Trading in listed derivatives tied to index dividends in the Eurozone reached records this year as investors sought to hedge income returns amid widespread cuts in company payouts.

Turnover in EURO STOXX 50® Index dividend futures, which reflect the dividends to be paid out by constituents in the flagship Eurozone benchmark, jumped to an all-time high in March and has remained above average since then. This coincided with a halving in the value of expected dividend payments in 2020. Total return futures (TRFs) on the index, which remove the dividend exposure risk of price index futures, also saw record demand.

“The disruption to dividend payments seen this year was unprecedented, and traders reacted to incorporate the new scenario in portfolios,” said Stuart Heath from Equity and Index Product Development at Eurex, the derivatives exchange. “Throughout this volatile time, dividend futures provided a liquid and efficient market to support the hedging of dividend exposure across the maturity curve.”

European ex-UK companies slashed dividends by 45% in the second quarter of this year, or $67 billion worth of cuts, according to Janus Henderson’s estimates.1 Banks accounted for half of the decline. Intesa Sanpaolo, Engie and Inditex were among businesses that reduced or suspended dividends for the first time in years as the pandemic forced shutdowns and regulators mandated banks to hoard up cash.

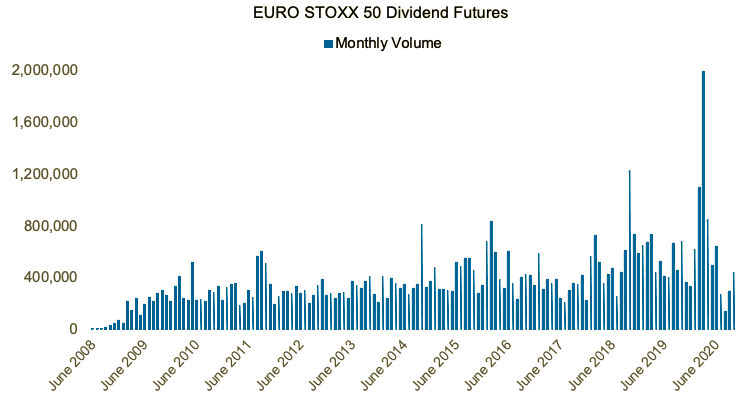

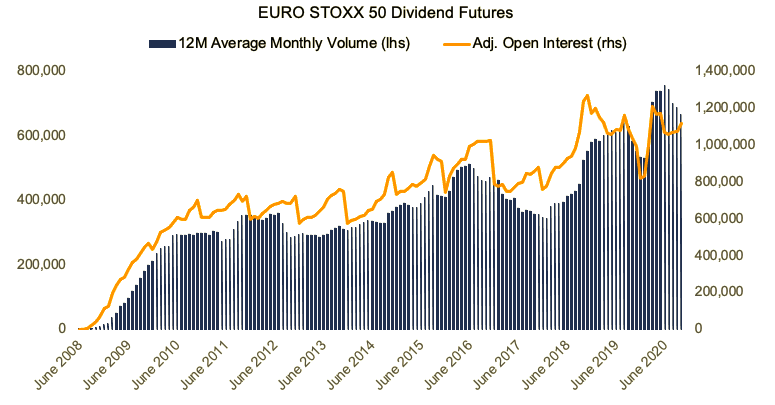

Figures 1 and 2 show trading and open interest in futures on the EURO STOXX 50 index dividends on Eurex. A record 2.42 million contracts exchanged hands in March this year. The futures give buyers and sellers a way to invest in or against the expected value of upcoming dividends, isolating them from share prices for investment and hedging purposes.

Figure 1 – Monthly volume in EURO STOXX 50 Index dividend futures

Figure 2 – Average volume and open interest in EURO STOXX 50 Index dividend futures

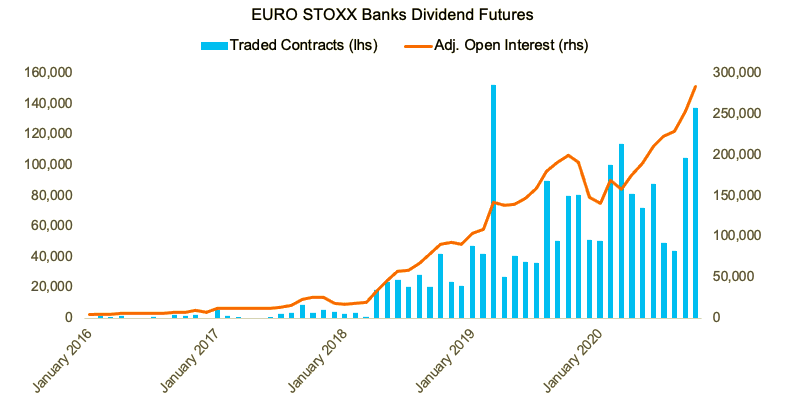

For the banking sector, there was particularly high activity in the dividend index futures as recently as last month (Figure 3). Several chief executive officers of large European banks have in recent weeks called on regulators to lift restrictions on dividend payments.

Figure 3 – Trading volume and open interest in EURO STOXX Banks Index dividend futures

Total return futures

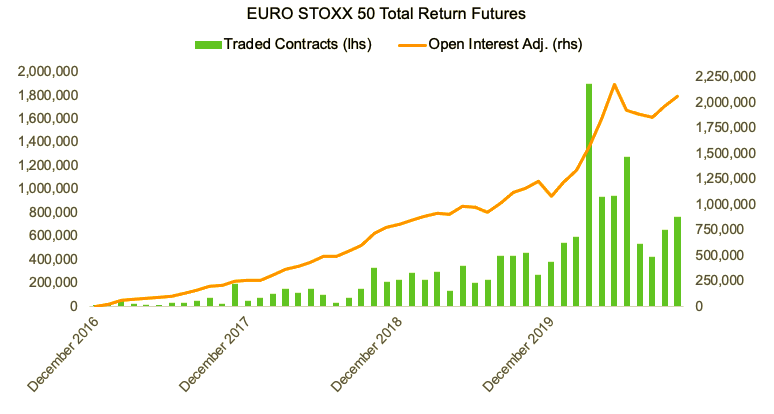

A record 1.9 million total return futures on the EURO STOXX 50 Index traded in March this year (Figure 4). Last month, volume amounted to 2.5 times the monthly average of 2019.

Figure 4 – Traded volume and open interest EURO STOXX 50 Total Return Futures

TRFs provide cost-efficient access to the total returns of an underlying index whilst hedging the implied equity repo rate. This rate is the profit earned from selling a futures contract and then buying the underlying or similar security in the cash market using borrowed money.

Importantly to our focus, a TRF holder will receive the price performance of the EURO STOXX 50 plus 100% of dividends. Due to the total-return nature of these products, there is less pricing sensitivity to dividends compared to price return futures.

“TRFs look to have been traded as a replacement for the regular price index future because of the unique levels of volatility and uncertainty over dividend payments,” said Heath at Eurex.

For more on the functioning of TRFs, please visit a dedicated section on Eurex’s web site.

Outlook

While dividend expectations have stabilized since the turbulent days of the first quarter, they are yet a long way from a full recovery.

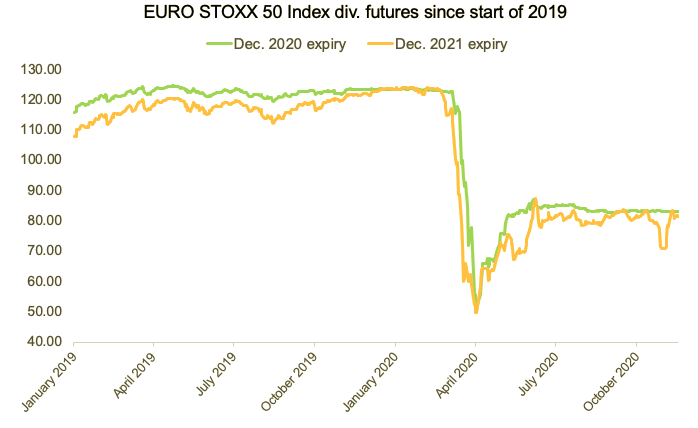

Figure 5 shows the evolution of the EURO STOXX 50 dividend futures expiring in December 2020 and December 2021. The contracts follow a steady trajectory until they crumble starting in the second half of February this year, touching a bottom in the first week of April.

Even after a slight rebound in recent months, futures still imply a 32% reduction in dividend payments this year, based on the 2019 closing price of 122.09 for the underlying EURO STOXX 50® Dividend POINTS (DVP) Index.

Figure 5 – EURO STOXX 50 Index dividend futures prices

Such a drop would exceed the 27% reduction in EURO STOXX 50 dividends during the global financial crisis in 2009. Following news this month that two frontrunner vaccines against Covid have proved efficient, it will be interesting to see how and if the futures, and in particular those with expirations beyond 2020, continue to recover.

New June maturities

This year’s events have also left their mark in another way: On Oct. 19, Eurex introduced new maturities on the EURO STOXX 50 Index Dividend Futures and Stock Dividend Futures for better hedging. The new expiries correspond to the next two rolling June maturities.

An unprecedented year

The market for dividend futures and total return futures provides investors a deep and transparent tool to protect their dividend exposure and place directional views on payments. The benefit of having this market was evidenced in what has been, by all means, a year for the history books.

1 Janus Henderson Global Dividend Index, Edition 27, August 2020.