Climate change continues to gain weight as a key risk consideration in investment portfolios. As the world forges ahead with carbon reduction goals, investors are increasingly embedding the threat of physical and transition climate risks into portfolio analysis and construction.

As money managers demand companies set climate commitments and report on their progress in a manner that is quantifiable, an abundance of forward-looking indicators has emerged in recent years to track corporates’ climate actions and trends. Yet, the menu of available climate metrics is vast and divergent — a real barrier to their adoption.

A new whitepaper from Qontigo’s Sustainable Investment team1 maps out this complex landscape by presenting an overview of prominent forward-looking climate metrics (FLCMs) available to investors today.

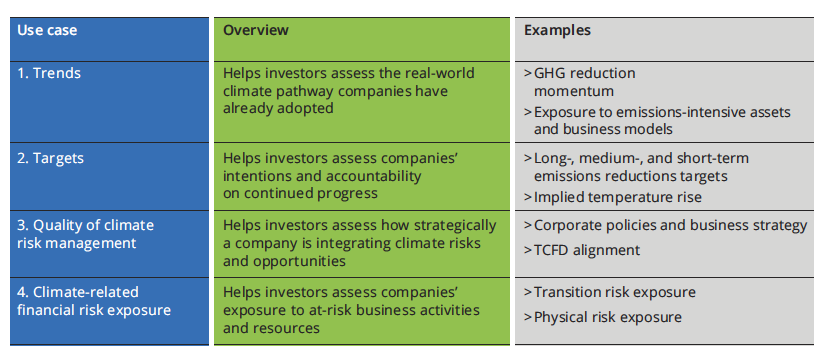

The report classifies the metrics according to four use cases: trends, targets, quality of climate-risk management, and climate-related financial risk exposure. Readers can access a review of a selection of current FLCMs definitions and coverage, a classification by data use case (Figure 1), and existing challenges — and possible solutions — to the various methods.

Figure 1 – FLCMs for financial institutions can be classified into four use cases

“Just as multiple traditional financial valuation metrics are used in mainstream financial decision-making, so no single climate-related metric can fully describe the position of a product, company, fund, or investment strategy in relation to the climate,” the authors write in the study. “As such, a broader dashboard of performance indicators and forward-looking metrics is needed.”

Difference between lagging and leading metrics

The authors explain that, on the one hand, lagging climate indicators are observable and measurable; they reflect output, past management decisions, and business strategy. They are akin to traditional business indicators such as revenue. One example would be greenhouse gas (GHG) footprint.

On the other hand, “leading indicators provide insights on where company performance is heading before this shows up in static reported data,” says Rodolphe Bocquet, Qontigo’s Global Head of Sustainable Investment. “Recent developments in climate metrics, climate investment methodologies, and uptake by investors have shown that there is now a shared agreement on the direction of travel. The next step is to ensure the pieces to this puzzle really do add up to contribution of real-world climate impact — the ultimate reason FLCMs exist.”

Challenges with climate data

Given the relatively short life of climate-related measurements, challenges abound with respect to the coverage, standardization, and reliability of the underlying data, the authors say.

To cite one example, there is a low correlation among the different providers’ reporting of companies’ Scope 3 carbon emissions. This is a result of the divergence in estimation methods, as well as gaps in the data collected and the complexity of it.

The authors further illustrate this divergence issue by comparing methodologically similar FLCMs for 135 companies from three different data providers. After transforming and normalizing scores from the different sources, the correlations among data points were found to range between 0.4 and 0.65, denoting only a modest positive relationship between the providers.

“Since usefulness often lies in the comparative, rather than absolute metrics, it cannot be emphasized enough how important it is for users to consider multiple FLCMs, as opposed to single metrics in isolation,” Qontigo’s Sustainable Investment team says. Moreover, “different providers’ assessments vary widely even when they are expressed in similar units, as in the case of temperature alignment.”

Implications for index design

Finally, the whitepaper looks at key implications of climate measurement for index design and argues that there is a bright future for benchmarks that combine financial and climate objectives.

“While climate metric-adjusted versions of existing benchmarks have existed for more than a decade, they have historically been designed to focus on backward-looking data and were intended to help investors hedge against climate transition risks,” the authors write. The new EU Climate Benchmarks — EU Climate Transition Benchmarks (CTBs) and EU Paris-aligned Benchmarks (PABs) — “go beyond climate risk to also incorporate a forward-looking goal of directing investments towards energy transition opportunities. By doing so, they pave the way for mainstreaming the use of FLCMs in index design.”

Qontigo introduced the STOXX® Paris-Aligned Benchmark Indices (PABs) and STOXX® Climate Transition Benchmark Indices (CTBs) in June last year. These comply with and exceed the minimum requirements under the EU-recommended methodologies and ensure diversification and comparability with underlying universes. The STOXX EU climate indices use various FLCMs to assess the portfolio constituents’ trends, targets, quality of climate risk management and climate-related financial risk exposure.

With better data availability, new regulation and progress in climate action, climate benchmark methodologies are also bound to evolve, the authors write.

A deepening trend

As climate action is shaping up to be one of most pressing issues for companies and investors alike, the conversation around the topic is evolving — from the need to the nuances of alignment with the low carbon transition. This is a make-or-break moment in history for asset owners, money managers and regulators to align expectations across the investment value chain.

Backward-looking data such as GHG intensity has shown to have limitations, therefore the future is likely to bring a greater focus on alternatives including using real economic outputs, absolute emissions reduction pathways and more sector specificity in calculations.

While the groundwork on climate-related measurement has been laid, the state of the market, data and tools currently available needs to improve to be truly effective, the report argues.

Asset managers will need to both take a holistic view and discern facts from noise, to manage risk, returns and investment impact efficiently. Most importantly, as this becomes a widely adopted practice, “the influence on the cost of capital for companies could finally result in major real-world outcomes,” concludes Qontigo’s Sustainable Investment team.

We hope that this latest Qontigo study will shed light on the current landscape of forward-looking climate metrics, and that it can accompany clients on their journey to ever more sustainable portfolios. We invite you to download the whitepaper here.

1 Rodolphe Bocquet, Anna Georgieva and Saumya Mehrotra, ‘Forward-Looking Climate Metrics – An Introduction to the Current Global Landscape,’ Qontigo, June 2021.