The Sustainable Development Investments Asset Owner Platform (SDI AOP) helps investors assess companies’ contributions to sustainability themes using the UN Sustainable Development Goals. The asset owner-led effort provides a robust SDG-alignment framework and data, and is already used worldwide by investors for implementation and tracking of sustainability strategies, and engagement with multiple stakeholders.

Traditional ESG and climate metrics tend to be risk-avoidance-focused. But as sustainable investments continue to evolve, more and more investors are looking to identify positive investment opportunities in sectors that can benefit from related policy. It is clear that in order to achieve societal goals around health, environmental quality, transport and energy provision, major investments in related technology and infrastructure will be required. The broad scope of the United Nations Sustainable Development Goals (UN SDGs) means the SDI framework can be used to align portfolios for different investors with widely diverse investment objectives.

To translate goals into actionable investments, investors can work with the SDI Classification – a robust dataset measuring contributions from companies’ products and services that align to the SDGs – for implementation, tracking and stakeholder engagement.

SDI AOP overview

The SDI AOP is an asset owner-led platform that is developing a family of data products centered around using artificial intelligence (AI) to assess company contributions (both positive and negative) to the UN SDGs. Building on the established product (the SDI Classification) that evaluates revenue streams, the newest offering (the SDI Innovation Outlook) analyses forward-looking potential based on firms’ patents.

Exhibit 1 – The UN SDGs captured through the SDI AOP

The SDI AOP was conceived to facilitate the implementation of thematic investing in sustainability, which historically has lacked robust industry standards and quality granular data. Unlike most ESG and sustainability ratings and datasets, the SDI AOP is designed and maintained by asset owners for asset owners. The platform was introduced in 2020 by a consortium made up of APG, AustralianSuper, British Columbia Investment Management Corporation and PGGM. Qontigo is the SDI AOP’s exclusive distribution partner.

Real-world use cases

Although every investor implements a ‘positive contribution’ analysis differently, below are representative examples of how one can leverage the SDGs and the SDI AOP taxonomy for goal-setting, strategy implementation, portfolio reporting and engagement.

Use case #1

Set goals and define strategies

Select sustainability themes that align with your stakeholders’ interests. For all relevant SDGs, distill strategic goals that are achievable and outcomes that are measurable.

Philips Pensioenfonds, a current SDI AOP user, narrowed its sustainable development focus to four sustainability themes (Good Health and Well-Being, Sustainable Cities and Communities, Responsible Consumption and Production, and Climate Action – Exhibit 2), all of which are goals that Philips’ beneficiaries support and expect to shift capital towards. When the pension manager implemented its sustainable investment policy for its equity investments, it established an SDG benchmark using SDI AOP data. This resulted in an increase from 15% to 35% in capital invested in companies with revenues that contribute to the selected SDGs, that match the required themes.

Exhibit 2 –SDGs selected by Philips Pensioenfonds

Use case #2

Select metrics and set targets

Based on the desired goals, define individual objectives.

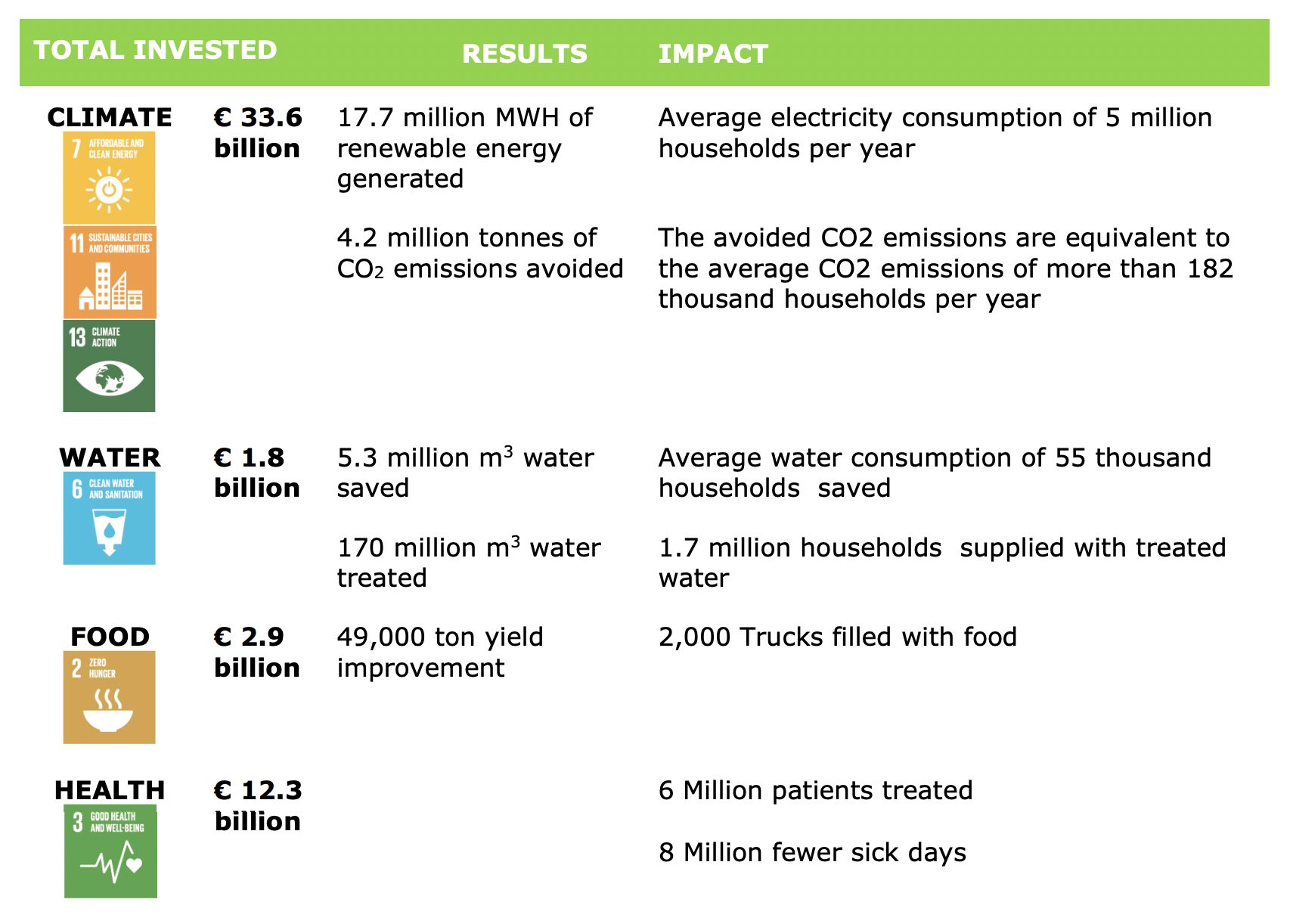

Users can leverage the SDI AOP’s granular and verified financial metrics and revenues (which are broken down by company, product category, and SDG) as key outputs and proxy metrics for target measurement. One of PGGM’s clients uses the SDGs as a guide in its new investment policy, whose objective is to double the measured impact on four focus areas — climate, water, food and health — and measure the results and impact of those capital allocations across seven related SDGs (Exhibit 3).

Exhibit 3 – Measuring the SDG-impact of investments at PGGM

The SDI AOP contains transparent information to make reporting to key stakeholders more efficient and reliable (e.g., actual revenue percentages linked to each SDG, warning flags for controversies, confidence scores, and an explanation of how the result has been derived). This enables reporting by investment theme or SDG and extends across a large equity and fixed income universe. The SDI AOP is currently working with its partners to enhance the ability to assess the related outputs and outcomes associated with the revenue streams identified.

Use case #3

Manager and company engagement

Rely on fair and transparent data to engage with asset managers and investee companies.

The SDI AOP data is used to track the evolution of positive and negative developments of portfolio managers and portfolio companies on priority sustainability themes. Asset owners can use the data to track the velocity and direction of change toward fulfilling their selected goals and outcomes. This data, in turn, can be sourced as key input for feedback with external managers and investee companies. Because the dataset is updated on a quarterly basis, it can reflect the changes in underlying benchmarks.

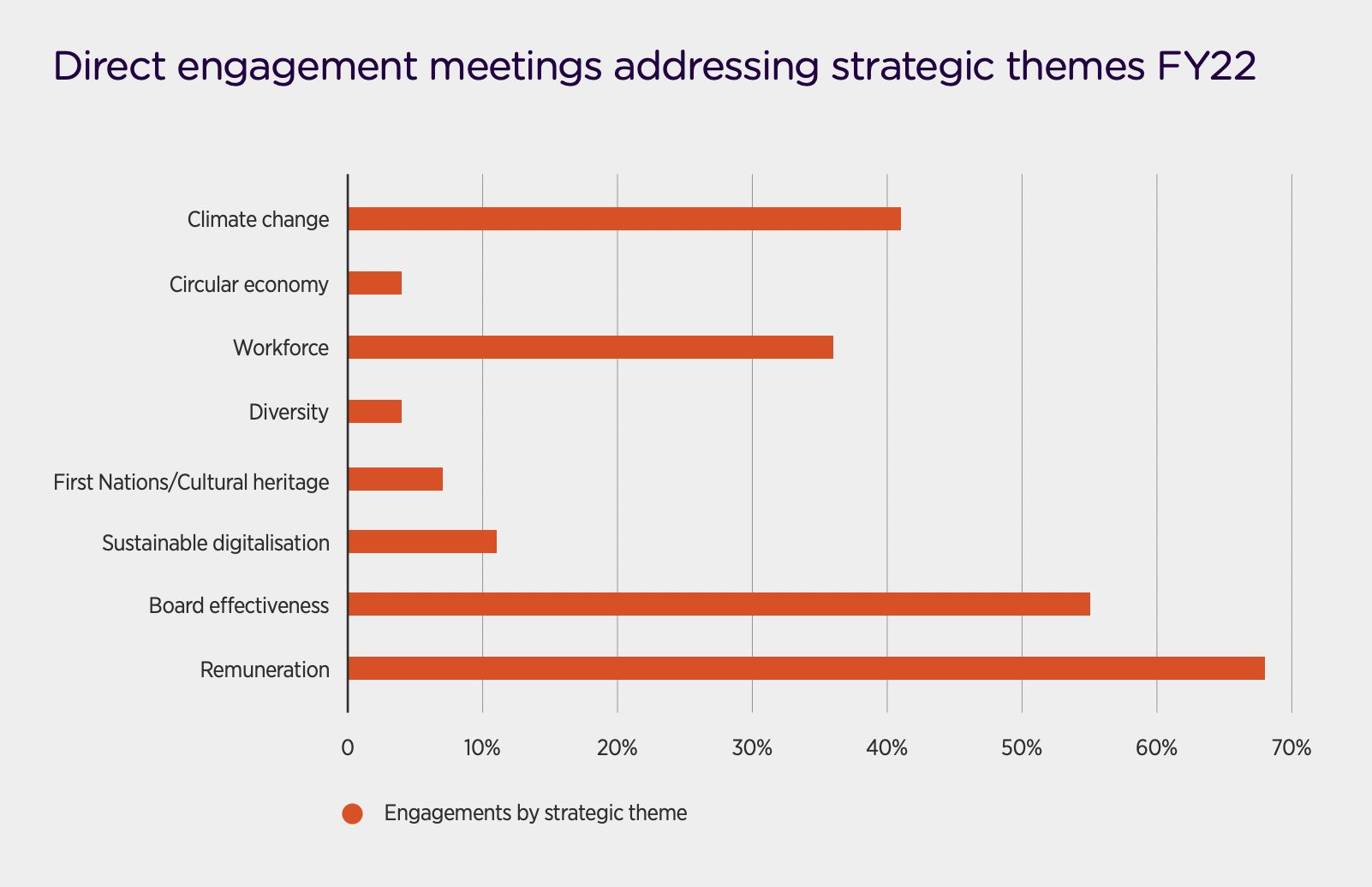

Australian Super has integrated SDI AOP data analysis into its stewardship program to inform and progress how it engages with companies. This enables the pension plan to have deeper conversations with companies about strategic themes, ultimately leading to more transparency and better investment outcomes for stakeholders. The SDI data products provide a number of insights that can be used to explore sustainable investment opportunities. Firstly the revenue data provides another lens to assess how a company’s business model is aligned with themes such as climate change or circular economy. The product focus looks beyond traditional sectors to understand who contributes to the value chain for areas such as clean energy systems, efficiency, or flood control.

Exhibit 4 – Australian Super’s engagement snapshot

Australian Super also uses the new SDI Outlook to inform engagement with companies on whether they are investing in the future solutions for these themes. The AI-driven global patent analysis measures the quantity and quality of research activity in relevant technologies. For example, this includes comparison across new and emerging areas relevant to the climate theme, such as storage, hydrogen and fusion in the energy space.

Asset-owner network effect

Through an asset-owner-first approach, the SDI AOP Design Authority’s goal is to develop a community of institutional investors who are jointly focused on advancing a credible standard for investing in sustainability themes, using the SDGs as a globally accepted framework. The taxonomy and data are designed to enhance engagement with portfolio companies, managers, regulators and other key stakeholders such as board members or trustees. The impact of a network of like-minded asset owners and managers promoting the adoption of SDG-aligned impact investing will help to spur positive momentum in sustainable investments.

Interested in learning more? Email sdi@qontigo.com.