The EURO STOXX 50® ESG Index was introduced in May 2019 as a sustainable alternative to the flagship EURO STOXX 50® Index. The ESG index follows norms- and product-based exclusions, and integrates companies’ ESG scores into the stock selection, resulting in a more comprehensive sustainable index whose risk and return profile resembles that of the benchmark.

In February 2021, Qontigo launched a market consultation on proposed changes to the EURO STOXX 50 ESG’s methodology, aimed at keeping the index aligned with evolving sustainability practices and new guidelines from regulators. The approved overhaul was announced in March (with further changes announced in April) and implemented at the June quarterly index review.

The changes

Key changes include increasing the number of replaced stocks to 20% of benchmark constituents, from 10%, through the removal of ESG score-based laggards and of sustainability screens violators.1 Two new exclusions — companies involved in military contracting and in tobacco distribution — were also introduced.2

The overhaul also changed the replacement process with the goal of increasing the overall ESG score of the resulting index. Companies with the highest free-float market capitalization adjusted by ESG score are now selected, as compared to just the highest free-float market cap previously.

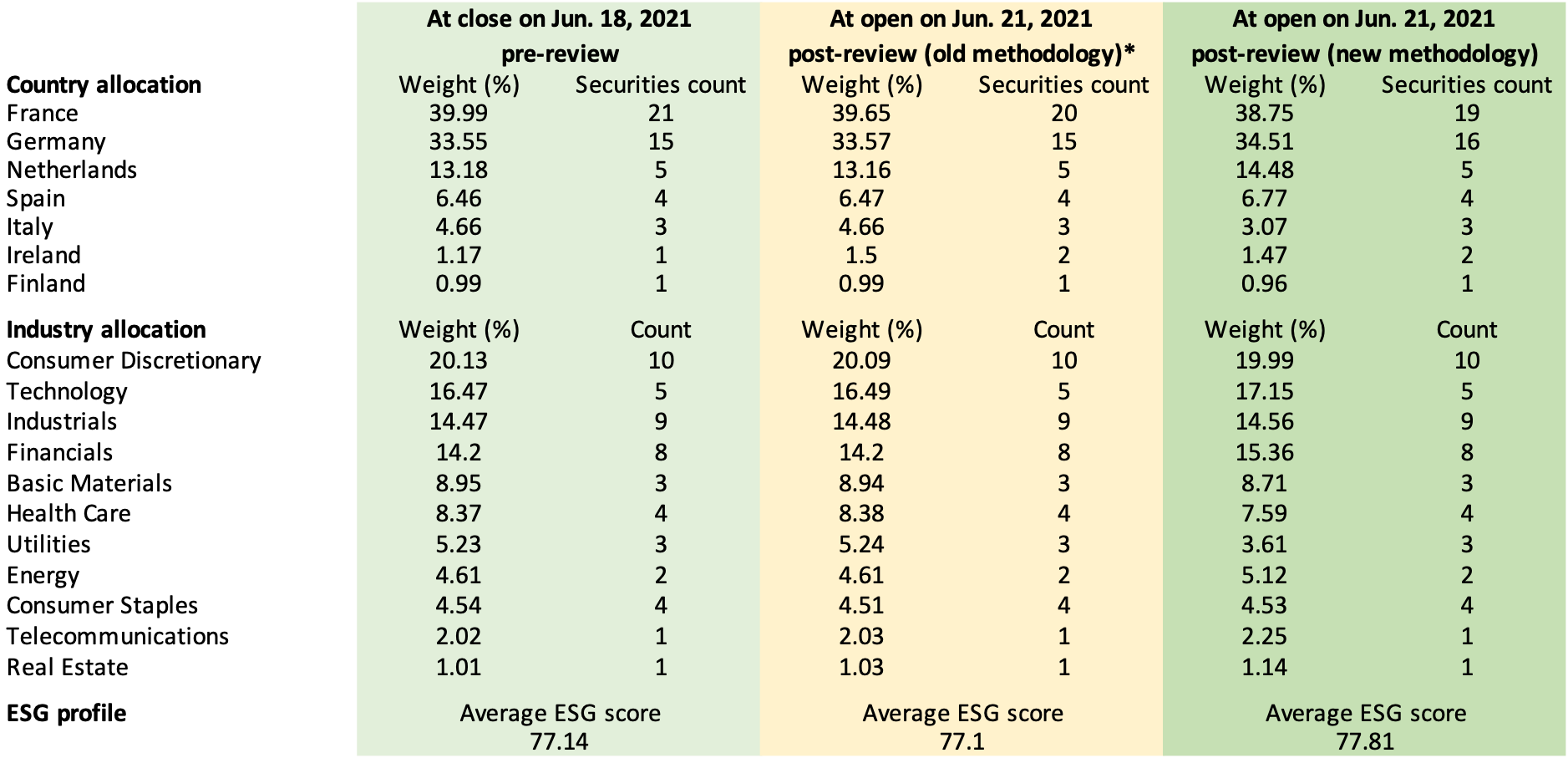

Table 1 shows the EURO STOXX 50 ESG’s country and industry weights, as well as its ESG score, before the Jun. 18 review this year (in light green). Next, we feature a comparison of allocations and ESG score after the review (on Jun. 21), first showing simulated statistics using the old rules (yellow) and then actual composition following the methodology changes (dark green).

Table 1 – EURO STOXX 50 ESG Index: effect of new rules

The new methodology has improved the ESG profile of the index, the data show. At the same time, the index has maintained a similar country and industry composition after the rules update. The latter is to be partly expected: the EURO STOXX 50 ESG Index aims to keep an industry exposure that is aligned with that of the benchmark, by replacing ESG underperformers with companies from the same ICB Supersectors that are constituents of the broader EURO STOXX® Index.

New weighting cap factors

The rules update has also incorporated a new weighting cap formula to the index. Constituent stocks are now weighted by free-float market capitalization, with caps on the lowest ESG-scoring companies. This seeks to raise the EURO STOXX 50 ESG Index’s weighted-average ESG score above the corresponding score of the EURO STOXX 50 Index minus its 20% worst ESG-scorers.

Performance

One interesting point evolves around index performance. The EURO STOXX 50 ESG has returned over 5 percentage points more than the benchmark in the three years to Jun. 30, 2021. As mentioned, such outperformance is not an intended feature of the ESG index’s design and goals. The extra returns may either reflect investors’ preference for companies with higher ESG scores, or be an indication that those companies also have better operations and management.

| Download our whitepaper: EURO STOXX 50®ESG – Liquidity and Tradability Characteristics |

ESG mandates continue to grow and expand

The EURO STOXX 50 ESG Index is part of Qontigo’s STOXX sustainability index solutions, which cover an extensive range of ESG targets and strategies. The index belongs to a second generation of sustainability indices that offer an alternative to investors who want to go beyond standard investment exclusions to increase further their portfolios’ ESG portfolios. It serves as underlying for two ETFs, structured products, and for futures and options listed on Eurex.

With the latest methodology update, we ensure that the EURO STOXX 50 ESG Index is up to pace with an evolving ESG landscape, a key objective for Qontigo as more investors and asset owners increase their sustainability uptake and ambition.

1 The EURO STOXX 50 ESG Index excludes 20% of EURO STOXX 50 components in the following process: A set of exclusion criteria is applied to the EURO STOXX 50 Index, screening out companies that fail Sustainalytics’ Global Standards Screening assessment, or are involved in controversial weapons, military contracting, tobacco production and distribution, and thermal coal. Thereafter, from the remaining companies of the EURO STOXX 50 index, exclude those with the lowest ESG scores until the combined exclusions from both step 1 and 2 amount to 20% of EURO STOXX 50 constituents. In the old methodology, steps 1 and 2 were inversed.

2 The threshold for exclusion due to thermal coal involvement has been adjusted to more than 5% of revenues from thermal coal extraction, including thermal coal mining and exploration (from more than 25% previously); and to more than 5% of power generation capacity: coal-fired electricity, heat or steam generation capacity/thermal coal electricity production, including utilities that own or operate coal-fired power plants (from more than 25% previously).