One corner of the equity market that has been shining in recent years as brightly as an exclusive diamond ring or a high-end car is that of luxury goods stocks.

Diana R. Baechle, PhD

Diana is a Principal at Qontigo and part of the Applied Research team. Her research is focused on equites.

The recently introduced STOXX® Europe Luxury 10 index has gained 23% in 2023 despite a global economic slowdown, and some of its constituents now rank among the world’s largest companies. By comparison, the STOXX® Europe 600 benchmark has climbed 9% this year. Since 2016, the STOXX Europe Luxury 10 has surged 234%, more than twice the returns of its benchmark and of the broader, sector-based STOXX® Europe 600 Industry Consumer Discretionary.

Luxury goods market overview

Luxury goods are highly desirable, expensive, and top-quality items that do not represent a necessity but rather an indulgence. Their exclusivity is maintained by limited supply and a high price point, granting consumers social status.

The luxury market’s largest segments — luxury cars, personal luxury goods and luxury hospitality — account for 80% of the industry.[1]

The personal luxury goods segment represents roughly a quarter of the luxury market and has experienced double-digit growth over the past year. As the fastest-growing segment, it is projected to climb about 60% from EUR 353 billion in 2022 to EUR 580 billion in 2030, according to consulting firm Bain & Co[2]. It is therefore interesting to note that most companies in the STOXX Europe Luxury 10 index derive the majority of their revenues from this segment.

But who are the main consumers of luxury goods? The top 2% of the luxury market’s customer base accounts for 40% of luxury sales globally[3]. Younger generations (Millennials and Gen Z) were responsible for the majority of market growth in 2022. Spurred by technology trends such as the Metaverse and social media, Bain predicts this cohort, along with generation Alpha, will become the biggest buyers and represent 80% of global purchases by 2030.

Increasingly, luxury consumers are turning to online shopping as a means of instant gratification. The channel is expected to capture more than 30% of market share by 2030.

The Americas captured the largest share (30%) of the global personal luxury goods revenues in 2022, followed by Asia and Europe. Asia lost the top position last year due to prolonged COVID lockdowns in China. In contrast, South Korea had a stellar year, becoming the largest consumer of luxury goods per capita[4].

However, with Chinese restrictions finally coming to an end, the share of global luxury spending is expected to increase not only in mainland China but also abroad, as Asian international travel resumes, boosting European tourism sales.

Asian countries (and especially China) show enormous potential. Both purchasing power and the number of high-net-worth individuals — the main consumers of luxury goods — are rising in Asian countries. China’s middle class, the largest in the world, is expected to continue its rapid expansion and consumers in the country could account for between 40% and 45% of global luxury sales by 2025[5].

New markets, such as India and other emerging countries in Southeast Asia and Africa, also have significant potential for growth.

New ETF and index overview

It’s no coincidence then that on Apr. 25, Samsung Asset Management listed the Kodex European Luxury Top 10 STOXX ETF, which tracks the STOXX Europe Luxury 10 index, on KRX, the Korean exchange.

The index aims to select ten companies that are most positively exposed to European luxury goods.

Stocks in the STOXX Europe Luxury 10 are selected from the STOXX® Europe Total Market Index, by applying liquidity, volatility, size and Industry Classification Benchmark (ICB) subsectors filters. Companies belonging to a defined set of countries and subsectors that derive more than 50% of their revenue from 20 RBICS sectors linked to the luxury trend are then pre-selected as index candidates. Finally, all eligible companies are ranked according to their free-float market capitalization multiplied by their aggregate luxury exposure. The top 10 companies are chosen, with a 20% cap per constituent.

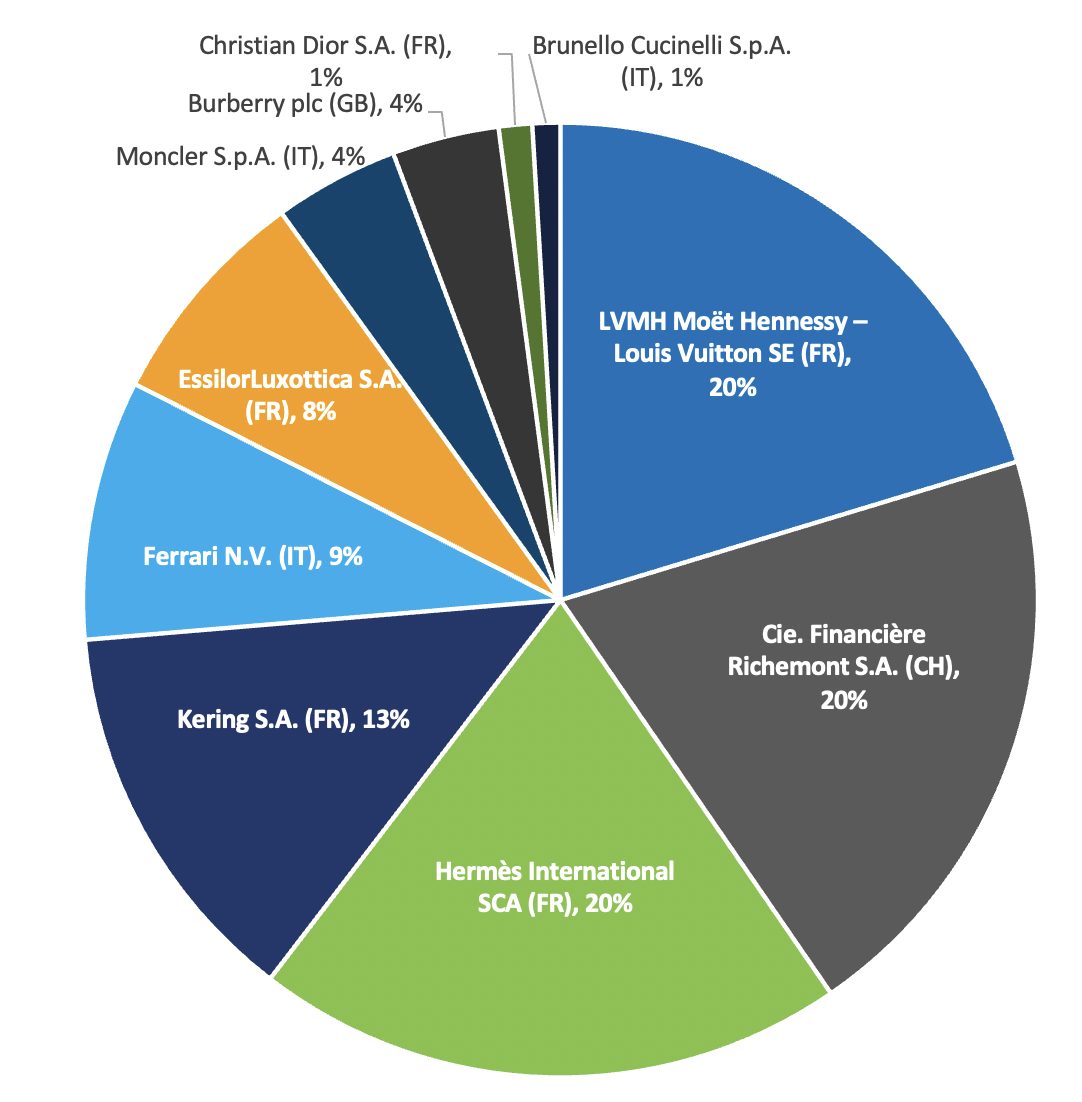

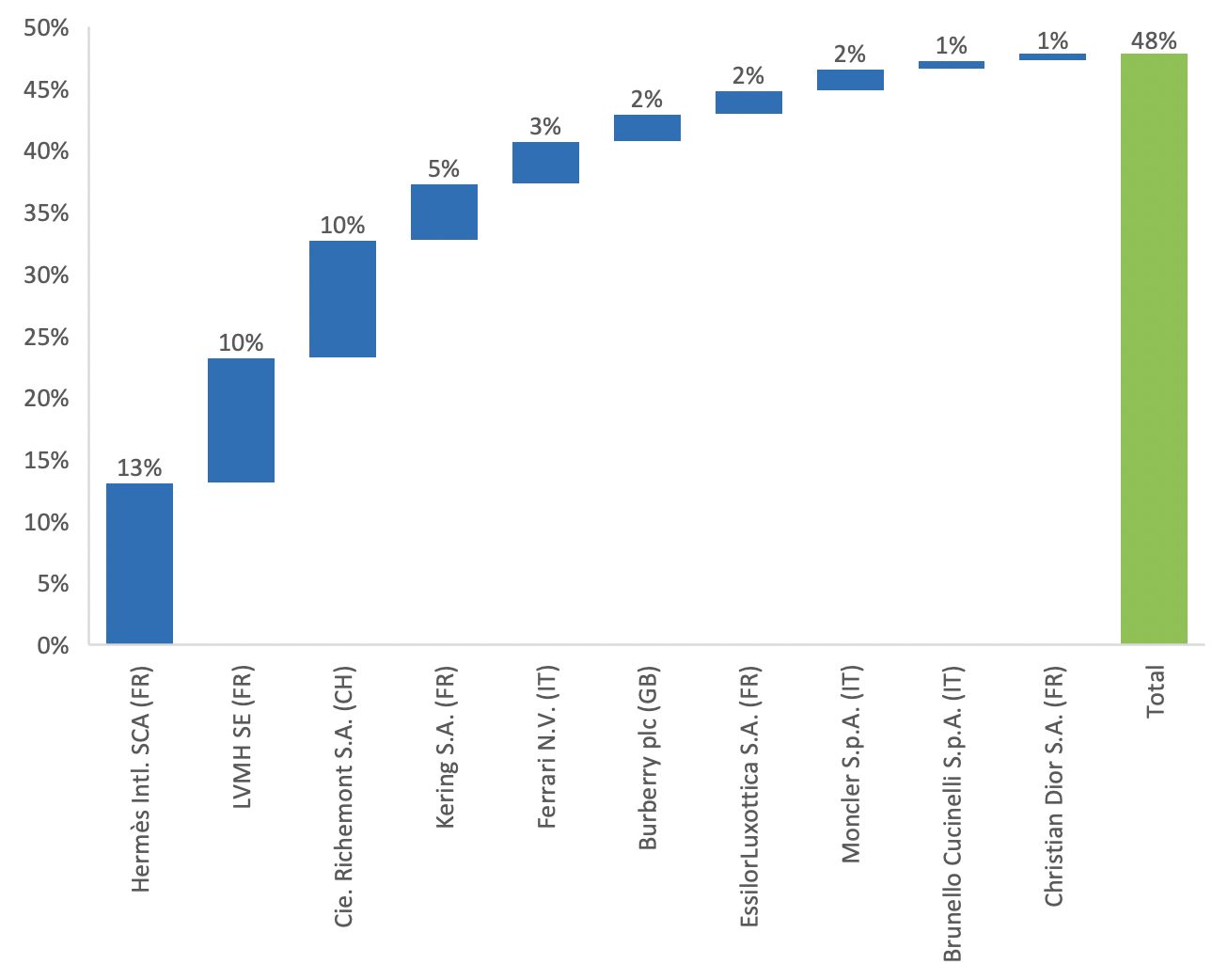

As of March 31, 2023, the STOXX Europe Luxury 10 included the stocks listed in Figure 1 (with the country of incorporation in parentheses, and their index weight in percentages). Most of these companies provide luxury fashion items and accessories, perfumery, jewelry and watches. Ferrari is the only luxury sports car manufacturer. LVMH Moet Hennessy-Louis Vuitton (LVMH) also sells fine wines and spirits.

Figure 1: Index weights on March 31, 2023

Conglomerates hold some of the largest weights in the index: 20% in the case of LVMH (main brands include Louis Vuitton, Tiffany & Co., Givenchy, Sephora, Fendi), 20% for Cie. Financière Richemont (Cartier, Montblanc) and 13% for Kering (Gucci, Yves Saint Laurent, Bottega Veneta). Hermès is the largest stand-alone company/brand in the index, also with a 20% weight.

Asia and the US are key markets for most of the companies in the index. Only Ferrari and Brunello Cucinelli (which together represent 10% of the index), derive most of their revenues in the European market.

Historical performance[6]

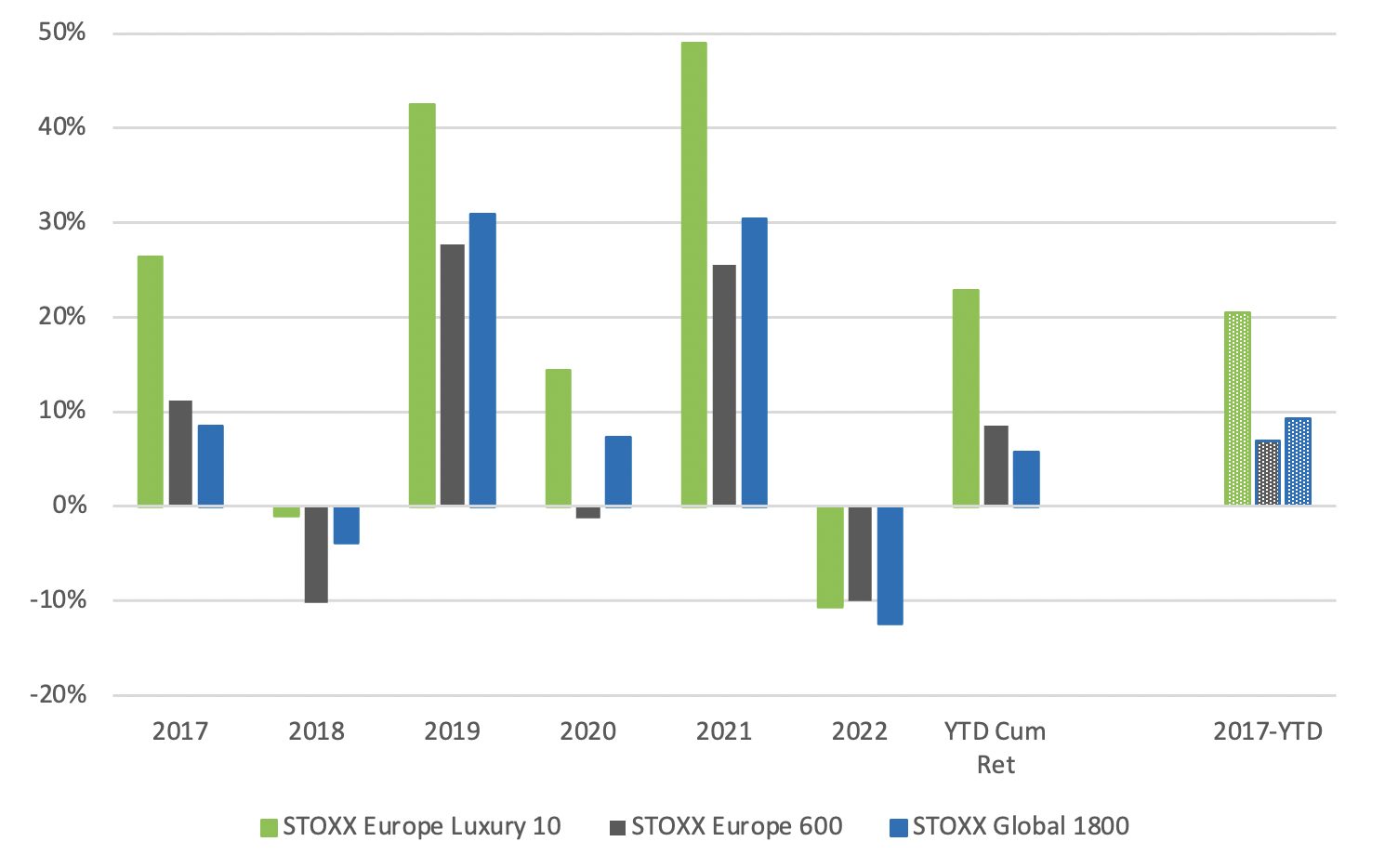

The STOXX Europe Luxury 10 has outperformed the global market regardless of the economic cycle over the past seven years, including year-to-date (Figure 2). That is, the luxury goods industry seems to be more resilient than other sectors in an economic slowdown, or even in a time of crisis and high inflation.

When most countries in Europe were in lockdowns in 2020 and the European stock market suffered an annual decline of 1%, the STOXX Europe Luxury 10 recorded a 14% return. While lower than the 40% annual return in the prior year, it was still a remarkable feat at a time of great social and economic distress. Although people were not able to visit stores, luxury stocks continued to rise thanks to increased online shopping.

Over the period under study (2017-2023), the STOXX Europe Luxury 10 saw its highest annual return (of nearly 50%) in 2021. The largest loss was recorded in 2022, in the wake of the Russia-Ukraine war, when the index saw a similar decline (about 10%) to that of the overall European developed market.

True to form, the luxury market bounced back in 2023, recording a cumulative year-to-date return of 23% by March-end. To put things in perspective, the aggregate European market has eked out less than half of the luxury market’s gains so far this year.

For the 2017-2023 period overall, the STOXX Europe Luxury 10 recorded a 20% annualized return, 14 percentage points more than the European developed stock market and 11% more than the Global Developed market.

Figure 2: 2017-2023 Returns

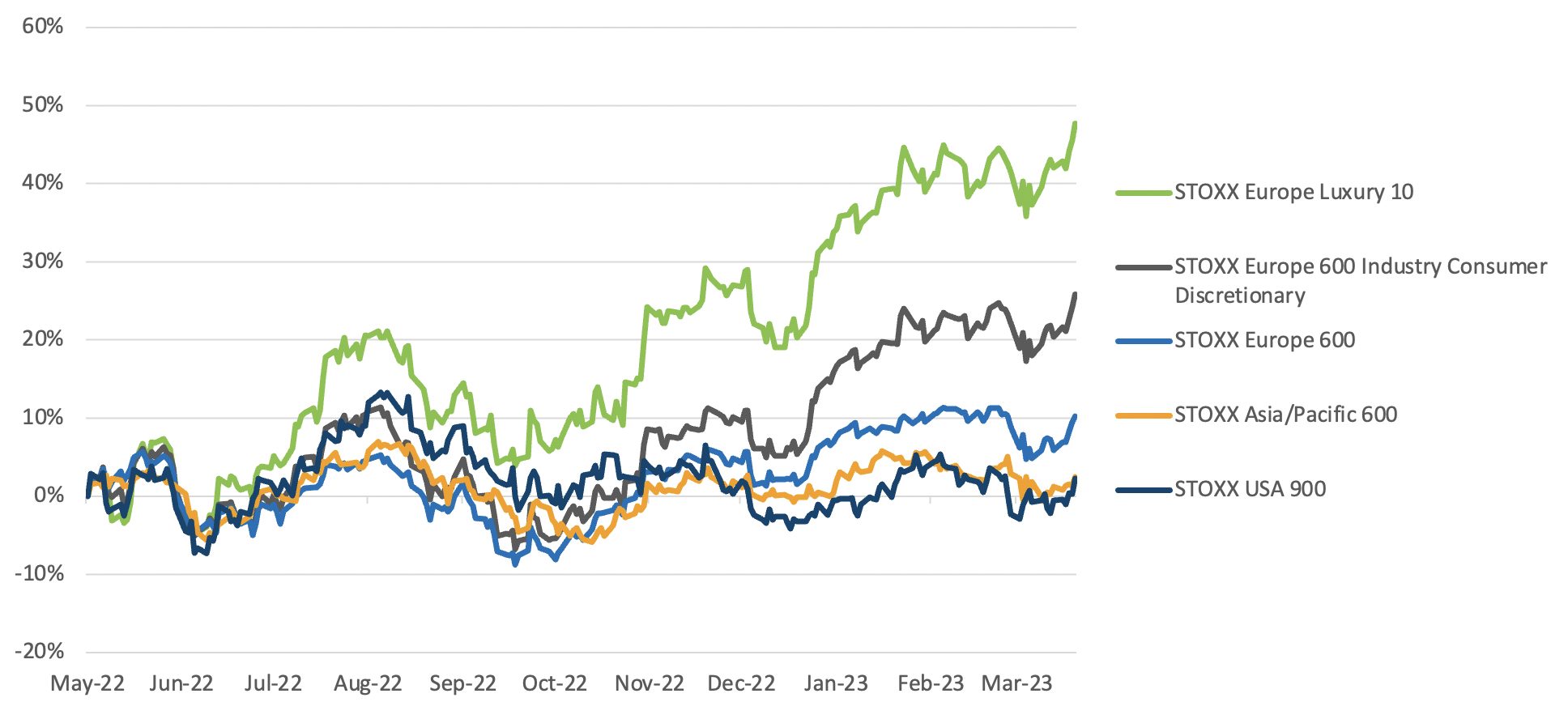

Performance between index launch on May 13, 2022 and March 31, 2023

Since the STOXX Europe Luxury 10 was introduced on May 13, 2022, it has recorded a 48% cumulative return, significantly outperforming the US, European and Asia-Pacific stock markets (Figure 3).

Digging deeper into the European market, the STOXX Europe Luxury 10 also outperformed the overarching Consumer Discretionary sector by over 20 percentage points over the same period. This seems to indicate that consumer demand for luxury goods grew much more than that for other discretionary items, as market sentiment improved in recent months.

Figure 3: Cumulative returns since index launch on May 13, 2022

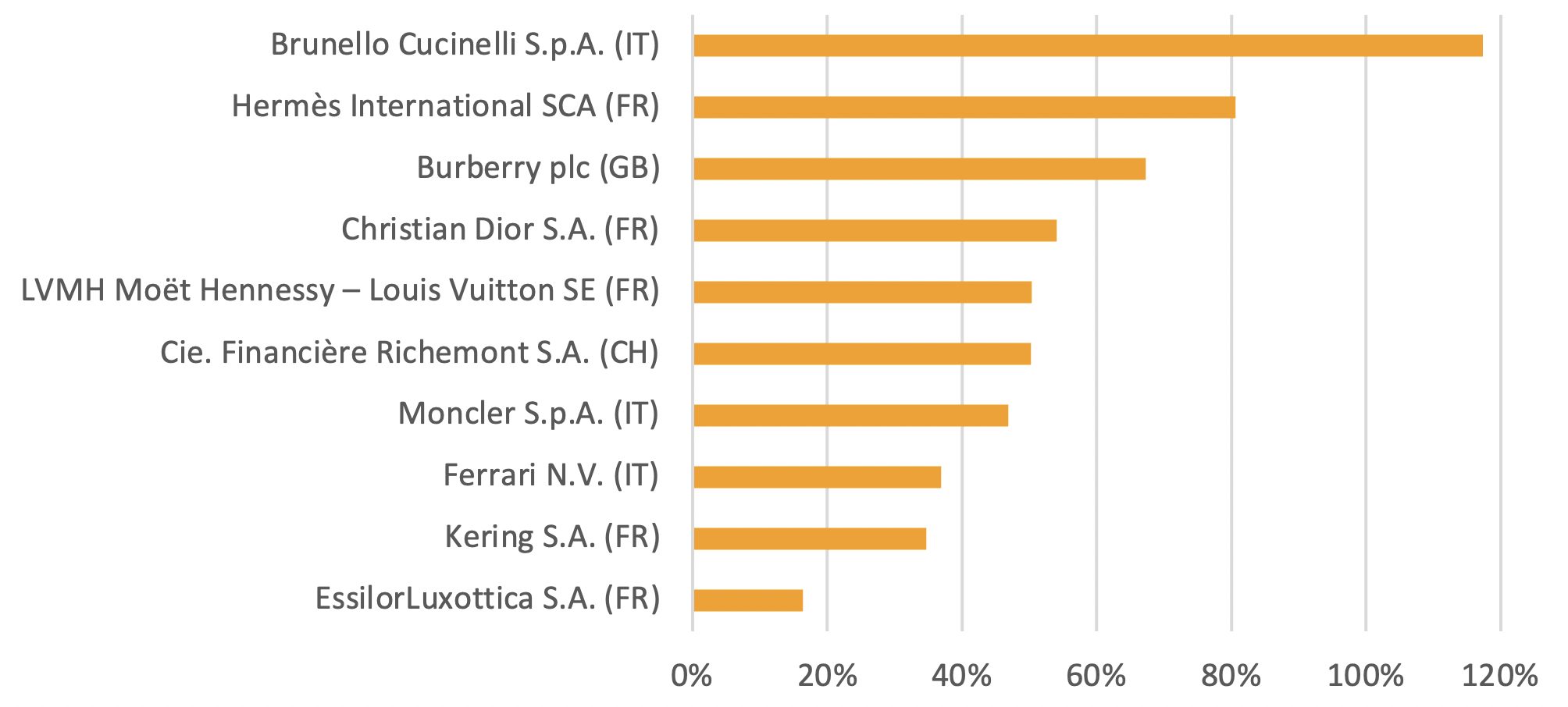

Brunello Cucinelli, Hermès, and Burberry saw the largest gains since index inception (Figure 4). The largest component of the STOXX Europe Luxury 10 — LVMH — posted growth of over 50%, becoming the fourth-largest component of the STOXX Europe 600 and the first listed European company to surpass the USD 500 billion-mark in market value.[7]

Figure 4: Total asset return since index launch on May 13, 2022

Due to their large weights in the index, Hermès, LVMH and Richemont contributed the most to the overall index gain (Figure 5). Together the three companies have been responsible for nearly 70% of index returns since launch. It is noteworthy that despite having only half the weight of EssilorLuxottica, Burberry contributed equally to the index’s overall gain.

Figure 5: Contribution to STOXX Europe Luxury 10 index’s gain since launch on May 13, 2022

Conclusion

The luxury goods segment has become a standout structural trend on its own apart from the discretionary-consumer sector. Booming sales in the industry have weathered some of the most difficult economic conditions the market has seen since the global financial crisis. The STOXX Luxury Europe 10 index allows investors to benefit from this trend, tracking the key companies in the European segment through a highly targeted selection methodology.

[1] https://www.bain.com/insights/renaissance-in-uncertainty-luxury-builds-on-its-rebound/

[2] https://www.bain.com/about/media-center/press-releases/2022/global-luxury-goods-market-takes-2022-leap-forward-and-remains-poised–for-further-growth-despite-economic-turbulence/

[3] https://www.bain.com/insights/setting-a-new-pace-for-personal-luxury-growth-in-china/

[4] https://www.cnbc.com/2023/01/13/south-koreans-are-the-worlds-biggest-spenders-on-luxury-goods.html

[5] https://www.bain.com/insights/setting-a-new-pace-for-personal-luxury-growth-in-china/

[6] This covers the period Dec. 30, 2016, to Mar. 31, 2023. Backtested data was used for the period Dec. 30, 2016, to May 12, 2022. The actual launch of the index was May 13, 2022. The analysis is done in EUR.

[7] Source: Bloomberg.