After several years of extraordinary performance, the oil and gas industry cooled off in 2023, as energy prices slid from the peaks that followed the Russian invasion of Ukraine.

Diana R. Baechle, PhD, is a Principal at Qontigo and part of the Applied Research team. Her research is focused on equites.

Nonetheless, energy majors have posted outstanding first-quarter results and the industry is still exhibiting strong attributes in the form of high earnings and dividend yields, profitability and value. These are trending factors and, therefore, ones that long-term investors seek exposure to.

Changing landscape

The COVID-19 pandemic was a pivotal moment for oil and gas. According to the Boston Consulting Group, in 2020 the industry exited the “Greening Era (2016-2019)” — which prioritized environmental issues — and entered the “Energy Trilemma Era,” which focuses on a secure, affordable and sustainable energy supply.[1] That is, the development of a global energy crisis prompted governments to intervene and put downward pressure on energy prices, as resource affordability is essential to a functional economy. At the same time, European nations reevaluated the importance of having a secure energy source on the heels of a new war in the region. Both pressures allowed for a more lenient view of fossil fuels. However, European oil and gas companies still need to prioritize the transition to green energy to adhere to regional regulations.

Amid falling oil and gas prices between 2016 and 2019, companies reduced exploration and production (“upstream”) capital spending and expanded their green energy capabilities, particularly as wind and solar technologies became less costly. The 2015 Paris Agreement prompted a reprioritization of environmental targets, which further contributed to the decline in energy prices and stock values.

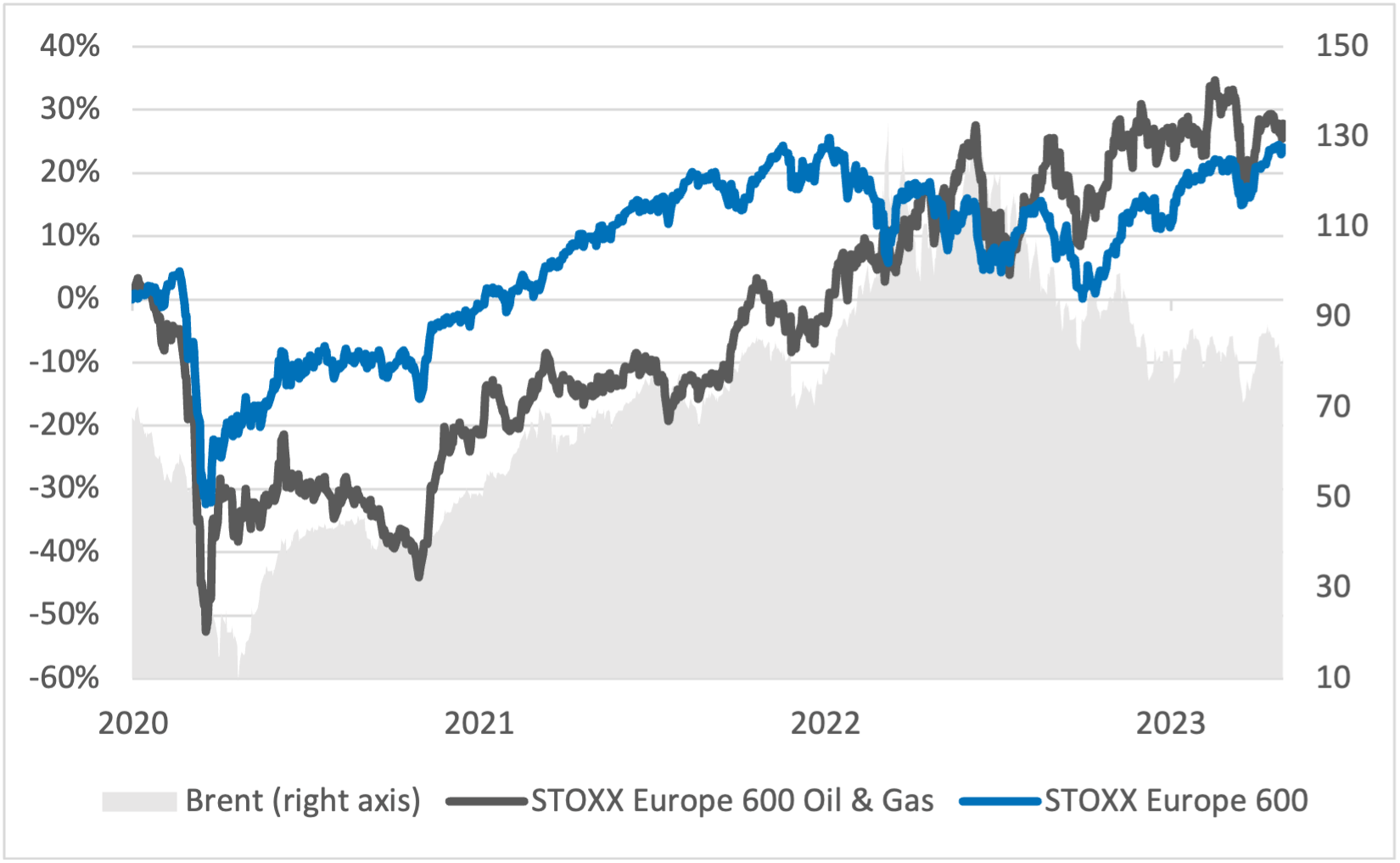

In the first quarter of 2020, the shutting down of economies resulted in a historic oil and gas demand shock, which sent energy prices and company stocks plunging. The STOXX® Europe 600 Oil & Gas index (Oil & Gas index) was hit harder than the European market (as represented by the STOXX® Europe 600). By March 18, 2020, the Oil & Gas index had more than halved in value since the beginning of that year, while the European market fell “only” 30% over the same period (Figure 1).

Figure 1: Index performance 2020 – 2023

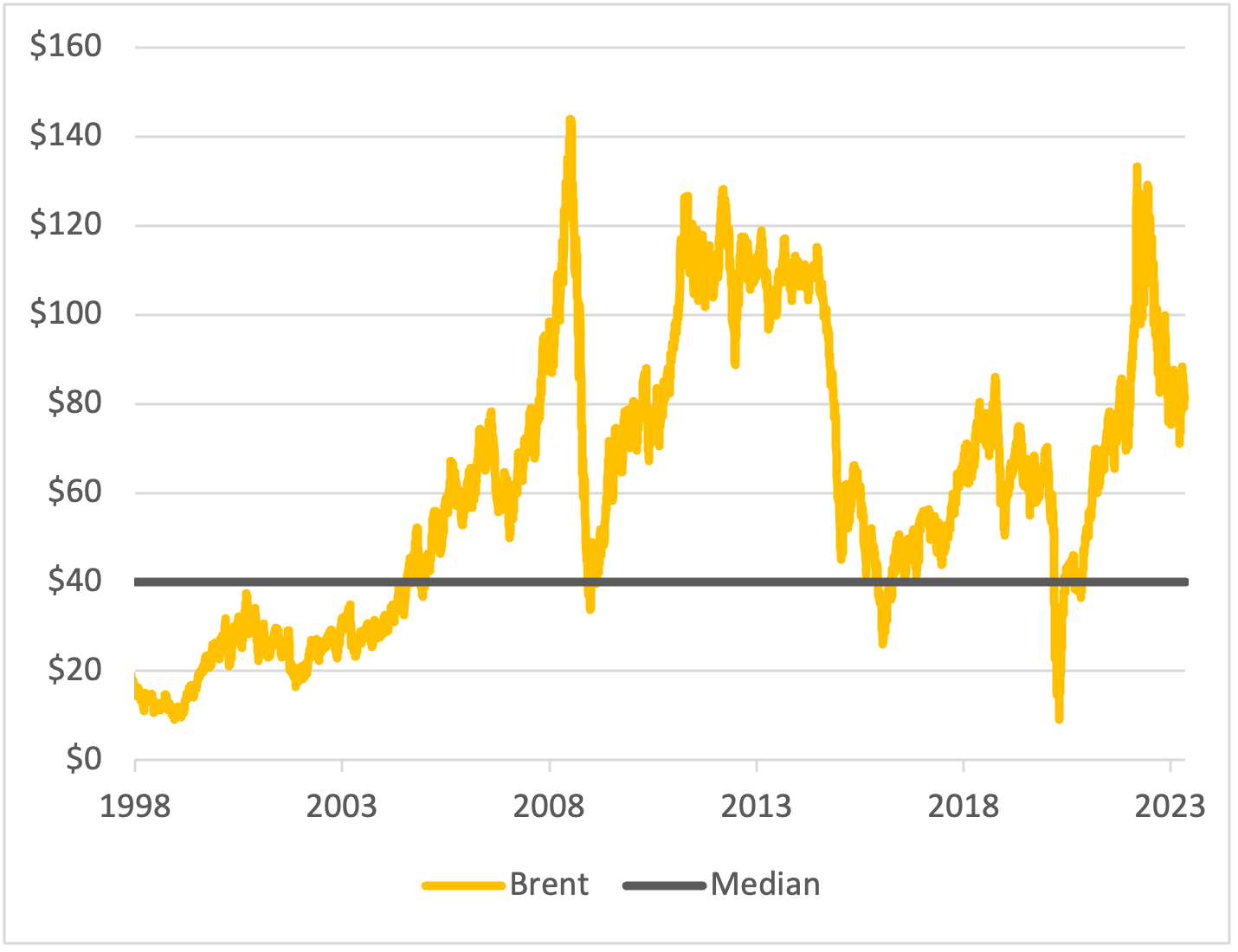

As the global economy recovered, driving up demand, energy prices rebounded. The Russia-Ukraine war exacerbated the increase, especially as Europe has strived to decrease its dependence on Russian fossil fuels. Brent crude, the global oil benchmark, shot up to around USD 130 per barrel in March 2022, the second-highest level in over two decades (Figure 2).

Since their March 2022 peak, however, oil prices have come down precipitously as a potential slowdown in global economic growth — driven by central banks’ interest rate increases — weighed on the perspectives for demand. Oil prices continued to fall in 2023, undermined by a mild winter and a deceleration in manufacturing and trade from the higher interest rate regime. Even as China’s economy finally reopened this year and has been utilizing more fuel, it seems to be rebounding more slowly than expected. The U.S. banking crisis has also added support to the idea of a global recession.

Yet, Brent crude has remained around USD 80 per barrel, well above the 25-year median of about USD 40 (Figure 2).

Figure 2: Brent price

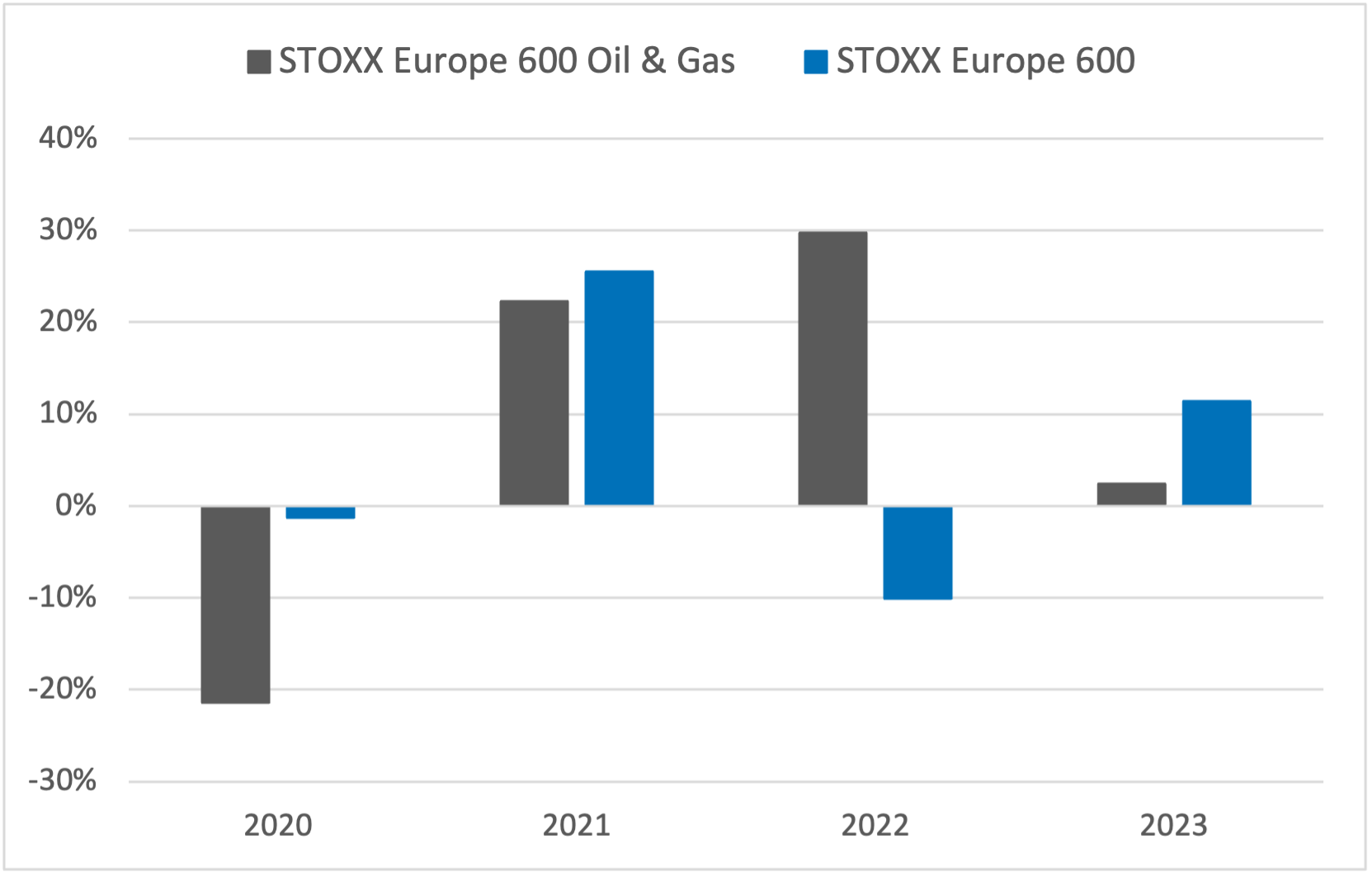

After sinking more than 20% as a group in 2020, European oil and gas companies raked in huge earnings as energy prices skyrocketed. The Oil & Gas index gained 22% in 2021 and jumped 30% in 2022. The further decline in oil prices this year has been reflected in the modest increase of 2% in the industry index — a nine percentage points underperformance versus the European benchmark (Figure 3).

The STOXX Europe 600 Oil & Gas index outperformed the benchmark for the Jan. 1, 2020 – Apr. 28, 2023 period by 400 basis points in cumulative terms.

Figure 3: Annual returns

Strong fundamentals

Although some oil and gas shares slipped in 2023, Europe’s biggest oil companies and largest constituents in the Oil & Gas index (TotalEnergies, Royal Dutch Shell, BP) have posted gains, and have reported better-than-expected first-quarter results.

Most share value losses in the index this year were among providers of energy equipment and services. This is not surprising given the industry’s efforts to reduce capital expenditure and protect profit margins in times of falling energy prices.

The Oil & Gas index has shown higher earnings and dividends yields, and has had better profitability and value profiles, than those of the overall European market this year.

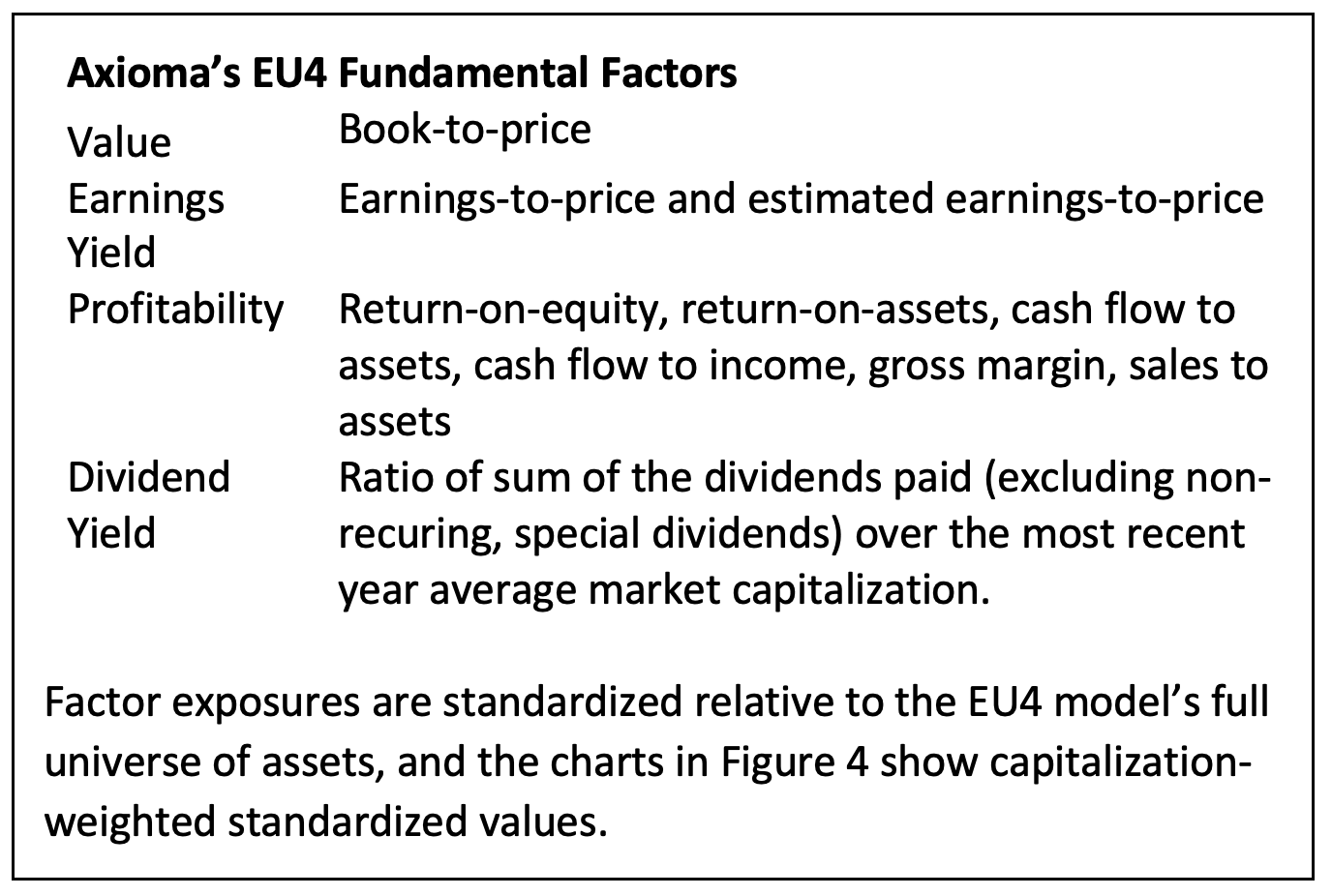

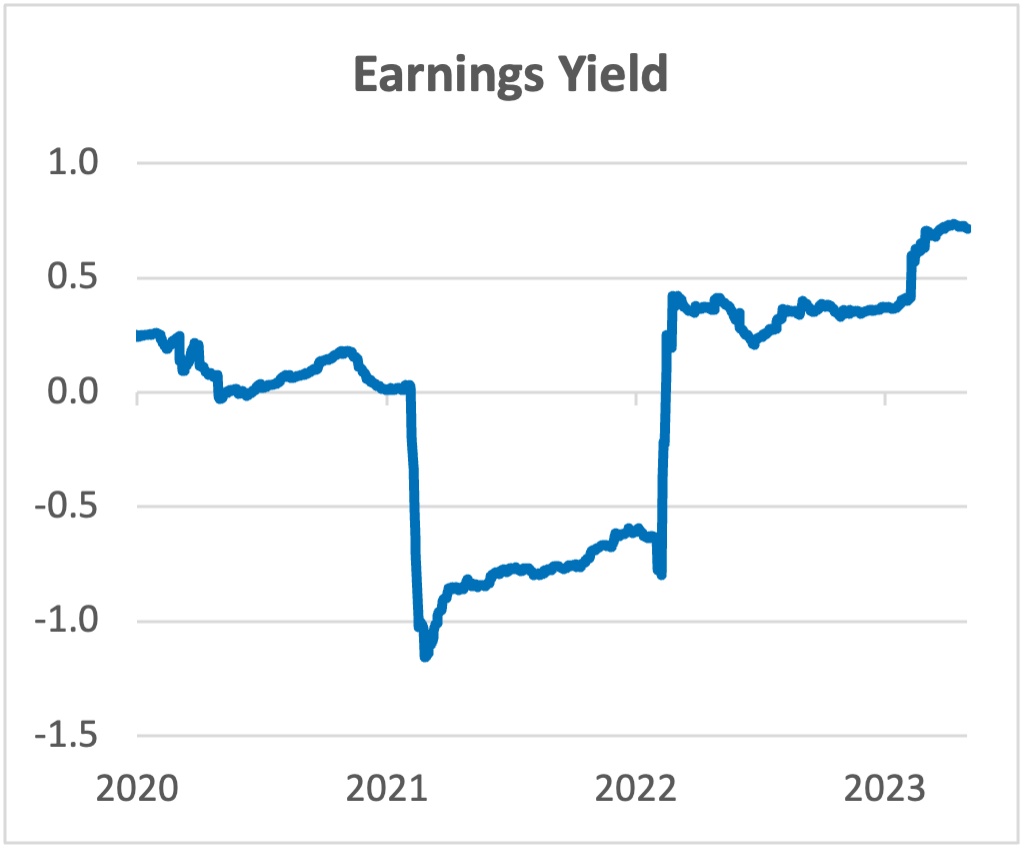

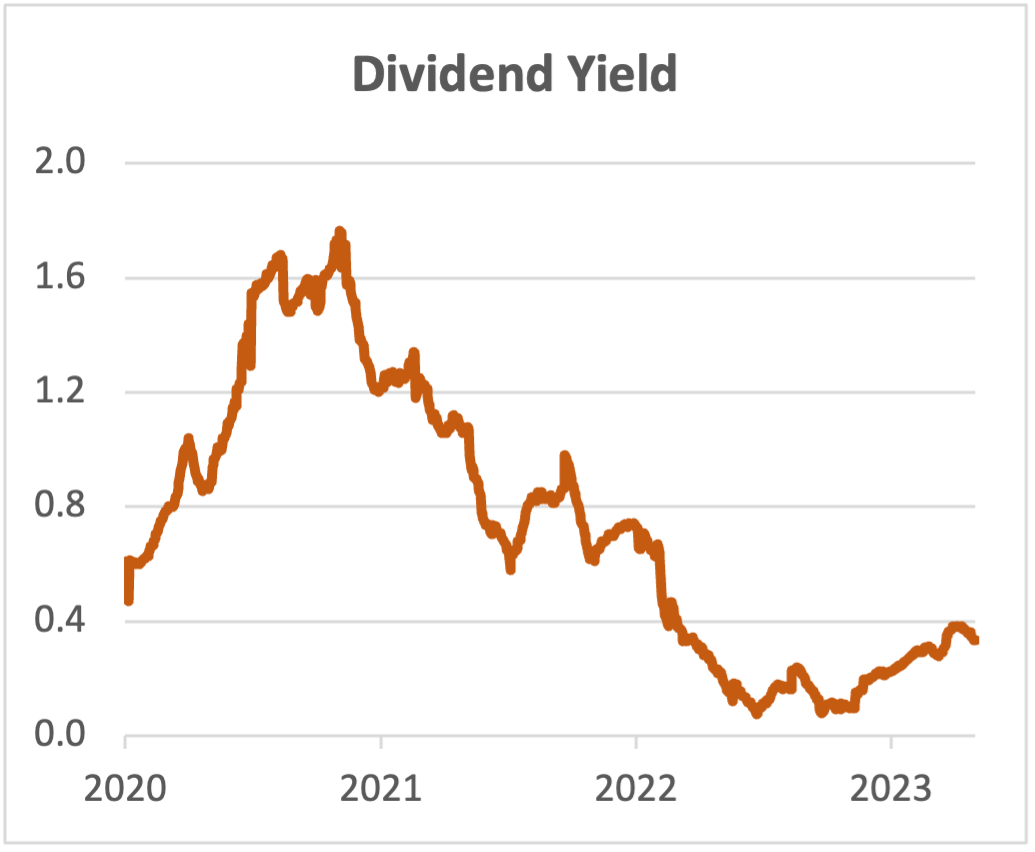

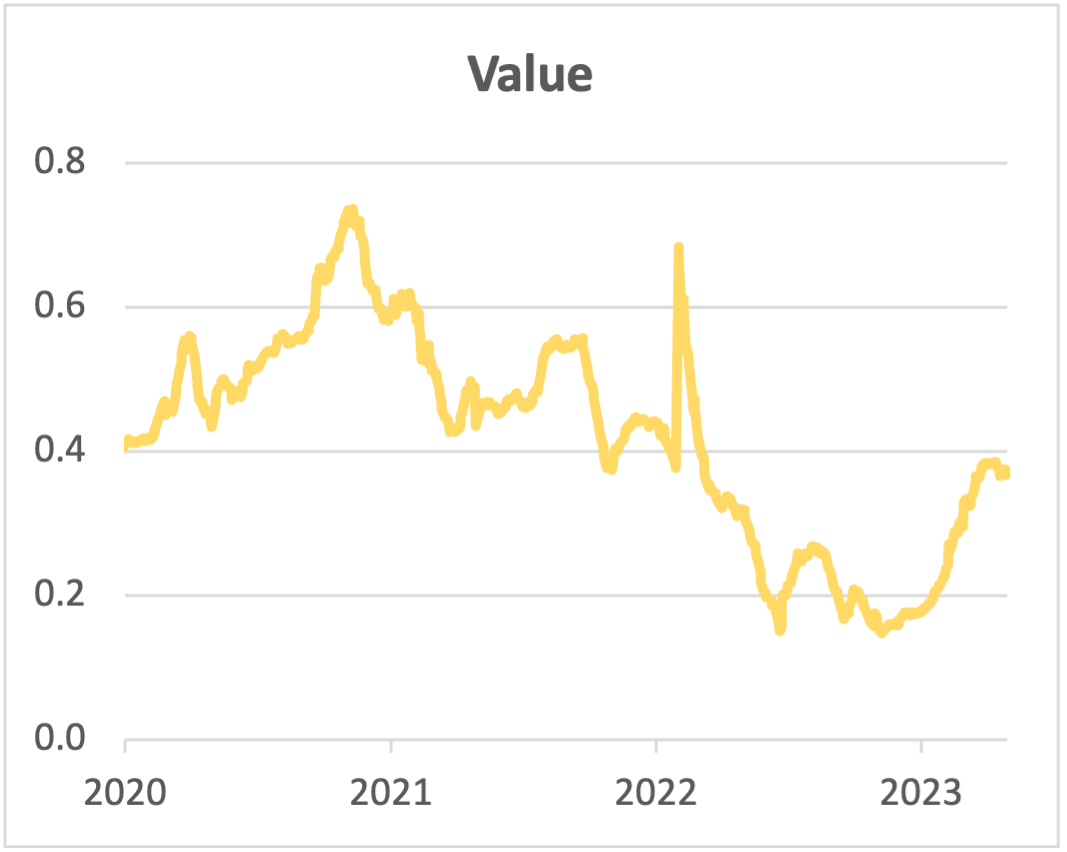

Figure 4 below shows the active exposures of the STOXX Europe 600 Oil & Gas index vs. its benchmark to the Earnings Yield, Dividend Yield, Profitability and Value style factors, using Axioma’s Europe Fundamental Medium-Horizon Risk Model (EU4). Positive exposures to all these factors are associated with excess returns over the long term.

The Oil & Gas index has shown better earnings yields than the European market since February 2022, as reflected by the positive active exposure. A similar pattern has been seen for the Profitability factor.

The large dips in Earnings Yield and Profitability active exposures between February 2021 and February 2022 are due to the significant negative earnings and/or cash flow reports in February 2021 (for Q4 2020), which rolled off the model a year later. For example, Shell lost USD 4 billion in the fourth quarter of 2020, compared to nearly USD 1 billion in earnings in the year-earlier report.[2] The company’s profit levels, however, are higher now than they have been for several years.

With cash abundant, oil and gas companies have boosted their dividend payments and stock repurchases. Dividend payouts from European energy companies have topped the average payment of the broader market during the 2020-2023 period, even as they peaked at the end of 2020. After reaching a three-year low in 2022, the Oil & Gas index’s dividend yield relative to market capitalization has risen through 2023.

Finally, although the active exposure in Value is lower than in previous years, it has been positive and rising in 2023. Although focusing more on the US market, this attribute is one that has not been lost on legendary Value investor Warren Buffet.[3]

Figure 4: Active factor exposures[4]

Remaining on solid ground

Despite a changing landscape, the energy industry’s backdrop shows positive underpinnings. OPEC is anticipating stronger global oil demand, and short-term supply constraints could lead to higher oil prices this year.[5] Volatile prices could also boost revenues from the lucrative commodity trading businesses of European companies such as Shell and BP.

In the long term, oil and gas companies need to maintain a balance between the legacy business and investing in green energy. Due to more restrictive regulations in Europe, they have already started diversifying away from fossil fuels, although the majority of their earnings increases in recent years still came from upstream activities. Investments in clean energy could reduce the risk of government action against fossil-fuel producers. Oil and gas companies can also benefit from future energy technologies that could provide less volatile, more reliable income streams.[6]

Conclusion

Three years after the onset of the COVID-19 crisis, the oil and gas industry is operating in a changed landscape than the one before the pandemic. While the move to clean energy remains a priority, the pace of the transition has slowed, as matters of national security and energy affordability have taken center stage.

After two years of rallying, energy stocks have seen a turn in fortunes in 2023 as commodity prices continue to slide. Nevertheless, the STOXX Europe 600 Oil & Gas index has retained some notable, positive attributes. With revenues and cash flows still rich for oil and gas companies, the industry index shows attractive profit and value characteristics for investors in the European energy market.

[1] https://www.bcg.com/publications/2023/report-on-oil-and-gas-tsr-in-volatile-times

[2] https://www.ogj.com/general-interest/companies/article/14197017/shell-loses-217-billion-in-2020-q4-losses-led-by-upstream-segment

[3] https://www.wsj.com/articles/warren-buffett-oil-stocks-berkshire-hathaway-charlie-munger-2c8b12b8?mod=hp_lead_pos3

[4] Analysis as of Apr. 28, 2023, denominated in EUR.

[5] https://oilprice.com/Latest-Energy-News/World-News/OPEC-Raises-World-Oil-Demand-Forecast-For-2023.html

[6] https://www.bcg.com/publications/2023/report-on-oil-and-gas-tsr-in-volatile-times