German stocks are at an all-time high, and the derivatives market suggests traders are largely unconcerned about the country’s general elections this month.

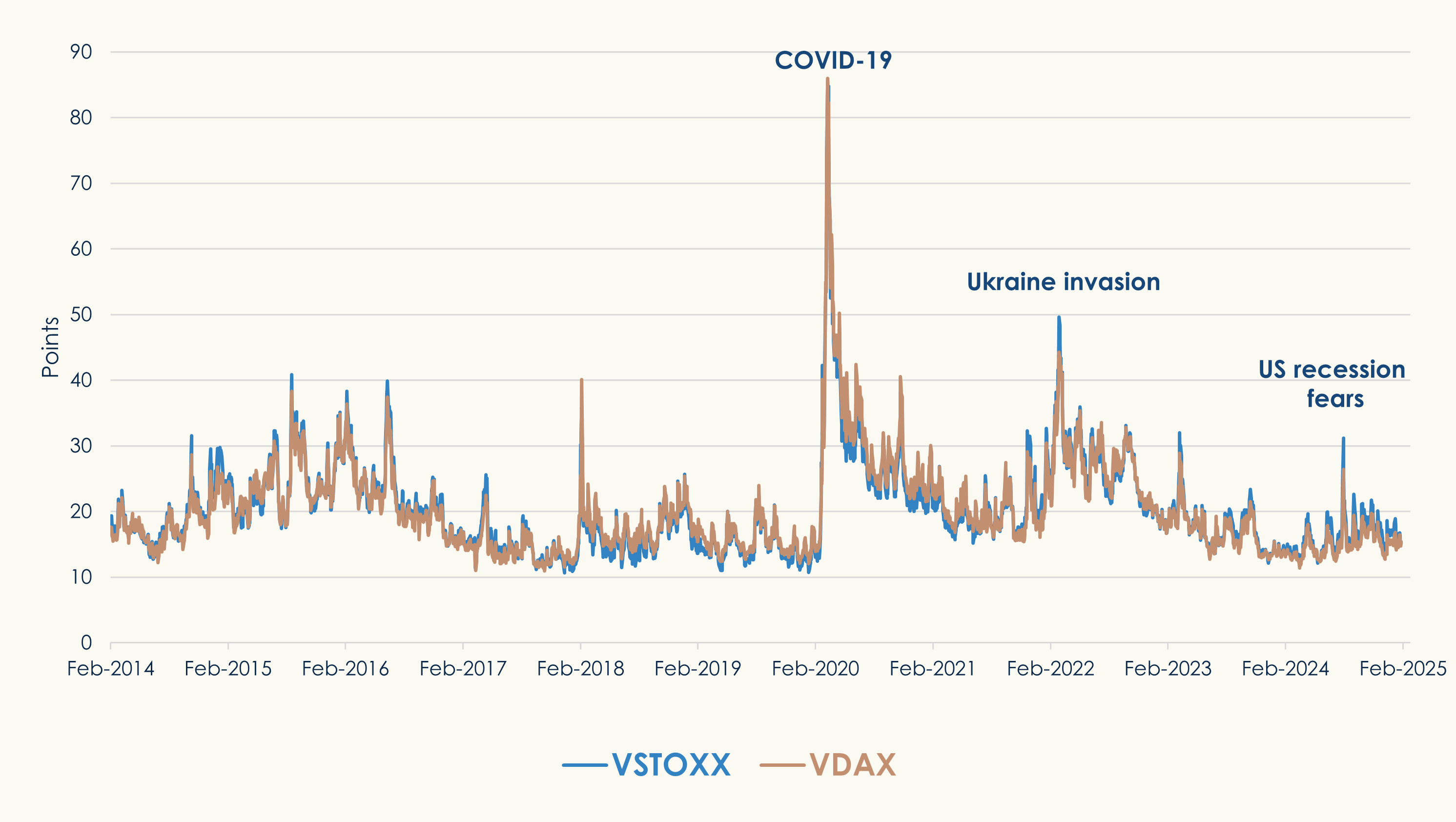

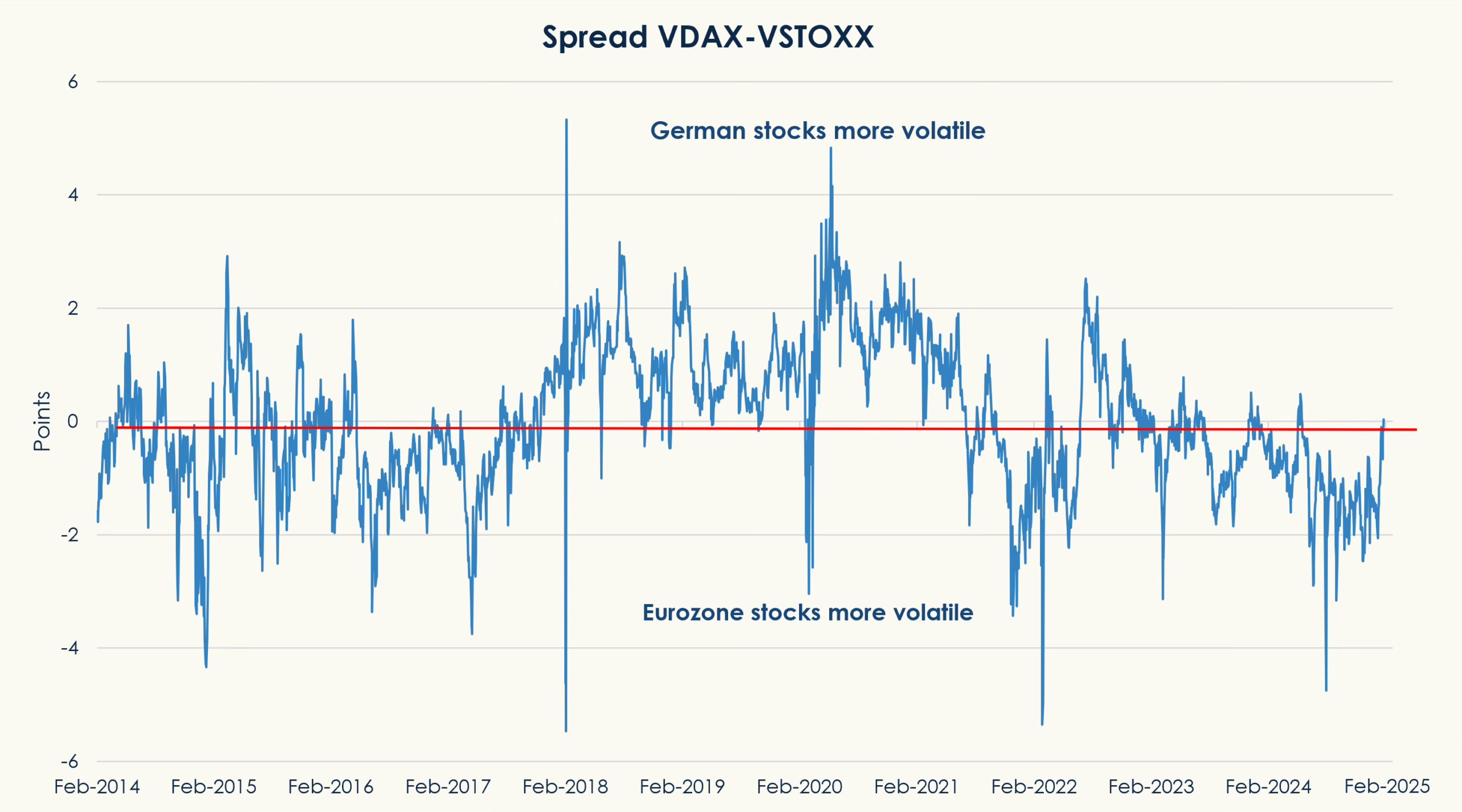

The DAX® blue-chip benchmark has climbed to a record, including a 9.4% jump so far in 2025.[1] Meanwhile, the VDAX®, which tracks the implied volatility in German equities, remains below the levels seen for most of this decade (Figure 1). Moreover, the VDAX is trading on par with the VSTOXX®, which measures volatility in the Eurozone equity market (Figure 2).

Figure 1: VSTOXX and VDAX indices’ performance

The VDAX closed at 15.4 on January 31, 2025, slightly above its 2024 average of 14.9 but well below its 3-year average of 19.5. The VSTOXX ended at the same level. Both indices closed last month below the Cboe VIX volatility index in the US, which traded at 16.4 on January 31.

Figure 2: German volatility vs. Eurozone volatility

Change of government?

Germans are heading to the polls on February 23 to elect a federal government. The center-right alliance of the CDU and CSU parties currently poll at first place with a 28% vote intention, according to a survey by the Forsa research institute published by Deutsche Welle.[2] The far-right Alternative for Germany (AfD) party is in second place at 20%.

While the CDU’s Friedrich Merz is expected to lead a coalition government, the question remains which parties he’ll form a governing alliance with. As the CDU/CSU have rejected partnering with AfD, the option remains to join the Social Democrats (16% vote intention in the Forsa poll) and the Greens (15%). Politico has a complete analysis of possible alliances here.

“We continue to think that the upcoming German elections can lead to more market-friendly politics in Germany, be it via tax cuts, more fiscal spending or a reprioritization of budget spending towards investments,” wrote a team of equity strategists at Deutsche Bank in a report on February 3.[3] Still, the bank warned that the process of forming a coalition government could be stymied by inter-party disagreements, leading to short-term political uncertainty.

Volatility indices

The VDAX and VSTOXX indices are used by investors seeking to hedge volatility in, respectively, the German and Eurozone equity markets. They measure their underlying markets’ implied volatility by tracking the price of all listed DAX and EURO STOXX 50 options trading on Eurex. Because the price of index-based puts tends to rise when market woes increase, lifting volatility indices, the VDAX and VSTOXX are considered gauges of “market fear.”

Futures on the DAX (FDAX) expiring March 20 this year closed on February 7 at 21,852, 0.3% higher than the closing price for the underlying index. Futures on VSTOXX expiring on March 17 are quoted at 17.8 on Eurex.

In November 2023, Eurex introduced daily expiring options on DAX® (ODAP), a few months after the launch of daily options on the EURO STOXX 50 (OEXP). The contracts give participants targeted market exposure to react quickly and precisely to specific events.

In 2024, 42 million futures and options on the DAX and more than 450 million derivatives on the EURO STOXX 50 exchanged hands on Eurex.

Global exposure

Because its constitution is dominated by large exporters, the DAX has become more a barometer of global trade than a gauge for the German domestic economy. According to an analysis from Deutsche Bank, only 20% of DAX components’ sales are generated at home, while 24% of revenue is generated in the US.[4] Germany is the world’s third-largest exporter[5], led by sales of automobiles, machinery, chemicals and electronics.

“US investors are focused on developments in the US,” with the new Trump administration, Rocky Fishman, strategist at Asym 500 LLC, said at a recent webinar organized by Eurex. “Potentially that’s the case with European investors as well. It’s notable to me that markets are pricing a lower implied volatility in Europe and Germany” than in the US. “Markets are just not pushing a whole lot of extra election risk into options pricing.”

DAX single exposures

While the DAX methodology limits the weight of any constituent at 15%, there are versions of the index with alternative caps: 8.5% and 10%. STOXX also recently introduced versions of the benchmark that have a 20% and zero caps on single stocks. The DAX 20% version is aimed in particular at investors who are seeking to align with the 20/35 rule as set out in the regulations for index-tracking UCITS.

[1] Total returns through February 7, 2025.

[2] DW, “German election: CDU, Merz drop in poll after AfD vote,” February 4, 2025.

[3] Deutsche Bank Research, “SX5E exceptionalism despite tariffs?” February 3, 2025.

[4] Deutsche Bank Research, ‘Made in Germany – Part 1. DAX up 50%?’ January 2025.

[5] CIA, The World Factbook data, 2023 estimates.