Eurex is listing futures tracking 12 STOXX® Industry Neutral Ax Factor Indices covering the European and US markets, allowing investors to target well-researched and robust factor strategies relying on Axioma’s Risk Models and optimization tools.

The STOXX Industry Neutral Ax Factor Indices are derived from two well-established market-capitalization regional benchmarks, the STOXX® Europe 600 Index and STOXX® USA 500 Index, offering a consistent methodology and factor definitions across regions. The indices track six styles: Value, Momentum, Size, Low Risk, Quality and Multi-Factor. The futures will start trading on Apr. 26, Eurex said in a press release.

The STOXX Industry Neutral Ax Factor Indices were introduced in February and implement the same methodology of the STOXX® Factor Indices while reducing the active industry constraint from +/- 5% to near neutral. In all but eliminating industry deviations, the STOXX Industry Neutral Ax Factor Indices may sacrifice some factor exposure, but benefit from targeting lower levels of active industry risk, further reducing what investors may consider unintended exposures.

The STOXX Factor Indices and STOXX Industry Neutral Ax Factor Indices rely on Axioma’s proven factor models. They are built using widely accepted and institutionally tested factor definitions and Axioma’s advanced portfolio-construction tools and risk models. The STOXX Factor Indices maximize the exposure to the targeted factor while constraining the exposure to non-targeted factors.1

To read more about the Industry Neutral Factor indices and review an analysis of returns, visit a recent blog post here. For a whitepaper exploring the standard STOXX Factor Indices, click here.

Return analysis of the Industry Neutral Factor indices

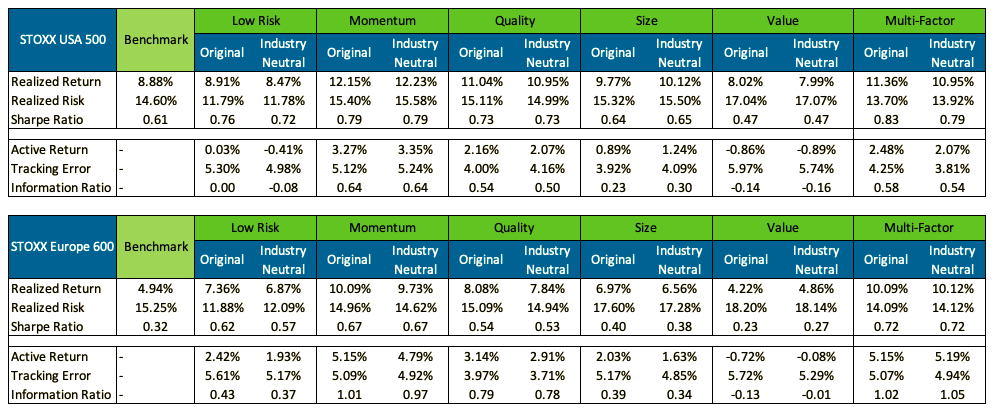

Exhibit 1 displays the returns and realized risk for the Industry Neutral Factor indices and the standard STOXX Factor indices derived from the STOXX Europe 600 and STOXX USA 500 benchmarks. In Europe, all but one of the factor indices outperformed their benchmarks during the period considered. In the US, all but two of the factor strategies beat the market.

Exhibit 1 – Annualized risk and return analysis since start of 2002

Constraints and caps to ensure portfolio liquidity and tradability

All STOXX Factor indices have single-stock weight caps2 and the effective number of constituents is set to represent at least 30% of that of the benchmark to ensure adequate diversification. Besides the industry weighting limitations discussed earlier, they cap the country exposure deviation from the benchmark at 5% and limit the tracking error to a maximum of 5%.

Other constraints are employed to ensure liquidity and tradability. There is a minimum weighted average days-to-trade ratio threshold for securities to avoid material build-ups in illiquid positions. The indices also have a 12.5% one-way turnover constraint per quarter, meaning that a maximum of 12.5% of the current index weight can be changed to meet the overall index objectives, using the latest data as of the quarterly review dates.

Multi-Factor

The STOXX Multi-Factor indices offer a diversified exposure to the individual factors. They are built in two steps. Firstly, for every security an aggregate multifactor score is computed, defined as the average of the individual factor scores. The portfolio construction process then seeks to maximize exposure to the multifactor score.

The STOXX Industry Neutral Ax Factor Indices are reviewed quarterly together with the parent index and rebalanced after the close of the third Friday in March, June, September and December, coinciding with the expiration of futures.

Facilitating the access to risk premia

Factor-based investing has become one of the most popular indexing segments in recent years. The new futures bring an innovative alternative to access the strategies, combining proven sources of risk premia, a transparent and state-of-the-art index methodology, and the cost-efficiency, safety and simplicity that exchange-traded and centrally-cleared listed derivatives provide.

Explore the new futures’ indices:

STOXX® Europe 600 Industry Neutral Ax Value Index

STOXX® Europe 600 Industry Neutral Ax Size Index

STOXX® Europe 600 Industry Neutral Ax Quality Index

STOXX® Europe 600 Industry Neutral Ax Multi-Factor Index

STOXX® Europe 600 Industry Neutral Ax Momentum Index

STOXX® Europe 600 Industry Neutral Ax Low Risk Index

STOXX® USA 500 Industry Neutral Ax Value Index

STOXX® USA 500 Industry Neutral Ax Size Index

STOXX® USA 500 Industry Neutral Ax Quality Index

STOXX® USA 500 Industry Neutral Ax Multi-Factor Index

STOXX® USA 500 Industry Neutral Ax Momentum Index

STOXX® USA 500 Industry Neutral Ax Low Risk Index

1 a) Untargeted style factors (single factor indices only): The parent index’s exposure to each factor is computed and the single factor index is constrained to be within a quarter standard deviation of that. These constraints make sure the index is closely related in structure to the parent index for the style factors that are not being targeted. b) Outliers (multi-factor only): The Multi-Factor index will not hold any overweight in constituents in the worst 5% with respect to the targeted style factors. c) Factor backstop exposures (Multi-Factor only): The parent index’s exposure to each factor is computed and the Multi-Factor index will not hold negative exposures to any of the targeted style factors.

2 Individual capping: The indices apply constraints such that maximum weights (4.5% / 8% / 35%) are not exceeded at index review, whereby the weight of a constituent cannot surpass 8% and the sum weight of those constituents above 45% cannot exceed 35%.