A breakout session at the recently held Deutsche Börse ETF Forum in Frankfurt provided a platform for STOXX partners to discuss two of this year’s most significant thematic trends in equity markets: European defense and artificial intelligence (AI).

The STOXX-hosted session consisted of Michael Stewart, Head of Equities Business Strategies at Amundi ETF & Indexing, and Vincent Denoiseux, Head of Product Innovation & Research at BlackRock. Nico Langedijk, Managing Director for Strategic Accounts at STOXX, moderated the discussion.

Europe-focused approach

European defense was the first topic discussed, a timely subject given the sector’s strong performance this year. Amundi and BlackRock have each launched ETFs tracking a STOXX thematic index — STOXX® Europe Total Market Defense Capped and STOXX® Europe Targeted Defence, respectively — with both posting gains of at least 83% in 2025.[1]

In March, the European Commission unveiled a package aimed at helping European Union nations invest over EUR 800 billion in defense and military research from European providers. Meanwhile, NATO countries have pledged to boost their military spending to 5% of gross domestic product (GDP) by 2035, up from 2% previously.

“Importantly, there is this real sense of a Europe-first take on defense spending,” said Amundi’s Stewart. “While in the past, only around 40% — on average — of European defense spending would go to domestic companies, we are now seeing announcements from governments such as Germany that look to exceed 90%”

BlackRock’s Denoiseux said ETFs have provided investors with timely and efficient vehicles to capture the momentum in European defense stocks. He highlighted three factors behind a robust ETF offering: conviction in the stock selection methodology and data, portfolio diversification, and liquidity.

Outlook on valuations

With European defense stocks having posted very strong gains this year, the question of valuations arose early in the discussion.

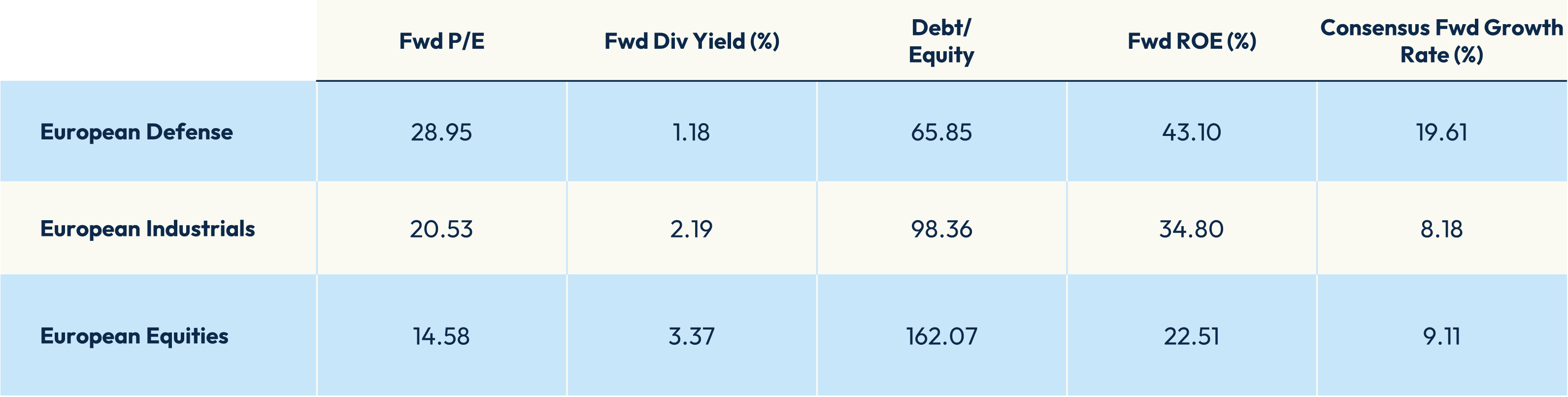

Stewart noted that, on traditional metrics such as the price-to-earnings (P/E) ratio, European defense shares may appear expensive relative to the broader market (Figure 1).

Figure 1: Price ratios comparatives

However, Stewart emphasized the importance of contextualizing those ratios for a sector in which earnings are expected to grow substantially.

“P/E numbers are helpful, but when the underlying earnings growth and margin expansion are as high as they are, P/E can be a little bit limited,” he said.

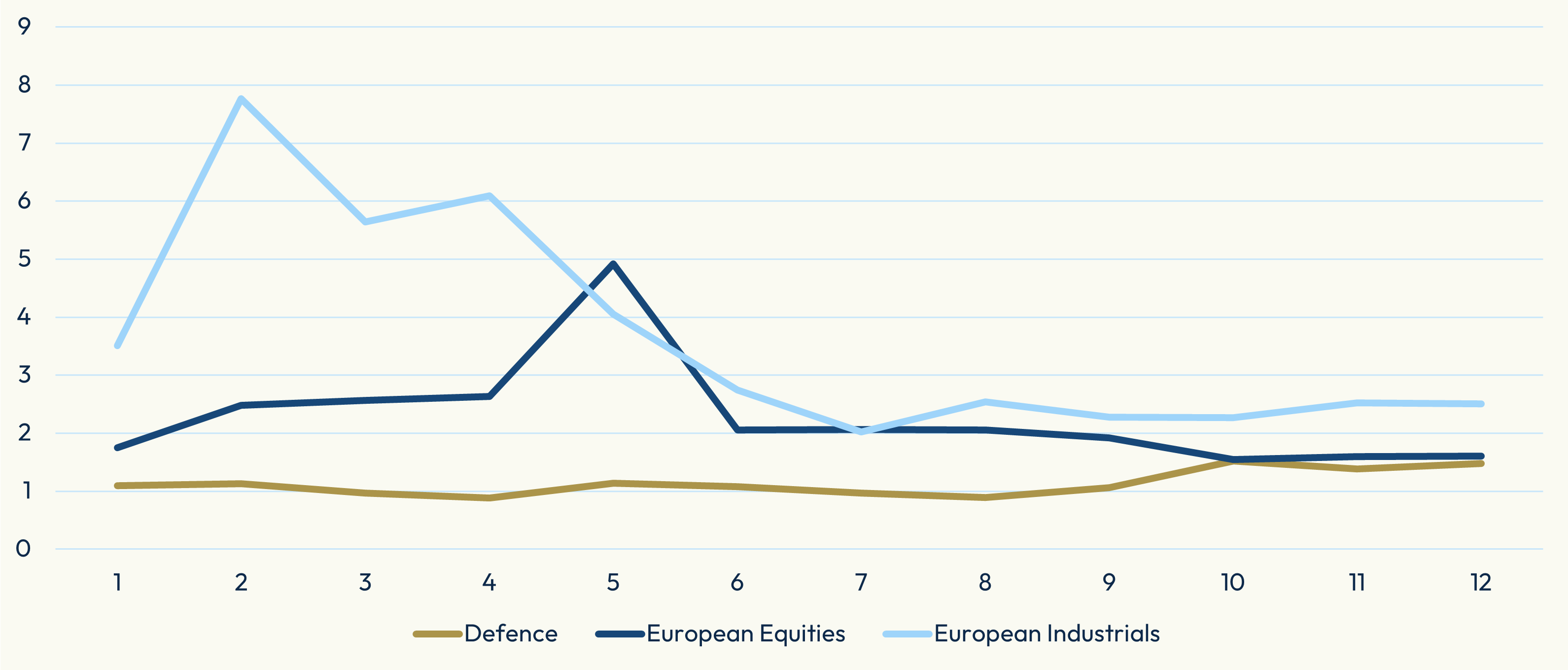

Stewart suggested using the price/earnings-to-growth (PEG) ratio instead, which combines a company’s P/E ratio with its expected earnings growth rate. The PEG ratio is calculated by dividing P/E by the annual earnings-per-share (EPS) growth rate, thereby accounting for how quickly earnings are growing and providing a more comprehensive view of a stock’s valuation. Figure 2 plots the PEG ratio on the vertical axis for three baskets representing defense stocks, industrial companies and broader European equities.

Figure 2: Price/earnings-to-growth (PEG) ratio for European defense stocks trades much in line with the market and below industrials

“The striking thing is that the valuation of defense stocks, based on this measure, not only has remained fairly consistent, but it also actually still trades at a slightly lower level than the broader market,” Stewart said. “How can this be? The PE is twice that of the broader market, but earnings are expected to grow at more than twice the rate of the market. This helps contextualize the investment. So we can ask ourselves: is this pure froth or has the valuation expansion so far been backed up by earnings growth estimates?”

AI as entire value chain

The conversation then shifted to the topic of AI, and how to approach such a vast and complex theme with ETFs.

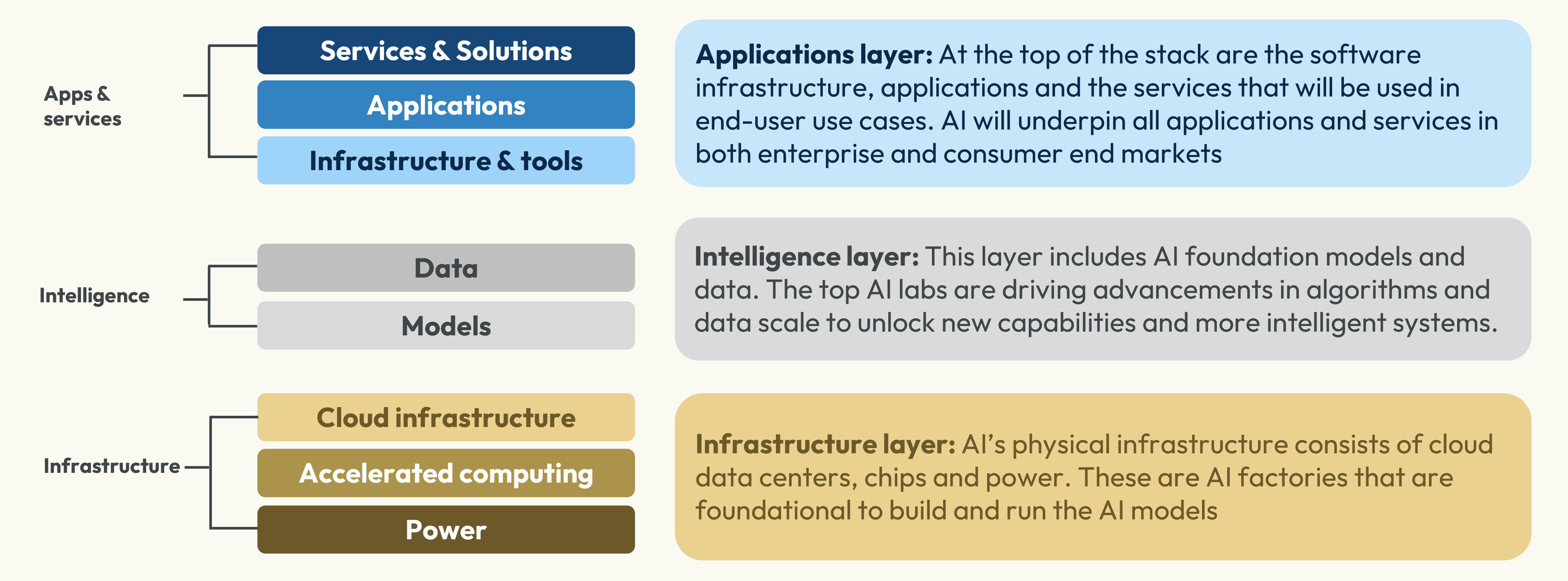

Denoiseux presented a ‘tech stack’ of the AI space, composed of infrastructure, intelligence, and apps & services (Figure 3). Each layer in the stack plays a key role in the rollout of AI and offers different opportunities for investors. Covering all layers means capturing both the large, established companies and under-the-radar, specialized businesses, according to BlackRock’s thematic investment team.

“When we think about AI, we usually think about applications,” Denoiseux said. “But the tech stack starts with computing power and energy. And then you build up the processes, the cloud, the machinery and so forth. There is a full scope of investments across the entire value chain.”

Figure 3: AI tech stack

“We will see investments bouncing back between these three parts of the stack because there will be innovation across the whole chain,” Denoiseux added. “And this innovation will not stop.”

While all sectors exposed to the AI deployment — from utilities to transition metals to turbine manufacturers — have performed strongly this year, investors have primarily focused on the foundation of the AI tech stack: companies providing the infrastructure for AI, such as cloud companies and chipmakers.

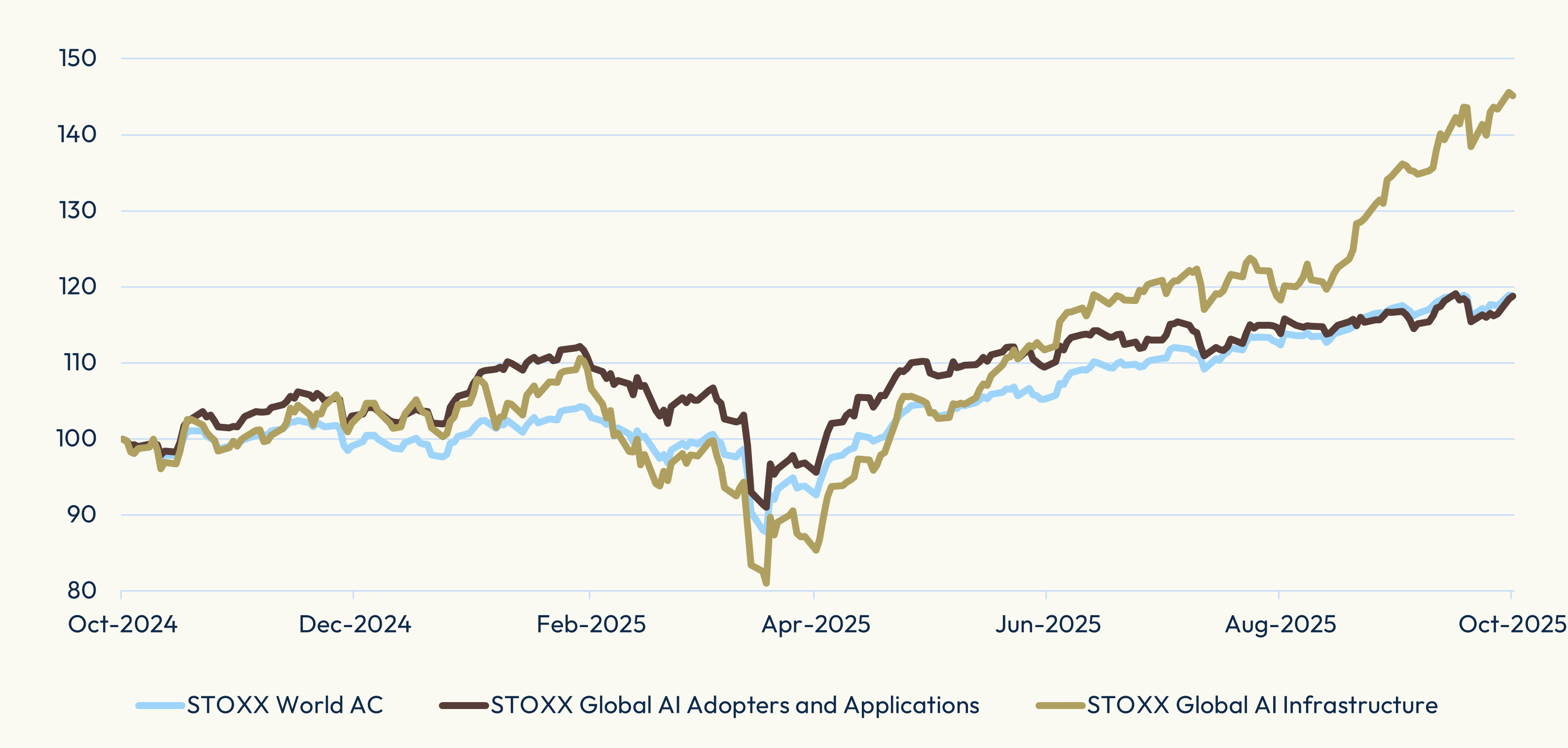

This year, BlackRock and STOXX teamed up to design two iShares ETFs that track STOXX indices targeting specific segments in the rollout of AI: STOXX® Global AI Infrastructure and STOXX® Global AI Adopters and Applications. The STOXX Global AI Infrastructure has risen 45% over the past 12 months (Figure 4). The STOXX Global AI Adopters and Applications, meanwhile, has performed in line with the STOXX® World AC benchmark, gaining 19% since October 2024

Figure 4: Index performances

STOXX’s Langedijk noted how the STOXX Global AI Adopters and Applications index outperformed during the so-called DeepSeek event in February, when the Chinese AI startup unveiled a chatbot product that was much cheaper than the most popular ones in the market, amid rising expectations for faster AI adoption. However, the STOXX Global AI Infrastructure index gathered pace, and outperformed, soon after.

The topic of valuations in the AI space also came up during the discussion. For Denoiseux, it is important to examine companies’ investments and tangible assets to understand how they are using their cash and how they may generate future value. He expects strong earnings to continue for AI firms, and noted that AI clients are still at the beginning of an efficiency cycle that is expected to enhance profitability.

Stewart agreed, adding that the trillion-dollar spending plans announced by companies such as Amazon, Microsoft and Alphabet are supported by their “phenomenal” current and projected cash generation. He explained that about two-thirds of those investments are going into long-term projects like data centers and energy infrastructure, compared to shorter-life assets such as semiconductors, and will ultimately help the companies fulfill contracts they’ve already signed.

“If you look at the hyperscalers, about 30–40% of their cash generation is going into long-term capex,” he said. “Meanwhile buybacks and dividends are still happening, which is a compelling point for equity investors. Revenues are starting to come through, and the backlog of deliveries is growing incredibly quickly, which helps support continued capex activity.”

Key topics

Deutsche Börse’s ETF Forum has become a key annual event for ETF issuers, investors and intermediaries from across Europe and beyond. The session on AI and defense investments provided an excellent opportunity to hear perspectives from two of Europe’s largest asset managers on topics that are top of mind for investors this year.

[1] Net returns in EUR through October 23, 2025.