Sustainability criteria have gained an even greater presence in investment portfolios in the past 12 months and may guide more than half of all professional portfolios in five years’ time, according to an Index Industry Association (IIA) survey.

About 85% of respondents in the IIA’s second annual ESG survey indicated ESG has become more of a priority for their firms in the past year, even as equity prices fell and energy markets were roiled by Russia’s invasion of Ukraine.

The forecast investment curve for ESG has also steepened in the past 12 months, the survey showed. On average, respondents now expect ESG assets to grow to 40% of their portfolios in 12 months’ time, climb to 48% in two to three years, and jump to 57% in five years. In the 2021 survey, the forecast shares were, respectively, 27%, 35% and 44%.

“The survey confirms that ESG investing has withstood the turbulence and uncertainty of the past 12 months, remains central to investment decision making, and if anything seems set to surge even further in the years ahead,” the IIA wrote in a report released on July 28. Overall, 300 European and US investors were interviewed for the poll in May 2022.

Over 60% of participants said that individual E, S and G criteria are now a core part or are included in most of their portfolios.

ESG integration seems to be spreading across asset classes too. The percentage of those consulted who indicated they expect to increase ESG elements in their investments in the next year topped 80% in the three asset classes of equities, fixed income and commodities.

What drives the surge in ESG investments?

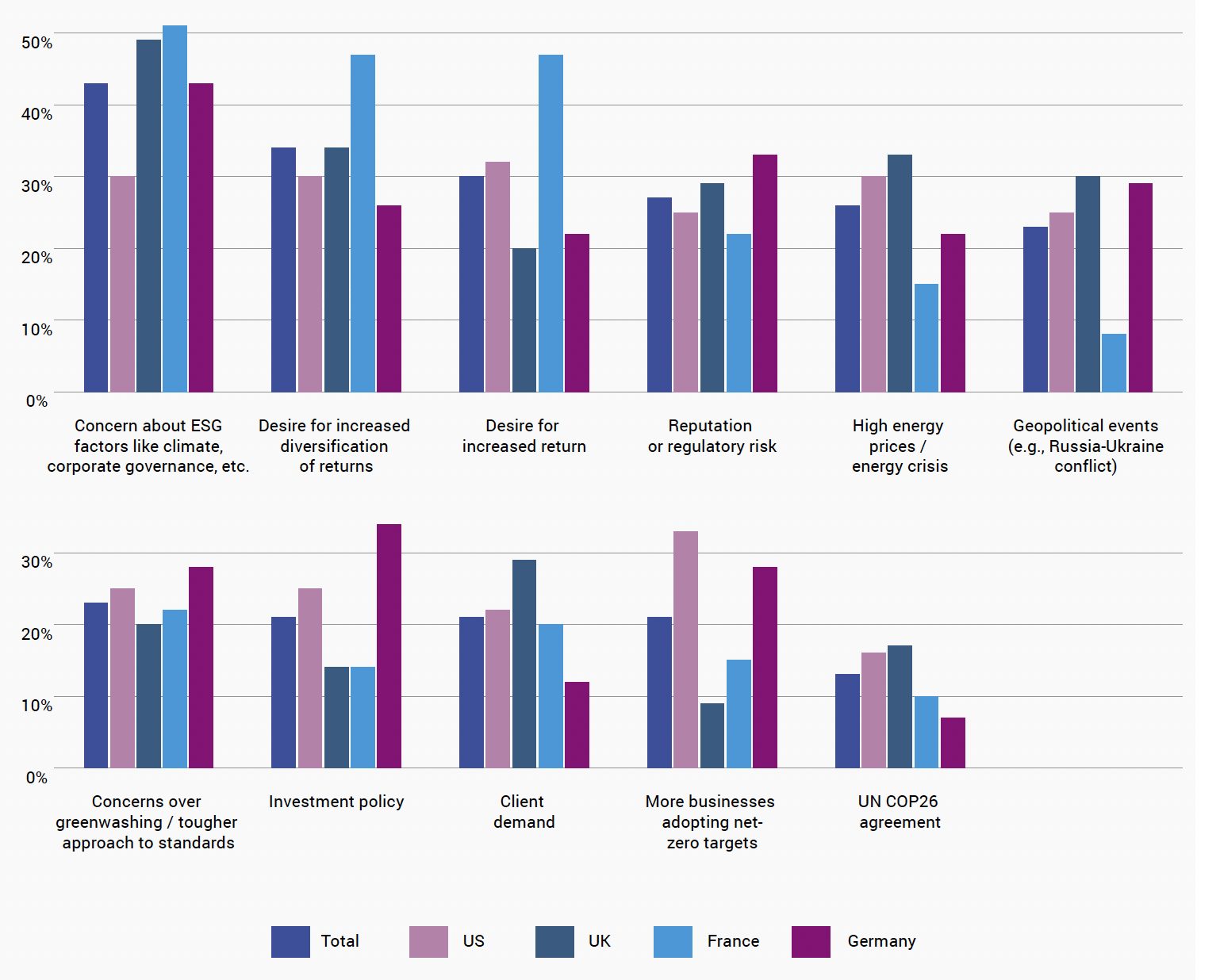

According to the survey, the main reason for ESG adoption has been concerns about climate, corporate governance and related factors. Interestingly, more respondents said geopolitical events were a bigger trigger than client demand in raising the importance of ESG considerations.

Exhibit 1 – Reasons why ESG has become more of a priority for respondents’ investment firms over the past 12 months.

Indices as ESG facilitators

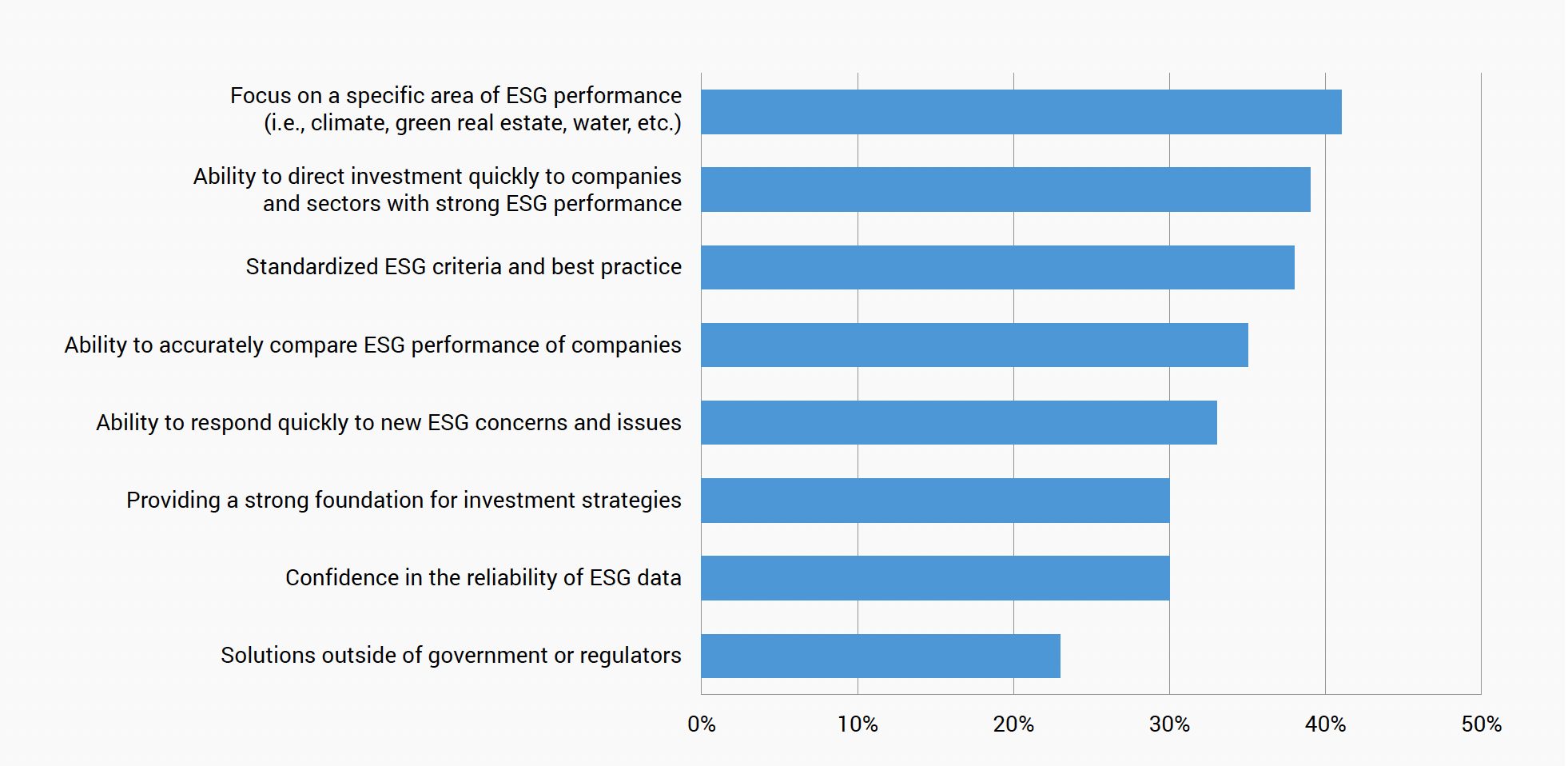

The survey confirmed the value of indices in implementing ESG practices, with a fairly high share of investors saying they use indices to assess specific areas of ESG performance, facilitate asset allocation into ESG segments, and help standardize sustainability criteria (Exhibit 2).

Almost all (99%) respondents use indices in some form for ESG approaches, the survey showed. About 41% employ them for measurement or benchmarking purposes, while 31% use them for investment strategies. Just over one-quarter of respondents (27%) use indices for both, the IIA said.

Exhibit 2 – Which of the following do you value about the services that ESG indices offer?

Factoring sustainability principles into investment decisions has become the norm for many of the world’s largest asset managers amid increasing demand and requirements from clients and regulators. The value of sustainable fund assets worldwide rose to USD 2.8 trillion in the first quarter of 2022 from USD 1.9 trillion a year earlier, according to Morningstar data.1

Challenges to ESG access

As in the first survey, most respondents pointed to hurdles in integrating ESG factors. Among the most cited issues were the lack of public corporate disclosure around ESG and the need for more standardized and comparable ESG data.

The IIA survey puts the spotlight on the robust and continued growth of ESG, and the work of index providers in the process. Qontigo is a member of the IIA and has collaborated with partners to design a wide range of STOXX sustainable index solutions to help them achieve their varied ESG strategies. In selecting the best available ESG data, implementing rules-based methodologies across regions and industries, and reflecting the evolving preferences of the largest asset managers, index providers play an important role in the ESG rollout.

In this sense, we welcome the findings of the survey and share the prediction that sustainability will continue to grow in importance as a pillar of portfolio management.

1 Morningstar, ‘Global Sustainable Fund Flows: Q1 2022 in Review,’ May 3, 2022.