With investors’ relentless adoption of sustainability principles, many ETF issuers have in recent months updated their funds’ underlying index methodologies to better reflect client demand.

This is true not just of relatively new and small funds, but also of popular and well-established ones. French manager Ossiam, for example, has announced that it is switching the index behind the 10-year-old Ossiam STOXX® Europe 600 Equal Weight NR ETF, which has over EUR 300 million under management — from the STOXX® Europe 600 Equal Weight NR to the STOXX® Europe 600 ESG Broad Market Equal Weight.

The STOXX ESG Broad Market indices apply a set of compliance, product involvement and ESG performance exclusionary screens on a starting benchmark universe until only the 80% top ESG-rated constituents remain. Companies that are non-compliant based on the Sustainalytics Global Standards Screening assessment or are involved in controversial weapons are not eligible for selection. Additional filters exclude companies involved in tobacco production, thermal coal and military contracting.

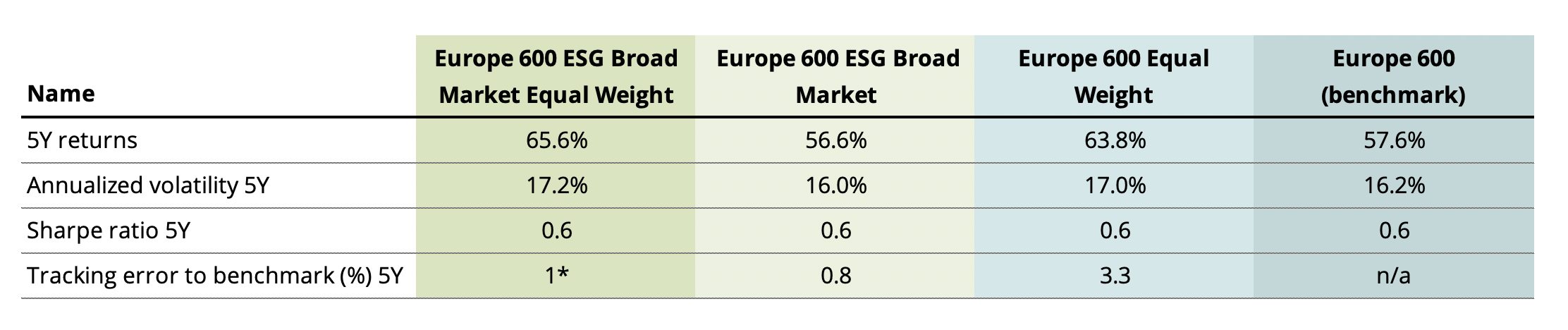

In the past five years, the STOXX Europe 600 ESG Broad Market Equal Weight Index has outperformed the STOXX® Europe 600 ESG Broad Market and STOXX Europe 600 Equal Weight indices, as well as the STOXX® Europe 600 benchmark (Figure 1).

Figure 1 – Simulated risk and returns

To find out more about the change in index, we caught up with Paul Lacroix, Ossiam’s Head of Structuring. Below is our exchange.

Paul, why is Ossiam changing the underlying index for the Ossiam STOXX Europe 600 Equal Weight NR ETF now?

“The financial industry was one of the first to tackle ESG topics, even before regulators started to work on the subject. ESG is at the center of all our conversations with clients and, as an ETF manager, Ossiam is committed to supporting the growth in ESG awareness and to offering smart and sustainable solutions to our clients.

“We believe ESG criteria can be implemented in core portfolios, but it should be done with caution. The Ossiam STOXX Europe 600 Equal Weight NR ETF was launched more than 10 years ago and is one of the most successful Ossiam ETFs thanks to its simplicity and strong financial results. Changing the underlying index of the ETF to replicate the STOXX Europe 600 ESG Broad Market Equal Weight Index that includes ESG screening is a natural step as it improves the ESG profile while retaining the main characteristics of the equal-weight strategy that made its success.”

In parallel to this growth in client demand for ESG approaches, there has been increasing regulation as policymakers seek to set clear rules for the sustainable investing market. How will the index change impact the ETF’s classification under the emerging ESG framework?

“Ossiam welcomes the initiatives from regulators to increase transparency in the market and avoid greenwashing. The Sustainable Finance Disclosure Regulation (SFDR) classification is now widely used by clients to monitor and select their investments. With the change of its underlying index, the ETF will be classified as SFDR Article 8 as it will promote ESG characteristics.”

What are some key characteristics and benefits of the selection methodology in the new index?

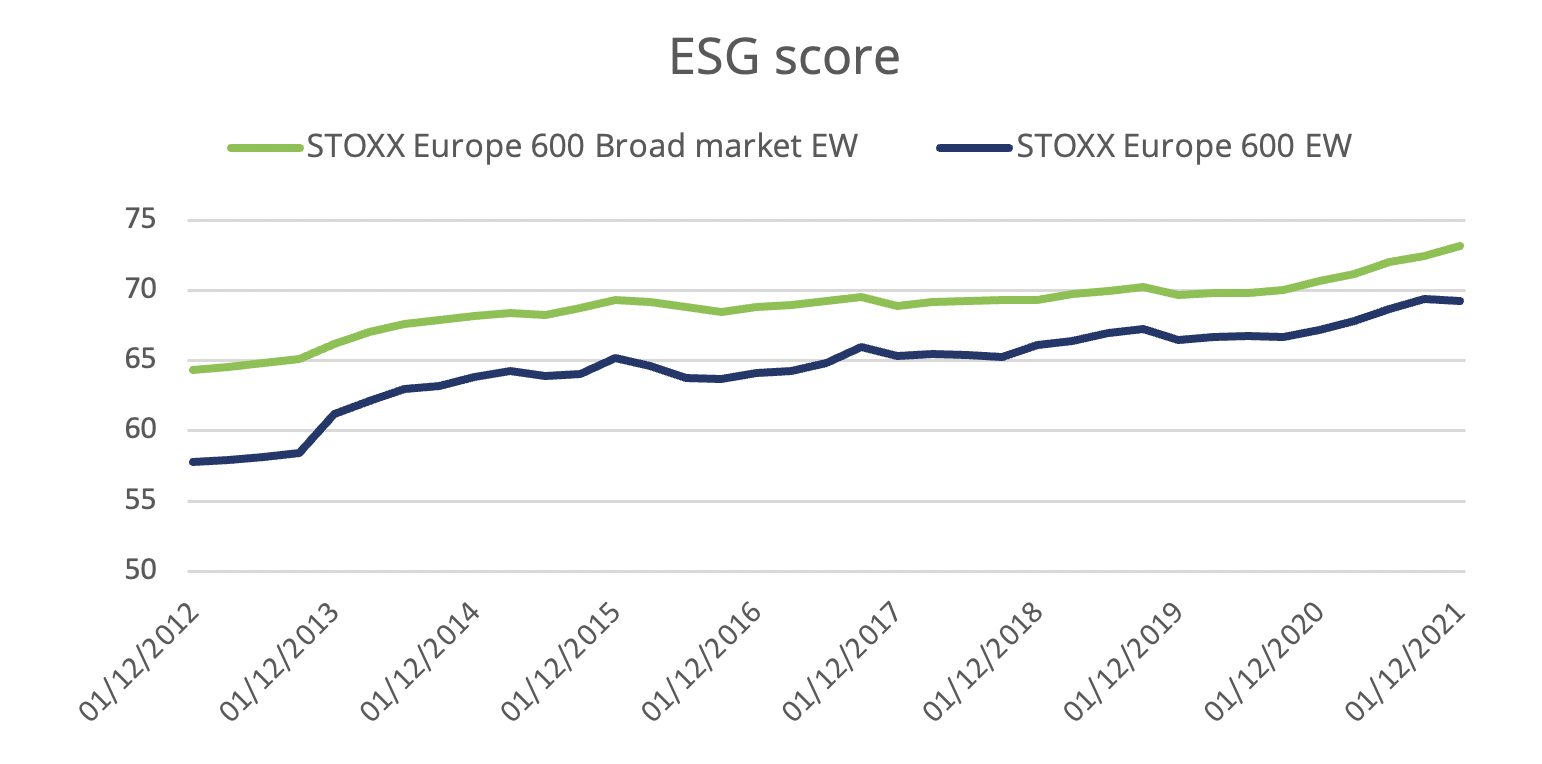

“The STOXX Europe 600 ESG Broad Market Equal Weight Index firstly follows negative exclusionary screens that are standard among investors. It removes companies found to be in breach of global norms, as well as those involved in controversial weapons, tobacco production, thermal coal extraction and power generation, and weapons in military contracting. Secondly, the 20% laggards in each ICB industry according to their ESG scores are also excluded. With these two steps, the methodology applies two of the most popular sustainability approaches: negative exclusions and best-in-class ESG integration. This combined strategy not only helps investors better manage ESG risks and opportunities related to the holdings’ activities, but it also enhances the overall ESG profile of the final portfolio (Figure 2).”

Figure 2 – Portfolio’s sustainability profile

Source: Qontigo, Sustainalytics.

And what impact will investors see at the portfolio level in the revamped ETF relative to the incumbent version?

“The STOXX ESG Broad Market indices have been designed to track their underlying benchmarks closely, with a very low overall tracking error. Investors should not notice any significant changes to the portfolio constitution at the headline level.

“Even though the STOXX Europe 600 ESG Broad Market Equal Weight removes 122 companies relative to the STOXX Europe 600 Equal Weight (478 constituents vs. 600 constituents, respectively), the impact on industry allocation is negligible. This is the result of the selection methodology, which removes the worst ESG offenders in every sector rather than across the entire portfolio, therefore making it as sector-neutral an exclusion process as possible.

“Despite this, the ESG profile of the portfolio is significantly enhanced. As of January, the ESG Broad Market Equal Weight Index’s ESG score was 73.1, compared with 69.3 for the standard Equal Weight Index.

“In summary, investors can get the upside of a more responsible allocation without running any significant increases in industry bias, sector risk or overall volatility.”

The equal-weight strategy has outperformed the benchmark STOXX 600 since inception of the fund, but it has also resulted in relative advantages when it comes to ESG. What are these and why may they occur?

“The long-term outperformance of an equal-weight strategy comes from several sources. The first one is diversification: indices weighted by market capitalization are skewed towards mega-caps. For example, the top 20 holdings of the STOXX Europe 600 Index weigh 28%, compared to only 3.3% for the Equal Weight version as of December 31, 2021. Increased diversification limits idiosyncratic risks and improves long-term risk-adjusted returns.

“The second driver of outperformance is the small-cap premium. The weight attributed to small caps is much higher in the Equal Weight version versus the market-cap-weighted benchmark. “Finally, the rebalancing effect can also produce outperformance: by reverting to an equal-weight allocation, the index will take profits by selling the best-performing stocks during the previous period and re-investing in the stocks that did not perform as well, hence following a ‘sell high, buy low’ mechanism.

“In terms of ESG, a positive side effect of equal-weight strategies is the relative underweighting of energy companies, which in Europe are typically large caps. Reducing the weight in these companies increases the ESG score and lowers the carbon footprint. This is not a mandate of the methodology but a positive side effect.

“The ESG filters implemented in the ESG version of the STOXX Europe 600 Equal Weight index have been designed to retain those characteristics that are part of the DNA of equal-weight strategies while further improving the ESG profile.”