STOXX is introducing a second generation of environmental, social and governance (ESG) benchmarks with a version of the flagship EURO STOXX 50® Index that follows standard investment exclusions and integrates companies’ ESG scores into the stock selection.

The EURO STOXX 50® ESG Index’s methodology is simple: it excludes the least sustainable companies as well as controversial ones from the benchmark EURO STOXX 50 Index, in favor of more sustainable peers from their same supersector group. The approach thus complies with the basic responsible principles of leading asset owners, but also integrates ESG scores positively.

The result is a more comprehensive sustainable index that keeps a risk and return profile close to that of the EURO STOXX 50 Index and is a more fitting benchmark for investors seeking to integrate ESG values to the core of portfolios. The index has been devised as a response to increased client demand and regulatory drive to take sustainability factors into account.

New ETF tracks ESG strategy

Exclusions and the integration of ESG factors are among the most popular responsible strategies followed by European investors.1 While the former is intended to limit reputational and idiosyncratic risks, the latter aims to gain exposure to corporations that are best managing their ESG risks and opportunities.

The new index is suitable as underlying for mandates, passive and exchange-traded funds (ETFs), structured products and listed derivatives. UBS Asset Management is the first firm to use the index as underlying for an investment product, an ETF that is listed on the Frankfurt Stock Exchange as of today.

Two-step process for a combined strategy

The EURO STOXX 50 ESG Index is made up of all EURO STOXX 50 components minus the 10% ESG laggards based on an ESG score determined by scores from STOXX’s research partner Sustainalytics.

In a second step, a set of standardized ESG exclusion screens based on the responsible policies of leading asset owners is applied on the entire EURO STOXX® Index, the EURO STOXX 50 ESG’s selection universe. This clears the ESG index’s constituency pool of activities broadly considered to be controversial from either a norm- or product-based perspective.

Companies are removed when Sustainalytics considers they meet at least one of the following:

- Non-compliance with the United Nations Global Compact principles of human and labor rights, the environment and anti-corruption

- Involvement in controversial weapons

- Tobacco production

- At least 25% of revenue originates in thermal coal extraction or exploration

- At least 25% of power output generated with thermal coal

All removed stocks are replaced by companies from their same Industry Classification Benchmark (ICB) supersector within the EURO STOXX Index. The replacement will be the largest company in the peer group with an ESG score higher than that of the exiting stock.

EURO STOXX 50 ESG Index components are weighted by their market capitalization, maintaining the same methodology as the benchmark. As is the case with other STOXX ESG indices, the EURO STOXX 50 ESG includes a ‘fast exit’ rule. This means that any component whose Controversy ESG risk level by Sustainalytics increases to ‘severe,’ is removed from the index in two days, and replaced with a more sustainable company from the same ICB supersector.

Such a case took place in 2015, when German automaker Volkswagen admitted to have lied about its cars’ nitrogen oxide emissions. The event triggered the fast exit rule and STOXX was the first index provider to remove Volkswagen’s shares from its ESG indices. The suite includes the STOXX® Global ESG Leaders Index.

Snapshot analysis

Besides the ESG laggards (bottom 10% ESG score), as of Jul. 24 companies in the EURO STOXX 50 were excluded for either involvement in controversial weapons production or breach of UN Global Compact principles. There are no tobacco or coal-mining companies in the EURO STOXX 50, nor any utility with coal power generating capacity exceeding 25%. In total, more than 10% of the EURO STOXX 50’s weight was replaced with companies showing a higher ESG score, thus increasing the EURO STOXX 50’s ESG profile.

Performance analysis

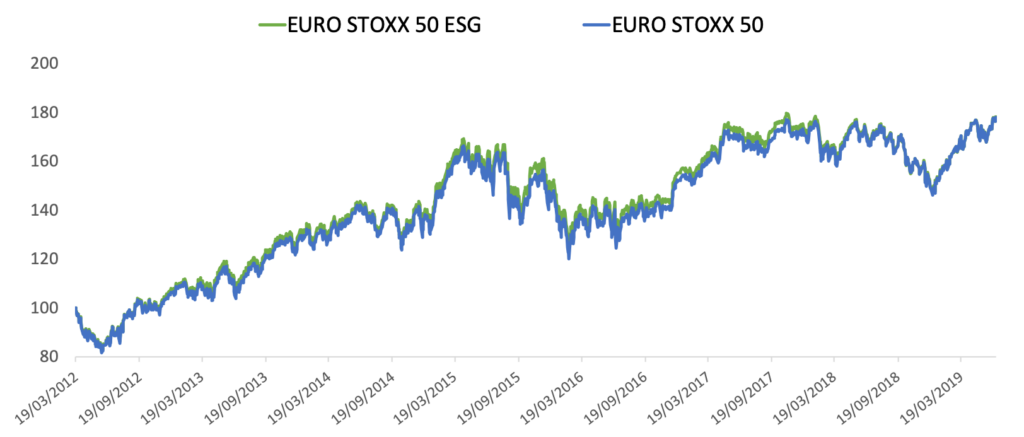

Both the benchmark EURO STOXX 50 Index and the EURO STOXX 50 ESG Index have returned 77% since March 2012 (Figure 1).

Figure 1.

Readings for volatility and risk-adjusted returns were also similar for both STOXX gauges (Figure 2).

Figure 2

A first generation of ESG indices with global reach

The set of standardized exclusions used in the EURO STOXX 50 ESG Index were introduced in a first generation of ESG-compliant benchmarks last November. That family includes the STOXX® Europe 600 ESG-X Index and the EURO STOXX 50® ESG-X Index. The indices only apply those standard exclusions and seek to provide asset owners with benchmarks beyond the traditional market-capitalization-weighted index for their responsible portfolios.

ESG moving to center stage

Experts at STOXX’s Innovate2Invest conference in London in May agreed that ESG indices are likely to become the benchmark for many asset owners in coming years, with the key role played by traditional market-cap-weighted indices being taken over by ‘market-cap-plus-ESG’ versions.

The new EURO STOXX 50 ESG Index aims to occupy that space for the pioneers already looking to align their core portfolios along responsible lines.

Featured indices

1 Eurosif, “European SRI Study 2018.”