Traditionally, multifactor portfolios have been viewed as less exciting than single-factor ones due to their relatively modest tilts and low tracking error. However, a new study shows that they can provide long-term outperformance thanks to the benefit of diversification.

A new article published in The Journal of Beta Investment Strategies suggests that an optimized multi-factor strategy with low levels of active risk offers the potential to outperform the cap-weighted market. Drawing on data from the past 20 years, the authors — factor-investing experts at BlackRock, SimCorp and STOXX — show that multifactor strategies offer diversification at two levels: within factors and among the individual sub-components of each factor. Both help improve relative performance, backtest results indicate.

Evolution in factor investing

The study comes as investor demand for, and expectations from, factor strategies has evolved significantly in the past decade. As an example, the STOXX® U.S. Equity Factor and STOXX® International Equity Factor indices, launched in 2022, have tracking errors of around 1%, or roughly a fifth of that of single-factor indices introduced ten years earlier.

Running the numbers on optimized factor portfolios

In “How Do Low Tracking Error, Multifactor ETFs Fit Into the Factor Investment Landscape?” BlackRock’s Andrew Ang, Bob Hum, Katharina Schwaiger and Lukas Smart; STOXX’s Anthony Renshaw, Hamish Seegopaul and Arun Singhal; and SimCorp’s Melissa Brown, analyze the performance of five single-factor portfolios and a multifactor one between March 2002 and June 2023.

The authors consider two parent universes: the STOXX® USA 900 and STOXX® Global 1800 ex USA indices. They select an alpha signal (a single factor, the multifactor signal[1], or the individual components used to create the factors) and then construct a portfolio that maximizes its exposure to that alpha signal, subject to tracking error, turnover, active exposure, sector and country constraints. The single factors are Quality, Momentum, Value, Small Size and Low Risk. The optimization is performed using Axioma’s portfolio construction software.

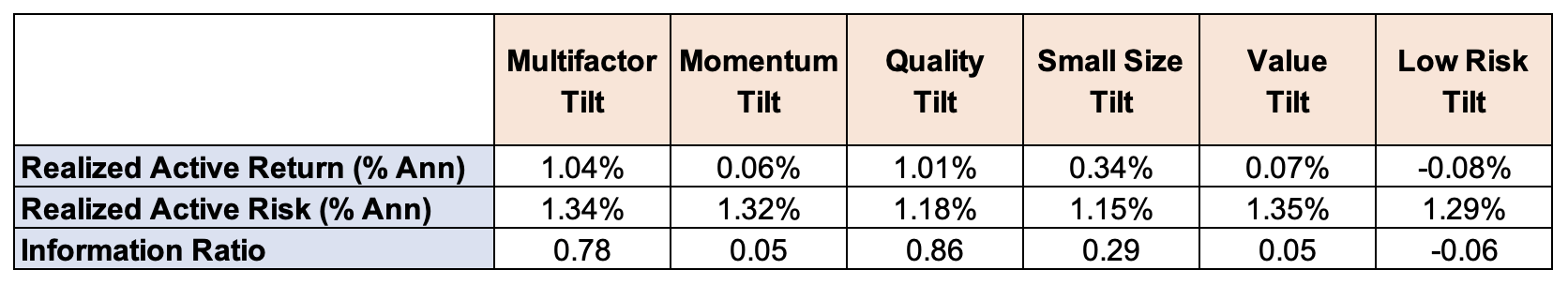

The multifactor portfolio drawn from the STOXX USA 900 universe beat the Momentum, Value and Low Risk portfolios by around 1 percentage point per annum over the period (Table 1). Multifactor also significantly outperformed the Small Size factor portfolio, and came ahead of the Quality tilt only slightly. The multifactor portfolio’s Information Ratio (IR) was higher than all single-factor portfolios except for Quality.

Table 1 – Performance Results

For the STOXX Global 1800 universe, multifactor also showed higher annualized returns over the period than all five single-factor portfolios considered, edging, for example, the Value and Low Risk signals by over 1 percentage point per year. The multifactor portfolio’s IR was higher than all single-factor portfolios.

“It is noteworthy that the multifactor case is at the top, or near the top, performance of all the portfolios constructed,” the authors write. “This is one of the advantages of multifactor indices, namely that they usually do well even when one or more of their underlying signals underperforms.”

As the authors note, the driving force behind this outperformance is diversification. Each of the underlying single-factor returns over the period shows low correlation with the others.

“Through careful construction, multifactor indices can harness the diversification benefits amongst factors and signals,” the authors write, and “their associated premia can be efficiently harvested in a low tracking error format.”

Further, the authors explore how performance changed over the period considered by looking at the trailing 36-month, realized active returns of each factor strategy. Once again, the advantage of a multifactor approach becomes evident. Several of the single-factor portfolios — including Low Risk at different times, and Value and Small Size most recently — showed significant periods of underperformance. The multifactor portfolio, on the other hand, did not exhibit any sustained underwater periods.

Intra-factor diversification

A final consideration involves the construction of individual factors. Just as the combination of styles in a multi-factor portfolio can perform better than the average of their individual contributions, a composition of the individual parts of a particular factor should perform better than the average of the components. Here again, the study shows that returns for a given factor should be superior to a simple average of its constituting metrics.

The turnover for the factor strategies analyzed in the study is only slightly higher than the parent universe’s, the authors added. The tracking error is modest, so portfolio managers should be comfortable with the risk implications of these products, they said.

Changing landscape

The construction of smart factor portfolios is of key importance in an increasingly competitive performance landscape. At the same time, the portfolios have become more attractive with decreasing management fees and transaction costs, while modern tools allow multifactor portfolio construction to target highly specific objectives.

We invite you to download the article and explore the study’s findings.

[1] The multifactor signal was designed as 36% Quality, 27% Momentum, 27% Value, 5% Small Size, and 5% Low Risk.