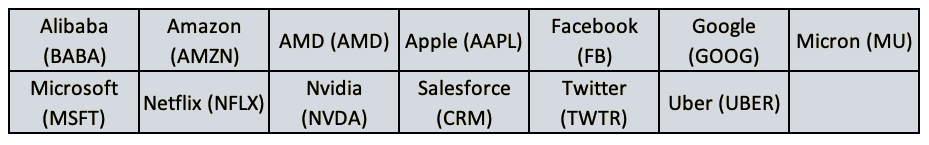

They add to an initial list of indices launched in 2020, which already underlie listed products and that cover the following technology-sector shares:

For example, the iSTOXX® Leveraged 3x TSLA Index represents three times the daily return of Tesla shares. The iSTOXX® Inverse Leveraged -1x PYPL Index tracks the inverse of the daily return of PayPal.

Versatility in index investing

For Qontigo, this latest launch further showcases the versatility of index-based investing and index construction.

“We are very pleased that Leverage Shares chose to partner with us to launch their new family of ETPs based on the iSTOXX Single-Stock Leveraged Indices,” said Brian Rosenberg, Chief Revenue Officer of Qontigo. “We see strong demand in the market for expressing high-conviction investment ideas, and these indices enable investors to do so in a way that is rules-based and transparent.”

Leverage Shares is a European pioneer in short and leveraged ETPs on single stocks, having launched almost 65 products on the London, Amsterdam and Paris stock exchanges.

“Our products offer an attractive alternative to traditional short and leveraged strategies, by enhancing risk management and collateral protection, while also reducing credit risk,” said Oktay Kavrak, Product Strategy at Leverage Shares. “The newly listed products cover a set of liquid stocks that will significantly broaden the possibilities for investors.”

Collaboration in innovation

The innovation in indexing products continues to grow unabated, helping to implement strategies with higher levels of efficiency and savings. Qontigo is excited to work with partners in the development of such products that open up new investment possibilities, facilitate trading and assist with portfolio management.

1 For example, withholding tax on US-source dividends is 15% for Leverage Shares ETPs, vs. 30% generally for non-US persons investing in US shares. Please note that STOXX indices use a 30% tax rate in their calculation.