This is a summary of a new research paper available here.

Low Volatility strategies have a deservedly good reputation for delivering equity-like returns with less risk. One of the basic tenets of such strategies is that they offer active downside protection, as lower volatility stocks are expected to hold up better than their jazzier counterparts when markets fall.

That said, performance expectations have departed from norms in a multitude of ways in 2020, and Low Volatility strategies have been no exception. But while many components of Low Volatility strategies have been upended, we do not believe this is the ‘new normal’ for the strategy.

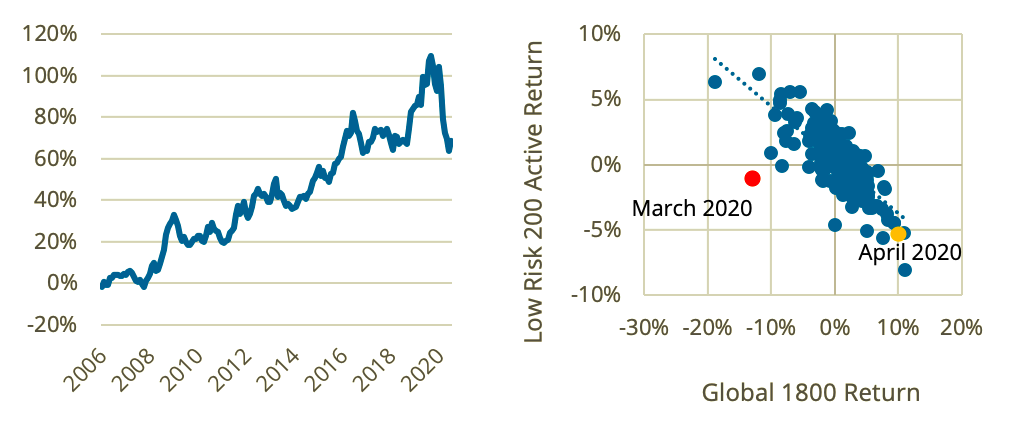

We have used the STOXX® Global Low Risk Weighted Diversified 200 Index (henceforth the ‘Low Risk 200’) to illustrate the anomalous behavior we have observed in 2020. From 2006 through August 2020, the Low Risk 200 returned 5.4% on an annualized basis, versus a return of 4.1% for the benchmark STOXX® Global 1800 Index (‘Global 1800’). Prior to 2020, the outperformance was fairly steady (Figure 1).

Realized tracking error was just over 8%, producing an information ratio of 0.15. While that information ratio may not sound dramatic, the strategy has delivered on its promise to provide better performance when the market was down. In addition, historically there has been a strong negative correlation between market return and active return.

Figure 1 – Cumulative active return, STOXX Low Risk 200 versus STOXX Global 1800 (left), and scatterplot of excess return vs. market (right)

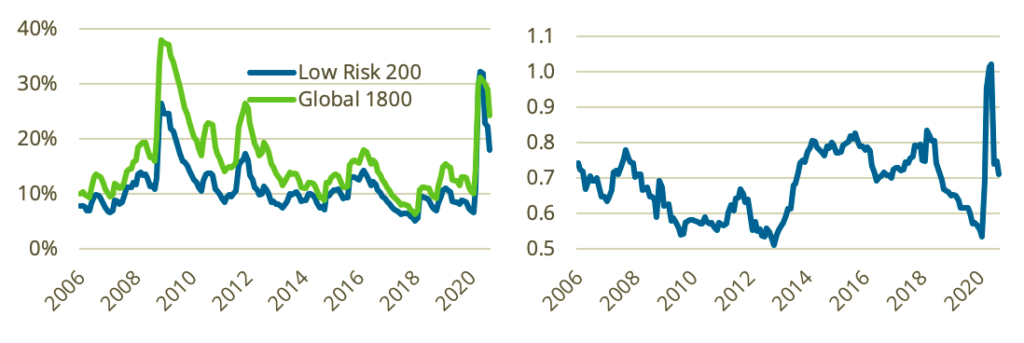

By design, we expect total risk, as measured by the Axioma Worldwide Medium-Horizon Fundamental Equity Factor Risk Model (AXWW4), to be higher for the Global 1800 than for the Low Risk 200. That was, in fact, the case until March of this year (Figure 2). The index’s beta, always below 1.0 historically, also shot up above that level in April and May. This should have been our first signal that we were playing in a different sandbox. How could our Low Volatility strategy have higher volatility and beta than our standard index?

Figure 2 – Predicted volatility (left) and STOXX Low Risk 200’s beta (right)

Changing portfolio profile

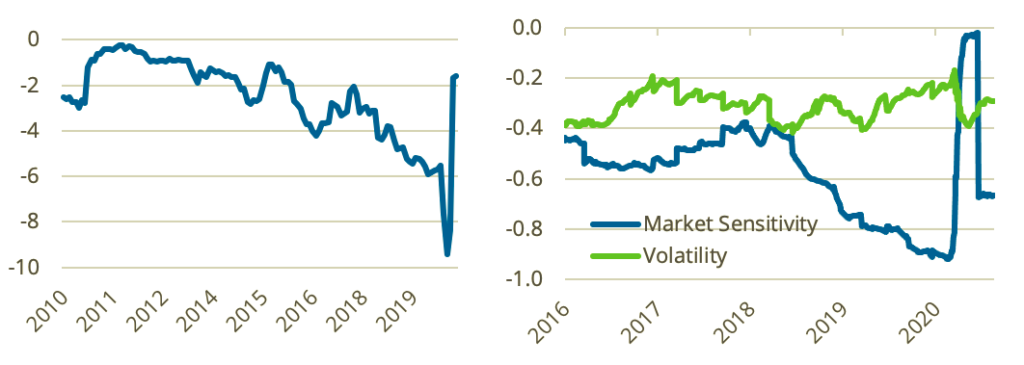

During 2020, the characteristics of our Low Volatility portfolio changed substantially. For example, the Low Risk 200’s active exposure to the Market Sensitivity style factor has typically been quite negative and had reached a level near -1.0 in February 2020 (Figure 3). Suddenly, that exposure shot up to near zero, meaning the index had the same exposure to the factor as the general market.

Sectors that had been low volatility, such as Utilities, became much more volatile, while Health Care and Information Technology replaced them.

Even the macroeconomic exposures of the index were affected during both the bear and subsequent bull markets, first becoming far more negative than usual and then quickly retracing their steps. Figure 3 shows the pattern of exposure (net of the market) to an aggregate of European 10-year government bond yields. Charts depicting exposures to other regions, as well as to term spreads and credit spreads, look similar. When the index rebalanced in June it experienced the highest turnover of its history (more than 140%).

Figure 3 – Low Risk 200’s exposure to EU 10-year bond yield (left), and Volatility and Market Sensitivity style exposures (right)

This turnover brought the Market Sensitivity exposure back into line and was driven by huge changes in sector weights (Figure 4).

Figure 4 – Sector weights in 2020

Attribution for Jan. 2 through Mar. 23, 2020, when the Low Risk 200 index fell slightly more than the market (when it would have been expected to outperform) shows that its negative average exposures to Market Sensitivity and Volatility provided a lot of ballast in the market decline. However, sector weights produced a substantial drag on return.

From Mar. 23 through Jun. 22, when the market retraced its steps but before the index was rebalanced, the Low Risk 200 returned almost 10 percentage points less than the Global 1800. Roughly half of the underperformance could be traced to factor exposures — mainly Market Sensitivity and Volatility. Sectors also clobbered returns, accounting for almost a third of the underperformance. After the June rebalance, the Market Sensitivity exposure was the biggest drag on performance. The impact of most other factors was relatively small, although the underweights in Consumer Discretionary and Information Technology together took away 70 basis points of active return.

Conclusion

The Low Risk 200 index has historically outpaced its Global 1800 benchmark and has produced a higher Sharpe ratio in about two thirds of the years since 2006. In months and years when the market fell, low risk outperformed. The strategy’s worst relative performance came when the market rose sharply. In 2020, however, when the market was down, the Low Risk 200 fell even more, and then continued to underperform (as expected) in the subsequent market recovery. Overall, that made for a very difficult year for Low Volatility investors.

Does 2020 performance mean the end of Low Risk strategies? Given the long history of outperformance, especially during market downturns, we do not think so. Instead, we believe the market environment so far in 2020 has been extremely unusual, driven not only by the unique economic circumstances of the COVID-19 crisis, but also by policy responses. By providing unprecedented liquidity and downside risk protection (e.g. by extending asset purchases into credit markets), the Federal Reserve has distorted investors’ views of the true risk of their investments. While this may be the ‘new normal,’ we do not think we are seeing the ‘consistent normal.’

1 Returns are based on monthly rebalancing and may differ from official figures that are calculated daily.

2 This means roughly that the index exposure was about one standard deviation below the average stock in the Global 1800.