(Updates February 27 article with inflows through March 6).

With the DAX index climbing to an all-time high and posting its best start to a year in a decade, interest in German equities is also backed up by fund flows.

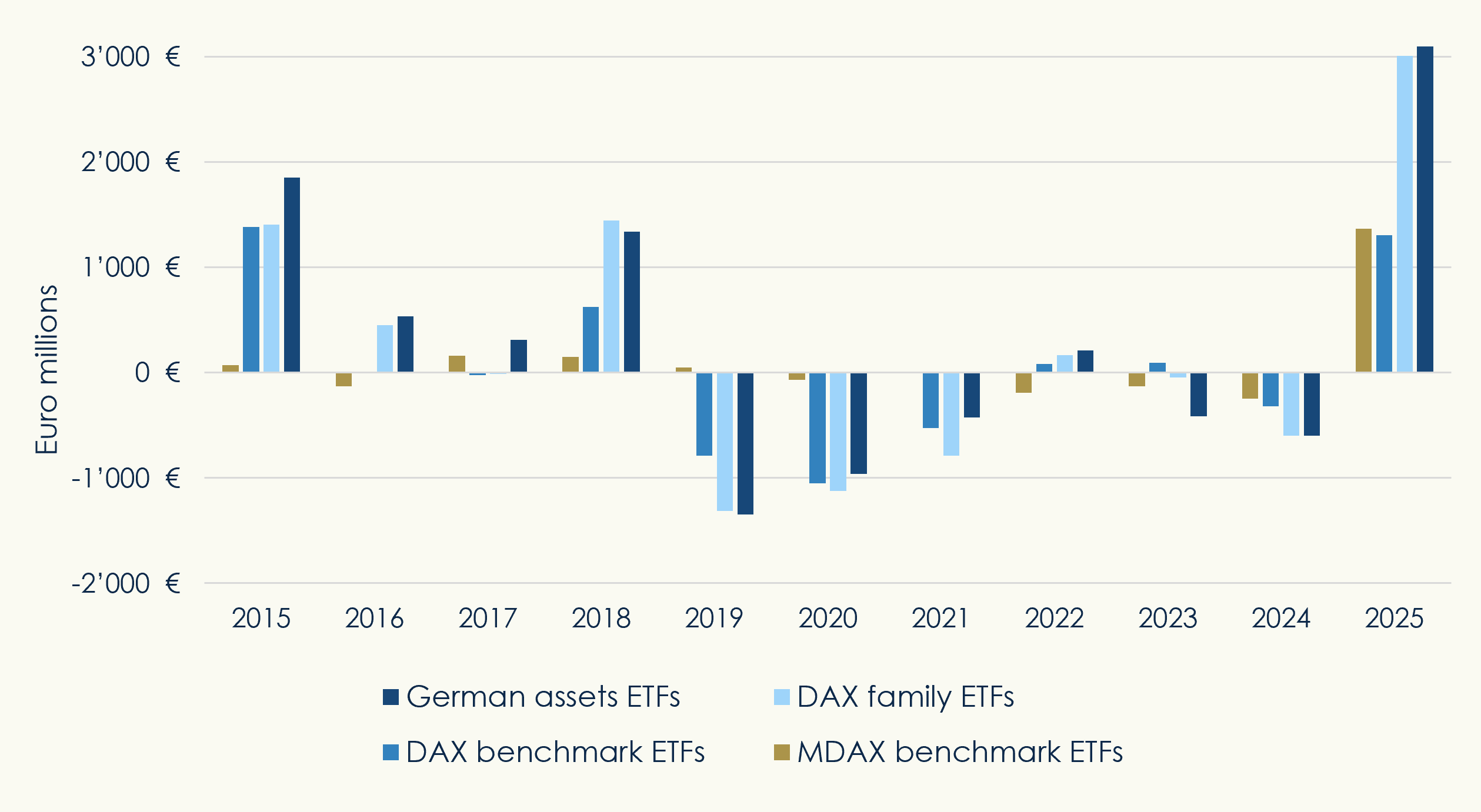

Net purchases of German assets ETFs listed in EMEA[1] have climbed to EUR 3.1 billion this year,[2] the most for any similar period since data starts in 2015, according to ETFBook (Figure 1). Net flows into funds tracking a DAX family index[3] amounted to EUR 3 billion over the period, or 97% of the total. Of those, EUR 1.31 billion flowed into ETFs tracking the benchmark DAX, while a record EUR 1.37 billion was poured into MDAX benchmark funds.

Figure 1: Net flows into German ETFs

German stocks

The DAX index rose 17.6% between January 1 and March 6, including dividend payments, its best performance for any similar period since it jumped 17.8% at the start of 2015.

The strong showing from German equities this year contrasts with a domestic economy mired in stagnation. At the same time, uncertainty about the composition of the next government has failed to deter investors. Germans held a general election on February 23, handing the most votes to the center-right candidate Friedrich Merz of the CDU, who must now negotiate a coalition government with opposition parties.

Flows into German equities gathered pace in March, as the CDU, CSU and SPD parties, which are in talks to form a government, agreed to loosen the country’s fiscal constraints to boost investments and spending on defense, breaking with years of budget discipline.

MDAX funds on a tear

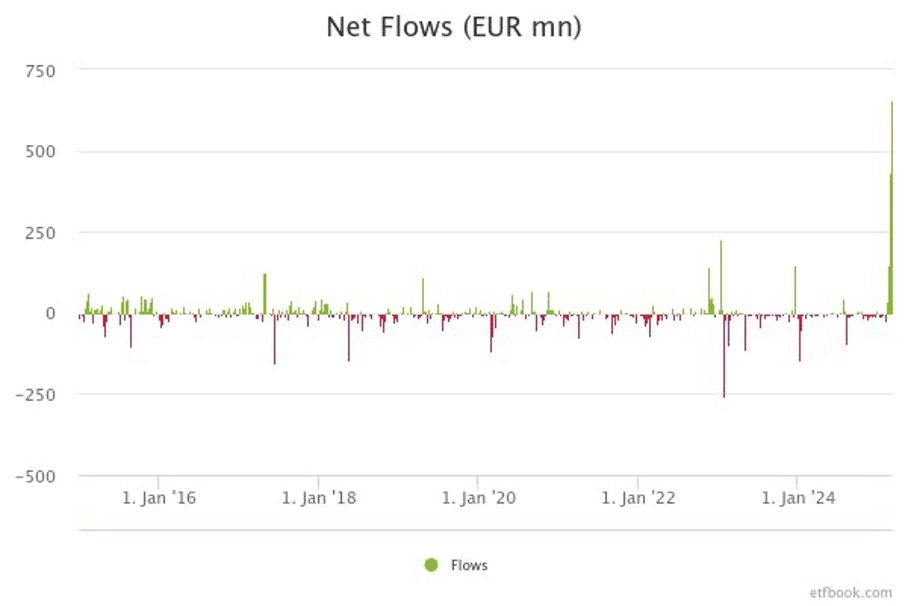

The three funds tracking the MDAX attracted more than EUR 1 billion in total in just the two weeks ended March 3, the best weeks since data begins in 2015 (Figure 2).

Figure 2: Weekly net flows into MDAX ETFs

Europe also on upward trend

To be sure, investors’ bullishness is not limited to Germany and has also lifted the STOXX® Europe 600 to a record high this year. The pan-European benchmark has closed at a new record in 12 sessions since January 23.

[1] The analysis includes 70 funds with a German focus, covering equities and fixed income.

[2] Data through March 6, 2025.

[3] STOXX Ltd., part of the ISS STOXX group of companies, is the administrator of the STOXX and DAX indices under the European Benchmark Regulation.