Eurex has listed weekly options on the pan-European STOXX® Europe 600 index amid growing demand for derivatives for flexible portfolio hedging and management.

The contracts started trading on June 24 and come as volumes for the traditional quarterly and monthly options tracking the European benchmark have increased. Up to six weekly contracts of the new options have been listed, with Friday as the expiration day, Eurex has said. The exchange has also added three monthly contracts on the index with month-end expiration.

Shorter-dated options are an innovative product that allows traders a more targeted exposure than the traditional monthly and quarterly expiries, providing increased flexibility to trade and implement specific views and strategies around short-term market fluctuations. Eurex has recently introduced daily options on the Eurozone’s EURO STOXX 50® index and Germany’s DAX®, adding to existing weekly contracts.

For the STOXX Europe 600, the new options further expand a comprehensive investment ecosystem in the listed derivatives space. Almost 47 million futures and options on the benchmark and its subsets were traded on Eurex in 2023, with nearly EUR 1 trillion in notional volume. The contracts include STOXX Europe 600 sector, size and sustainability strategies.

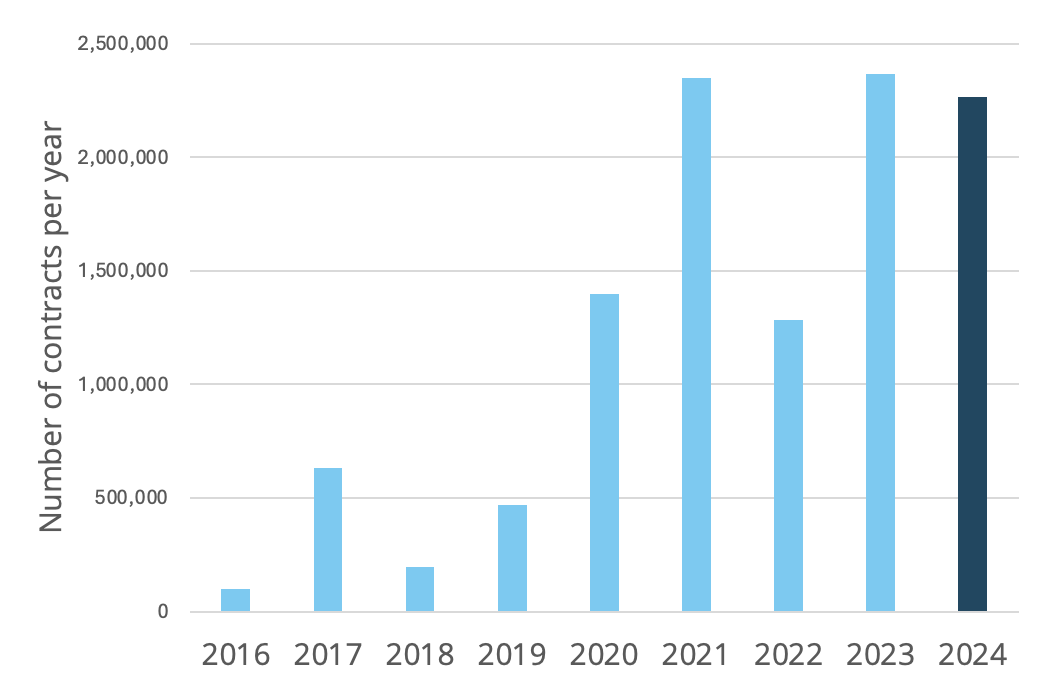

Already in the first five months of 2024, nearly all of the entire 2023 volume in STOXX Europe 600 options has been traded (Figure 1).

Figure 1: STOXX Europe 600 options (OXXP) traded on Eurex

Find out more about the STOXX Europe 600 trading ecosystem here.