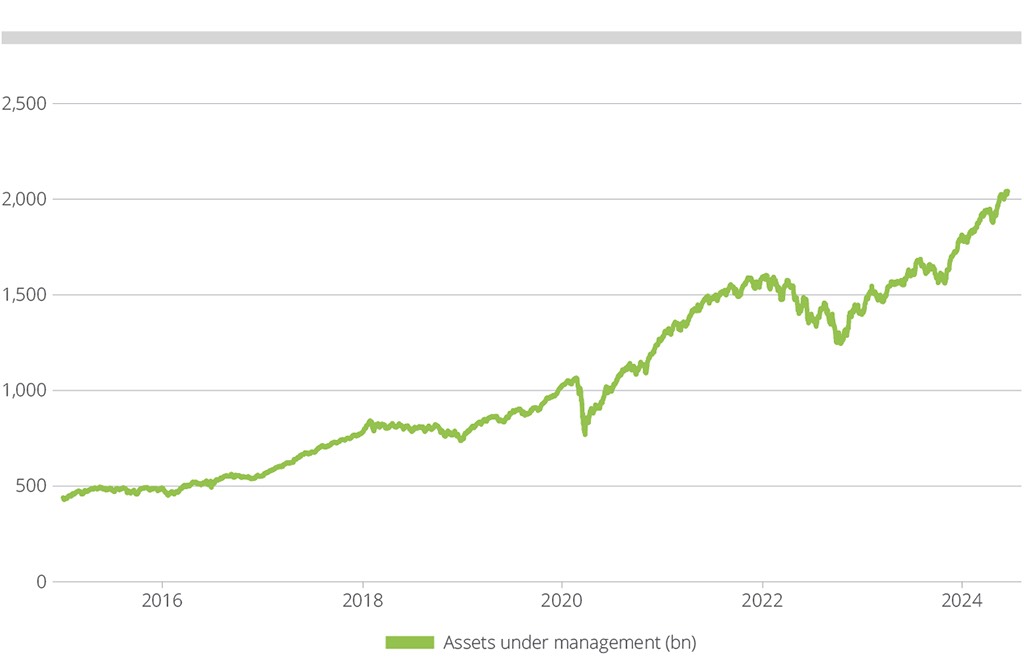

Money inflows and rising share prices have lifted the value of assets invested in European exchange-traded funds (ETFs) and similar products to a record USD 2 trillion this year.[1]

Assets under management (AuM) have grown from USD 1.6 trillion a year earlier, according to data from ETFbook. While it took the industry almost two decades to reach its first USD 1 trillion in 2019, it has gathered as much in just over four years since then.

About USD 1.44 trillion, or 71% of the total in European ETFs, is invested in equities products.

Figure 1: European ETFs’ assets under management (USD billion)

By comparison, AuM in all ETFs worldwide reached a record USD 13 trillion at the end of May 2024, according to ETFGI.

STOXX was behind the launch of Europe’s first two ETFs 34 years ago. The two funds were listed at the Frankfurt Stock Exchange in April 1990 and tracked, respectively, the EURO STOXX 50® and STOXX® Europe 50 indices.[2] STOXX today underlies over USD 100 billion invested in Europe- and German-focused equity ETFs domiciled in Europe, ETFbook data show,[3] 14% more than in May 2023 and 22% higher than May 2022. That makes STOXX the leading index provider in this segment.

Capital flows

Funds tracking the flagship Eurozone index, the EURO STOXX 50, attracted almost USD 2 billion in net new money in the first five months of 2024, nearly four times the amount for all of 2023 and poised for its best year since 2017. The EURO STOXX 50 has climbed 22% in the past 12 months[4] as investors turned to European equities in search of low valuations and their potential for growth.

ETFs tracking the pan-European STOXX® Europe 600 index have received a net USD 886 million this year.

European ETFs have registered USD 107 billion in net new capital this year, poised for their tenth straight year of net inflows.[5]

“There is a diversification and valuation story in Europe, but there is also the continued shift towards low-cost, passive investing funds that is supporting flows into ETFs more structurally,” said Nico Langedijk, Head of EMEA ETF and Index Investments at STOXX. “European stocks may not capture all the headlines, but they are attracting capital.”

[1] Data includes all-assets ETFs, ETPs and ETNs domiciled in Europe. Total AuM reached USD 2.04 trillion on June 13, 2024.

[2] The funds were the precursors to the iShares Core EURO STOXX 50 UCITS ETF and the iShares STOXX Europe 50 UCITS ETF, both currently trading.

[3] Includes STOXX and DAX indices.

[4] Gross returns in euros, data through May 31, 2024.

[5] Data from ETFbook.