Sustainability will make further inroads into investment portfolios, according to a new global survey of asset managers, who also view indices as key enablers of this trend and of the integration of environmental, social and governance (ESG) data.

Overall, the 300 European and US investors consulted in the Index Industry Association (IIA) poll expect ESG assets to grow to 44% of their portfolios over the next five years, from 27% in twelve months’ time. About 85% of fund-management companies surveyed said ESG is a high priority for them, the IIA reported. For US fund managers, the proportion reached 94%.

Factoring sustainability principles into investment decisions has become the norm for many of the world’s largest asset managers amid increasing demand and requirements from clients and regulators. The value of sustainable fund assets worldwide more than doubled to USD1.9 trillion in the first quarter of 2021 from a year earlier, according to Morningstar data.1

What’s driving the surge in ESG investment?

According to the survey, the main reason for ESG adoption is client demand, cited by 54% of investment companies polled. A desire for increased return was the second-most cited driver (44% of respondents), highlighting the increasing conviction that there is an alignment between financial and societal goals. Diversification of returns, investment policy, and concerns regarding ESG factors (climate, corporate governance, etc.) followed as further motivations for ESG adoption. Last on the list was reputation or regulatory risk.

Challenges to ESG access

With higher ESG uptake, related challenges have gained visibility. According to the IIA survey, a majority of respondents said significant problems exist in integrating ESG factors. Among the most common issues is obtaining access to better, more standardised and comparable ESG data. Other challenges include regulatory uncertainty, weak corporate disclosure, and differences in ESG definitions and measurement.

“There is a dizzying array of different ESG reporting organizations and ESG benchmarks — for example, the U.N. Principles for Responsible Investment (UNPRI), the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), to name but a few,” the IIA said in the survey’s report. “By one estimate there are over one hundred different organizations producing ESG ratings. The result is that companies vary widely in terms of how they choose to report their ESG activities and metrics.”

In other responses to the survey, money managers also highlighted the difficulty in keeping up with changing societal views and expectations around ESG as hindering their sustainable strategies. An additional obstacle is the uneven geographic development of ESG investing, the survey found.

More rules ahead

Increasing regulation may be further complicating matters, according to the survey. Over half of respondents (56%) said they are finding it difficult to comply with constantly evolving ESG rules. Almost two thirds (65%) said regulators do not pay enough attention to the asset-management industry’s views on ESG issues, while a total of 78% forecast the regulatory burden will only get heavier over the next few years.

Unsurprisingly, asset managers favor an industry-driven rather than a regulation-driven approach to ESG. Seventy-three percent of respondents to the survey agreed that the market is often better than regulators at driving ESG forward.

Indices as ESG facilitators

The survey also pointed to the usefulness of indices as facilitators to accessing ESG data and approaches. A total of 55% of respondents who employ quantitative ESG data said they resort to indices to track ESG factors and monitor ESG strategies. While that matched the ratio of respondents who said they rely on own internal ESG research, it surpassed the share who use third-party providers of raw ESG data.

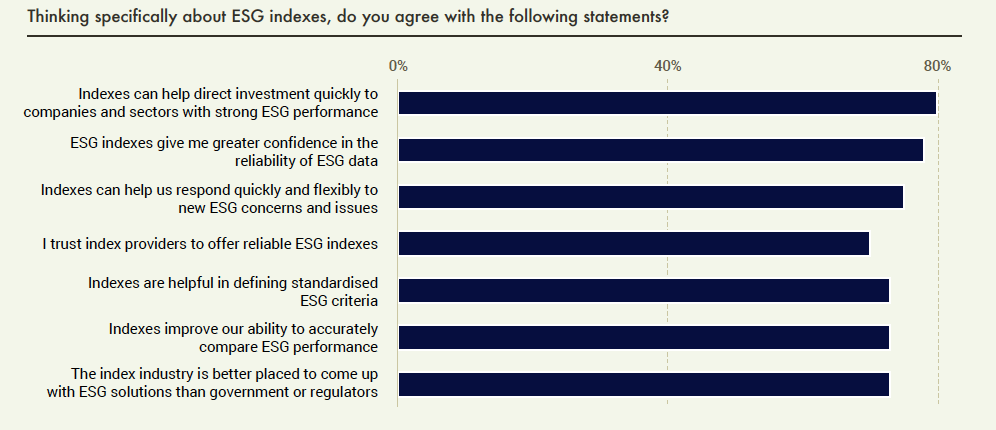

A vast majority of managers believe indices present multiple advantages when tackling ESG strategies, ranging from quickly directing capital to best-in-class ESG companies, to fostering the reliability of data and improving the comparability of ESG performance (Figure 1).

Figure 1 – The role of indices

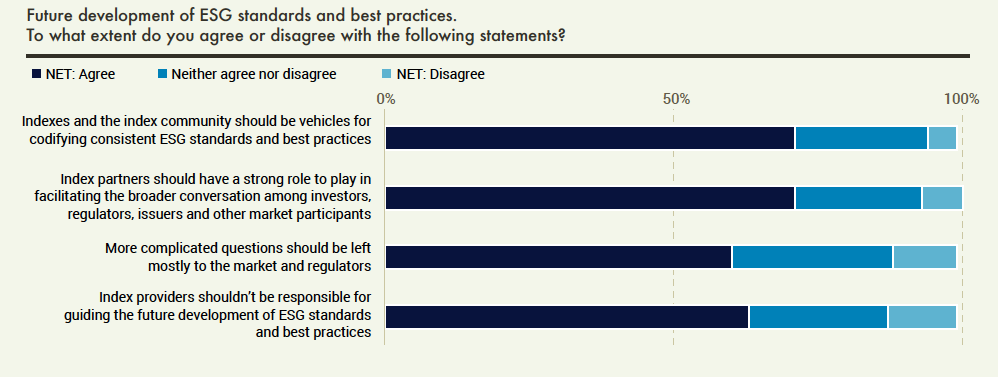

In line with their favored market-led approach, asset managers see indices as key to supporting the codification of ESG standards and best practices, and a vast majority also said that index partners should be active participants in the broader debate around ESG. However, respondents did not see the development of ESG standards themselves as a role of indices and said that more complicated questions should be left to the market and to regulators (Figure 2).

Figure 2 – Indices and best practices in ESG

The IIA survey puts the spotlight on the robust and continued growth of ESG, and on the work of index providers in the process. Qontigo is a member of the IIA and has collaborated with partners to design a wide range of STOXX sustainable index solutions to help them achieve their varied ESG strategies. In selecting the best available ESG data, implementing rules-based methodologies across regions and industries, and reflecting the evolving preferences of the largest asset managers, index providers are playing an important role in the ESG rollout.

In this sense, we welcome the findings of the survey and share the prediction that sustainability will continue to grow in importance as a pillar of portfolio management.

1 As cited in IIA, ‘Measurable Impact: Asset Managers on the Challenges and Opportunities of ESG Investment,’ July 2021.