Qontigo has introduced the STOXX® Europe Luxury 10 index, which tracks Europe’s leading manufacturers of high-end clothing, watches and vehicles under some of the world’s most iconic premium brands. The thematic index serves as underlying for an ETF from Samsung Asset Management, the first such fund to track Europe’s luxury-goods industry in Korea.

The ETF, listed on the Korea Exchange on Apr. 25, comes amid a post-Covid rebound in European luxury products, partly buoyed by Korean spending. Recently reported to be the world’s biggest consumers of personal luxury goods, Korean spending totalled USD 16.8 billion, or USD 325 per capita, in 2022. That’s 24% more than a year earlier and six times the amount spent by Chinese consumers[1].

Index methodology

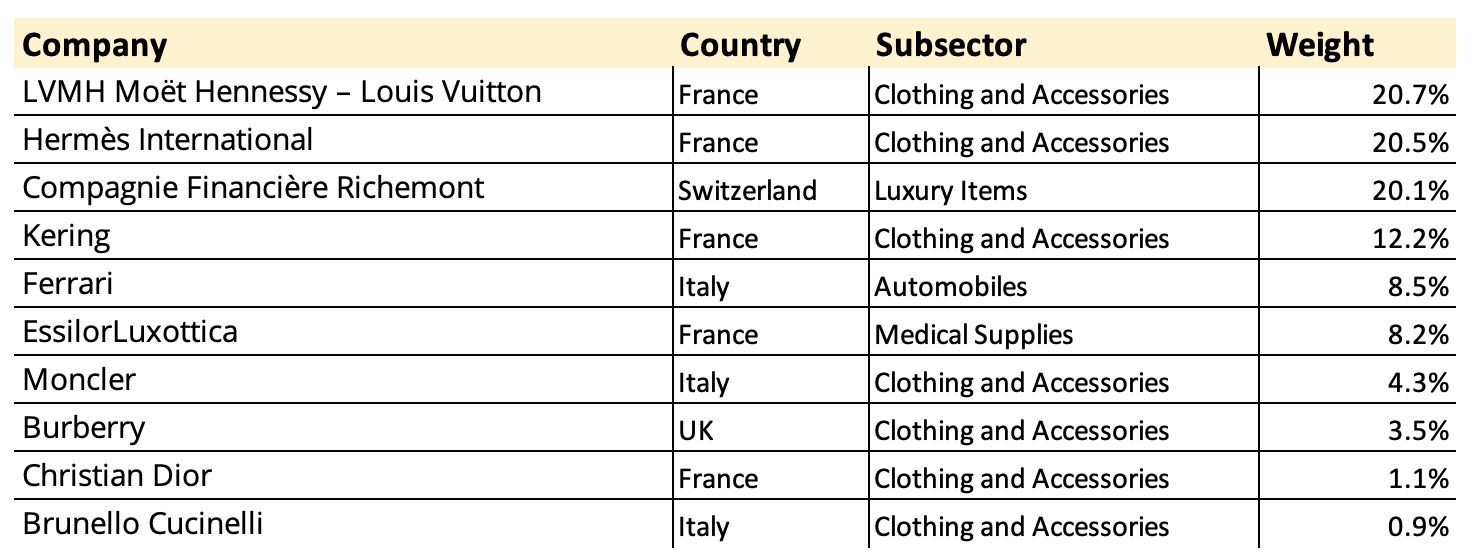

Composition of the STOXX Europe Luxury 10 index starts with the universe of stocks in the STOXX® Europe Total Market Index that belong to the following ICB Subsectors: Clothing and Accessories, Luxury Items, Apparel Retailers, Medical Supplies, Footwear, Recreational Vehicles and Boats, and Automobiles.

From there, a ‘luxury’ screen that includes sales exposure to 20 RBICS sectors, minimum revenue threshold to those sectors, and selected countries filters the final index constituents. All eligible companies are ranked according to their free-float market capitalization multiplied by the aggregate exposure to the targeted theme.

Revere (RBICS) data allow for a more detailed breakdown of companies’ revenue sources than available through traditional business classifications.

Figure 1: Index holdings

No slowdown for the luxury market

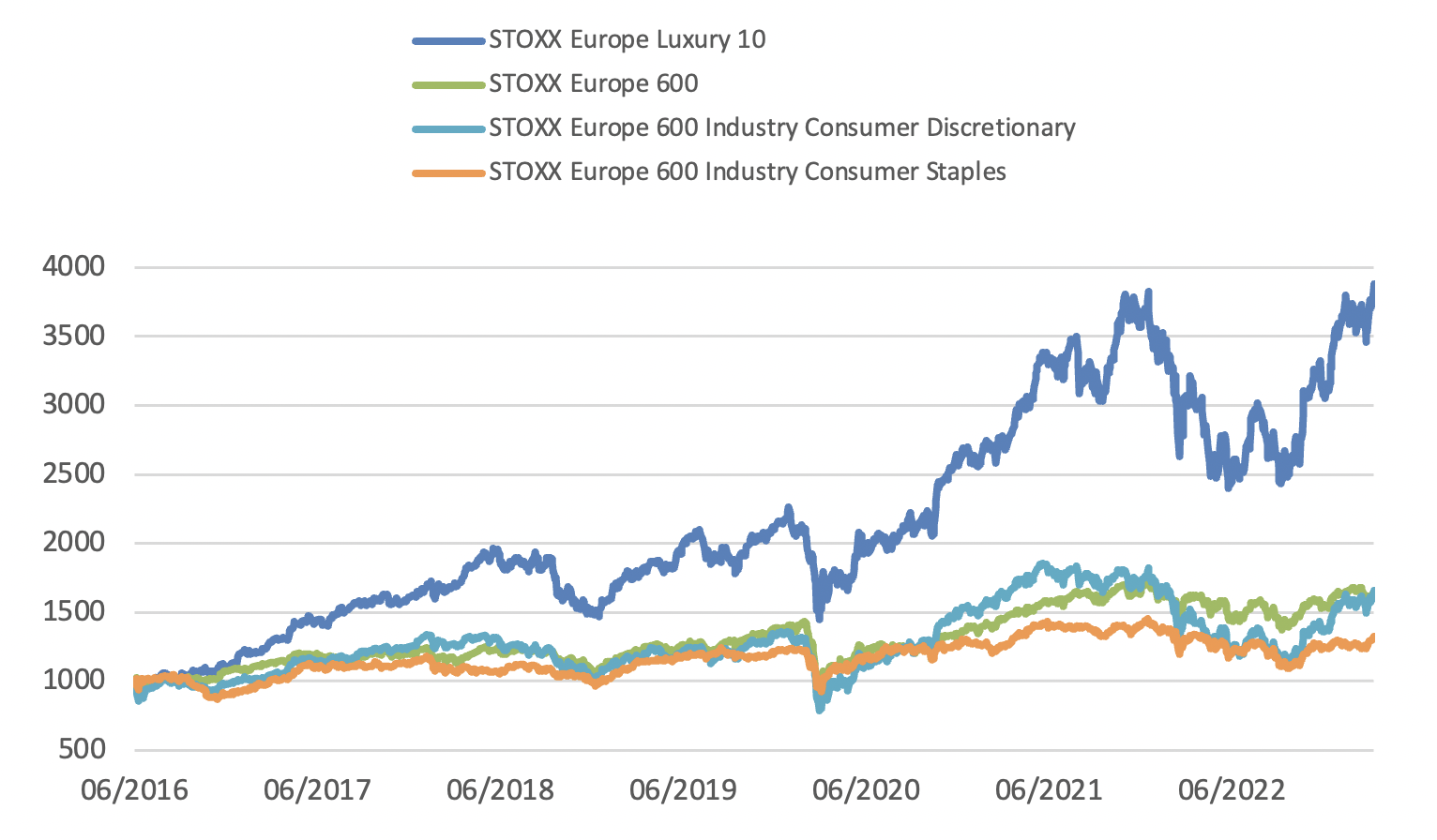

The index allows investors a more targeted approach to a business segment that could not be achieved with a traditional sector index. Its introduction comes at a time when luxury companies are beating most other industries amid strong demand from Asian investors. In spite of a global economic slowdown, the STOXX Europe Luxury 10 index has gained 25% in 2023, compared with a 22% advance for the broader STOXX® Europe 600 Industry Consumer Discretionary index. The STOXX® Europe 600 benchmark has climbed 8.6% this year.

The re-opening of China’s economy following the pandemic is acting as a short-term catalyst for the sector’s recent gains. More structurally, the industry is riding a new wave, as a result of increasing disposable incomes in developing economies and avid consumption from younger generations who want desirable and high-quality products.[2] Consulting firm Bain & Co. has estimated that the personal luxury goods market may grow to EUR 580 billion by 2030 from EUR 353 billion in 2022.

In April, LVMH Moët Hennessy – Louis Vuitton, the index’s largest component, became the world’s tenth-biggest company by market capitalization in dollars, after jumping 31% this year.[3] It is now the first European listed company to surpass USD 500 billion in market value. The world’s biggest luxury-goods maker said Apr. 12 that first-quarter sales rose 17% to EUR 21 billion from a year earlier, beating analysts’ expectations.

“We are excited to have collaborated with Samsung on this thematic index solution and to connect Asian investors with Europe’s luxury-goods industry and equity markets, through our rules-based and transparent methodology,” said Charlene Low, Managing Director and Head of Asia-Pacific at Qontigo.

Strong returns

The STOXX Europe Luxury 10 has surged 234% since 2016, more than twice the returns of its benchmark and of the STOXX Europe 600 Industry Consumer Discretionary (Figure 2). It has also logged three times the performance of the STOXX® Consumer Staples Index, with analysts saying luxury-goods makers can better pass on cost inflation to consumers.

Figure 2: Performance

“We are pleased to announce the launch of our Samsung KODEX ETF,” said Taihyuk Imm, Head of ETF Management at Samsung Asset Management. “As European luxury goods are gaining popularity both domestically and worldwide, this ETF provides timely exposure for investors. The ETF portfolio is made up of valued brands and based on a sound index methodology we can trust.”

Qontigo offers over two dozen STOXX-branded thematic indices, which target the economic upside of long-term structural trends, through either a revenue-based strategy or via alternative approaches where it is more suited.

[1] ‘South Koreans are the world’s biggest spenders on luxury goods,’ CNBC, Jan. 12, 2023.

[2] Bain & Co., “Global luxury goods market takes 2022 leap forward and remains poised for further growth despite economic turbulence,” Nov. 15, 2022.

[3] Data through April 14.