STOXX is introducing its first global family of factor-based indices, built using Axioma’s advanced portfolio-construction tools and risk models, and designed to offer strong and tradable factor exposure.

The STOXX Factor Indices stand out for their methodology that targets proven sources of excess returns and, as well, manages exposure, liquidity and risk characteristics to provide an efficient approach to factor investing. They are the first new indices to rely on both Axioma and STOXX data and technology since the two firms combined to form Qontigo last September.

“The launch of the STOXX Factor Index Suite truly brings together the analytic and indexing expertise of Qontigo in a clear demonstration of the value of this powerful combination,” said Holger Wohlenberg, Chief Business Officer of Qontigo. “With commercially accepted factor definitions contributed by Axioma, clear index construction rules, and advanced portfolio construction techniques, our factor index suite sets a new, high quality industry benchmark in this growing market segment.”

Factor-based investing, often referred to as ‘smart beta,’ has become one of the most popular indexing segments in recent years. These products aim to capture sources of risk premia in a systematic process, relying on equity characteristics to determine index compositions in a transparent and economical way.

Comprehensive index family unveiled

The STOXX Factor Indices are derived from market-capitalization benchmarks covering five different regions: the STOXX® Global 1800 Index, STOXX® Global 1800 ex USA Index, STOXX® USA 900 Index, STOXX® Europe 600 Index and STOXX® Asia/Pacific 600 Index.

The suite consists of five single-factor indices for each region —Value, Momentum, Size, Low Risk, and Quality — and a Multifactor index that targets exposure to all five of them. The factors are defined using the risk model factors from Axioma’s equity risk models.

These factor definitions follow the standards found in academic literature and industry.

The five factors were chosen for their clear economic rationale. They are approached in a way that seeks to avoid so-called data mining, ensures that the indices are transparent and robust, and is supported by the use of high-quality data analytics to verify historical exposures.

Control of exposures, liquidity

The indices maximize the exposure to the target factor while constraining the exposure to non-targeted factors, as well as controlling for attributes such as country and industry exposures. The goal is to avoid unintended biases that ‘pollute’ the factors’ performance and to ensure diversification. Finally, in order to guarantee tradability, the methodology is designed to manage turnover, control constituency numbers and weights, and limit investments in illiquid positions.

“The STOXX factor indices are built to be investable,” said Hamish Seegopaul, Managing Director, Quantitative and Multi-Asset Solutions, at Qontigo. “On paper, factor exposures and factor performance can be stronger among small, illiquid stocks. A key objective of the STOXX indices is to ensure strong intended factor exposures, while constraining exposure to less liquid securities.”

Performance analyzed

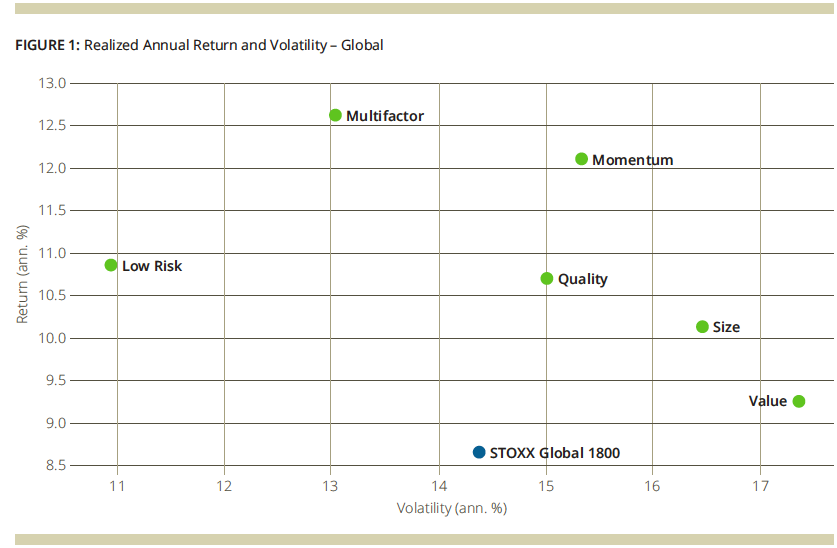

A research study1 published this month introduces the key principles behind the indices’ construction and analyzes their performance. Figure 1 from the report shows that factors have delivered above-market returns in recent years. The pattern is repeated across regions, with the only exception being Value in Europe.

Multifactor integration

The Multifactor Index may warrant closer attention. As shown in Figure 1, the strategy has provided the best returns among the global set of indices, as well as the lowest volatility with the exception of the Low Risk Index. This mirrors academic and empirical findings that explain the outperformance of multifactor portfolios as the aggregation of single factors that have positive performance but different cyclicality and often uncorrelated return profiles.

The STOXX Multifactor Indices do not invest in multiple single-factor portfolios according to desired weights, but rather seek to integrate the different factors in an efficient way to capture factor diversification. For every security, an aggregate multifactor score is computed as the average of the individual factor scores. Then, the Multifactor index maximizes exposure to the multifactor score, under a set of constraints, by building up the index in a manner similar to the single-factor indices.

Factor clarity

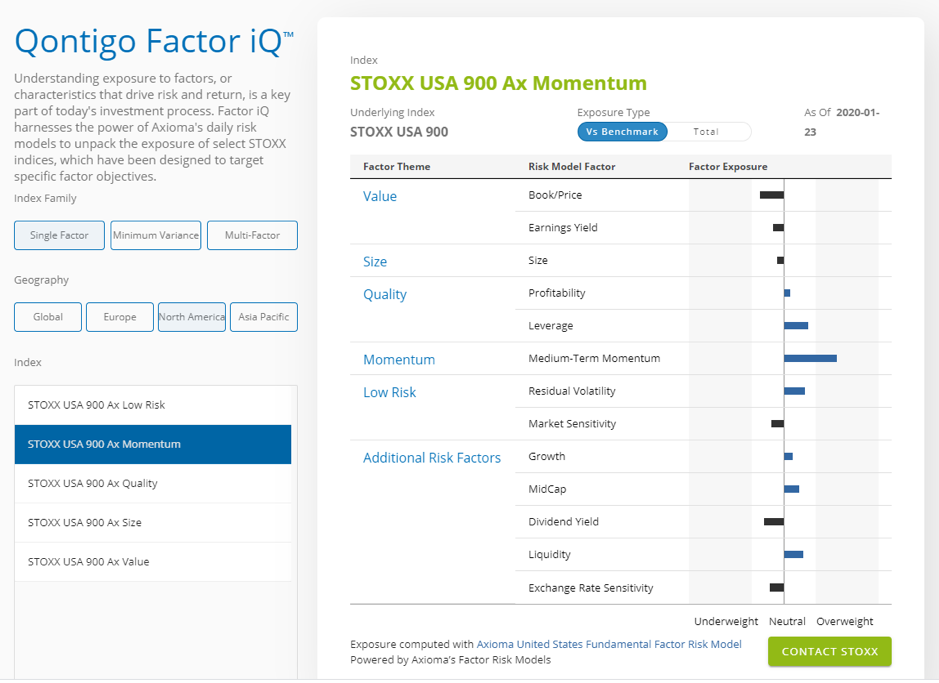

To help investors visualize factor exposures and target benchmark tracking, Qontigo has launched Factor iQTM – an online tool designed to illustrate current factor portfolio exposures according to Axioma’s risk models. Factor iQ can be found here: www.stoxx.com/factoriq.

Analytic and indexing expertise

By employing well-established factor definitions, and transparent and efficient index construction rules, the STOXX Factor Indices are designed to become the benchmark in factor investing. Please visit us in coming weeks as we will be reporting on other characteristics of factor investing and, in particular, of the STOXX Factor Indices.

1 Qontigo applied research, ‘STOXX Factor Indices: Targeted Factor Exposures with Managed Liquidity and Risk Profiles,’ January 2020.