Qontigo has licensed the STOXX® Global Digital Entertainment and Education Index to BlackRock as underlying for an iShares UCITS ETF (Euronext Amsterdam ticker: PLAY), the latest addition to a growing range of innovative thematic solutions. The ETF was launched on June 30.

The iShares Digital Entertainment & Education ETF aims to track the beneficiaries of two accelerating structural trends of our modern society, as the public changes the way it consumes media and accesses learning. Spending on digital entertainment and education has strongly outpaced more traditional businesses in those sectors and is expected to continue doing so.

The STOXX Global Digital Entertainment and Education Index is part of Qontigo’s Thematic Indices suite. It selects companies from the STOXX® Global Total Market Index that generate more than half of their revenues from 34 sectors associated with the targeted theme, including Educational Software, General Gaming Products and Services, Content Platforms and Electronic Devices. The revenue categorization is based on FactSet’s Revere (RBICS) granular business classification.

The index applies liquidity and market-capitalization filters in the selection of stocks, which are finally weighted by adjusted equal weight1. The methodology also implements standard exclusionary ESG screens provided by Sustainalytics.

“Index-based thematic investing offers a rules-based, systematic and transparent way to target megatrends that are having an impact on our world,” said Hamish Seegopaul, Managing Director, Product R&D at Qontigo. “The transition to on-line and technology-focused learning and entertainment was already gathering momentum before COVID-19 and has only accelerated since then. Both activities are bringing about a paradigm shift that is, for investors, best captured through a thematic strategy.”

“Thematic investing is being used by an increasingly diverse investor base who are seeking exposure to the secular, disruptive and long-term trends that are set to define the future of the global economy,” said Evy Hambro, Global Head of Thematic and Sector Investing at BlackRock. “As technology continues to revolutionize the entertainment industry and demand for digital experiences changes the way people play and learn, we have worked with Qontigo to design the iShares Digital Entertainment & Education UCITS ETF, providing investors with granular exposure to one area of the global economy that is evolving rapidly. This addition to our Thematics range leverages the strength of our global investment platform to capture drivers of structural change and to position investors’ portfolios for long-term growth.”

WHITEPAPER

The future of school and play: STOXX Global Digital Entertainment and Education Index

The STOXX Global Digital Entertainment and Education Index captures the global digital transformation of entertainment and education – a long-term structural change. The individual characteristics of the stocks in this index are what set it apart: the Specific Return factor made the largest positive contribution to the seven-year return of all the indices in the study.

Download >

Performance

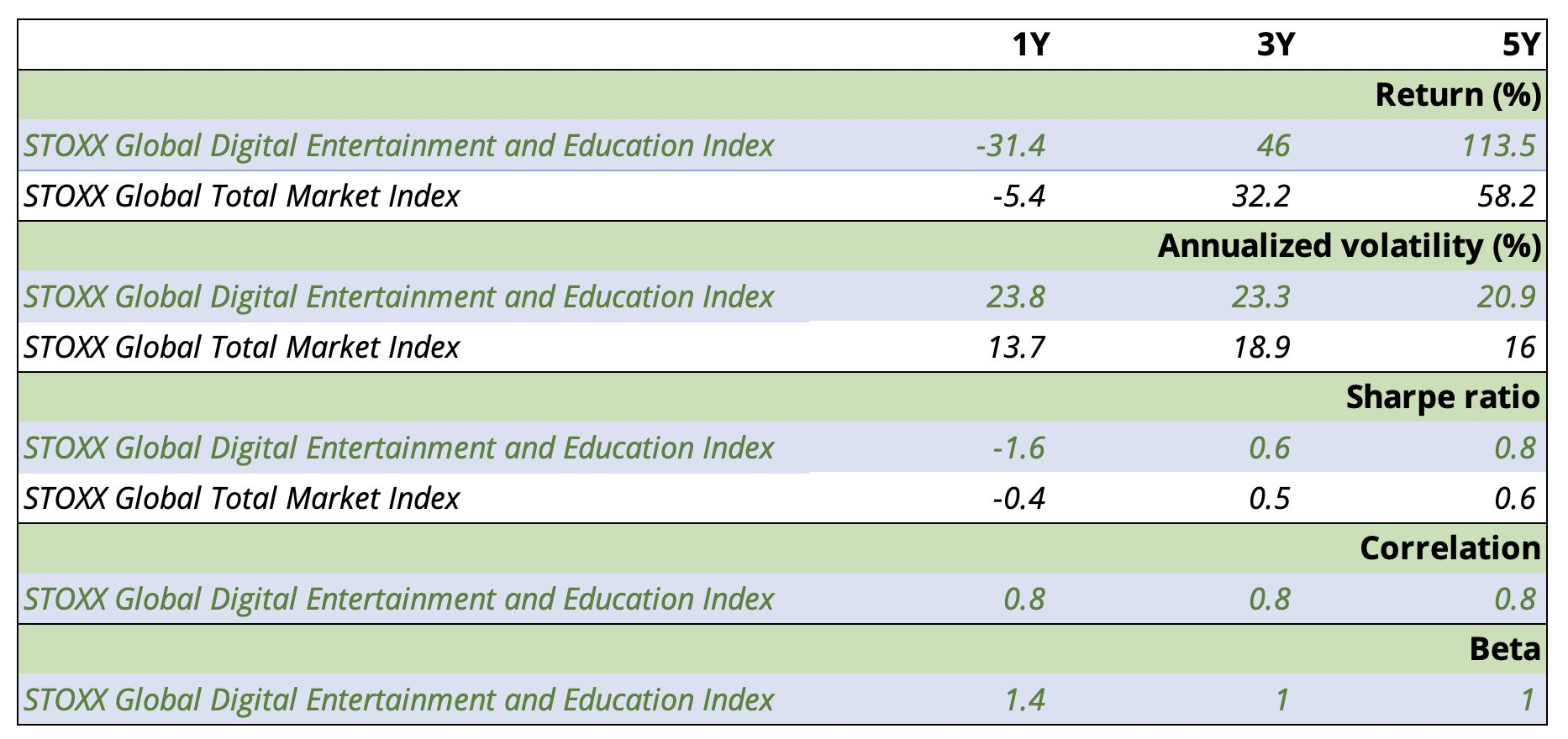

In backtested data through the end of April, the STOXX Global Digital Education and Entertainment Index had higher risk-adjusted returns than its parent index (Figure 1) over three and five years. The outperformance persisted despite a difficult 2022 for technology and consumer-related stocks.

Figure 1: Risk and returns of STOXX Digital Education and Entertainment Index

Smart, accessible education

Digital education is underpinning a revolution in learning as a smarter, more personalized alternative to traditional and print-based practices, presenting cost, access and reach benefits. Revenues in the global digital education market are expected to grow 14% annually between 2021 and 2027, to USD 585 billion.2

Entertainment

In media, the transformation from print or analog to digital — which includes video and music content, live streaming, text, social media and gaming — has been even more radical. The global entertainment market accessed via digital sources expanded to USD 71.9 billion in 2021 from USD 28.7 billion in 2017, and growth is expected to continue at a strong pace.3

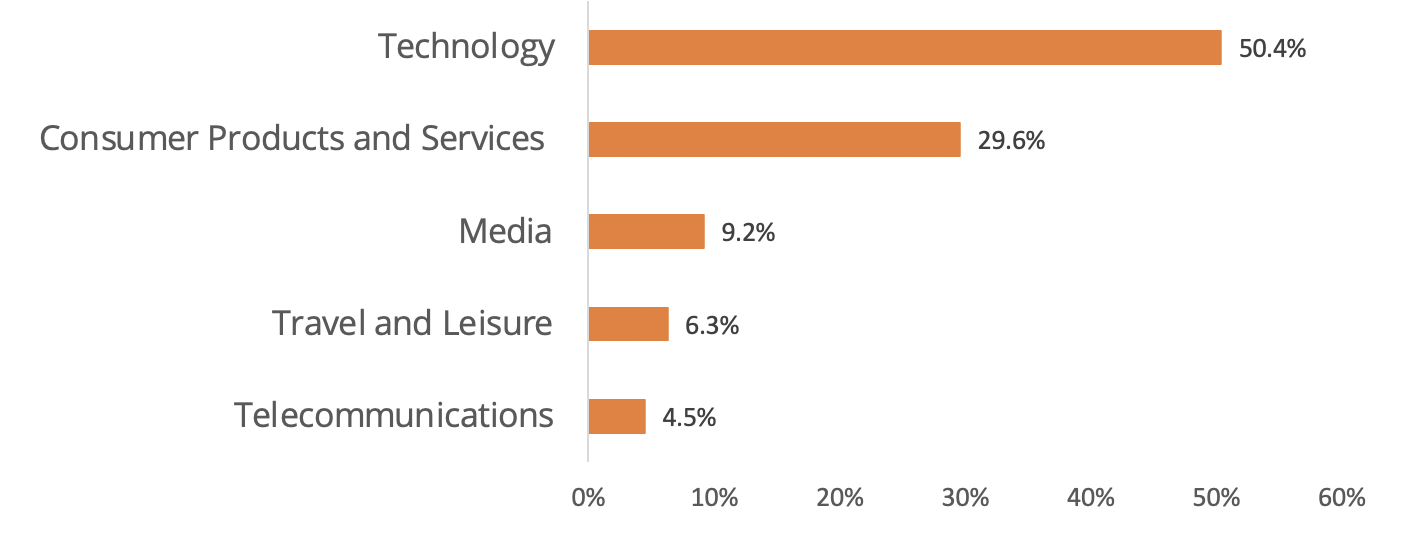

Figure 2: Supersector allocation of the Global Digital Entertainment and Education Index

The meta future

Digital entertainment and education are two of the pillars upon which a new reality of human interactions and activities is being built — one that helps consumers solve modern lifestyle needs and satisfy changing habits. Next-generation electronic devices and fast digital penetration, coupled with full adoption of social media, on-line shopping and web-based communications, have laid the groundwork for what has been termed the metaverse. Nowadays, many businesses across the board offer both virtual and real presences, gearing up for what is expected to be a major shift in social life, connectivity and consumer behavior.4

Qontigo’s STOXX Thematics indices have been designed to target the beneficiaries of such powerful, long-term and structural trends transforming our modern economies and societies. For a factor performance analysis of tech-oriented thematic indices, visit a recent Qontigo whitepaper.

Qontigo and BlackRock’s thematic collaboration started in 2016 and now includes eight ETFs covering themes such as Automation & Robotics, Healthcare Innovation, Digitalization and Ageing Population. The funds track STOXX indices and have USD 8.9 billion in assets.5

1 The index employs an ‘adjusted’ equal weighting scheme: constituents are equally weighted but capped at five times their free-float market cap weight. This helps to balance between diversification and liquidity.

2 Source: BlackRock, from ResearchAndMarkets, March 1, 2022.

3 Source: BlackRock, from Theme Report 2021, Motion Picture Association, accessed on April 27, 2022.

4 For more on the metaverse, see Deloitte, ‘2022 Digital media trends, 16th edition: Toward the metaverse,’ March 28, 2022.

5 Data as of May 13, 2022.