The index suite lets investors slice and dice the world’s equity markets and implement their customized, targeted strategies. This is particularly true of ESG objectives, where Qontigo’s open architecture and flexibility in portfolio construction enable clients to integrate the best datasets for each case.

The modular STOXX® World indices allow investors to flexibly build portfolios covering a broad and liquid universe of stocks, slicing and dicing the world’s equity markets along regions, countries, market capitalization and sectors. A consistent methodology and international standards mean the indices leave no gaps or overlaps in their coverage.

We caught up with Serkan Batir, Global Head of Index Product Development at Qontigo, to find out how asset owners, ETF issuers and investors can use the suite to derive portfolios targeting strategies such as ESG and others.

Serkan, investors are increasingly seeking targeted and tailored strategies. How do the STOXX World indices fit in this new landscape?

We specifically devised the STOXX World indices as a comprehensive, modular set upon which global investors can implement their targeted strategies. The suite is designed to combine a flexible geographic offering with specific client needs. We are marrying that flexibility with Qontigo’s long-standing open architecture, which enables the integration of different datasets that best fit our client requirements.

How are clients using the STOXX World indices?

There’s been strong interest in the indices since the launch, a testament to the demand in the market for highly customized solutions.

As an example of how strategies and indices can be successfully created from the STOXX World family, last year we introduced the iSTOXX® World Min Vol ESG for a pension-fund mandate managed by Legal & General Investment Management (LGIM). Derived from the STOXX® World AC index, which covers large- and mid-cap developed and emerging markets, this sustainable, factor-based index solution uses the Axioma optimizer to balance multiple investment objectives and considerations. These include minimizing portfolio volatility, offering above-average factor exposure to the low volatility and quality factors, reducing carbon emissions, and investing in high ESG-rated companies.

The index incorporates the use of LGIM’s proprietary ESG scores and third-party carbon intensity data, showing we are not limited to any given internal or external datasets.

In other words, we are offering investors Qontigo’s largest pool of country exposures to date as a starting base. From there, they can customize their strategies, choose objectives, remove unwanted securities and narrow the geographic exposure. It is no longer enough to offer customization, but you have to offer optimized customization and come up with the right solution in little time.

You bring me to sustainability strategies, which have been among the most demanded and are growing increasingly diverse. Will we see more ESG solutions based on the STOXX World indices?

Absolutely. ESG is a field where we’ve seen much innovation in the last couple of years, and we expect this to continue at a strong pace. Through our open architecture, we work with several leading data providers and have rolled out customized ESG, climate and Paris-aligned versions of many of our index families. Working with clients, for example, we were at the forefront of sustainable indices with the STOXX® Europe 600 ESG-X. The index underlies the world’s most heavily traded sustainable derivatives1, which allow responsible investors to accurately hedge their portfolios.

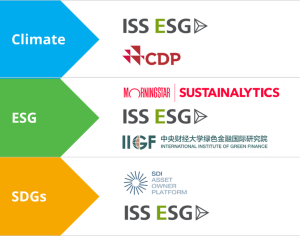

Exhibit 1 – Qontigo’s current data partners in ESG and sustainability

We are now working with several clients to build customized indices based on their specific objectives using the STOXX World indices as the starting point. Our data partners include ISS ESG, Sustainalytics, the International Institute of Green Finance (IIGF) and SDI AOP, to name a few. Different datasets are more appropriate depending on the final objective, geography, etc. And we can combine objectives, too, as shown with the iSTOXX World Min Vol ESG index. In essence, we are taking the versatility we’ve always had in our index-building to a new, geographically exhaustive index family.

For that index building, Qontigo can also draw on Axioma’s analytics and optimization tools. How does that make a difference for investors?

Indeed, having the state-of-the-art Axioma analytics and portfolio optimization tools means we can best deliver the customization and bespoke exposures that our clients seek. It is key for investors to tailor the indices in a way that they can efficiently control for the investment objective, risk, tracking error, exposures and impact. We can do that in every step of the building process, and the optimization remains a key methodology and monitoring tool of the portfolio.

The STOXX World indices offer exposure to emerging markets (EMs). What does that mean when it comes to having a thorough ESG strategy?

Advances in reporting, information gathering, and technology allow investors to have a comprehensive ESG strategy across the world. The STOXX World indices cover both developed and emerging markets, having a global investor’s needs in mind. Again, it is of paramount importance that investors are able to select the datasets that will deliver their objectives in each geography. If they need, for example, to build an ESG, small-cap EM portfolio, we will help them do just that.

A lot of asset allocators want to have separate strategies for developed and emerging markets, with the view that if you want to create a sustainable outcome you might want to use different thresholds and criteria. In using the STOXX World indices as building blocks, you can do this without compromising the consistent index-construction methodology.

It is of paramount importance that investors are able to select the datasets that will deliver their objectives in each geography. If they need, for example, to build an ESG, small-cap EM portfolio, we will help them do just that.

A lot of asset allocators want to have separate strategies for developed and emerging markets, with the view that if you want to create a sustainable outcome you might want to use different thresholds and criteria. In using the STOXX World indices as building blocks, you can do this without compromising the consistent index-construction methodology.

Can you tell us a bit more as to why investability is so important in emerging markets?

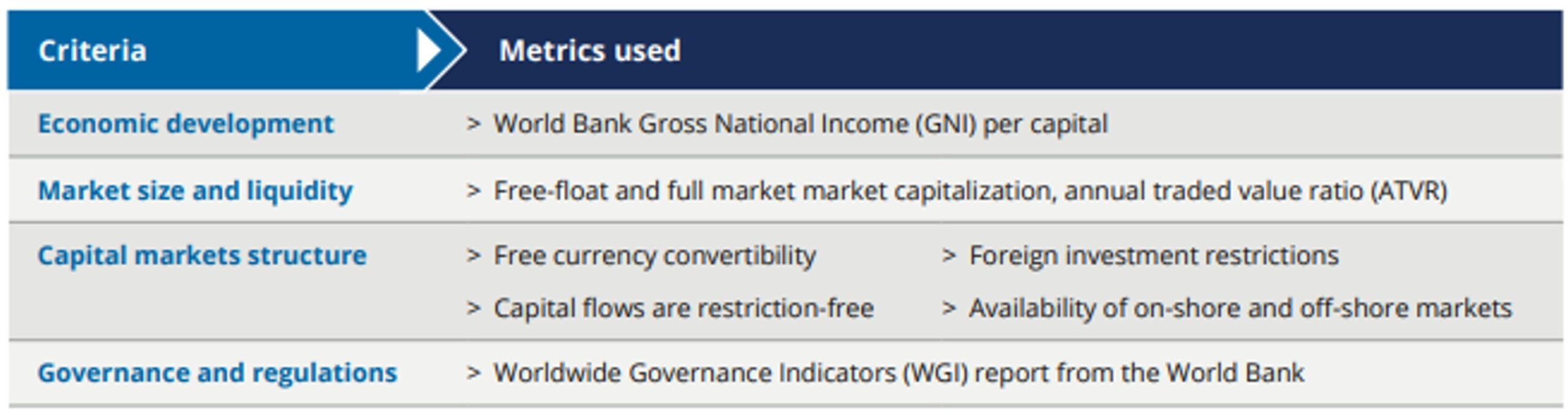

Emerging markets cannot necessarily be accessed in the same way as developed markets. Through our methodology, we are ensuring that the specific requirements are taken into account. The STOXX World suite has Qontigo’s largest coverage of emerging markets, including the Gulf Cooperation Countries (GCC) and China A shares and P chips. Tradability and accountability are reflected by taking into account the underlying market’s macroeconomic data, liquidity, free currency convertibility and availability of on-shore and off-shore trading (ADRs). Importantly for emerging markets, we also ensure that the country has no restrictions on capital flows, we consider its political stability, control of corruption and regulatory quality, and we review that restrictions on foreign investments fall within certain limits.

Exhibit 2 – STOXX World country classification framework

Finally, Serkan, what makes the STOXX World indices appealing to a modern-day global investor?

In summary, the STOXX World indices offer flexibility thanks to their modular design and allow global investors to integrate their desired sustainability strategies and create tailored solutions.

Qontigo is a client-first company; we aim to be nimble because we believe that that is the way to accommodate clients’ requirements and to deliver results in a short turnaround time. The one-size-fits-all offerings in the market fail to provide investors the right tools for the current times.

With a strong pipeline of ESG, but also factor- and thematic-based solutions in the works, I expect to see a lot of launches and growth around the STOXX World indices. And we couldn’t be more excited about it.

Qontigo is a client-first company; we aim to be nimble because we believe that that is the way to accommodate clients’ requirements and to deliver results in a short turnaround time. The one-size-fits-all offerings in the market fail to provide investors the right tools for the current times.

With a strong pipeline of ESG, but also factor- and thematic-based solutions in the works, I expect to see a lot of launches and growth around the STOXX World indices. And we couldn’t be more excited about it.

To find out more about the STOXX World index suite, please visit our STOXX World product page or schedule a meeting with our Sales team.

Request Info >

1 Source: Qontigo. Based on all exchange-traded contracts during 2022.