Sustainable investing is evolving amid tightening regulation and wider ESG data availability, and investors are becoming more discerning about their impact goals.

At a webinar hosted by Investment & Pensions Europe (IPE) on March 21 entitled ‘Navigating Europe’s equities and sustainable investing landscape,’ representatives from Qontigo and DWS discussed how multiple variables yield new options for investors and shape novel forms of constructing sustainable portfolios.

Europe is at the forefront of the sustainable investing revolution because of investor demand, and regulators have caught up in recent years to establish rules that can advance green investments. The EU sustainable finance agenda comprises several legislative frameworks that interconnect: SFDR, Taxonomy, Benchmark regulation and MiFID II. Yet, lack of clarity in the regulation has often led to confusion, and investors would be better served by more clarity, Vera Cady, Director for Index Product Management at Qontigo, said at the webinar.

“Even though the intentions of the regulators are moving us in a positive direction, current regulatory language is open to interpretation,” said Cady. “That can create ambiguity and confusion, and also a little bit of anger. Some investors don’t know how to navigate this current landscape.” Complying with regulations should become a more practical and pragmatic task with time, she added.

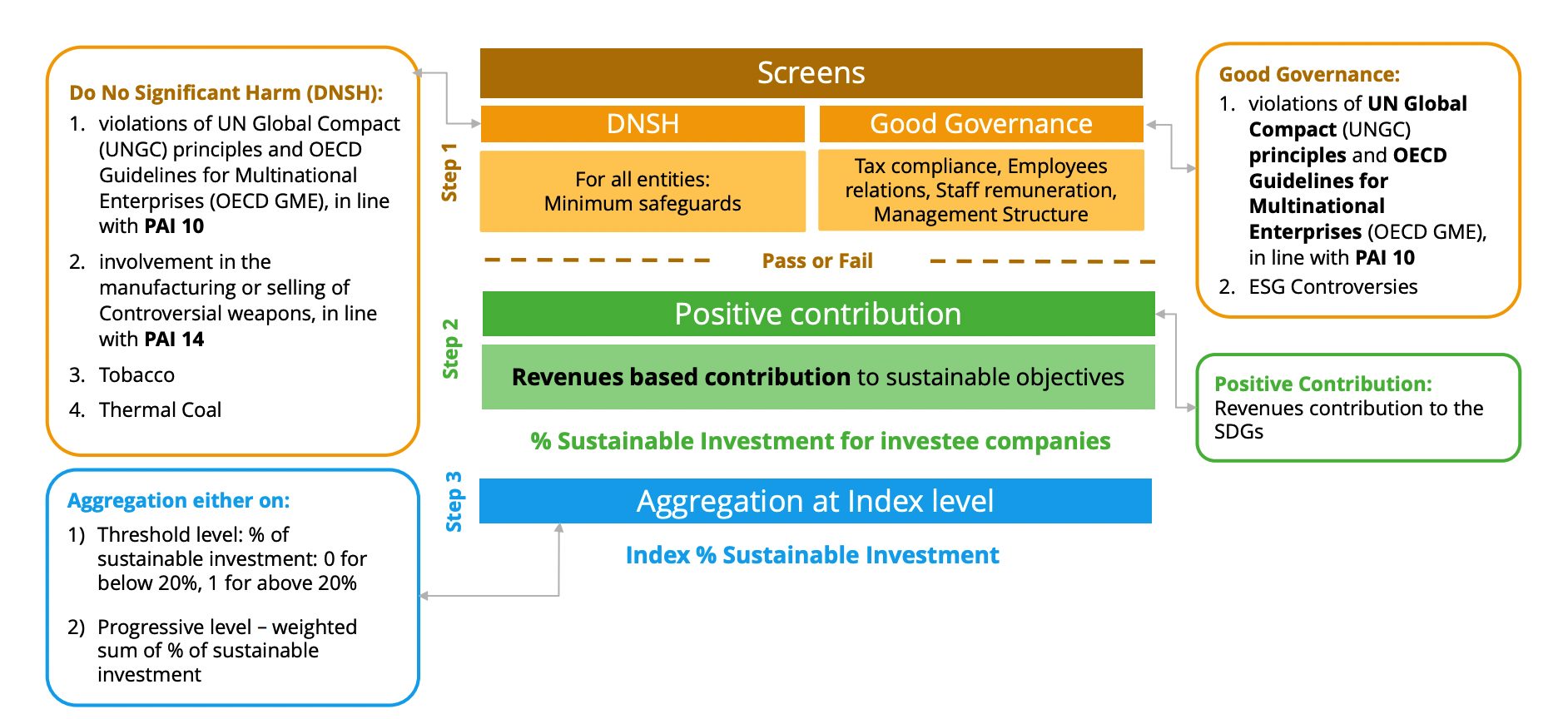

In building indices at Qontigo, Cady explained, the determination of whether an investment is sustainable or not relies on two steps: 1) a screening process for minimum sustainability performance, including Good Governance and ‘Do No Significant Harm;’ and 2) a measurement of positive contribution, which can be achieved, for example, through aligning companies’ revenues contributions to the United Nations’ Sustainable Development Goals (SDGs).

Exhibit 1 – Overview of Qontigo’s Sustainable Investment Framework

To illustrate the challenge faced by investors in creating ambitious SFDR Article 9 funds, Cady told the audience that only 12% of companies in Qontigo’s global pool of stocks have at least 20% of revenues aligned with the SDGs.

Qontigo offers a wide range of products to support investors in their sustainability journey. The suite of sustainable STOXX indices comprises ‘green’ versions of established benchmarks including the EURO STOXX 50® and DAX®. More recently, the firm introduced the modular STOXX® World indices, which allow investors to flexibly build sustainable portfolios covering a broad and liquid universe of stocks spanning regions, countries, market capitalization and sectors.

Pragmatism, transparency, customization

Providing the asset manager’s perspective in the discussion was Sebastian Schiele, Head of Xtrackers Mandates Sales EMEA & APAC at DWS Group. Schiele said that the combination of growing regulation and objectives means portfolio construction must be pragmatic and transparent, and flexible enough to adjust to the client’s particular needs.

“It’s about delivering investable benchmarks that are diversified, liquid but also representative of the broad objective,” said Schiele. That’s also where one has to distinguish between products created for a wider audience and the bespoke perspective, he added.

Melissa Brown, Managing Director for Applied Research at Qontigo, agreed that sustainability is deepening the need for tailored solutions.

“Different investors will have different views on how they want to trade off being as close as possible to the broad market versus getting as much sustainability, however you want to define it,” said Brown. “And also, how do you want to get there? There is not one answer to that question. It varies by investor, and that’s why you need customization.”

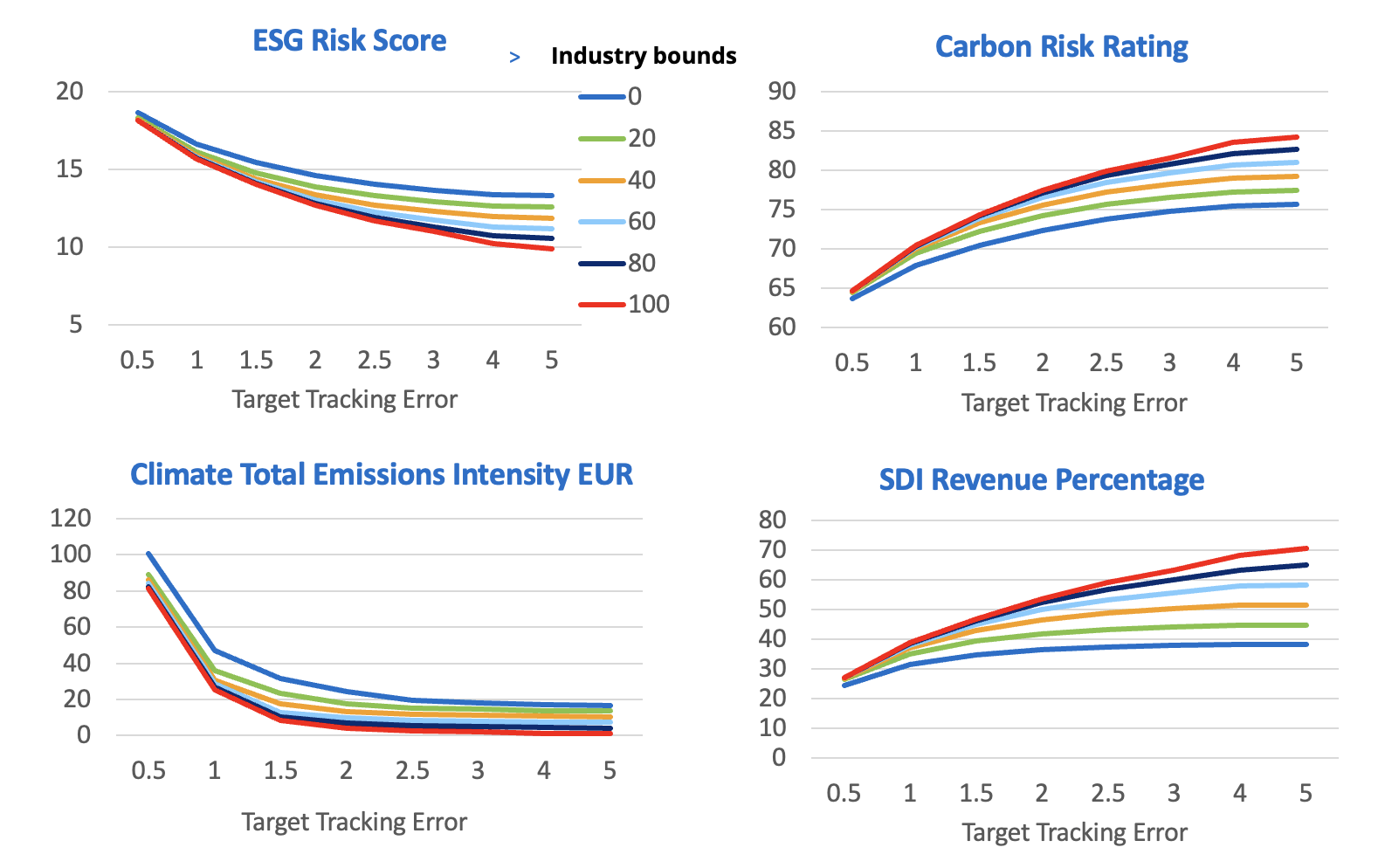

Brown presented an analysis that showed the extent to which strategy customization affects portfolio returns and sustainability impact. In the study, the STOXX® Europe 600 index was optimized to maximize exposure to various sustainability factors, across a spectrum of target levels of active risk. Unsurprisingly, the analysis confirmed that the further a portfolio deviates from an underlying benchmark, the higher the sustainability impact.

Exhibit 2 shows how the portfolio’s ESG risk score, carbon risk, emissions intensity and SDG-aligned revenues improve the more active risk is allowed. The four metrics (for two, a higher value is better; for the other two, a lower value is better) improve further the more the portfolio breaks away from the market’s sector allocation (“industry bounds” = the lower the percentage, the more the portfolio mirrors the market’s industry allocation).

Exhibit 2 – Higher Risk or looser industry constraints = better sustainability scores

The analysis offered two other findings. Firstly, certain strategies (e.g., minimize emissions) can achieve most of the improvement at a lower active risk. Secondly, targeting one sustainability objective often improves metrics in other goals, which allows investors to create more efficient portfolios by exploiting those correlations.

“It’s helpful to use an optimizer because you ensure a certain level of expected active risk and you maximize your exposure to the variable you are looking at,” said Brown. “You can tilt on one and still get others that come along for the ride. That’s good news as well.”

A limited tracking error is almost a universal demand of investors, but this may change over time, DWS’ Schiele said.

“As investors become more comfortable with a particular topic, they will also, over time, allow for a higher tracking error budget” in their bespoke solutions, he said.

More targeted themes

Rounding off, the panelists mentioned some of the big trends they see in sustainability investing.

According to a CREATE-Research survey supported by DWS last September, pension funds are most interested in the topics of affordable and green energy, biodiversity, and reduced inequalities, strategies that reflect more thematic SDG- than ESG-type of investing.

The DWS-CREATE poll also showed that ESG indices are already used on a broad basis, but that fund managers expect to use more Climate Transition and Paris-aligned benchmarks, as well as more thematic SDG-type investments.

“The focus is moving towards climate and thematic SDG investing,” said Schiele. “But that’s building on a good basis of investors deploying sustainability across the board using ESG benchmarks.”

Layering in

These days, Qontigo’s Cady said, on the institutional side, different sustainability themes — such as ESG, climate and SDGs — are being blended into one strategy. Some investors favor a “layered-in” approach to index building, she explained, where several indices can be created, each one adding sustainable objectives in an incremental manner. In this way, investors can measure how tracking budgets are used within each layer of the methodology and how each investment criterion impacts the final index.

With multiple options and varying objectives, selecting the right sustainability approach may feel like a formidable task for many investors in European equities. The panel at the IPE webinar offered several key points that might help investors as they start crafting such strategies.