This year’s record-setting rally in gold and silver has put specialized mining stocks on course for their strongest year ever, fueled by expectations of a major earnings windfall.

Two STOXX indices tracking miners of gold and silver have gained 126% this year[1], each poised for their strongest annual performance in data going back to 2018. Gold has advanced 57% to above USD 4,100 an ounce (oz) in 2025, while silver has jumped 78% to USD 51.5/oz[2], as investors and central banks stockpile the precious metals amid macroeconomic and geopolitical uncertainty.

Gold has become more attractive amid a weakening US dollar and concerns over a slowdown in global economic growth. Falling US interest rates make holding the commodity less costly. Gold last year surpassed the euro as the world’s second-largest reserve asset among central banks.[3]

Silver has also benefited from its safe-haven appeal, while strong industrial demand and supportive market fundamentals have also played a key role in lifting prices.

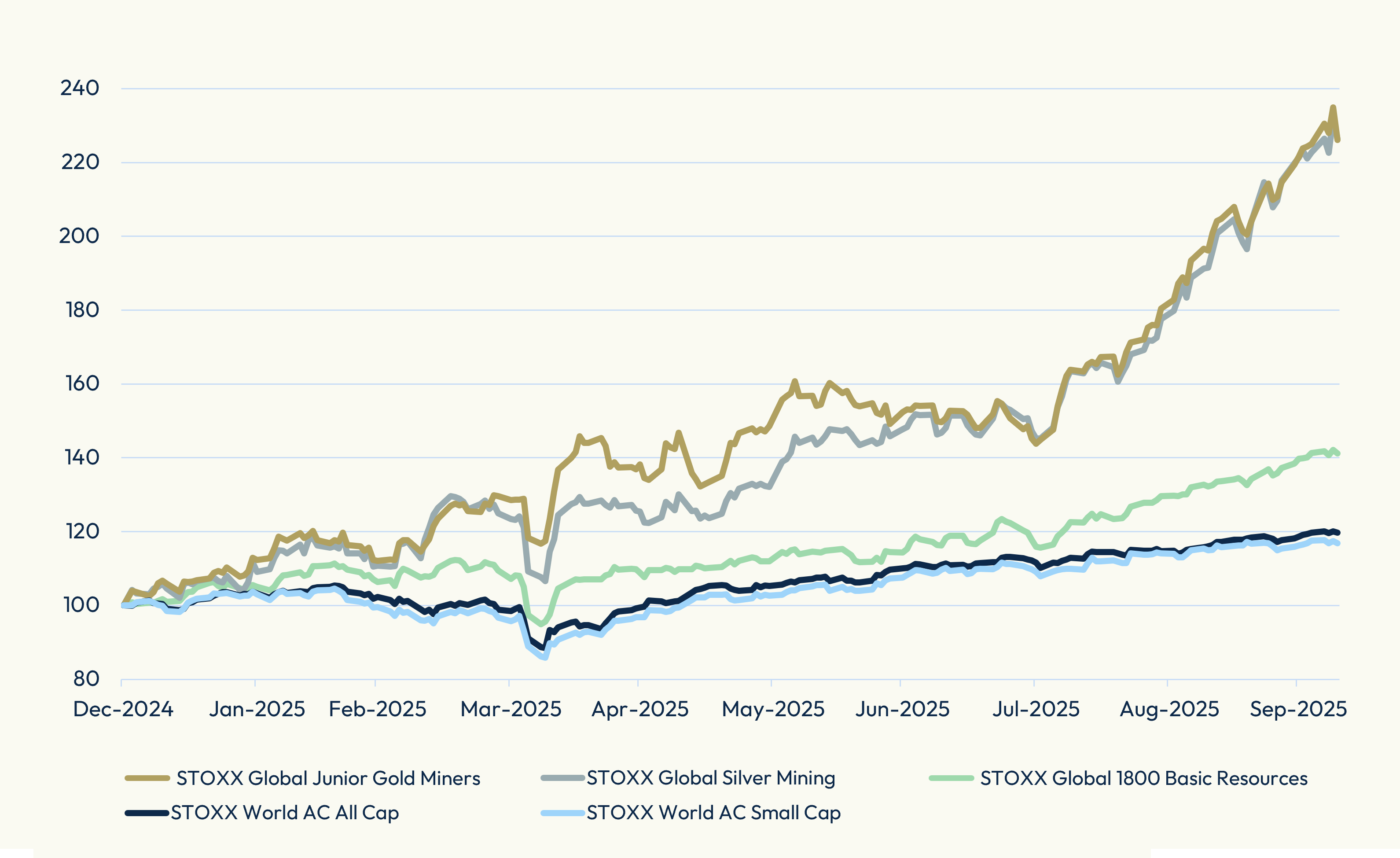

Figure 1 compares the 2025 performance of the STOXX® Global Junior Gold Miners and STOXX® Global Silver Mining indices against the STOXX® World AC All Cap, STOXX® World AC Small Cap and STOXX® Global 1800 Basic Resources benchmarks. The gold and silver mining indices have outpaced the global Basic Resources sector by 85 percentage points this year and the broader World AC benchmarks by at least 100 points.

Figure 1: Performance of gold and silver mining stocks

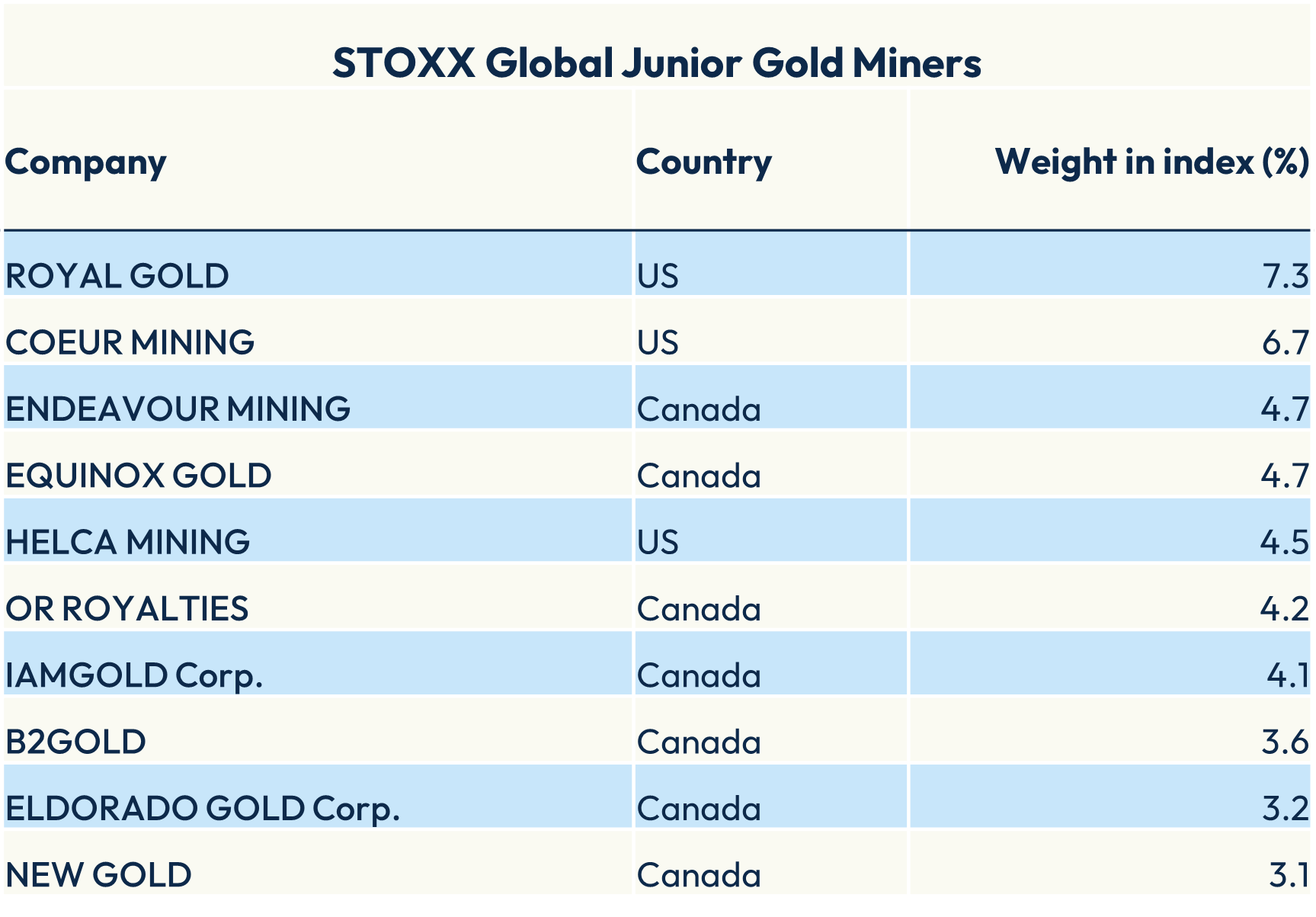

The STOXX Global Junior Gold Miners

The STOXX Global Junior Gold Miners index tracks small-cap stocks with high sales from the gold ore mining industry, resulting in a portfolio of specialized gold businesses. The index is derived from the STOXX World AC Small Cap benchmark and typically includes at least 50 constituents selected for their direct revenue from 17 targeted FactSet RBICS L6 sectors.

As of September 30, the largest stock was Royal Gold, which in 2024 made 76% of its revenue from the yellow metal.[4]

Figure 2: Top ten holdings

STOXX Global Silver Mining index

The STOXX® Global Silver Mining index, meanwhile, is also made up of companies with substantial exposure to mining of the targeted commodity, but has a slightly different methodology.

Two RBICS L6 sectors datasets — Silver Ore Mining, and Silver Streaming and Royalties — allow detailed breakdown of the revenue sources of eligible companies. A two-tier process that considers companies’ revenues and market share in those sectors helps select index constituents.

As of September 30, the index held 38 components. The largest constituent was Fresnillo, which is listed in London and is the world’s leading producer of the white metal.

Figure 3: Top ten holdings

Market dynamics

This year’s advance in gold and silver has smashed many analyst forecasts, and the question remains whether the momentum can continue. Historically, gold has shown little consistent correlation with equities, offering few clues as to whether both assets can keep rising together.[5]

For now, investors are anticipating that gold and silver miners stand to benefit from this year’s surge in the metals.

[1] Gross returns in USD through October 9, 2025.

[2] Source: Bloomberg, data as of October 14.

[3] WSJ, ‘Gold Surpasses Euro as Second-Largest Global Reserve Asset, ECB Says,’ June 11, 2025.

[4] Source: Royal Gold.

[5] See Fisher Investments, ‘Gold $4000 Isn’t Foretelling Much,’ October 10, 2025.