European bank stocks had a record performance in 2025, pacing gains across sectors for a second year in a row, as investors favored an industry with low valuations and positive earnings surprises.

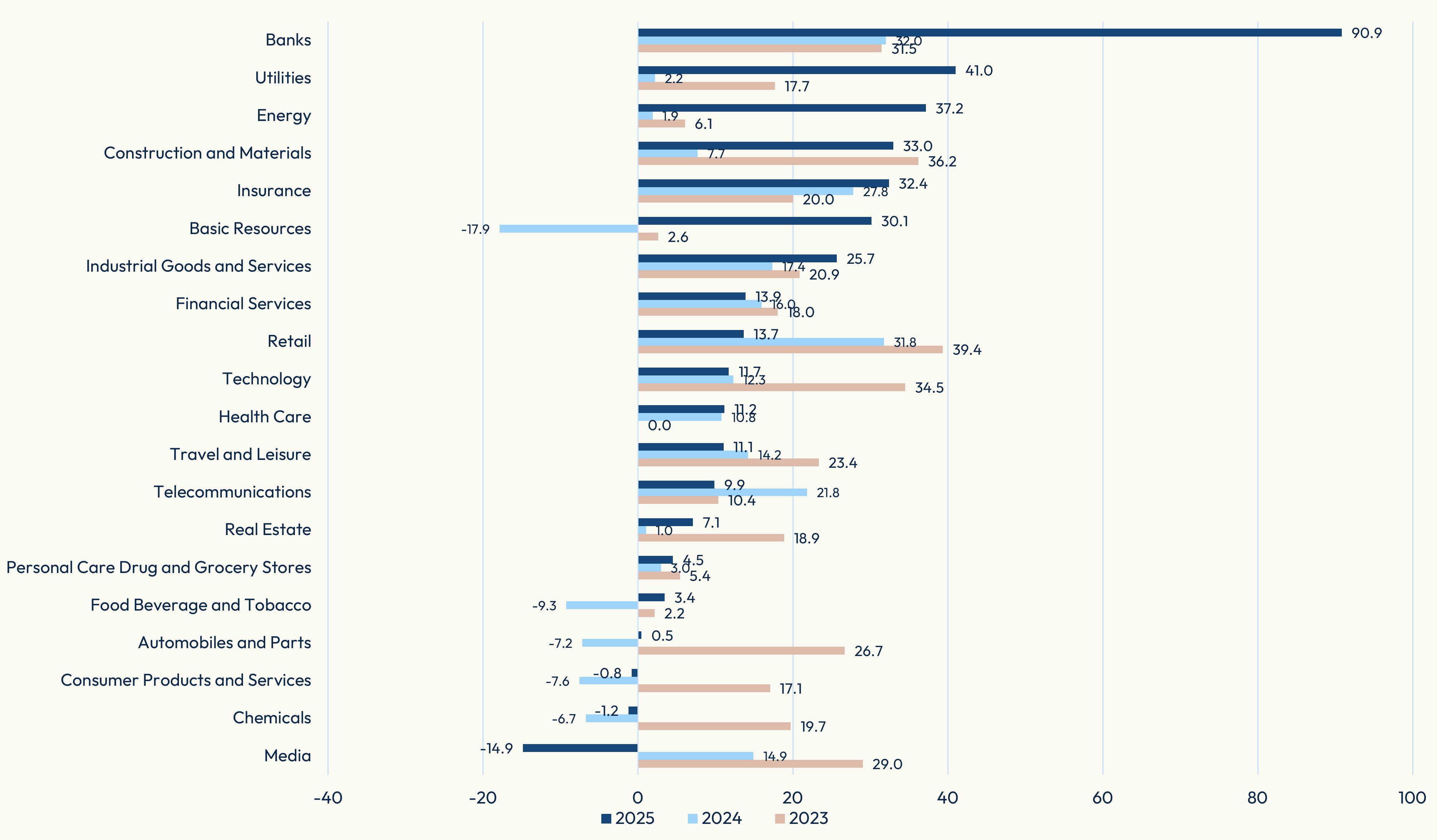

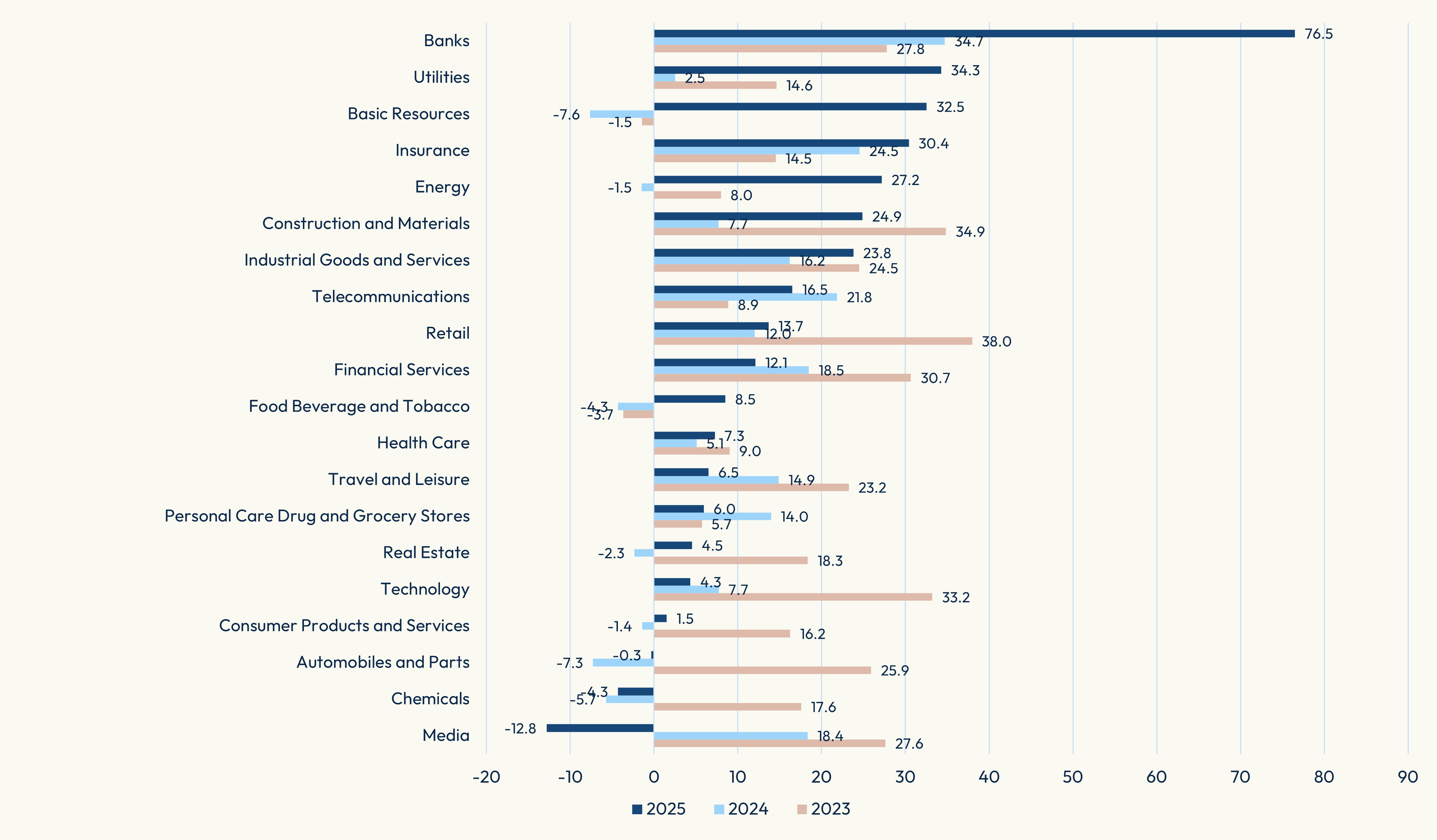

The EURO STOXX® Banks index, which tracks the largest lenders in the Eurozone, jumped 80.3% last year excluding dividends, its best annual performance since data going back to 1987. That compares with gains of 21.2% for the EURO STOXX® index and 18.3% for the EURO STOXX 50® benchmark of the region’s blue chips.[1] The STOXX® Europe 600 Banks index, which includes non-euro markets, climbed 67% last year, also its best year since 1987. The STOXX Europe 600 Banks beat all other 19 ICB Supersectors for a second consecutive year. The EURO STOXX Banks was the No.1 Supersector in 2025 and No.2 in 2024.

A combination of better-than-expected industry earnings, regional economic optimism and low valuations has drawn investors to a sector undergoing consolidation and one that has improved its capital ratios in recent years. Banks are often seen as a proxy on economic growth, and investors have welcomed efforts by European nations, including Germany, to shake off years of stagnation.

“European banks have significantly enhanced their profitability since COVID, and maintained a strong Return on Tangible Equity despite lower interest rates,” wrote a team of Deutsche Bank analysts in a note to investors at the end of 2025.[2] “This robust performance has finally triggered sector re-rating, particularly prominent this year. While the outlook for both profitability and valuation remains positive, we anticipate the improving growth profile of this often-considered ‘ex-growth’ sector to become the third pillar supporting its continued share price performance.”

Figure 1: EURO STOXX Supersectors’ performance

Figure 2: STOXX Europe 600 Supersectors’ performance

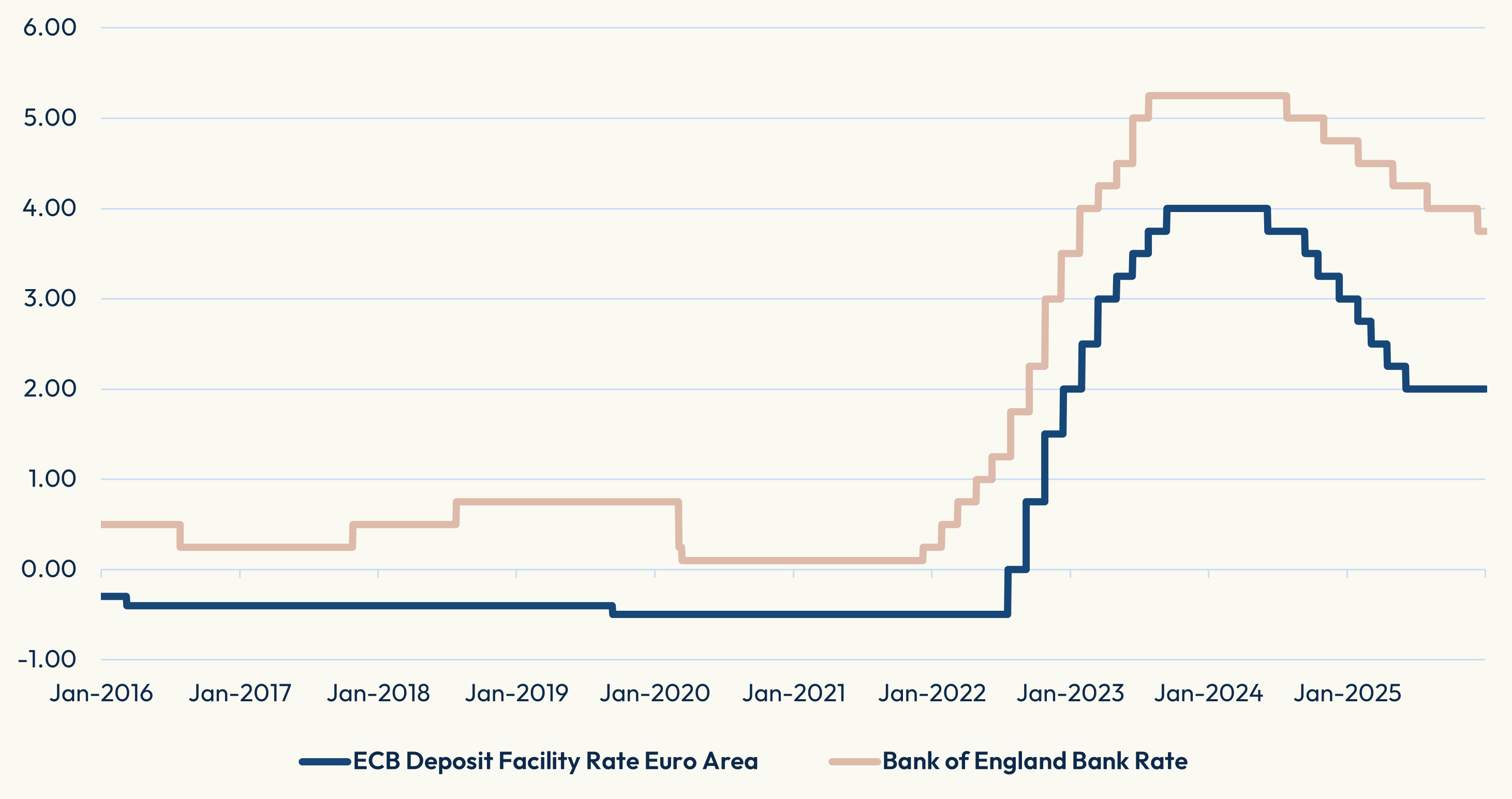

Gains for bank shares in 2025 came even as macroeconomic fundamentals remained fickle. Interest rates, which support banks’ net interest margin and profitability, declined in both the Eurozone (Figure 3) and the UK. Sovereign bond yields rose over the year in Germany and France but fell in the UK. Germany elected Friedrich Merz as chancellor with a reform agenda, while France remained in gridlock amid a hung Parliament.

Figure 3: European interest rates

Strong demand for investment products

Due to its cyclicality and sensitivity to markets and the economy, the banking sector has traditionally been key in European portfolios. Futures and options on banking sector indices are the most popular sector derivatives listed on Eurex. Over 50 million futures and more than 45 million options on the EURO STOXX Banks index were traded last year on the exchange, and nearly 2.5 million futures and more than 56,000 options tracking the STOXX Europe 600 Banks index exchanged hands.

2025 was a strong year for the six ETFs based on STOXX indices tracking the European banking sector. The funds more than tripled their assets under management over the year to EUR 13.2 billion, following net inflows of EUR 4.5 billion, according to STOXX data.

Amundi launched an ETF tracking the EURO STOXX Banks index in 2013, while the STOXX Europe 600 Banks index underlies an iShares ETF introduced 25 years ago this coming April.

Lagging behind long-term

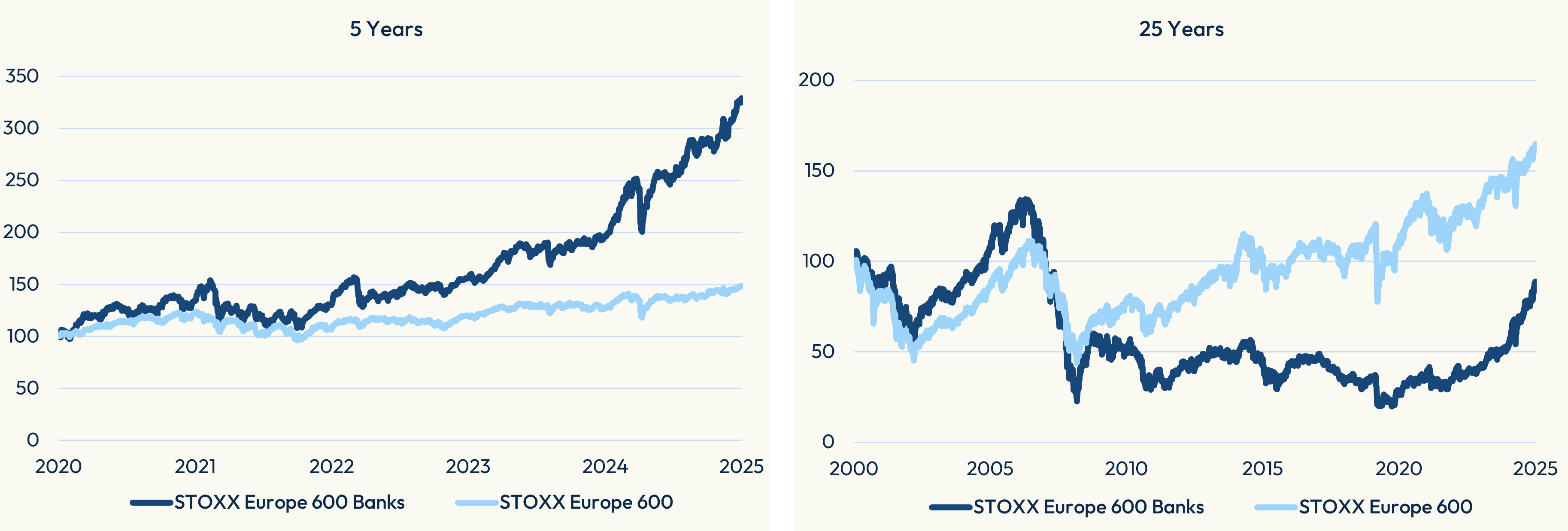

Europe’s banking sector remains far below the levels reached before the 2007-2009 financial crisis. That contrasts with the broader market, as both the EURO STOXX 50 and STOXX Europe 600 reached record highs in 2025.

Figure 4 shows that while the STOXX Europe 600 Banks index has outperformed its benchmark strongly in the past five years (left chart), it’s still a laggard on a longer-term horizon (right chart).

Figure 4: Long-term performance

Value sector

The EURO STOXX Banks index trades at 1.2 times its companies’ book value, about half the price of the benchmark EURO STOXX 50, STOXX data show. The banks gauge is valued at 10.3 times its members’ trailing earnings, compared with a ratio of 18 for the benchmark.

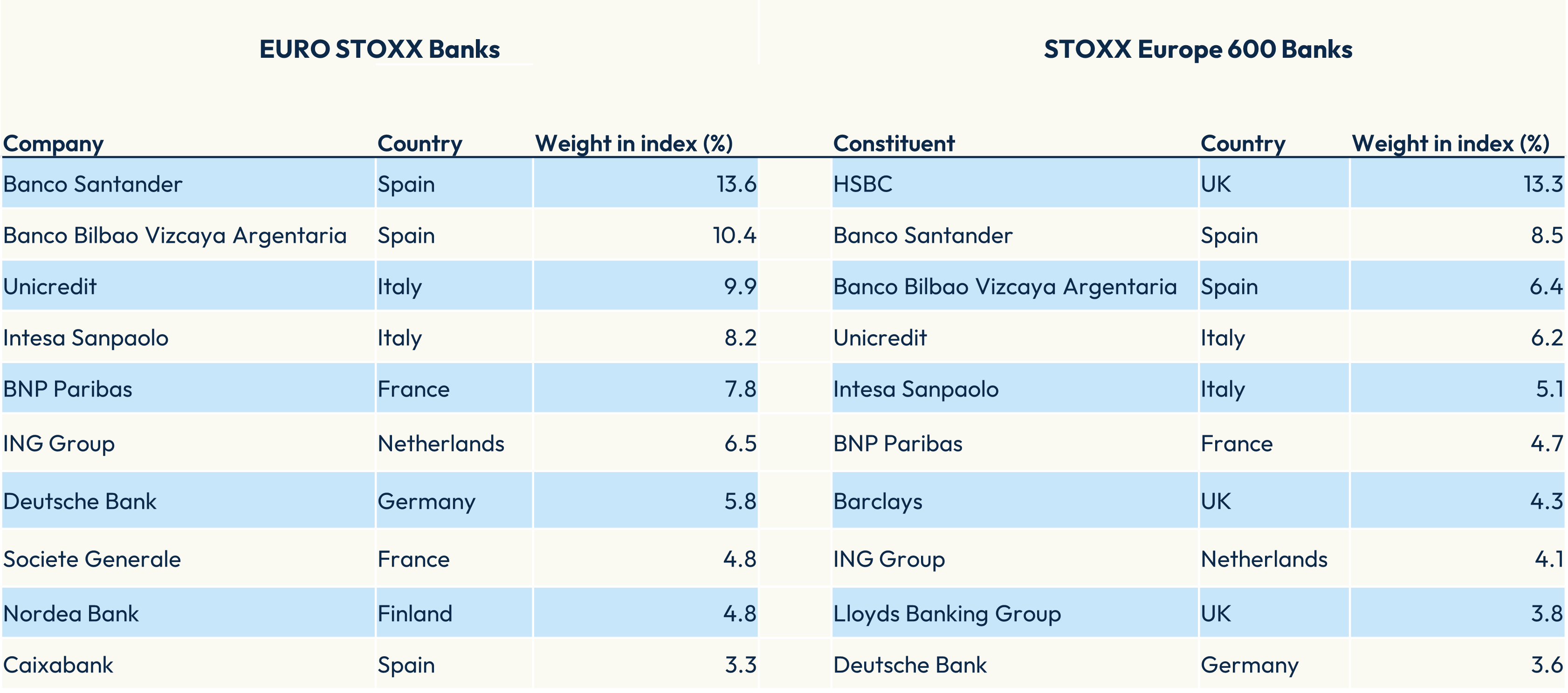

Figure 5 shows the largest components in the EURO STOXX Banks and STOXX Europe 600 Banks indices.

Figure 5: Top holdings

“Net interest income (NII) should have already troughed for the vast majority of our coverage universe,” added the Deutsche Bank analysts. “With stabilizing margins and continuously accelerating loan growth, we expect NII to re-emerge as the primary top-line growth driver in 2026, surpassing consensus expectations.”

[1] All price returns in EUR.

[2] Deutsche Bank, “European Bank, 2026 Outlook: The Year of Growth,” Nov. 24, 2025.