Total-return futures (TRFs), introduced at Eurex in 2016, are relatively new derivative products but growing in popularity as an efficient, exchange-traded and centrally cleared alternative to over-the-counter (OTC) total return swaps. On January 31, the exchange will add 40 new TRFs on single stocks, expanding the roster of available products to around 290 companies.

An equity TRF (ETRF) provides a collateral-efficient and listed replication to a bespoke equity swap used in equity financing. In the agreement, a TRF holder receives the price performance of the underlying index or security plus 100% of its dividends from a seller, in exchange for a fee. In contrast to a swap, ETRFs are governed by exchange rules, bringing a whole set of cost, risk and operational benefits.

ETRFs are meant to be the basic building blocks for customized basket trades of equity total return futures (BTRFs) defined by exchange participants. Eurex already offers TRFs on STOXX benchmark indices that hedge the implied equity repo rate, and on iSTOXX collateral indices.

To find out more about the launch and the possibilities of ETRFs, we sat down with Stuart Heath from the Equity and Index Product Design team at Eurex.

Stuart, index TRFs such as those tracking the EURO STOXX 50® Index have attracted record open interest. What do ETRFs now add to the existing offering?

“Index TRFs have attracted nearly half of the volume of the OTC market, so we know there is room to repeat that success with single stocks.

“ETRFs, in particular, are aimed at the equity financing market. Equities have traditionally been a popular collateral used to raise financing. Recently we have seen synthetic financing growth via swaps based on underlying equity (either single stocks or basket of stocks) used as collateral. ETRFs were designed to futurize these transactions and move the derivatives leg of finance trades onto the centrally cleared environment. The first ETRF contracts were launched in 2019 and to date over EUR 4.3 billion notional has traded on the entire segment.

“ETRFs facilitate the trade of packages via basket trades of equity total return futures (BTRF). These are bespoke package trades of one or multiple ETRFs constructed by traders within certain parameters with eligible underlying shares. For participants, BTRFs offer a rules-based, negotiable and customized option to trade baskets of ETRFs.”

What are some of the key benefits of an exchange-traded ETRF as opposed to an OTC swap?

“There are several advantages, which make overall for a significantly more efficient product. First, the listed nature of the ETRF reduces counterparty risk and standardizes the entire process. Parties can enter and exit the market in a very short time and in a simple transaction.

“Having a TRF that’s traded on a regulated exchange brings enormous operational and cost advantages relative to OTC derivatives at a time when the latter have been subject to increasingly demanding regulation, such as the Uncleared Margin Rules (UMR) to mention one.

“Futurization also brings greater standardization to the products. In the OTC market, swaps are tailor-made to specific needs, which brings benefits in terms of customizability but limits the scalability and ability to cross-margin the positions. Eurex Clearing, our clearing house, allows cross-margining between related products with its portfolio margining system PRISMA, making margining costs more precise.”

“In addition, the development of listed products has created standards around substitution, or the replacement of pledged collateral for similar equity. Currently in the OTC world, there are no universally accepted substitution rights, which often have to be negotiated for every case. With ETRFs, substitution is a streamlined process that does not require a new trade or basket ID.”

How do ETRFs account for dividends paid by the underlying, and how are corporate actions treated?

“Any dividends, as well as overnight funding costs, will accrue into the futures price daily and add towards the total returns obtained by the ETRF holder. On an ETRF level, a corporate action is processed in line with those of single-stock futures at Eurex. Special dividends are accumulated on a net basis in the same way as regular ones.”

And what’s the role of the index and of Qontigo in the construction and management of ETRFs?

“As with index TRFs, and to facilitate the accurate calculation of total returns, Qontigo has developed Equity Dividend Indices (EDI) for each ETRF underlying, accounting for accrued dividends (both ordinary and special ones) to be used in the future’s final settlement price. For ETRFs, these are calculated on a net-of-withholding-tax basis – using STOXX tax rates. The EDI rules also replicate the standard Eurex corporate actions methodology used for with respect to the underlying equity.”

Finally, Stuart, what can we expect from the TRFs segment in the next couple of years?

“As mentioned, TRFs provide a fully fungible, cost-efficient and liquid alternative to total return swaps. As regulatory requirements become more demanding, TRFs offer market participants a solution that improves the capital cost, compliance and risk management profile of the transaction. These are very important considerations that we believe will drive growth in the TRF segment as a standardized and futurized version of the popular OTC swaps market.”

_________________________________________________

Overview 1 – Design of ETRFs

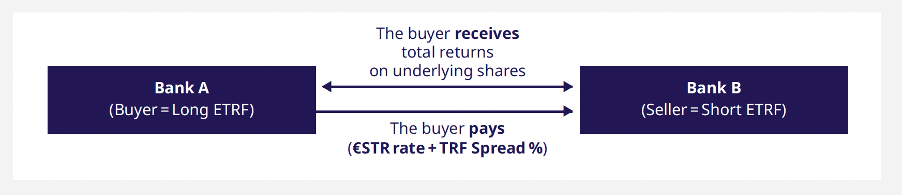

TRFs follow the OTC total return swap structure, quoted as an annualized spread in basis points that represents the premium added to an overnight funding benchmark rate to determine the financing cost.

The holder of the long position receives the distribution associated with holding the cash equity, against which they will pay the financing cost associated with the purchase.

The financing cost is made up of two parts:

1- The euro short-term rate (€STR) as the overnight funding benchmark and

2- the traded TRF Spread, which represents the additional spread required by the seller.

The TRF Spread in basis points is converted by Eurex into a futures price for the ETRF, which is expressed as a price per share. Any dividends as well as overnight funding costs will accrue into the futures price daily to reflect the total returns. Variation margin is paid daily on this change in value.

Source: Eurex.