This article was first published on ETF Stream.

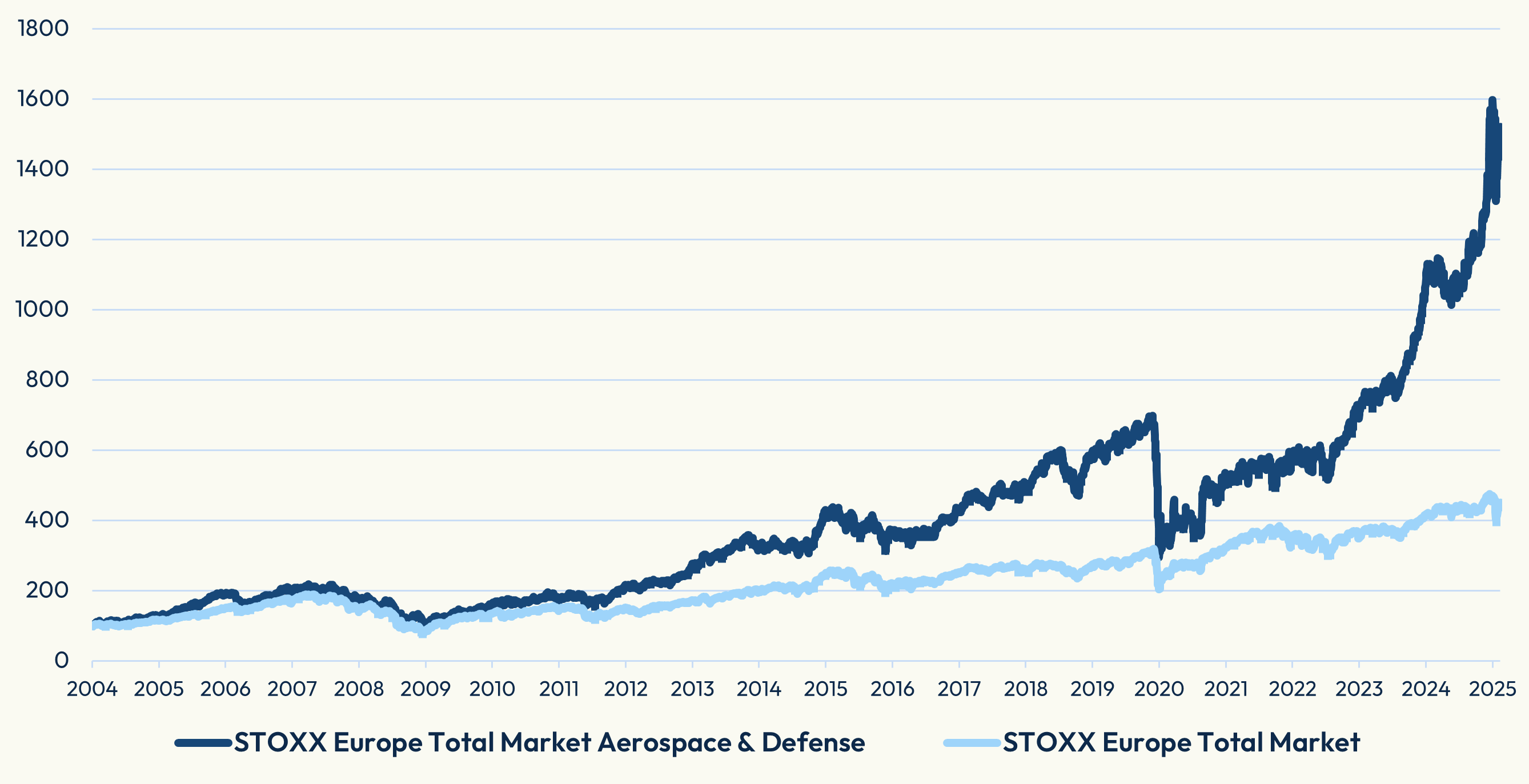

Defense stocks have been standout performers in Europe this year, outpacing all other business sectors, as investors target the economic potential from the historic military buildup across the region.

As several issuers have launched ETFs that offer exposure to this market segment, there are differences in the way that strategy is achieved — and in the resulting portfolios.

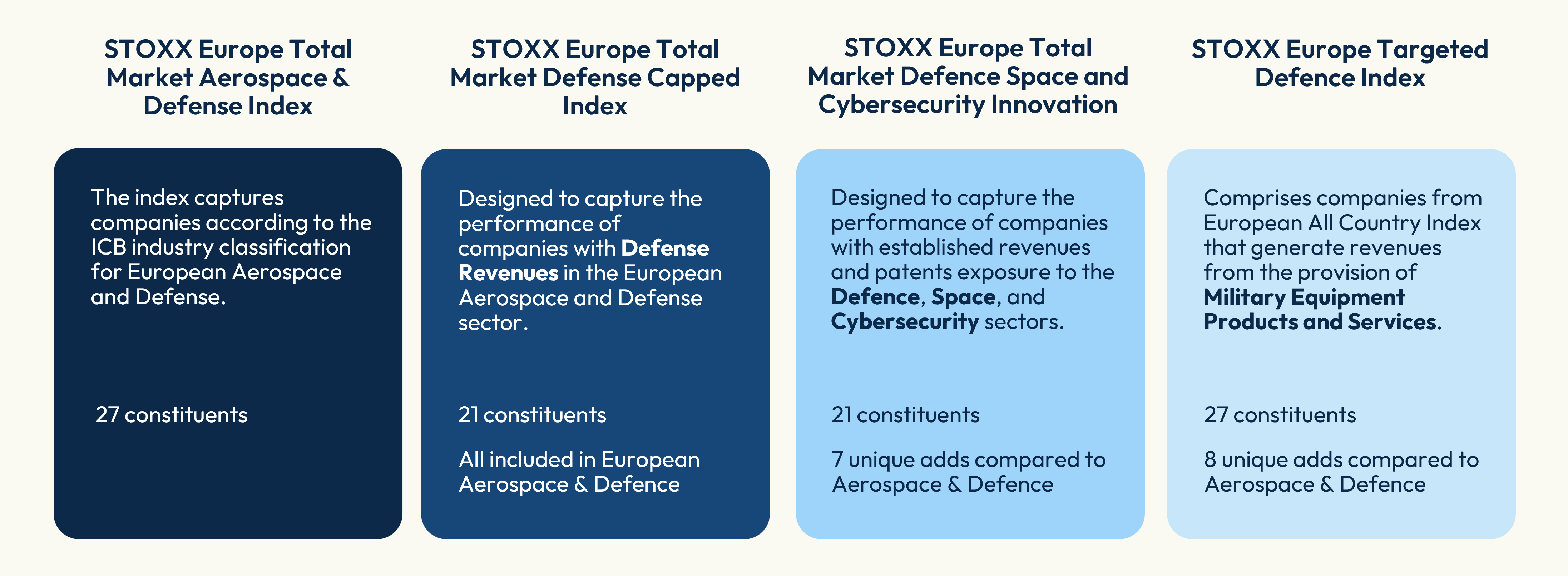

Ladi Williams, Head of Thematics and Alternative Strategies at STOXX, explains how the index provider has catered to the specific needs and objectives of ETF managers in devising a series of indices targeting the defense sector. These include the STOXX® Europe Total Market Defense Capped, STOXX® Europe Total Market Defence Space and Cybersecurity Innovation and STOXX® Europe Targeted Defence indices, as well as customized solutions for clients.

Figure 1: STOXX Defense indices – overview

STOXX has devised as many as five defense thematic indices this year. What’s behind this interest?

“We have seen unprecedented demand from clients for exposure to the defense theme this year. This has been driven, as you might expect, by the current geopolitical situation.

Since Russia’s invasion of Ukraine in 2022, shares of defense suppliers have rallied and the trend has accelerated this year as Donald Trump has said that the US would no longer underwrite Europe’s defense needs. This has led to enhanced commitments from Europe on its military capabilities, including the European Commission’s plan to spend 800 billion euros by 2030 in defense equipment and government efforts to build up disruptive innovation and technologies in the military industry.

These developments have fueled expectations that suppliers of military equipment and services will benefit from the investment trend. End investors are eager to participate in this growth and our clients have responded by stepping in to meet the rising demand.”

Figure 2: European Aerospace & Defense Sector outperformed European market since 2005

One common feature of the new STOXX Defense indices is that they are not a typical sector index but rather they have a thematic approach. Can you explain that?

“What many of our Defense indices have in common is the ICB Aerospace & Defense sector classification as a starting point — a backstop if you want. From there, we have drilled down further to achieve a basket of stocks that is even more closely aligned with the defense theme. One question you might ask is, why not just go for the Defense subsector? And the answer is that would only yield a very limited number of companies.

Instead, we work closely with clients to strike the right balance, expanding beyond the confines of ICB categories to capture a broader set of relevant stocks, while preserving the thematic purity. To achieve this, we leverage taxonomies such as FactSet’s RBICS revenue classification and EconSight’s patent datasets to identify the companies most exposed to the theme. Some clients have chosen to bypass sector classifications entirely, opting instead to build their thematic exposure from the outset using revenue-based approaches. Revenue and patent data also enable the upweighting of companies with stronger alignment to the targeted theme.”

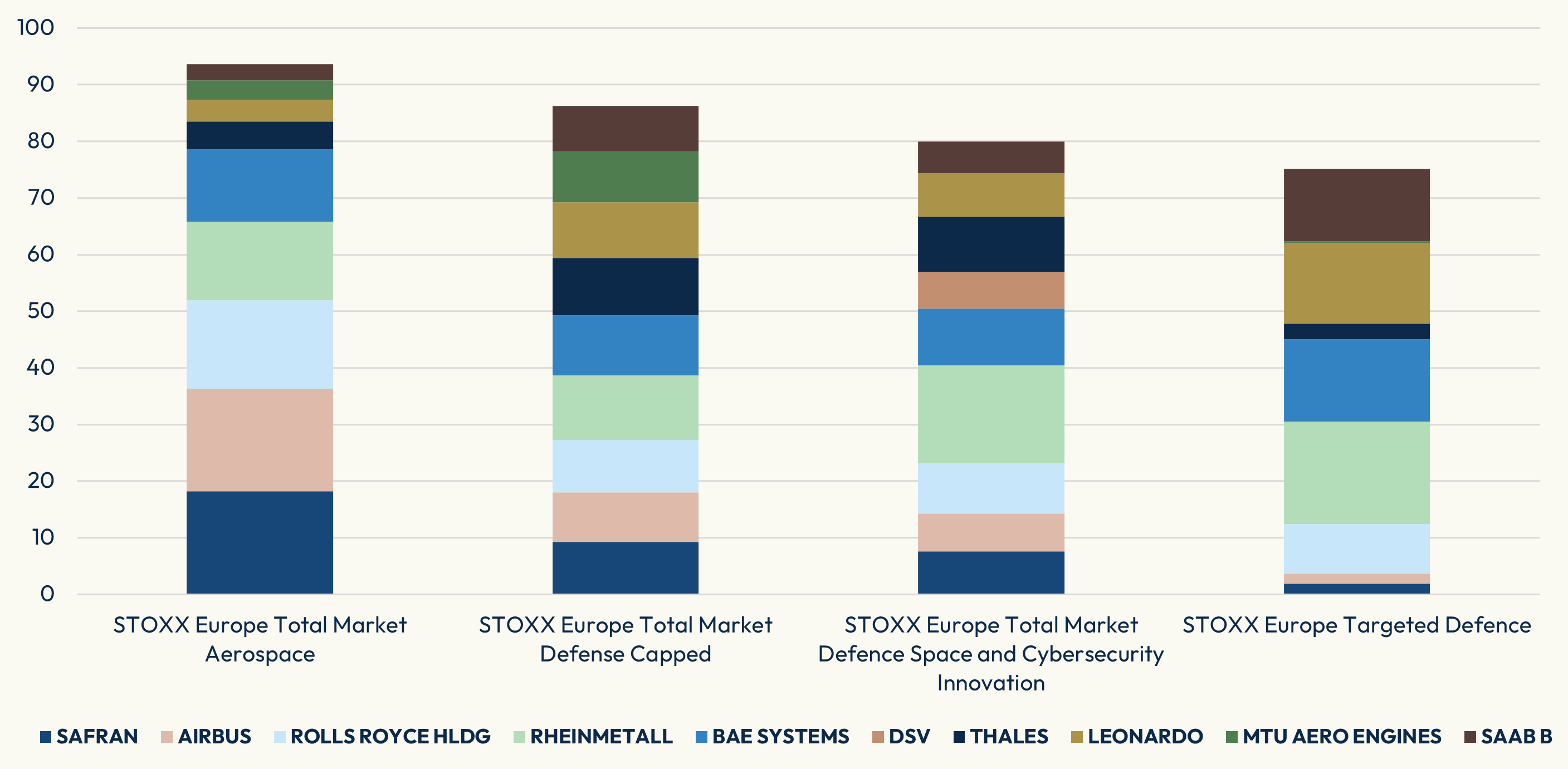

You have designed different index methodologies for different clients. Why is that?

“A key demand of our clients is to differentiate their product offering, being cognizant of the fact that they are dealing with a competitive market. And then there are all the elements involved in the creation of an index, where ETF issuers may have their own preferences, from the very definition of the theme to the choice of datasets, weighting schemes, and right down to the single-stock caps we employ in the methodologies.”

Figure 3: STOXX Defense indices – Top 10 components

“We have been happy to pull all levers and explore all parameters to construct indices that best reflect each client’s philosophy. Building an index presents us with multiple choices and clients will have their view on each one of them.”

Several variables in that methodology optionality stand out. One is the differentiation between revenue-based and patents-based methodologies that you have mentioned. Why would you choose one or the other?

“With a revenue-based approach, we look to capture established providers of military equipment and services that have existing revenues from this sector.

When we look to patents, on the other hand, it is more of a forward-looking approach where we are trying to find companies that might not necessarily yet generate revenues within this sector, but they have demonstrated innovation through the filing of patents. We are acknowledging their potential to be leading commercial players in the sector in coming years. Both approaches, or a combination of them, allow us to capture companies across the spectrum and life cycle of the theme.”

A second variable at play is the decision to have ESG exclusions and which screens to consider. Can you explain that?

“This is a decision where each client typically has a distinct perspective. Managers work to balance their own sustainability considerations regarding the defense sector with the need to have proper exposure and ensure investment viability.

At STOXX, our framework is designed to be highly flexible. We enable clients to articulate their views and provide the tools necessary to help them achieve their objectives.

Whether we apply exclusionary screens — and which ones — is testament to that flexibility. As an index provider, we are agnostic and neutral to these choices. We’ve also integrated clients’ proprietary sustainability data and exclusionary criteria, all while maintaining a rules-based and robust methodology.”

Given so many variables from index ideation to final launch, how does STOXX work together with a client through this process?

“We see index design as a collaborative process. At STOXX we have the indexing know-how and research capabilities to identify the right themes and determine the most effective way to capture them. But just as importantly, we work closely with clients throughout the entire process, to incorporate their ideas and needs, understanding their views, and, at times, even integrating their own data. Each final product is a true joint effort, where index provider and client bring their strengths together to deliver the most suitable outcome.”