STOXX has announced the results of the annual review of the STOXX® Global ESG Leaders Index, with the number of companies in the benchmark of sustainability champions reaching a record high.

A total of 125 companies are scheduled to enter the index on Sep. 23, with US computer maker HP Inc. and British private-equity firm 3i Group Plc joining with the highest scores among new constituents. LVMH Moet Hennessy Louis Vuitton SE, Cisco Systems Inc. and Anglo American Plc were also included as part of the review, STOXX said Sep. 18.

Meanwhile, 72 companies will be removed. The index will count 440 members, the highest number since inception in 2011.

European footprint among established members

The STOXX Global ESG Leaders Index is STOXX’s broadest benchmark tracking the highest-scoring companies in environmental, social and governance (ESG) criteria. ESG indices have attracted interest from investors allocating more assets along responsible lines and have also incentivized public companies seeking to enhance their sustainability standing.

A total of 115 companies have been permanent members of the index for the past five years or more, pillars in a corporate world that’s raising the standards in the way it operates.

Europe is home to 77% of that established group, including industry bellwethers such as Vodafone Group Plc and BMW AG. By comparison, the region represents 33% in the broader universe of the STOXX® Global 1800 Index.

North American and Asian companies have taken up more slots in recent revisions of the index. Europe’s share of companies that have been index members in the past three to five years is 64%. The share drops to 53% when considering the group of firms that were index members for less than three years before the latest revision.

This week, however, a net 40 European companies was added into the constituency count. That compares with a net 14 for North America. More Asian companies were removed (29) than selected (28).

A thorough analysis of sustainability data

The STOXX Global ESG Leaders Index is derived from three gauges covering each ESG category individually. The indices are compiled based on ESG indicators from Sustainalytics, which continuously researches companies employing internal data, media reports and sector and public studies.

Sustainalytics reviews a set of indicators for each ESG category and assigns a score ranging from 0 to 100 for each indicator. These scores are aggregated into a total company rating per ESG criterion using a weighted sum, where both indicators and weight are adjusted to reflect industry idiosyncrasies.

The ratings form the basis to calculate an overall ranking for each ESG category and finally for entry into the specialized ESG indices and the overarching STOXX Global ESG Leaders Index. The latter comprises all components eligible for at least one of the specialized indices and is weighted by the sustainability scores.

Before the selection process begins, a set of filters meeting standard responsible investment criteria excludes companies in contravention of United Nations Global Compact principles as well as those involved with controversial weapons.

This month STOXX also updated the series of ESG key performance indicators (KPI) used in its sustainability indices by switching from DVFA/EFFAS rules and datasets to ones designed by STOXX’s partner Sustainalytics. In this way, KPIs will be now fully aligned with Sustainalytics’ research methodology.

Latest revision

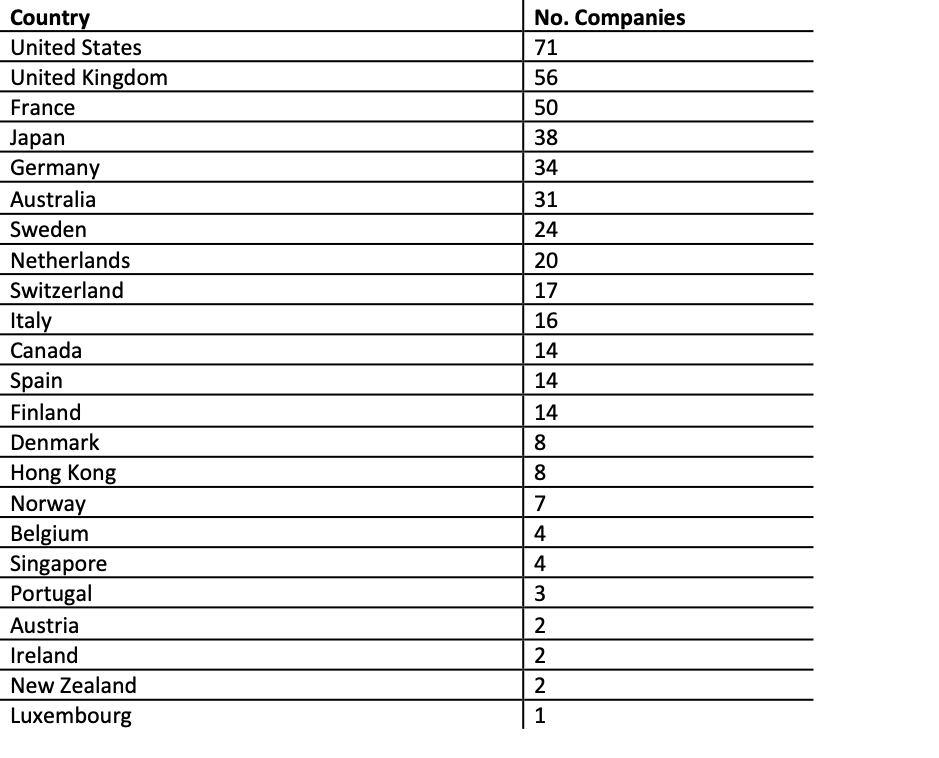

Table 1 lists the number of STOXX Global ESG Leaders Index members per country, following the latest review.

Table 1

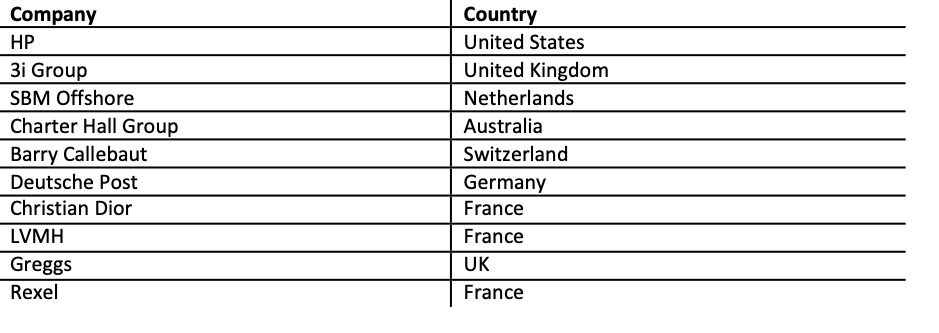

Table 2 shows the top 10 new constituents by index weight.

Table 2

General Electric Co., Hennes & Mauritz AB, Home Depot Inc., East Japan Railway Co. and Singapore Exchange Ltd. were among those companies named to leave the index.

The composition of the three global specialized ESG indices — STOXX® Global ESG Environmental Leaders Index, STOXX® Global ESG Social Leaders Index and STOXX® Global ESG Governance Leaders Index — was also reviewed in the current revision.

A corporate responsibility trend

Facing increasing shareholder and social activism, more and more companies are implementing new ways to govern and run their businesses responsibly, manage sustainable-related risks and limit the impact of their operations on the environment and societies. With investors also stepping up their fiduciary role and looking at the sustainable profile of their holdings, corporate responsibility is a trend set to grow.