The launch of the DAX® 50 ESG Index last month presents an opportunity to analyze the effect of implementing environmental, social and governance (ESG) exclusionary screens and ESG integration on a portfolio of German equities.

The new index excludes companies engaged in controversial activities, but it additionally integrates ESG scoring into stock selection. That means that any tracking error relative to benchmarks will be the result of both the negative exclusions and of positive ESG integration. In this article, we will focus on the former.

For this, we draw from a Qontigo research study published earlier this month1 . The report looks at the impact of ESG exclusions on the HDAX® Index, which forms the selection universe for the DAX 50 ESG, as well as on the flagship blue-chip DAX® Index. The HDAX groups all equities that belong to either the DAX, MDAX® or TecDAX® indices, and currently has 99 components.

Focus on sustainability and replicability

Before we delve into the analysis, let’s briefly review the DAX 50 ESG Index’s methodology.

From the starting universe, companies are firstly excluded if Sustainalytics deems them to be non-compliant with the Global Standards Screening assessment,2 or involved in controversial weapons3, tobacco production, thermal coal (extraction and power generation), nuclear power and military contracting.

The DAX 50 ESG Index is composed of the 50 remaining stocks with the highest rank in three parameters: trading volume, free-float market capitalization and ESG score. The latter is calculated by Sustainalytics’ transparent ESG performance rating model. For a full description of the selection methodology and the review calendar, please click here.

The methodology and number of index constituents means the resulting portfolio has a sufficiently large investment capacity while offering replicability from a tradability and liquidity perspective.

Effects on portfolio composition

Let’s now look at the resulting portfolio of the DAX 50 ESG Index and its performance.

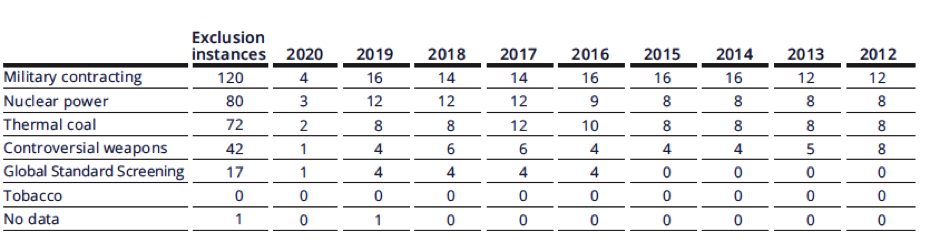

Table 1 summarizes the number of instances when each of the applicable ESG principles were breached within the HDAX universe, leading to exclusions. The counts are not mutually exclusive, meaning one company may have infringed more than one principle.

Table 1

Military contracting accounts for the highest number of ESG infringements. It is noteworthy that there have been only 17 instances of negative Global Compact Screenings outcomes since 2012. There have been no listed tobacco producers in the German market since data begins.

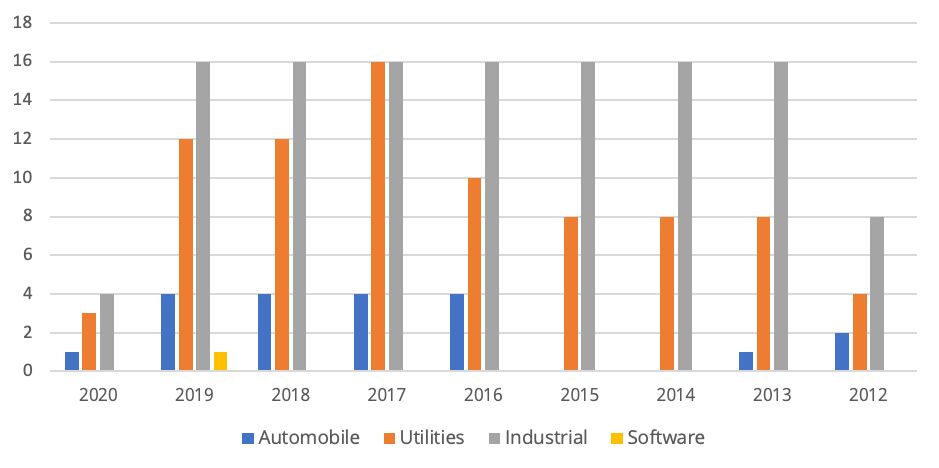

Another finding is that the number of exclusions has been, through the years, concentrated in the same industries (Chart 1). Only four sectors in the HDAX — automobiles, industrials, software and utilities — have had securities removed due to preliminary ESG exclusion screens. Within them, however, the number of companies affected has fluctuated somewhat. Here, again, the figures represent violation instances as opposed to number of securities.

Chart 1

Industrials has consistently been the sector most affected by exclusions. This reflects the sector’s involvement inmilitary contracting and controversial weapons.

The other industry that stands out is utilities, a result of the methodology’s ban on businesses that use or produce thermal coal and nuclear power. However, the number of utilities excluded has varied — from a peak of 16 in 2017 to 12 in 2019. Automobile companies have also been excluded due to their involvement in controversial weapons and as a result of the Global Compact Screenings.

Impact of ESG allocations

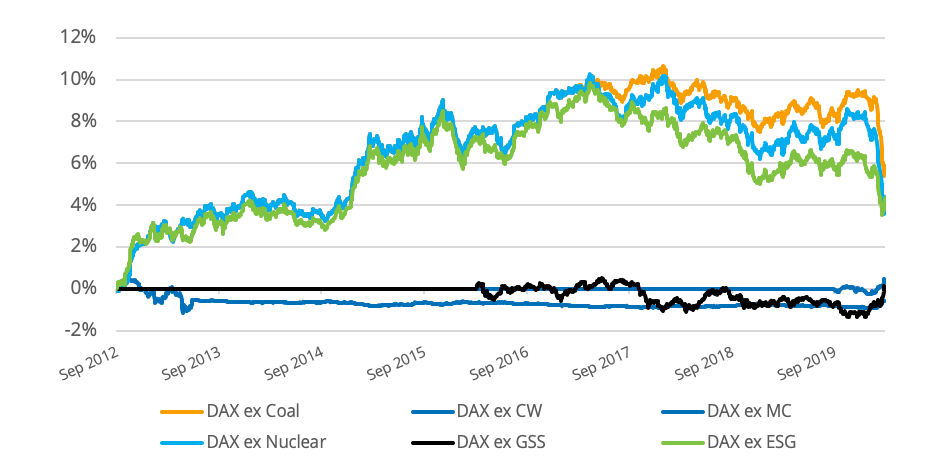

Turning now to performance, Chart 2 looks at the impact that applying negative exclusions on the narrower universe that is the flagship DAX Index would have had on returns.

The removal of companies associated with nuclear power and thermal coal has been accretive to results. On the other hand, Global Standards Screenings weighed on returns in recent years but have this year reverted the trend. Controversial weapons exclusions have had only a slightly negative impact over the entire period. The exclusion of companies involved in military contracting has had a negligible effect on performance.

Chart 2 also shows that the market downturn during February and March this year has narrowed the tracking error of the ESG portfolios relative to the DAX.

Chart 2

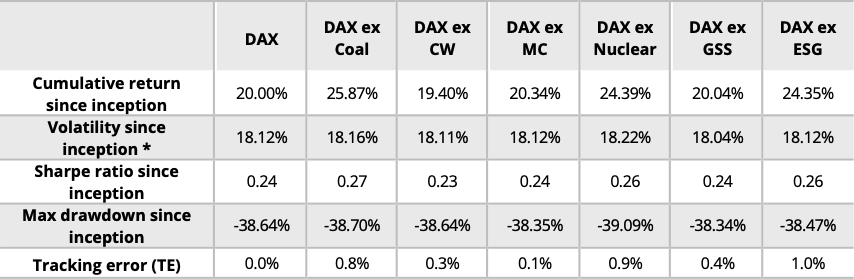

Table 2 presents the risk and return characteristics of each portfolio in Chart 2, plus the benchmark DAX, using Axioma Portfolio Analytics calculations.

Table 2

Performance relative to DAX Index

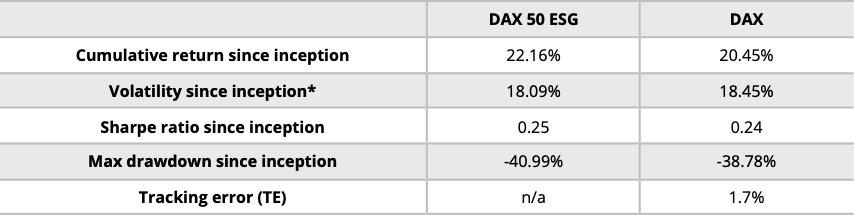

Overall, as we reported last week, the DAX 50 ESG hasn’t had a materially different performance to that of the DAX. Table 3 shows the risk and return of the two indices using the official DAX methodology calculation.4 Since 2012, the ESG Index has outperformed the blue-chip German benchmark by a cumulative 1.71 percentage points, while its volatility has been 0.36 percentage points lower.

Table 3

Source: Axioma Portfolio Analytics, STOXX Index data, returns in EUR. Data from Sep. 21, 2012 to Mar. 20, 2020. From Williams, L., Venkataraman, A. – Qontigo, April 2020. * Volatilities are annualized.

A new standard in German ESG investing

The DAX 50 ESG Index was designed as a new standard for the growing pool of investors embracing sustainable principles in Europe’s largest economy and looking for a German ESG benchmark. With its robust framework, transparent methodology and emphasis on liquidity, the index was born with the ambition to occupy that space.

Featured indices

DAX® 50 ESG Index

Featured study

DAX® 50 ESG – The New Standard in German ESG Investments

1 Williams, L., Venkataraman, A., ‘DAX® 50 ESG – The New Standard in German ESG Investing,’ Qontigo, April 2020.

2 Global Standards Screening identifies companies that violate or are at risk of violating commonly accepted international norms and standards, enshrined in the United Nations Global Compact (UNGC) Principles, the Organisation for Economic Co-operation and Development (OECD) Guidelines for Multinational Enterprises, the UN Guiding Principles on Business and Human Rights (UNGPs), and their underlying conventions.

3 The following weapons are considered controversial: anti-personnel mines, biological and chemical weapons, cluster weapons, depleted uranium, nuclear weapons and white phosphorus weapons.

4Analyses based on portfolio returns from Axioma Portfolio Analytics can differ slightly from actual index returns. This may be the result of a difference in the treatment of corporate actions between Axioma Portfolio Analytics and the official DAX methodology.