The prospect of further monetary stimulus has raised questions about the performance of Eurozone banks just as the sector has once again fallen to near record low levels.

In its Jul. 25 meeting, European Central Bank officials discussed the benefits of combining interest-rate cuts with bond purchases in a package that economists expect may come as early as next month.1 This may spell bad news for the banking industry, whose net interest income suffers when rates drop.

Under outgoing President Mario Draghi, the ECB cut its deposit rate to a record low of -0.4%. Authorities may need to step up their monetary stimulus amid sluggish economic growth — Germany is flirting with recession — and tepid inflation. The US Federal Reserve in July cut rates for the first time in a decade.

Even as the ECB has offered cheap loans to cushion the effect of extra-loose monetary policy on banks’ business, the sector’s profitability has suffered. The industry’s total net operating income has fallen every year since at least 2015.2 Around half of European banks have a return on equity running below their long-run cost of capital.3

Share prices have performed accordingly. Since the current bull market started on Mar. 9, 2009, the EURO STOXX® Banks Index has had a total return of 43%.4 That’s the worst performance among 19 supersectors in the benchmark EURO STOXX® Index, which is up 215% in the period.

Returns for bank shares in the period were entirely derived from dividends, with the equities’ value before dividends shrinking by 7.4%. The EURO STOXX Banks Index has fallen 27%, before dividends, since Mario Draghi became ECB President in November 2011.

Concerns emerge with plunging yields

The underperformance of banks has intensified this year amid a deceleration in the Eurozone economy and expectations that the ECB will resume monetary easing after 3 1/2 years of unchanged policy. The move downwards in bank shares has coincided with a plunge in bond yields, many of which are in negative territory. Yields on 10-year German bunds have fallen to a record low of -0.71% from 0.28% in January, fueling talk that banks may have to charge clients to accept their deposits.5

Only this month, executives from three large European banks — UniCredit, Commerzbank and ABN Amro — confirmed that low rates are likely to hurt earnings.6

The EURO STOXX Banks Index in August erased its gains for this year, after rising as much as 19.8% in April. The gauge has now dropped 4.9% so far in 2019,7 compared with a 14.6% jump for the benchmark. Among the 19 supersectors, only the EURO STOXX® Basic Resources Index has fared worse.

A trough re-tested?

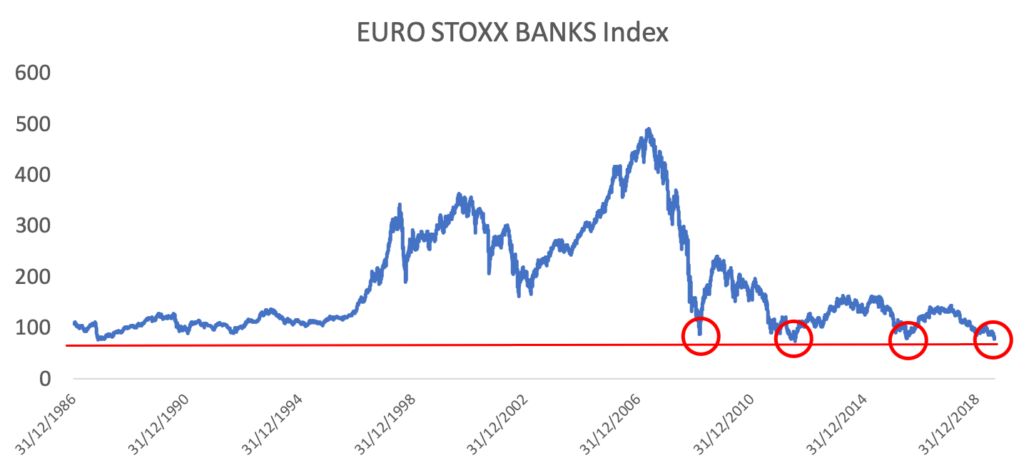

One point of solace for investors may come from the fact that these levels marked a bottom in 2016, as well as in 2012 after the European debt crisis and during the global financial crisis in 2009 (Figure 1). A similar trough formed in 1987. From those four lows, the ensuing 12 months brought average gains of 74% for the index.

Figure 1

The EURO STOXX Banks Index fell to 77.45 on Aug. 15. That is just over 1 point higher than the 1987 low, and about 4 points higher from an all-time bottom in 2012. However, the index has already breached the 2016 trough and surpassed the 2009 low by more than 9 points.

Strategists often watch the banking industry as an indicator of the market cycle. Banks have also, in the past, weighed on investor sentiment more than other sectors. Futures on the EURO STOXX Banks Index trading on Eurex far outweigh volumes on other sector indices. More than 5 million futures contracts on the EURO STOXX Banks Index exchanged hands in August, the second-most popular equities futures on the exchange. Only futures on the EURO STOXX 50® Index garner more interest.

With Christine Lagarde taking over the helm at the ECB next October, investors will be watching whether central bank policies may help the banking industry perform better than the ups-and-downs registered under Draghi.

Featured indices

1 Wall Street Journal, ‘ECB Minutes Back Up Signals of Broad Stimulus Package,’ Aug. 22, 2019.

2 European Banking Authority, ‘Risk Assessment of the European Banking System,’ December 2018.

3 European Banking Authority, ‘Risk Assessment Questionnaire – Summary of Results,’ July 2018.

4 Total return before taxes in euros.

5 Deutsche Bank Research, ‘Negative interest rates and their effect on humans,’ Aug. 23, 2019.

6 Financial Times, ‘UniCredit leads trio of European lenders alarmed by low rates,’ Aug. 7, 2019.

7 Gross return in euros through Aug. 23.