BlackRock’s iShares has introduced an ETF that tracks the STOXX® Global Quantum Computing index, amid growing demand for ultra-fast information processing technologies capable of running advanced industry applications and artificial intelligence models.

Quantum computing is an emerging field of computer science that applies the principles of quantum mechanics to solve problems too complex for classical computers. In a quantum computer, information is stored in quantum bits, or qubits. While with classical bits computers check possible outcomes one by one, qubits can represent and process more information through superposition and entanglement, enabling exponentially faster computation compared to traditional systems.

By tackling problems in ways that were previously impossible, experts say quantum computing can optimize algorithms and AI systems to accelerate processes such as the design and improvement of materials, drugs and financial models.[1]

McKinsey has forecast that the quantum computing market will grow from USD 4 billion in revenue in 2024 to as much as USD 72 billion by 2035.[2] Growth will be driven by demand for quantum technologies across segments including AI, robotics, sustainability and cybersecurity, as well as industries such as pharma, chemicals and finance.

The index

The STOXX Global Quantum Computing index aims to select companies involved in the development and application of quantum computing technologies. This includes areas such as quantum processors, and quantum hardware and software. The index also considers companies engaged in exploratory research and development that support the advancement of the quantum computing field.

This selection is conducted via a breakdown of eligible companies’ patents, annual reports and corporate websites to come up with an overall score that determines the exposure that businesses have to the targeted theme. This unique, multi-focus process is the first of its kind among STOXX indices.

Selection process

The starting investment universe is the STOXX® World AC All Cap index, to which a set of stock size, liquidity and sustainability filters is applied.

The methodology identifies key companies by means of three channels:

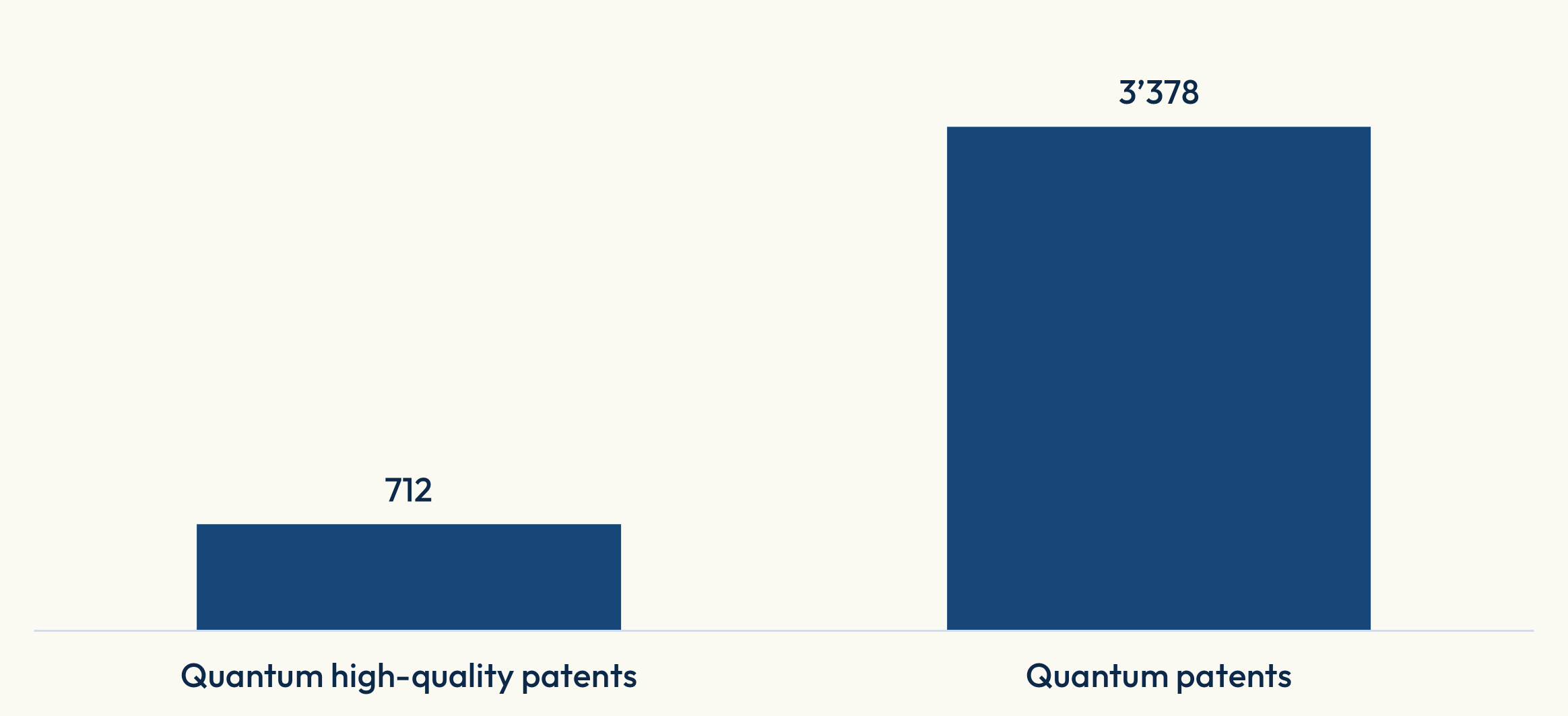

- Patent exposure: scored on a scale of 0 to 5, this grade is based on companies’ number of high-quality patents and high specialization in quantum computing.[3]

- Text analysis exposure: scored on a scale of 0 to 5, it is based on AI text analysis of annual reports and corporate websites. The higher score of the two is selected.

- Overall exposure: calculated as the sum of the patent score and text analysis score, forming the Quantum Computing Score. Companies are ranked in descending order based on this last score. The top 30 companies with more than one active quantum computing patent are selected for inclusion in the STOXX Global Quantum Computing Index.

Figure 1: Number of quantum patents identified in index construction

Weighting scheme

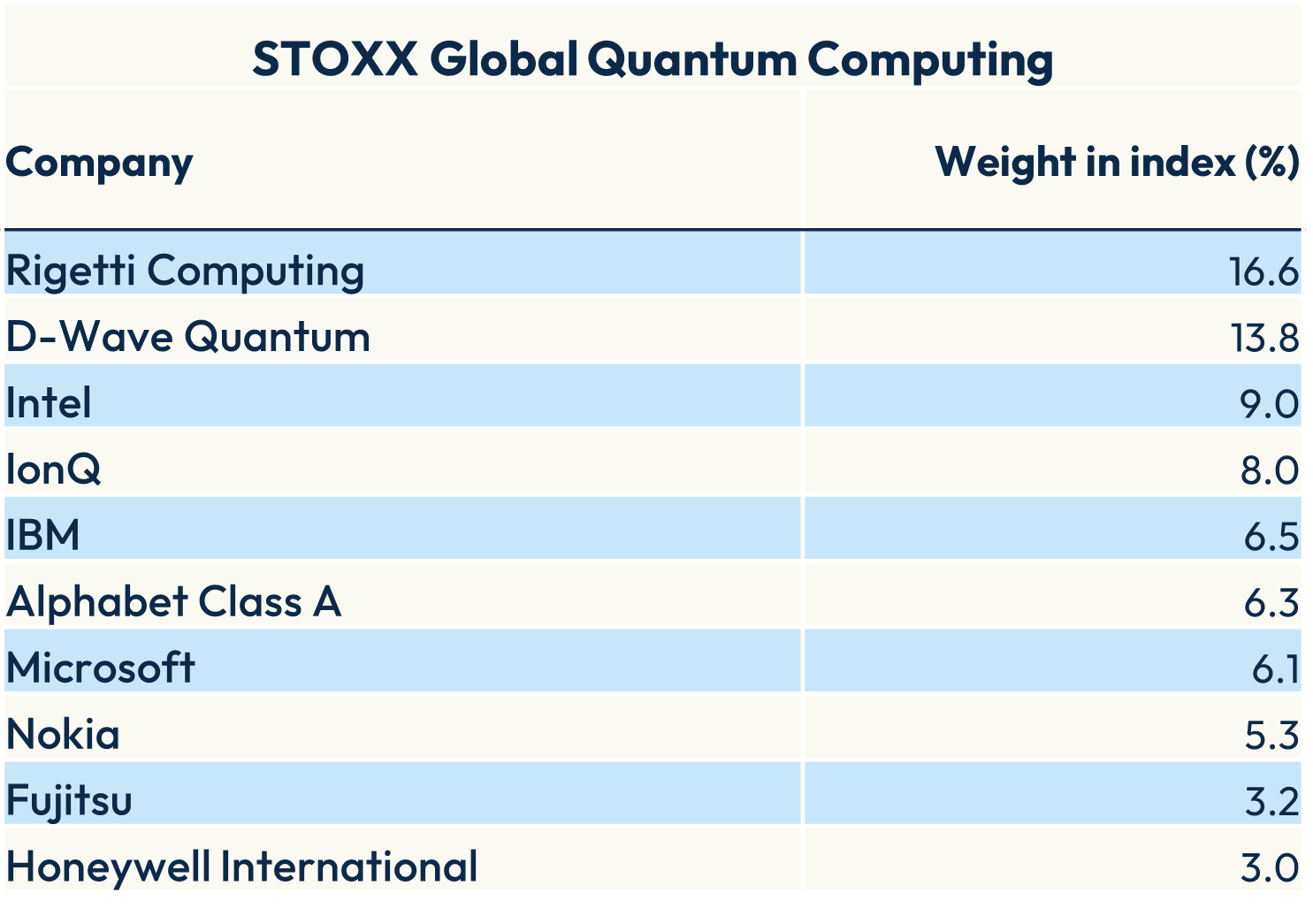

Index constituents are weighted according to their exponential quantum computing scores, subject to security capping, in order to maintain the purity of the targeted theme. Whenever two companies have the same quantum computing score, preference is given to the one with the most high-quality patents. If needed, final preference is given to the company with the highest patent specialization. The index is reviewed semi-annually in June and December.

Figure 2 shows the top 10 constituents in the STOXX Global Quantum Computing index, out of a total of 29.

Figure 2: Index top 10 constituents

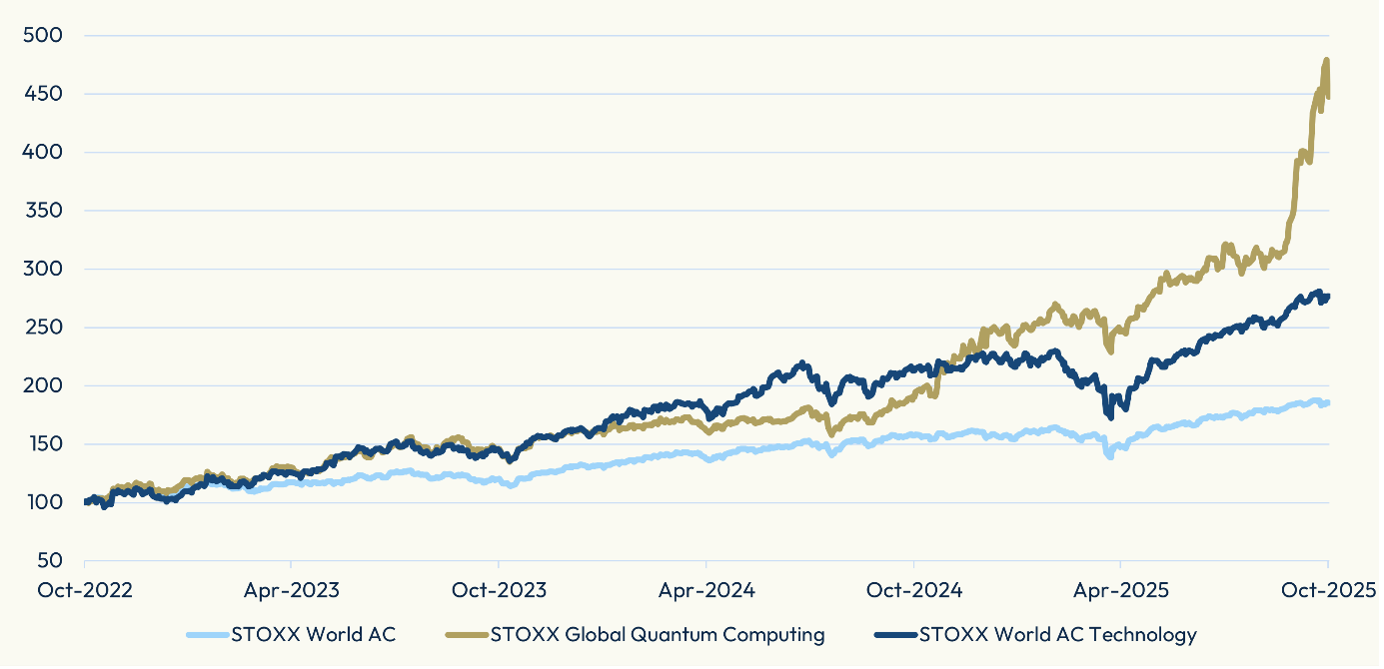

In the past three years, the STOXX Global Quantum Computing index has gained 348% (Figure 3). By comparison, the STOXX® World AC benchmark has climbed 86% since October 2022 and the STOXX® World AC Technology index has advanced 177%.

Figure 3: 3-year performance

Quantum computing has the potential to revolutionize industries and accelerate the adoption of AI, robotics and other advanced technologies. The STOXX Global Quantum Computing index and linked iShares UCITS ETF offer investors a targeted, systematic and cost-efficient way to gain exposure to the leaders driving this rapidly growing field.

[1] Alessandro Curioni on WEF, ‘Why education must take a quantum leap,’ April 11, 2022.

[2] McKinsey & Co., ‘The Year of Quantum: From concept to reality in 2025,’ June 23, 2025.

[3] STOXX uses EconSight’s extensive patents database and classification to identify companies with intellectual property in the targeted technology.