Eurex has introduced mid-curve[1] options (Eurex product ID: OED1-5) on EURO STOXX 50® index dividend futures, expanding a popular derivatives offering.

The options on EURO STOXX 50® Index Dividend Futures (FEXD), which track the EURO STOXX 50® DVP (Dividend Points) index, were listed on February 5. The new contracts have quarterly expiries and will help transfer trading that currently takes place off-exchange onto the regulated market, Eurex, the world’s largest exchange for dividend derivatives, has said.

Index dividend futures are popular derivatives that allow investors and traders to gain exposure on the direction of corporate payments and to hedge their portfolios’ dividend risk.

The EURO STOXX 50 Index Dividend Futures are based on the underlying calculation of dividends for the constituents of the EURO STOXX 50 Index, the benchmark for the Eurozone’s largest stocks. Over 5.3 million contracts were traded in 2023, for a notional volume of nearly EUR 72 billion.

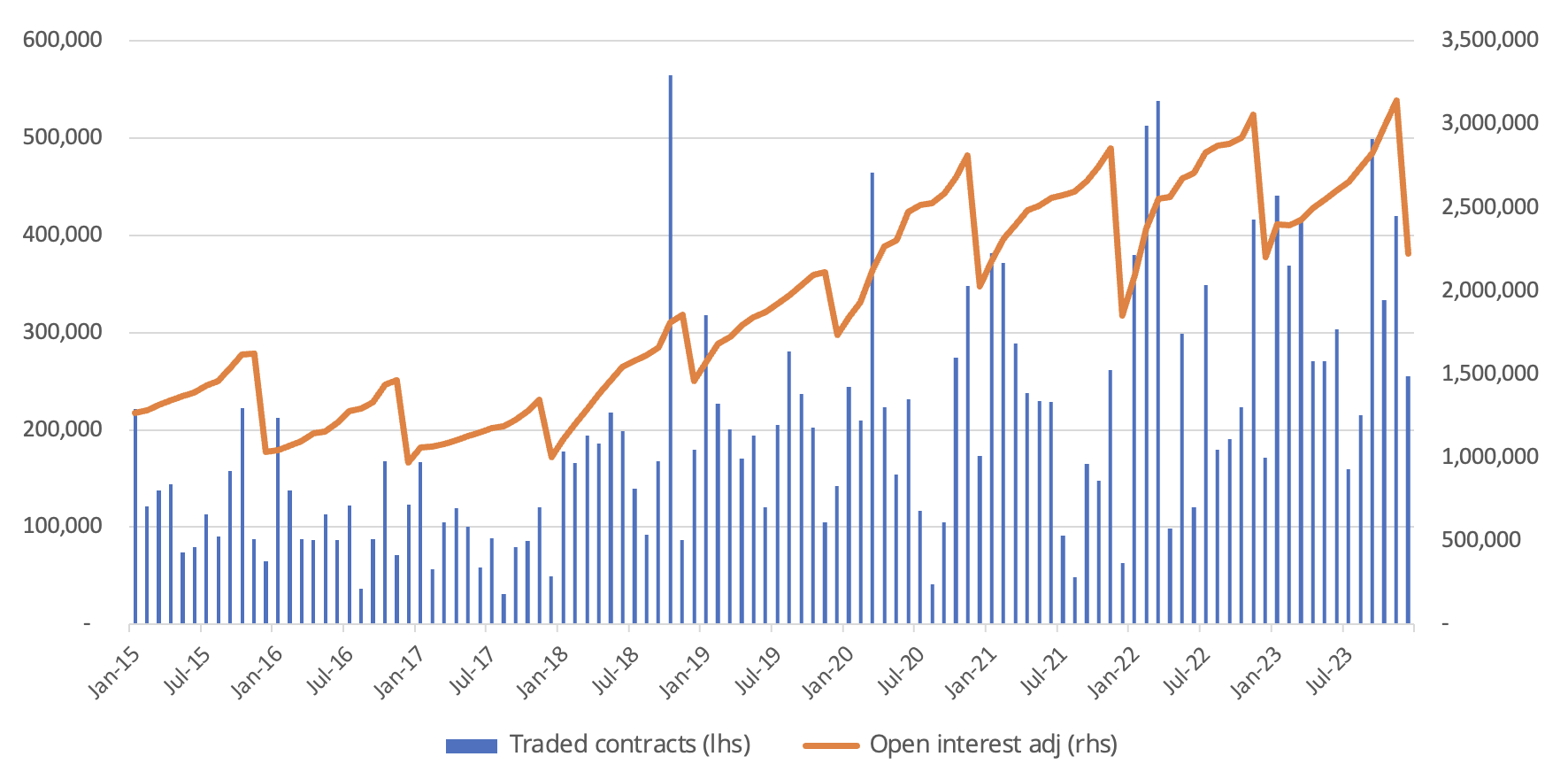

While there already exist options on the underlying index, these have an annual expiration. Options on the futures will give market participants a more targeted instrument, around a quarterly cycle. More than 3.8 million EURO STOXX 50® Index Dividend Options (OEXD) contracts were traded in 2023, a 12% increase from 2022 (Figure 1). Open interest in the contracts stood at 2.1 million at the end of December.

Figure 1 – Trading volume and open interest on EURO STOXX 50 Dividend options

[1] Mid-curve options is the generic name for listed options that expire into an underlying future that has a longer expiry date than the next settling future.