A year ago, in partnership with APG, Qontigo introduced the iSTOXX APG® World Responsible Indices. We took a ‘building block’ approach to the indices, starting with a broad global developed-market index (iSTOXX® World A) and, using Axioma’s portfolio construction tools, we layered on the exclusion of non-ESG leaders, favored companies actively reducing their carbon emissions, and those that are contributing to the UN Sustainable Development Goals (SDGs). These portfolios were built while simultaneously maintaining low active risk. Details on the portfolios and the metrics used can be found in a whitepaper from November last year entitled ‘A building block approach to sustainability portfolios.’

The goal in this article is to provide an update on the responsible-investing characteristics of these indices, and reaffirm that the process continues to create indices with substantial improvement in sustainability criteria without straying too much from the standard capitalization-weighted parent benchmark.

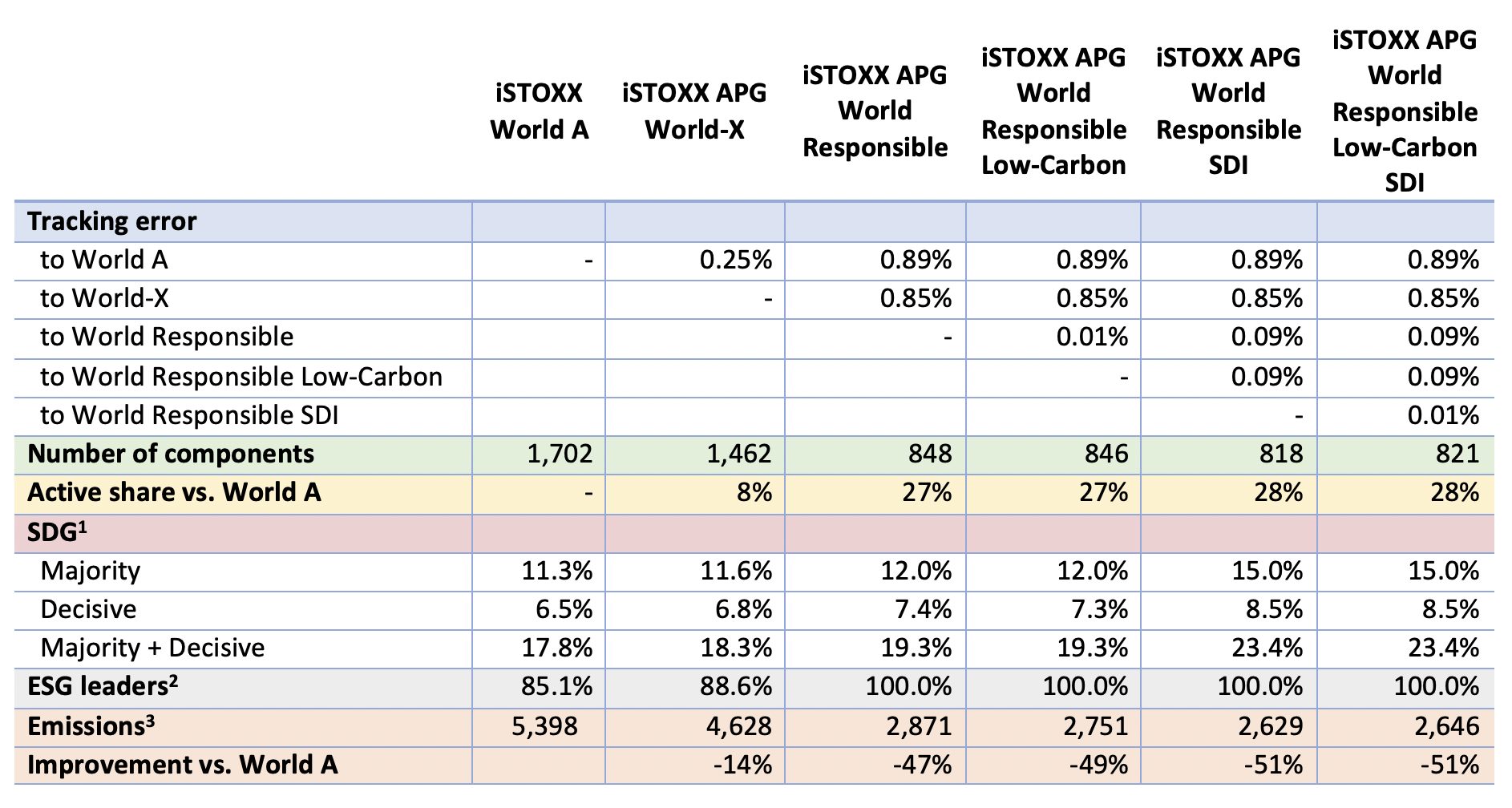

Metrics in the table below (Figure 1) are based on index holdings as of October 3, 2022, and the latest available sustainability data. They confirm the goals of index construction are being met.

The iSTOXX® APG World-X index eliminates those companies from the iSTOXX World A universe that fail APG’s product-involvement screens, and although 240 names are excluded, active risk and active share are minimal. However, we already see a slight improvement in the allocation to names meeting the SDI criteria and more ESG leaders, and most notably, a 14% improvement in emissions.

The iSTOXX® APG World Responsible index only holds stocks from the APG World-X index deemed to be ESG leaders, and shows substantially lower emissions (an almost 40% further reduction), while also achieving better SDG representation vs. World-X as well as World A. The World Responsible index and those others with more significant screens have less than 1% active risk versus the parent benchmark, and a relatively low active share of 27-28%.

The iSTOXX® APG World Responsible SDI index adds an SDI-minimum target, and also sees additional improvement in emissions (even though that is not an explicit objective), and, as stated, with low active risk and active share. The iSTOXX® APG World Responsible Low-Carbon index has almost identical active risk criteria to the World Responsible SDI, and almost 50% lower emissions than the World A index. The final index, iSTOXX® APG World Responsible Low-Carbon SDI, which seeks to target an SDI floor and a substantial carbon emissions reduction, does both and does not require any more active risk.

Finally, as we observed in the 2021 whitepaper, “adding another layer, a goal to reduce carbon emissions relative to the World A Index, does not significantly increase risk, nor does seeking an SDG exposure that is higher than that of the parent index. And when the objective of the final portfolio is to minimize tracking error to the World A Index, reduce emissions, increase exposure to Sustainable Development Goals all the while selecting from a universe of ESG Leaders, predicted tracking error remains low.” “We view this as a win-win for the investor, who should realize returns similar to the market while investing more responsibly.”

Figure 1: Overview index comparison

* Melissa Brown, CFA, is Global Head of Applied Research at STOXX.

1 Percent of revenue attributable to one or more of the SDGs. Majority indicates that at least 50% of revenues meets at least one of the goals, decisive indicates 10%-50%.

2 Based on APG’s proprietary assessment.

3 Tons of CO2 equivalents in millions.