The COVID-19 crisis has dramatically impacted our societies. It has brought manifold behavioral change, but it has also accelerated pre-existing social and economic trends.

What we have witnessed this year is the appreciation of a world that was already immersed in deep transformation. Trends like digitalization, online shopping, breakthrough healthcare and renewable energy have gained additional impetus as we awake to the risks stemming from urban concentrations, mass travel and environmental vulnerability.

Many observers forecast the world is unlikely to return to the way it was before 2020, as new habits take hold and the risk of more virus-related health crises looms large. This will alter the way we live, work and interact with our surroundings.

One study1 has predicted that the share of digitally-enabled products at established companies has accelerated in 2020 at a pace seven times faster than that of pre-COVID years. The shift towards e-commerce has sped up by five years, IBM Corp. has estimated.2 Facebook Inc. Chief Executive Officer Mark Zuckerberg has said he expects as many as half of the company’s 45,000 employees will work from home in ten years. A study from the World Economic Forum has argued that COVID-19 is a ‘game-changer for renewable energy.’3

In many industries, change appears equally powerful. The pandemic may have been a catalyst, but the engines of evolution were already running everywhere.

Winners and losers

As with any transformative process, winners and losers have emerged. While many brick-and-mortar stores, theaters and gyms have closed down this year, providers of videoconferencing, delivery services and antibiotics have thrived.

To help investors navigate this new world, Qontigo is introducing the iSTOXX® Global Transformation Select 30 EUR Index, which seeks exposure to companies in innovative technologies and services that are benefitting from social and economic change in our fast-evolving world.

The Transformation Index targets low volatility and high dividend-yield companies involved in four large superthemes:

- Connected World

- Industry 4.0

- Sustainable Growth

- Better Healthcare

These superthemes are each divided into sub-themes. The Connected World, for example, covers businesses in digital security, education technology, cloud computing and the 5G ecosystem. In turn, the sub-themes go even deeper, being associated with a total of 431 business sectors in FactSet’s RBICS categorization. The sectors make up a comprehensive and granular catalogue of activities — from express couriers to air purification and filtration equipment products; from bacterial vaccines to healthcare management software; and from food delivery services to internet entertainment retail.

Marrying megatrend, sustainability and fundamental screens

Aside from its thematic focus, the index follows additional fundamental criteria in the stock selection that define the portfolio’s profile.

The process starts by selecting the top 50% of stocks in the STOXX® Developed and Emerging Markets Total Market Index, ranked according to their environmental, social and governance (ESG) score as calculated by Sustainalytics. A liquidity filter is applied to remove shares with low trading volume, to ensure replicability.

Thereafter, another screen removes companies that Sustainalytics considers are in breach of social norms or are involved in undesirable activities from a responsibility perspective.4

From the remaining companies, those with revenue exposure above 25% to the aggregate of the 431 business sectors linked to the broader Transformation theme remain in the selection list.

Optimizing for the structured-products space

From this selection list, the top 50% of companies with the lowest volatility proceed to the next step, where the 30 companies with the highest dividend yields are selected such that country and industry diversification constraints are met. The volatility and yield screens are a staple of the Select family of STOXX indices, which have proved popular with structured-products issuers as they bring down the price of packaging the securities.

Constituents are weighted by the inverse of their historical volatility, subject to geographical constraints, sector caps and a 10% individual weight cap to ensure diversification. For a more detailed methodology explanation, please click here.

The iSTOXX Global Transformation Select 30 EUR Index has been licensed to Citigroup Global Markets Ltd. to underlie structured products.

Versatility in portfolio construction

The multi-strategy approach at the center of the Transformation Index caters to specific demands from investors and exemplifies the versatility of index construction and passive investing. Last year, STOXX introduced a similar approach with the iSTOXX® Global Cities of Tomorrow Select 30 Index, which enables investments in the sustainable smart city megatrend. These systematic strategies also allow STOXX to partner with world-leading data providers.

Outperformance of Transformation theme

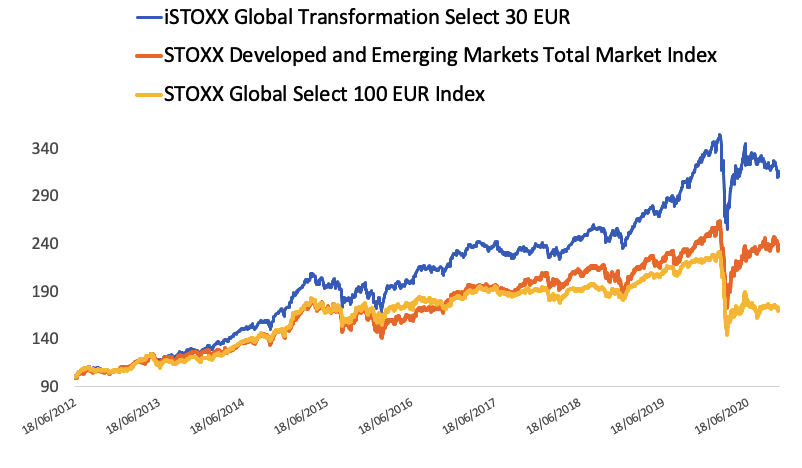

Chart 1 shows the performance of the iSTOXX Global Transformation Select 30 EUR Index against its parent index. Also featured is the STOXX® Global Select 100 EUR Index, which is a global basket of low-volatility and high-dividend stocks that has no ESG or thematic filters.

Chart 1

Responding to investor needs, maximizing possibilities

The iSTOXX Global Transformation Select 30 EUR Index provides a responsible way to target the economic upside of a world in disruption. Its distinctive approach is designed to cater to several investor objectives, aiming to maximize the possibilities of the strategy and of index-based investing.

Featured indices

iSTOXX® Global Transformation Select 30 EUR Index

1 McKinsey & Co., ‘How COVID-19 has pushed companies over the technology tipping point — and transformed business forever,’ Oct. 5, 2020.

2 TechCrunch, ‘COVID-19 pandemic accelerated shift to e-commerce by 5 years, new report says,’ Aug. 24, 2020.

3 World Economic Forum, ‘COVID-19 is a game-changer for renewable energy. Here’s why,’ Jun. 16, 2020.

4 Companies that are non-compliant with the Global Standards Screening or are involved in Controversial Weapons activities, as identified by Sustainalytics, are excluded. Additionally, companies involved in Weapons (Small Arms and Military Contracting), Gambling, Adult Entertainment, Unconventional Oil & Gas (Arctic Oil and Gas Exploration, Oil Sands and Shale Energy), Conventional Oil & Gas, Thermal Coal, Nuclear Power, Tobacco, Aerospace and Defense are also excluded.