Leveraged exchange-traded products (ETPs) continue to grow in assets under management (AuM) and, more noticeably, in trading volume, as an efficient and low-cost way to pursue leveraged strategies.

Leverage Shares, a leading ETP issuer, partnered with STOXX more than four years ago to develop underlying indices for single-stock ETPs. That partnership has resulted in over 60 listed products tracking inverse (-1x to -2x) and leveraged (2x to 3x) investments in widely traded stocks and American Depositary Receipts (ADRs).

We recently caught up with Oktay Kavrak, Head of Communications & Strategy at Leverage Shares, to discuss some common misconceptions about trading leveraged ETPs. Below are a few key points he highlighted.

1. Leveraged ETPs always deliver exactly 2x or 3x the return of the underlying over any timeframe.

“Leveraged ETPs aim to deliver a multiple of the daily performance of their underlying asset — typically +2x, +3x, or –1x.

Daily resets mean the return multiples apply only to daily performance, and not on longer periods. Compounding and volatility create path dependency, so longer-term returns can vary significantly from the expected multiple when held for longer than a single day. In strong trends, this can help; in choppy markets it can hurt returns.”

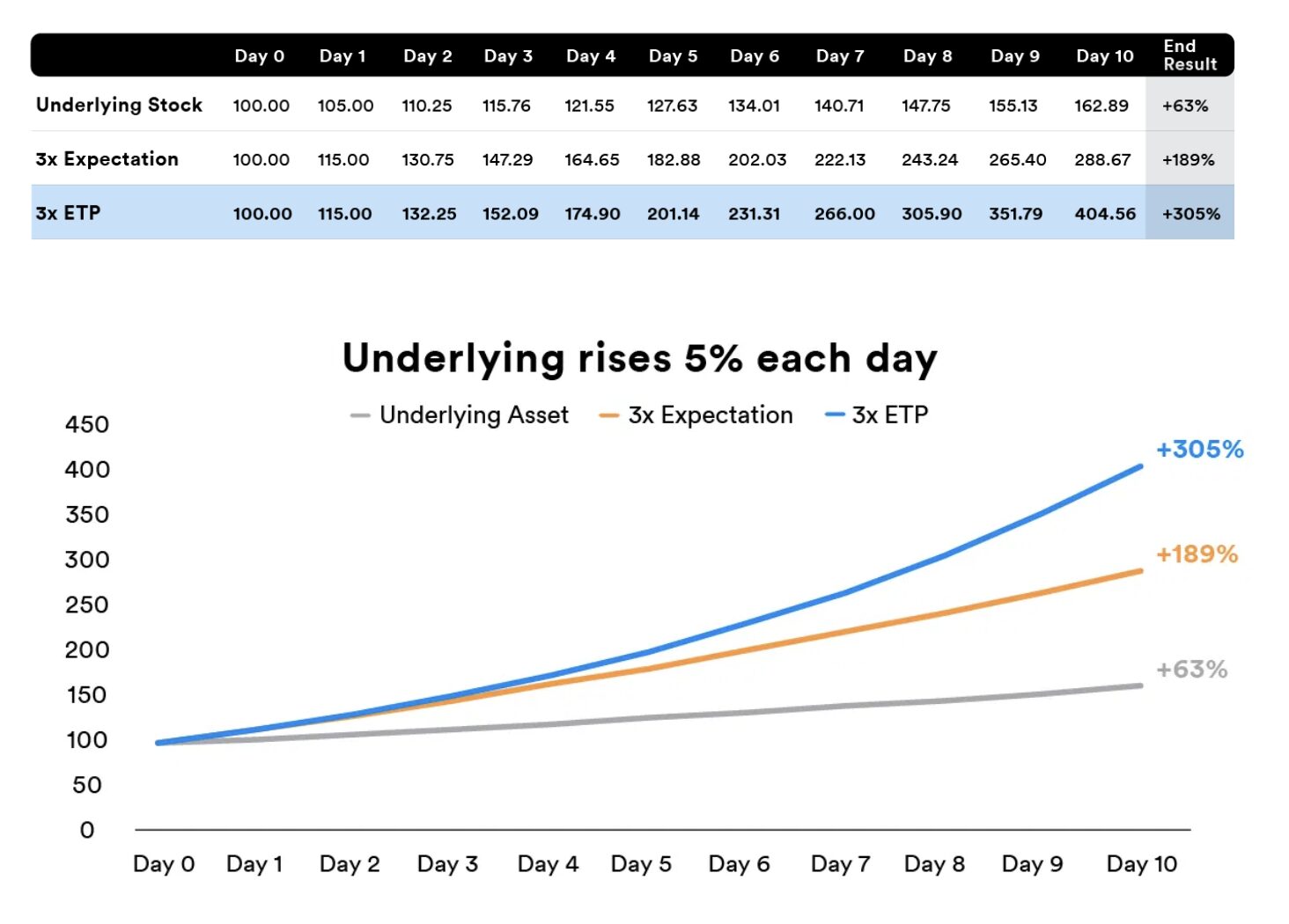

Figure 1 shows the cumulative performance of an underlying asset that rises 5% every day for ten consecutive days, and a +3x leveraged ETP, which delivers three times the daily return of the underlying instrument.

Figure 1: Compounding returns in an up-trending market

In the example above, investors may expect that the 10-day return would produce three times the cumulative return of the underlying, or 189%. However, the cumulative return of the ETP is 305%, as the compounding effect has outperformed the sum of the daily returns.

In down markets, the compounding effect can outperform the sum of negative daily returns as well, since every day the loss is applied to a smaller ETP value.

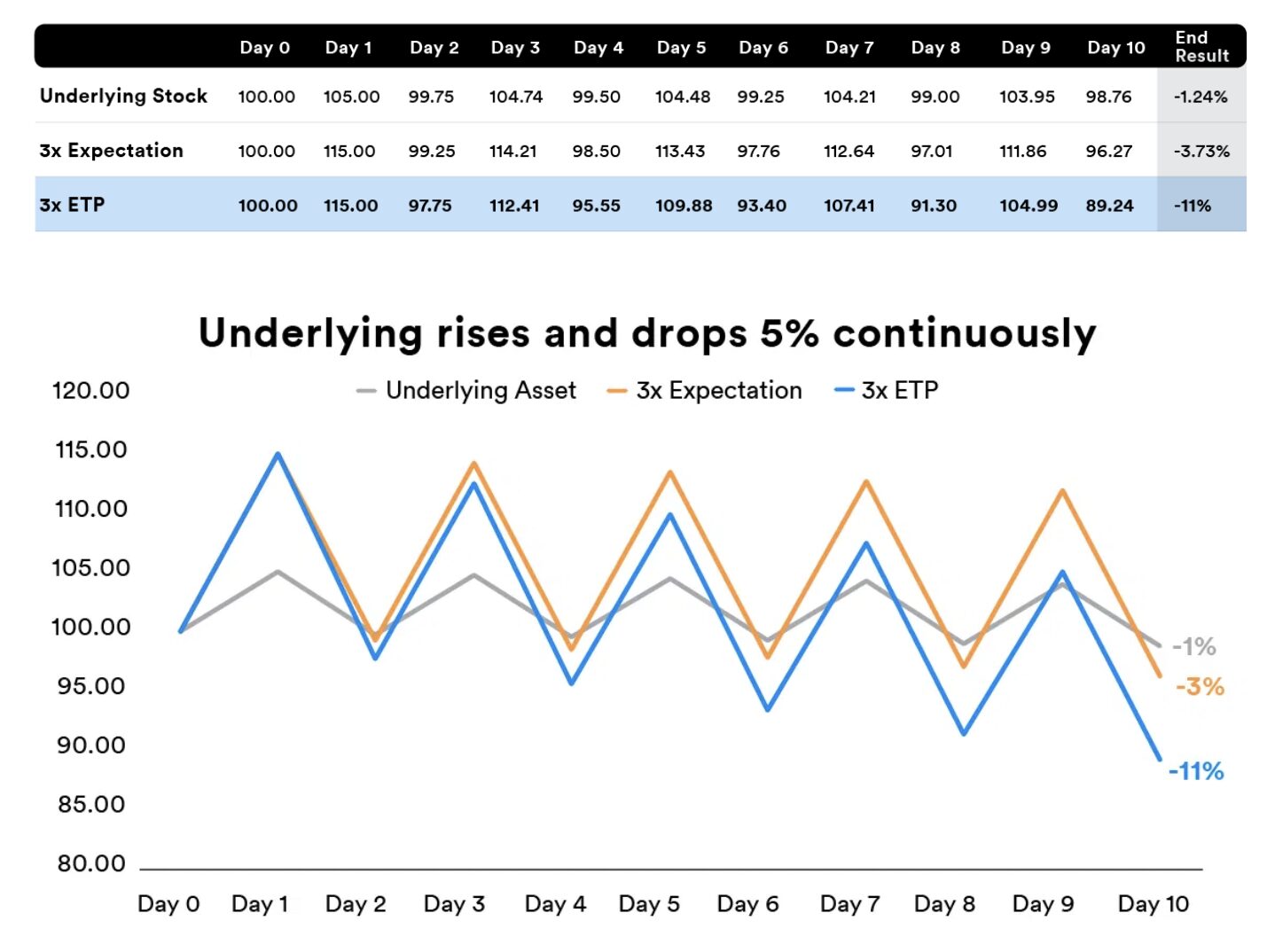

In volatile markets, however, compounding can lead to underperformance. Figure 2 shows the cumulative performance of an underlying asset that rises and falls by 5% continuously for ten consecutive days, and that of a +3x leveraged ETP.

Figure 2: Daily returns in a volatile market

While one could expect that the ten-day return of the ETP would produce three times the cumulative return of the index (i.e., –3.73%), it actually dropped 11% as the compounding effect underperformed the sum of daily returns.

2. Investors can lose more than their initial investment or face margin calls.

“This is false for listed leveraged ETPs, which by nature have their losses capped at the invested amount, with no margin calls or additional liability risk. This differs from other means of trading with leverage, such as CFDs and futures.”

3. Leveraged ETPs always decay to zero.

“There is a misconception that leveraged ETPs are subject to compounding and volatility decay, which can erode returns over time in volatile or range-bound markets.

However, this is not true. There’s no built-in ‘melt’ mechanism or automatic decay over time. Performance is path-dependent — meaning that a high-volatility, sideways market can lead to value erosion. On the flip side, a steady upward or downward trend can produce returns exceeding the expected multiple of the underlying. The key driver is the behavior of the underlying instrument or index, not the passage of time. Essentially, ‘the trend is your friend.’”

4. Leveraged ETPs aren’t very popular.

“It’s true that leveraged and inverse ETPs make up a relatively small share of total ETF AuM — roughly 1% globally. But when you look at trading activity, the picture completely changes. These products can account for more than 15% of US ETF daily trading volume, according to some estimates.[1] A +3x Tesla ETP from Leveraged Shares, for example, is the most traded ETP on the London Stock Exchange.

That means leveraged ETPs punch far above their weight: they’re not designed to be buy-and-hold core positions, but rather tactical trading tools used by active investors, hedge funds and institutional desks to:

- Express short-term directional views.

- Manage exposure around events such as earnings or economic reports.

- Implement hedges without using margin or derivatives accounts.

It may also be inferred that ETPs have low trading volume simply because there isn’t much capital tracking the products. This is not the case. Liquidity is primarily sourced from the underlying shares, and our ETPs track some of the most liquid names in the world. Thanks to market-making agreements in place, a trader will always be able to buy and sell Leverage Shares ETPs regardless of the trading volume.”

5. All leveraged ETPs are the same.

“It’s a common misconception that all leveraged ETPs are the same. In reality, they can differ substantially in how they’re built and how they trade.

Each product has its own underlying exposure — whether that’s a single stock, an index or even a commodity — and that affects its volatility, liquidity and behavior. Beyond that, factors such as expense ratio, funding costs, bid–ask spreads, and total AuM can vary widely across issuers and exchanges, with some of those factors significantly impacting returns over the long term.

Unlike other providers, all Leverage Shares ETPs are 100% physically backed and ring-fenced, offering transparency and investor protection from credit and counterparty risk. So even if two products both say ‘3× Tesla,’ their structure, tracking efficiency and cost to trade might be very different.”

Growing segment

Investors and traders have long used short and leveraged strategies to express directional views, but such positions are also common for other tactical purposes, such as hedging, portfolio management or relative-value trading. STOXX is pleased to support the growth of this segment by contributing its indexing expertise to the securitization of these strategies.

[1] See for example, Bloomberg, “Leveraged Bets Dominate Trading in Tariff Rout Like Never Before,” April 7, 2025.