Corporate dividends have become the latest corner of the market to be affected by the COVID-19 pandemic.

Since the end of February, bellwether European companies including UniCredit, Orange, Anheuser-Busch Inbev, EssilorLuxottica, ING and LVMH Moet Hennessy Louis Vuitton have said they are either slashing or skipping dividends. They are acting in the face of slumping revenue and increased regulator pressure to shore up capital, a reality that was not in the cards until very recently for many well-funded companies.

Overall, dividends from blue-chip European companies may almost halve in value this year, if pricing in the dividend futures market is anything to go by.

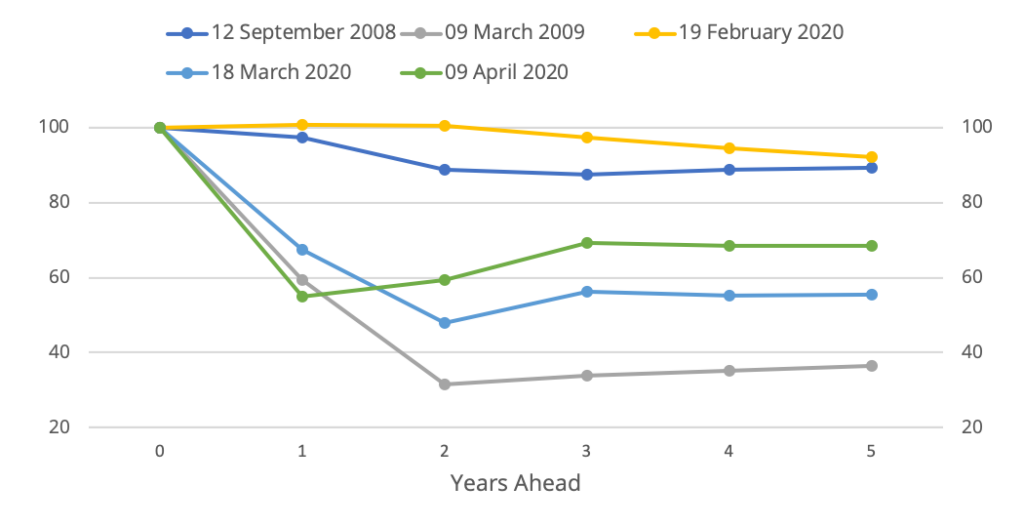

Chart 1 comes courtesy of Capital Economics. It displays actual (shown as 100) and expected trailing 12-month dividends in the EURO STOXX 50® Index at five points in time: two during the global financial crisis (Sep. 12, 2008, around the time of Lehman Brothers Holdings’ collapse; and Mar. 6, 2009, when the Eurozone index reached a bottom). The three other time points belong to this year: Feb. 19, when the index peaked; Mar. 18, when it troughed for 2020; and Apr. 9 to capture the rebound since then.

Chart 1

Chart 1 shows that on Feb. 19 this year (yellow line) investors were expecting to receive by December 2020 roughly the same amount in annual dividends as they did in December 2019, according to Capital Economics’ analysis of dividend futures data. However, the picture had taken a considerable turn for the worse by Mar. 18 this year (light blue line), when traders were pricing in a 33% slash in dividends in the first year, and a cumulative 52% drop by the second year.

By Apr. 9, following a rebound in share prices, some of the pessimism around dividend payments had also waned, at least as reflected in the later maturities in the expirations curve. Investors still expect dividends to fall by more than 40% this year — a more bearish view than even the one they had in the depths of the global financial crisis — but they now see a slight rebound in 2021 and a further recovery in 2022. That said, by 2022 total dividends would still be worth around 30% less than those in 2019, the chart shows.

A source of stable income

Dividends are traditionally less volatile than earnings growth, as companies tend to hoard up cash during good times to reward shareholders in equal form when business slows down. Companies resist cutting dividends unless it’s imperative, because of the negative message the move sends. At the same time, dividends are an important factor underpinning equities as many income investors and pension funds are attracted to the stable cash flows.

Dividend index points

The EURO STOXX 50® Index Dividend Futures are based upon the underlying calculation of dividends for the constituents of the EURO STOXX 50 Index, the benchmark for the Eurozone’s largest stocks.

Index dividend futures settle to the annual value of the EURO STOXX 50® DVP (Dividend Points) Index, which calculates the gross cash dividends paid out by constituents during the annual period. On Apr. 20 this year, the DVP Index was 23% below its level at the same time a year earlier.

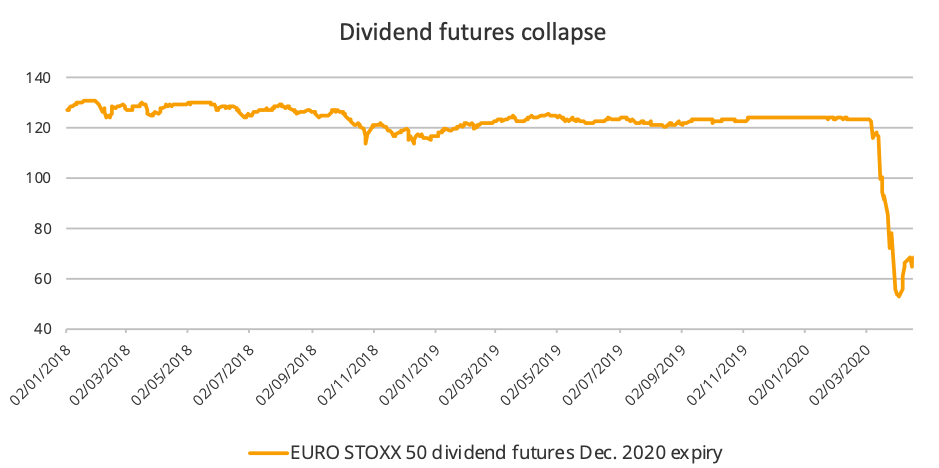

Chart 2 takes a closer look at the evolution of the December 2020 EURO STOXX 50 dividend futures traded on Eurex since the start of 2018. The contracts follow a steady trajectory until they crumble starting in the second half of February this year, touching a bottom in the first week of April. Even after a slight recovery since then, they still imply a 44% reduction in dividend payments this year relative to dividends paid out in 2019.

Chart 2

Such a drop would overshadow the 27% reduction in EURO STOXX 50 dividends in 2009, as measured by the EURO STOXX 50 DVP Index.

Conclusion

Futures are reflecting current expectations of what may occur with dividends this year. Payments may regain ground in 2021, but the pace of any recovery will be dependent on how quickly and vigorously the various national economies can emerge from likely recessions this year.

Featured indices

EURO STOXX 50® DVP (Dividend Points) Index