Invesco, a global leader in equal-weighted (EW) strategies, has launched its first ETF tracking the EURO STOXX 50® Equal Weight index, an alternative weighting version of the leading Eurozone benchmark.

The index assigns an equal weight to each stock in the EURO STOXX 50® at its quarterly rebalances, rather than weighting constituents by market capitalization. The new ETF is the only one currently tracking the EW index and was listed in Germany, Italy and Switzerland last week, and in the UK yesterday. It employs a physical replication approach.

Invesco currently oversees USD 87 billion in EW strategies out of a total USD 2.1 trillion in assets under management.1 The launch expands the collaboration between the Atlanta, Georgia-based firm and STOXX, which began in 2009 with the introduction of a EURO STOXX 50 ETF. That Europe-domiciled UCITS ETF currently has EUR 1.2 billion in assets.2

“The EURO STOXX 50 is the flagship Eurozone equity index, and we are committed to providing innovative solutions linked to it that support investor portfolio diversification,” said Axel Lomholt, General Manager at STOXX. “We are delighted to collaborate on Invesco’s launch, building on a long history of collaboration with Invesco that began in 2009 with the launch of its first EURO STOXX 50 ETF.”

EW strategies have a large following, built on two primary arguments. First, they avoid over-concentration in a few mega-cap stocks — a problem particularly evident in US markets today. Second, they systematically “buy low and sell high” by increasing the weight of underperforming stocks at each review and reducing the weight of those that have outperformed. Critics say that the strategies fail to capture the momentum of market leaders.

“This latest launch further expands Invesco’s global market leadership in equal-weight ETFs,” said Matt Tagliani, Head of EMEA ETF Product at Invesco, “with the offering increasing diversification through an automated process of rebalancing at regular intervals, a relatively simple, common-sense investment strategy that investors have been increasingly turning to over the past year to gain a more balanced approach to broad equity exposure.”

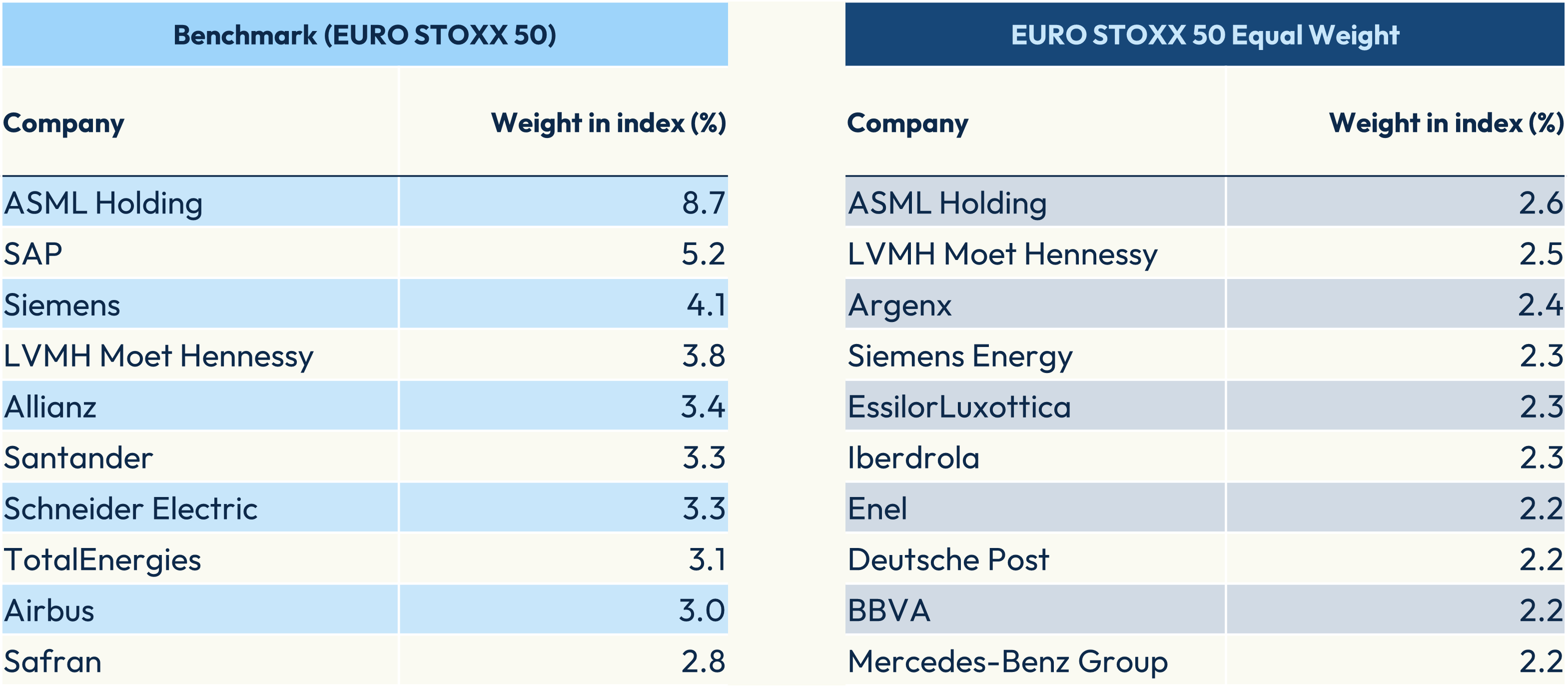

Figure 1: Top ten holdings

Source: STOXX. Data as of November 19, 2025.

Fundamental differentials

Chris Mellor, Head of EMEA ETF Equity Product Management at Invesco, has said the EW ETF is a timely offering given increased concentration and higher valuation in the EURO STOXX 50 benchmark.

The ten largest stocks in the EURO STOXX 50 account for 41.2% of the benchmark, almost twice the 23% weight for the top ten holdings in the EURO STOXX 50 Equal Weight. The benchmark is trading at 2.4 times its book value — roughly a third more expensive than the equal-weight index, STOXX data show.3

Concerns about market valuations have pushed some investors toward equal-weight strategies this year. According to Invesco, USD 1.9 billion in net assets has flowed into its Europe-domiciled range of European, US and global equal-weight exposures since January.

1 All assets’ data sourced from Invesco, data as of September 30, 2025.

2 Source: STOXX.

3 Data as of October 31, 2025. Price-to-book ratio is trailing.