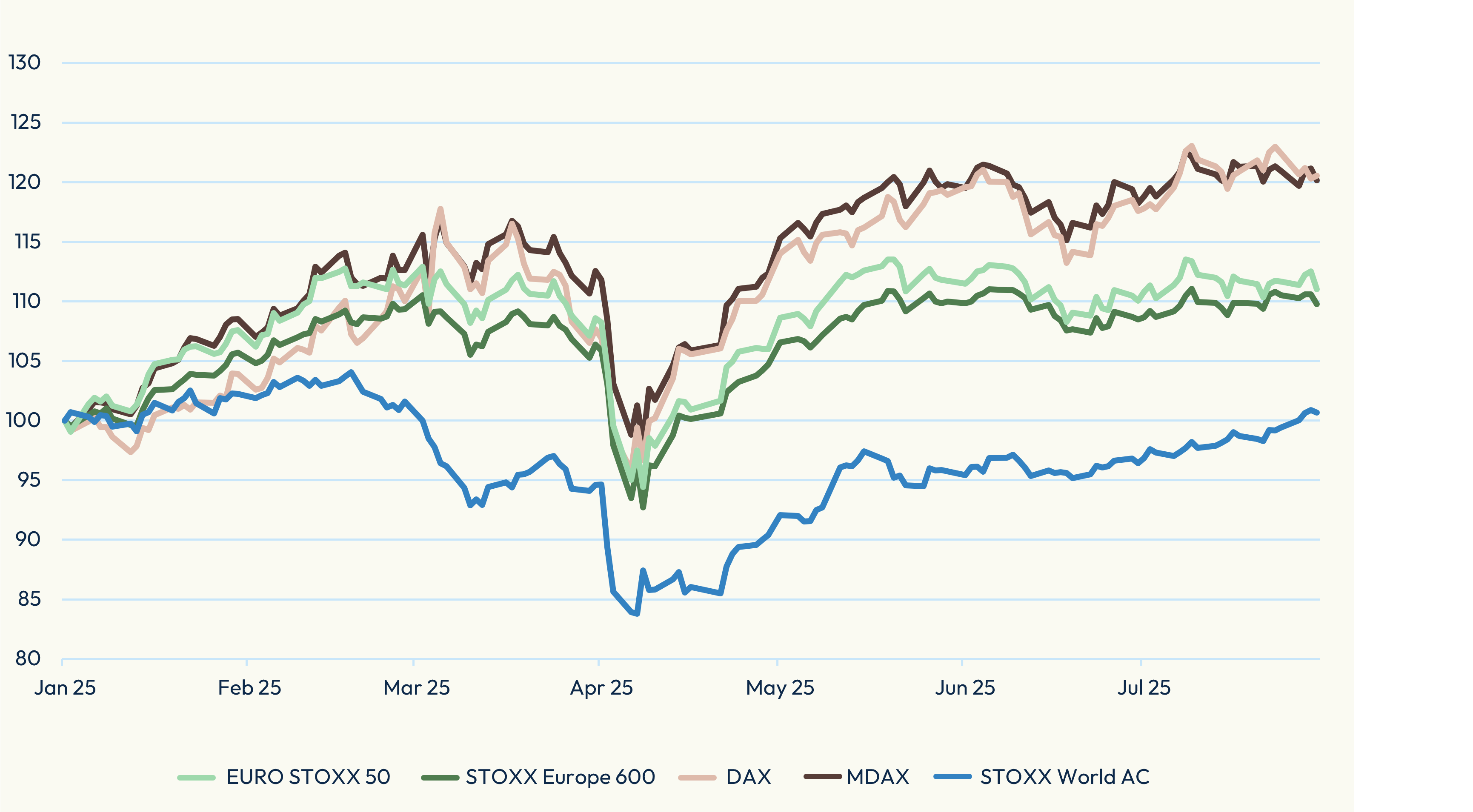

Flows into European stocks have accelerated this year as investors seek a cheaper, more diversified alternative to the US and other markets. Several national and sector benchmarks in the region are on track for their strongest annual returns in years.

In a recent webcast hosted by IPE, Lukas Ahnert, Senior Product Specialist at Xtrackers by DWS, and Arun Singhal, Head of Product Management and Client Success at STOXX, examined the drivers behind this year’s resurgence in European stocks. They also discussed new investment strategies that the two companies have jointly developed.

Figure 1: YTD performance

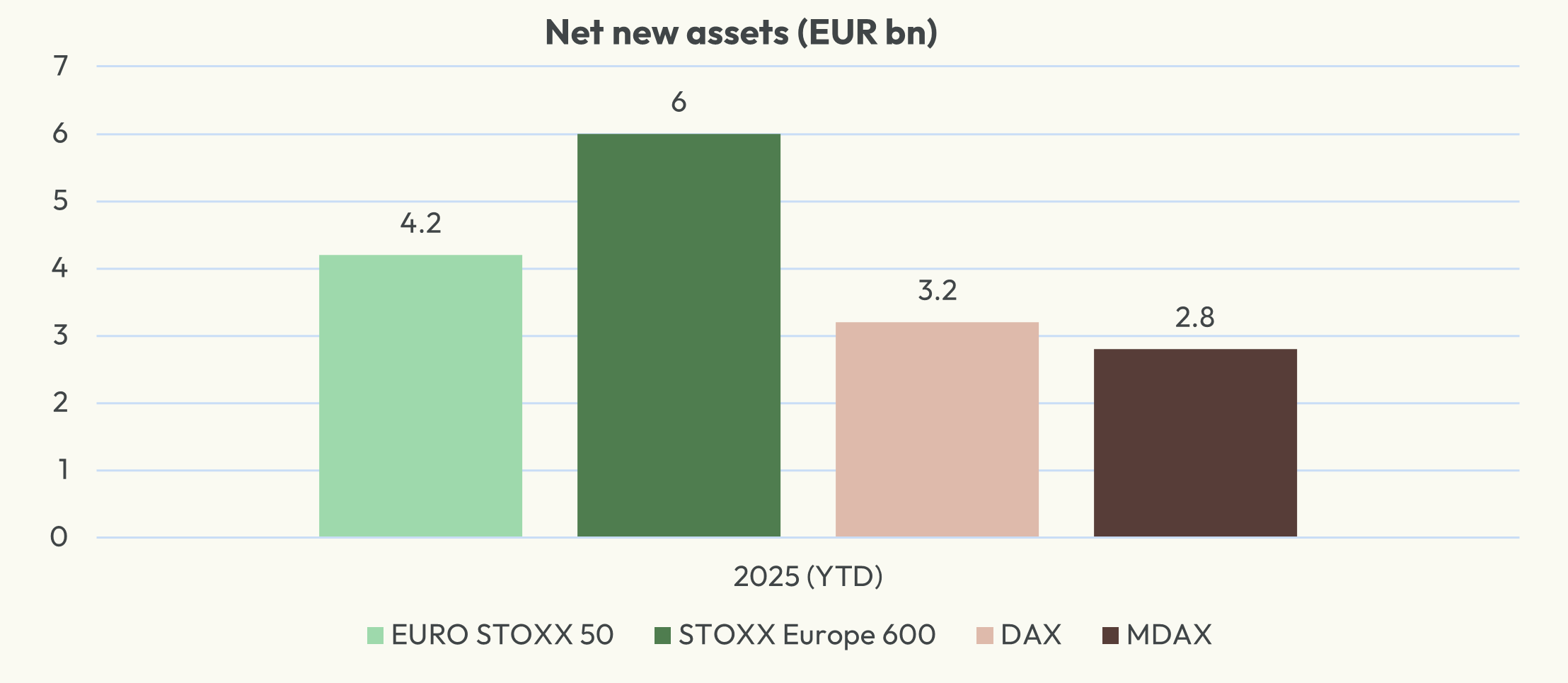

Figure 2: 2025 inflows into European benchmark ETFs

“We’ve seen a change in dynamics – European stocks are back,” said Arun. “With record inflows, some European products have doubled their AuM year over year. Is this a long-term trend? We believe it is.”

Even with this year’s surge in fund flows, global portfolios have not significantly changed their allocations to European equities. As Lukas pointed out, an analysis of UCITS ETF holdings shows that Europe-based investors exhibit little home bias, with 57% of assets allocated to the US — closely tracking global benchmarks.

“Most portfolios are heavily weighted towards the US,” Lukas said. “Europe’s gotten incredibly marginalized over the last decades, and many European allocations are down to 10-15%.”

“The mindset is shifting but the allocations have not yet shifted massively,” he added. “It’s a wake-up call for US-centric portfolios. Investors have allocated more and more towards US markets. That has driven returns nicely over the last decade, but there are challenges from this heightened exposure to the US.”

Prices, diversification

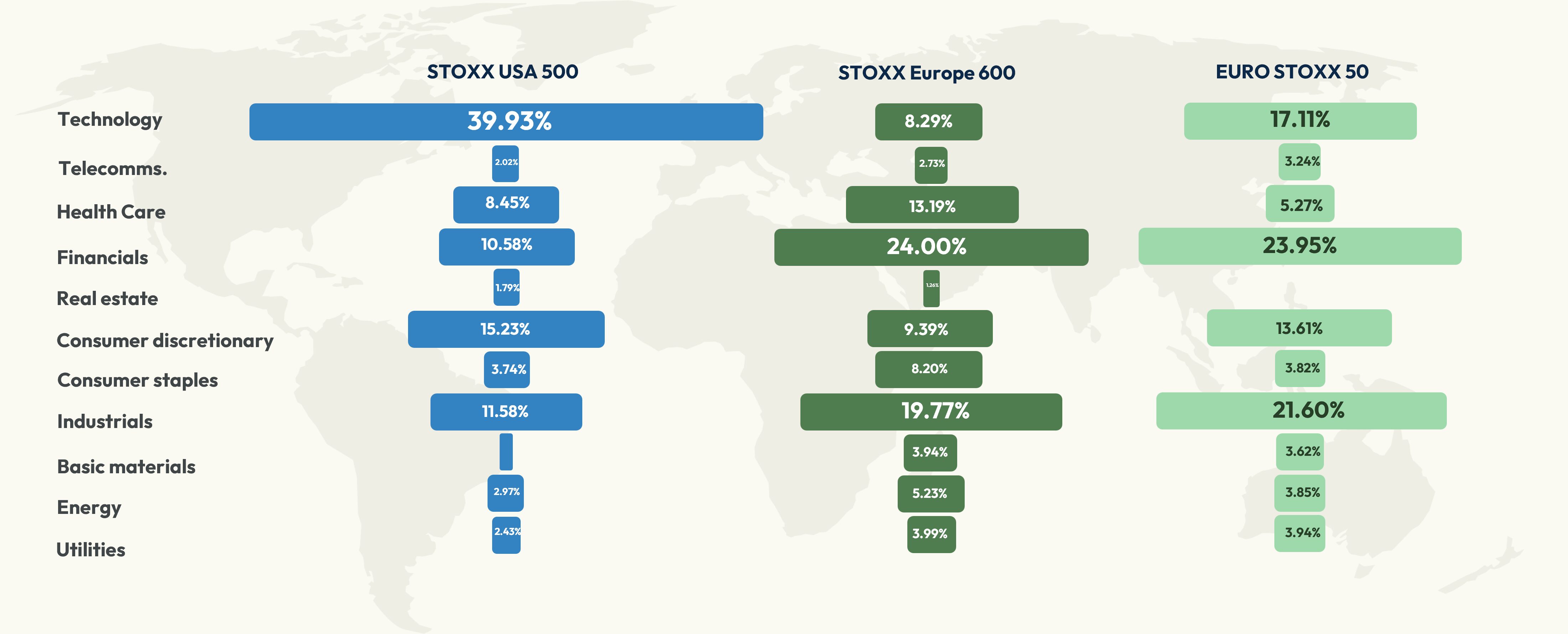

Two of those challenges are stretched valuations and heavy industry concentration, areas where European stocks can offer a useful counterbalance.

Firstly, the STOXX Europe 600 is trading at 15.5 times forward earnings, nearly half the 24.9 ratio for the STOXX USA 500.

Secondly, Technology has come to dominate US markets in recent years, shaping returns to an unusual degree. By contrast, no single sector in Europe commands such sway, with allocations showing a more balanced exposure (Figure 3).

Figure 3: Sector allocation – US vs. Europe

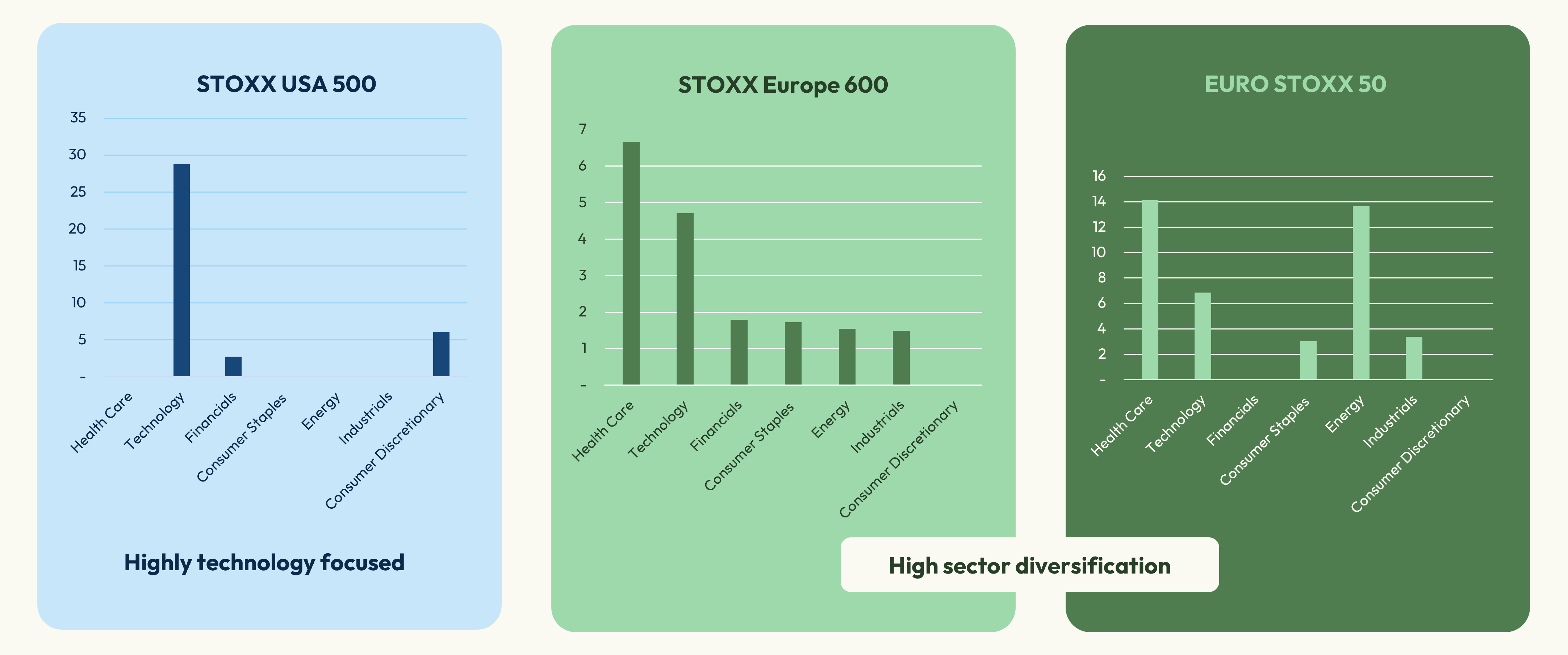

Market concentration in the US is very much a result of the weight that the largest US stocks have accumulated in recent years. In the case of the STOXX® USA 500, the top 10 constituents represent 29 percentage points of the index’s nearly 40% exposure to Technology (Figure 4).

Figure 4: Sector allocation, top 10 constituents – US and European benchmarks

“Europe brings much needed diversification into portfolios,” said Lukas, who added that the region also provides more diversified exposures when it comes to thematic investing.

Pockets of value

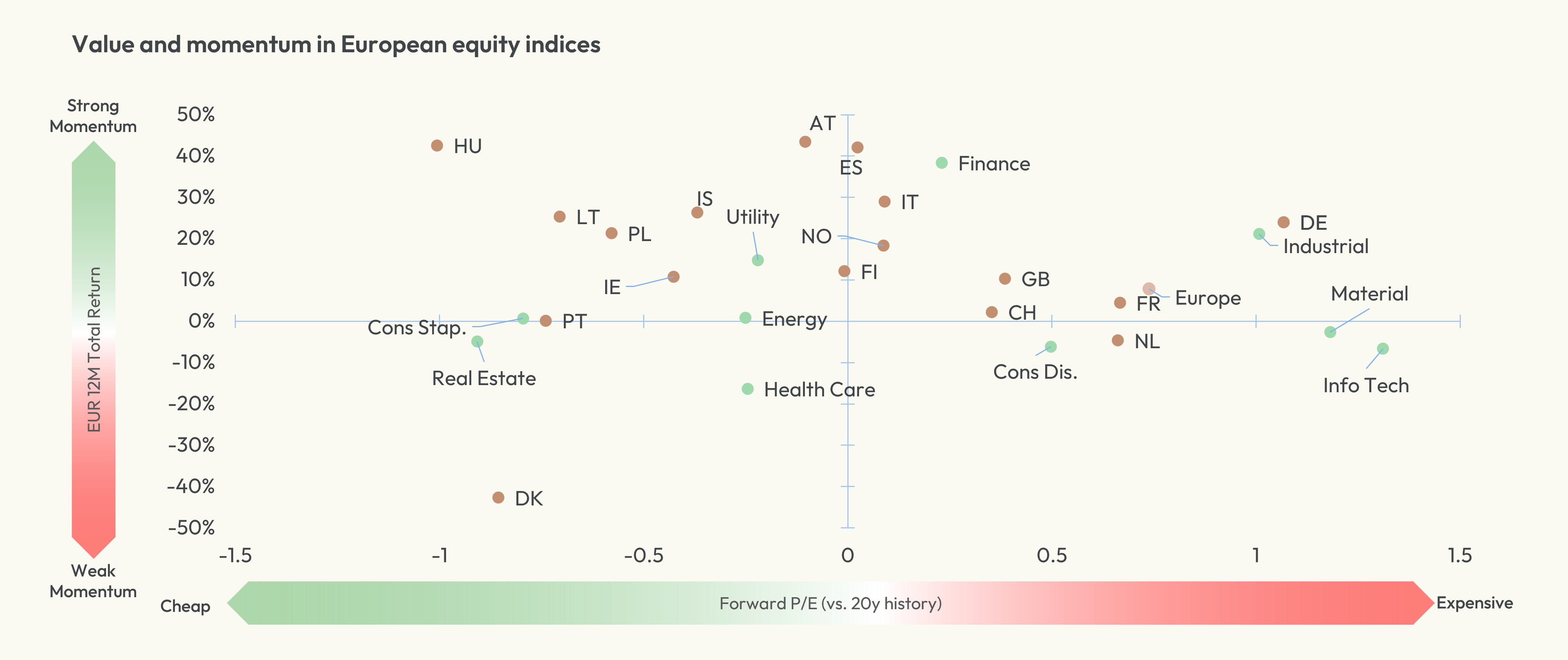

Europe’s breadth means that while regional indices have delivered double-digit gains this year, the strength hasn’t been uniform across countries or sectors (Figure 5). By Lukas’ estimates, roughly two-thirds of European ETF flows this year have gone to major benchmark categories, while only one third has gone into more specialized or select exposures.

“Despite the comeback story in Europe, it has not materialized fully across the region,” said Lukas. “There are still plenty of pockets where valuations remain low and momentum is yet to pick up. What this means is that there is benefit in being selective.”

Figure 5: Value and momentum in European equity indices

Indexing in a new regime

With European equities back in favor, demand for customized solutions has surged, the panelists noted. That set the stage for the second part of the presentation, which explored indexing in a new regime. Index design is becoming increasingly smart and targeted, shaped by shifting market dynamics, technological change and fresh datasets.

Arun and Lukas illustrated this innovation with two case studies, showcasing new investment solutions jointly developed by STOXX and DWS.

European Leaders

One such strategy is the Xtrackers Stoxx European Market Leaders UCITS ETF, launched at the end of September. The fund tracks the STOXX® Europe Total Market Leaders index, selecting companies based on factors such as market dominance, competitive strength and superior profitability relative to peers. As Arun put it, the fund provides a new perspective on Europe’s large-caps.

Alongside strong market positioning, pricing power and financial stability, ‘Leaders’ also tend to bring innovation and industry influence, lower volatility and solid dividend potential.

In Lukas’ words, the Leaders strategy is a strong complement to traditional sector and size approaches, offering the kind of diversification global investors are seeking today. Even though it doesn’t factor sector allocations into its methodology, the strategy still ends up more diversified than a US benchmark, he noted.

In the past ten years, the STOXX Europe Total Market Leaders index has beaten the STOXX Europe Total Market benchmark by a cumulative 35 percentage points.[1]

Defense stocks

The discussion then turned to defense stocks, a sector that has delivered outstanding returns this year amid rising government spending on security. The European Commission has announced plans to spend EUR 800 billion by 2030 on defense equipment and NATO members are boosting military investments.

DWS’ Xtrackers has launched the Xtrackers Europe Defence Technologies UCITS ETF, based on the STOXX® Europe Total Market Defence Space and Cybersecurity Innovation index. The index tracks companies with significant revenues and patent exposure to the three thematic segments, hence covering established suppliers of traditional military equipment and of more advanced defense systems, as well as those likely to play relevant roles in those fields in the future.

Companies are selected based on high revenues from specific RBICS sectors or on holding patents in technologies relevant to the targeted themes.

“We combine all this data to give you a really innovative look and exposure into the core players within defense, but also the ones that are innovating and will be emerging leaders in this space,” said Arun. “Defense as we see it today is not the defense we are going to see tomorrow. There is going to be significant disruptive technology innovations in this space.”

Complement to traditional benchmarks

Towards the end, Lukas highlighted the advantages of passive, index-based strategies enhanced by cutting-edge analytics and artificial intelligence. “You can design very innovative products that are good complements to traditional ways of portfolio construction,” he added.

Wrapping up, Lukas and Arun agreed that, with growing interest in European equities, innovation and tactical exposures could play a central role in portfolio construction. They forecast that flows will expand beyond traditional benchmarks into new themes and next-generation indices.

[1] Net returns in EUR through Sept. 18, 2025.