On February 18, 2019, Eurex launched its ESG index derivatives segment with three STOXX-linked products, forging a market and new partnership venue between both firms that have since grown in size and innovation.

The advent of ESG derivatives marked an important milestone for investors who need to observe responsible mandates while managing their portfolios’ risk and flows. With the market for sustainable funds continuing to grow, and more regulation driving ESG disclosure and flows, listed and centrally-cleared derivatives will play an increasingly large role for investors.

Standard exclusions – a starting point

The first ESG contracts at Eurex linked to STOXX indices included futures on the STOXX® Europe 600 ESG-X, which implements a negative exclusions strategy on the popular European benchmark. The contracts saw quick adoption, not least because negative screens are considered a starting point in the sustainability ladder: they are a simple strategy that limits market and reputational risks with a generally low tracking error.

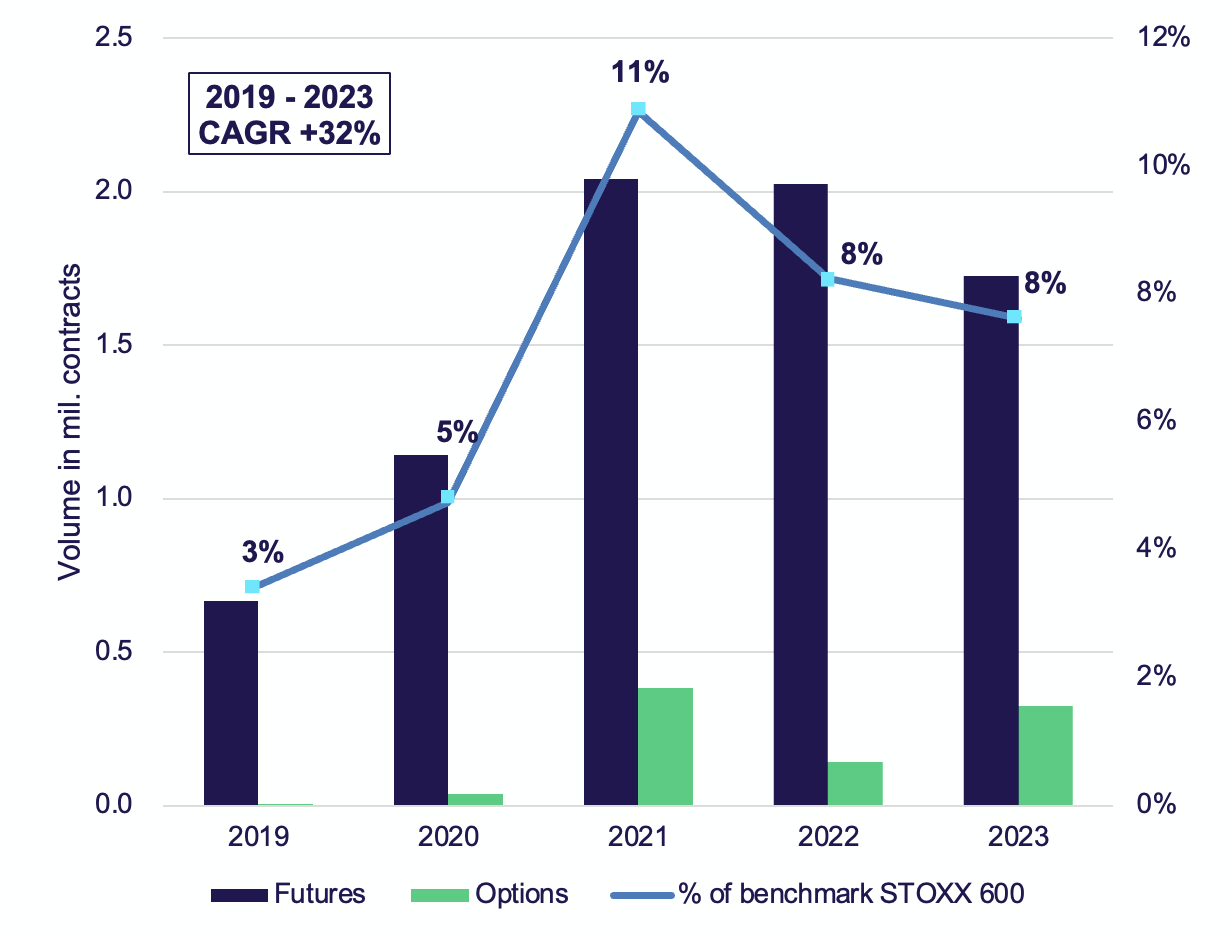

Over 1.7 million futures and more than 320,000 options on the STOXX 600 ESG-X exchanged hands in 2023, for a notional value of EUR 35 billion, representing around two-thirds of the entire ESG segment at Eurex (Figure 1). Since listing in February 2019, more than 7.4 million STOXX 600 ESG-X futures have traded on Eurex. Volume in the STOXX 600 ESG-X futures now amounts to over 7% of the total in the benchmark’s products.

Figure 1: STOXX 600 ESG-X derivatives volume

ESG integration

As investors’ objectives and preferences evolved, the number and type of available solutions have increased — and Eurex and STOXX have continued to pioneer ESG products. In November 2020, the EURO STOXX 50® ESG became the underlying for futures and options, bringing a second generation of ESG indices to the derivatives space.

The ESG version of the flagship EURO STOXX 50® follows standard investment exclusions but also integrates companies’ ESG scores into the stock selection, replacing controversial companies and the least sustainable ones with peers from the same ICB Supersector group.

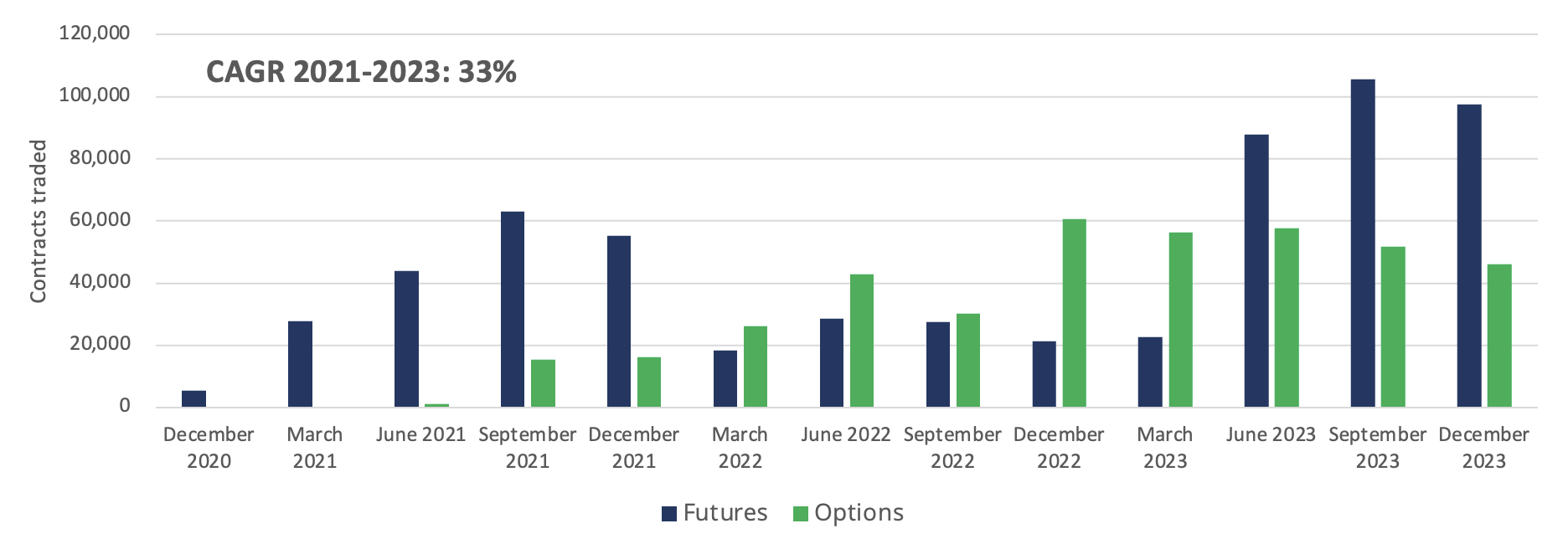

Contracts on the EURO STOXX 50 ESG have seen significant uptake (Figure 2), helped by the popularity of its benchmark. The EURO STOXX 50 is the center of a unique and extensive ecosystem that includes funds, ETFs, listed derivatives and structured products.

Figure 2: EURO STOXX 50 ESG derivatives volume

“The ESG segment has seen an astounding pace in innovation in only a few years, a reflection of strong customer demand,” said Zubin Ramdarshan, Head of Eurex Equity & Index Product Design. “Listed ESG index derivatives enable a broader pool of investors to implement, manage and hedge their desired strategies, and help bring efficiencies to sustainable portfolios. That’s why they are key in the transition to a responsible marketplace.”

Broadening strategies

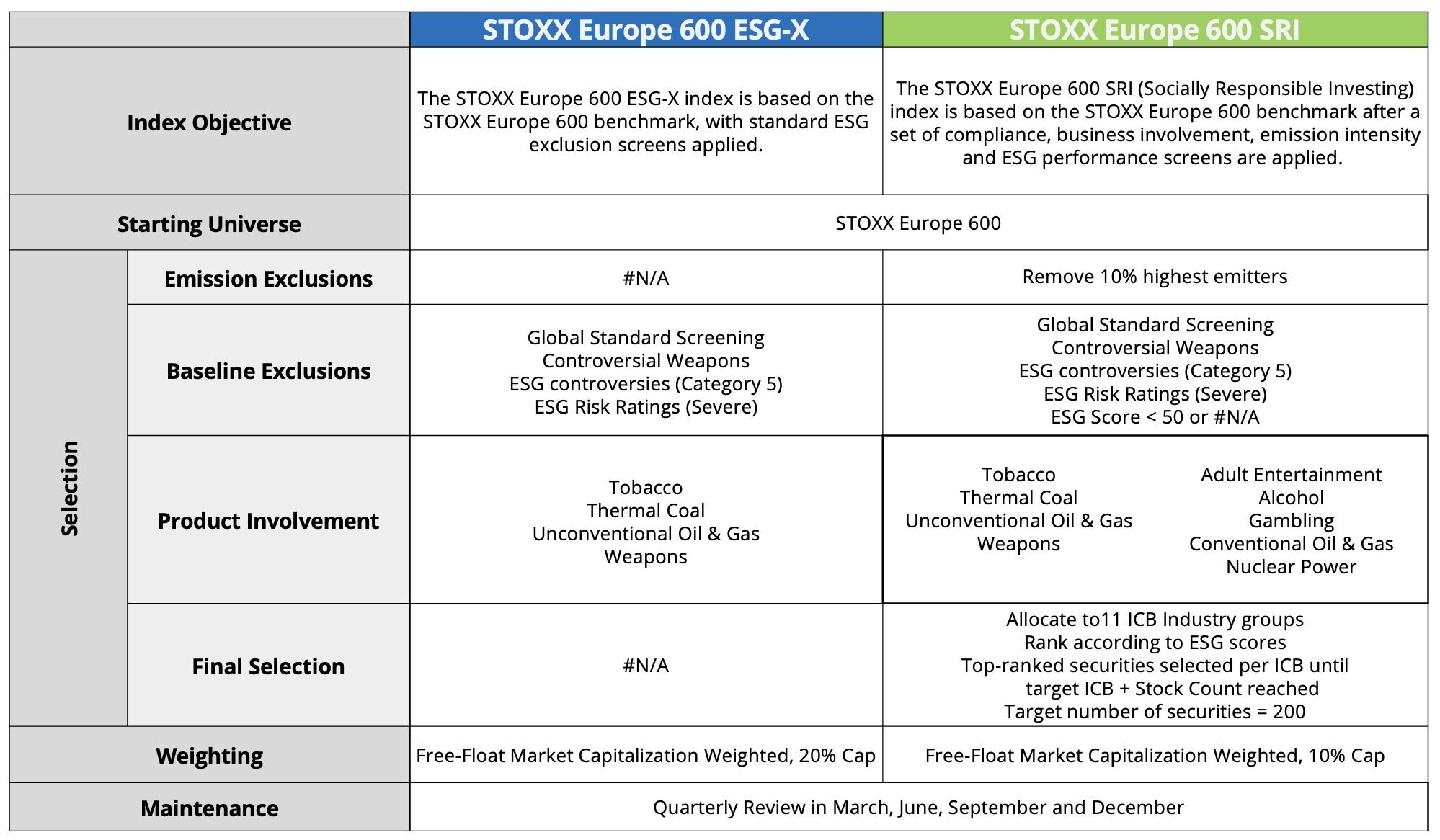

Just this year the evolution in ESG index derivatives took one step further with the introduction of a Socially Responsible Investing (SRI) strategy. On January 22, Eurex listed futures on the STOXX® Europe 600 SRI, an index with norms and product-involvement exclusionary screens, as well as best-in-class filters to include companies with the highest ESG scores and lowest emissions. The latter is provided by ISS ESG.

The STOXX Europe 600 SRI’s exclusionary filters go beyond those represented by the STOXX Europe 600 ESG-X (Figure 3). For example, they remove high carbon-intensity companies as well as those involved in Oil & Gas. The screens are also aligned with the enhanced requirements of large asset owners.

Following the screens, the remaining securities are ranked in descending order of their ESG scores within each of the 11 ICB Industry groups. The STOXX SRI Indices select the top-ranking companies in each of the ICB Industries until the number of stocks reaches a third of that in the starting benchmark.

Figure 3: Methodology comparison STOXX Europe 600 ESG-X vs. STOXX Europe 600 SRI

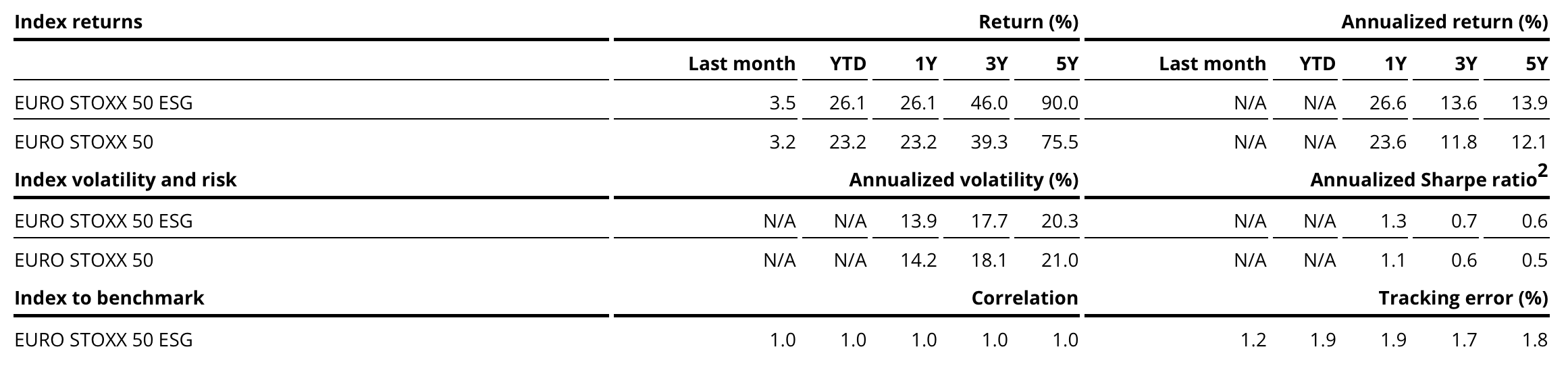

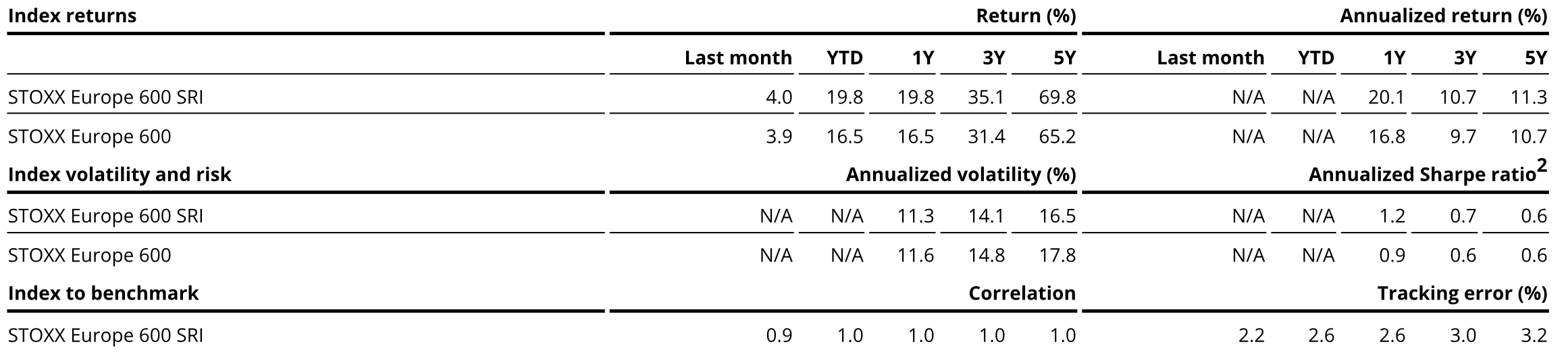

While not part of their remit, many ESG indices have shown higher returns and lower volatility levels than their benchmarks. This is the case, for example, with the EURO STOXX 50 ESG and STOXX Europe SRI (Figure 4).

Figure 4: Risk and return

Evolving demand

The family of STOXX-linked ESG derivatives at Eurex is complemented by contracts on the EURO STOXX 50® Low Carbon, STOXX® Europe Climate Impact Ex Global Compact Controversial Weapons & Tobacco and STOXX® Europe ESG Leaders Select 30 indices, which further expand the possibilities for investors.

The DAX space, covering German equities, also got a sustainable alternative in derivatives with the introduction in 2020 of listed futures and options on the DAX® 50 ESG. As with the EURO STOXX 50 ESG, the DAX 50 ESG removes companies in undesirable or controversial activities, and also integrates sustainability parameters into stock selection. There already are ETFs and structured products that are linked to the German sustainable benchmark.

“We see a trend of broadening demand, specifically towards more advanced, elaborated and targeted products,” said Antonio Celeste, Global Head of Sustainability Index at STOXX. “And we are also meeting investors’ changing needs in updating some of the underlying methodologies when needed.”

For example, there have been two updates to the STOXX Europe 600 ESG-X rulebook. As of March 2023, companies that Sustainalytics identifies as having a ‘Severe’ ESG Risk or Controversy Rating have been removed from the index. The threshold to exclude companies with revenues from thermal coal was also lowered to match the requirement of an increasing number of users. Similarly, the EURO STOXX 50 ESG and STOXX Europe 600 SRI indices have also undergone adjustments in their rules.

The next five years

The ESG space is evolving, and in few places is that as palpable as in the derivatives market. STOXX is excited to have worked alongside Eurex over the past five years in developing solutions that enhance transparency, liquidity and cost efficiency. In a segment where customization is commonplace, listed derivatives also bring standardization in strategies, facilitating trading.

In the short term, new regulation such as the Sustainable Finance Disclosure Regulation (SFDR) and the Corporate Sustainability Reporting Directive (CSRD) may guide flows into ESG investments. The next five years promise to bring more volumes, and continued innovation and ambition in the world of ESG index derivatives.